Hitoshi Nishimura/The Image Bank through Getty Images

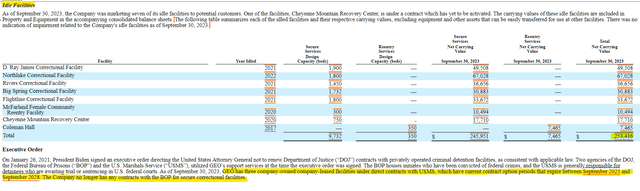

The GEO Group ( NYSE: GEO), a rehab centers business, has actually seen its share of hardship of the previous couple of years. The business needed to change its business structure from a REIT to a C Corp, and as a result removed its dividend. Furthermore, GEO has actually needed to sustain regulative obstacles and in 2015, the business finished a financial obligation exchange to offer it more monetary versatility. Back in December of 2022, I composed how Geo Group’s bonds were an appealing financial investment. Today, with 2 of GEO’s long outdated maturities still yielding above 10% to maturity and will offer excellent earnings for noteholders.

FINRA

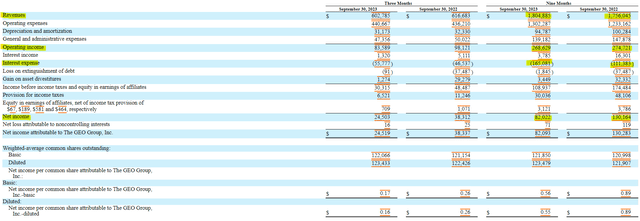

For the very first 3 quarters of 2023, Geo Group’s profits grew by roughly $50 million, or 3%. Sadly, operating costs grew by somewhat more than profits. The development in operating costs caused running earnings dropping to $268 million from $274 million the previous year. It is essential to keep in mind that despite the fact that interest costs increased by $54 million, the business had the ability to cover those expenses with running earnings and still maintain $82 million as earnings.

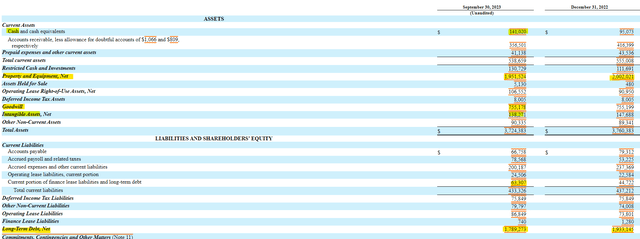

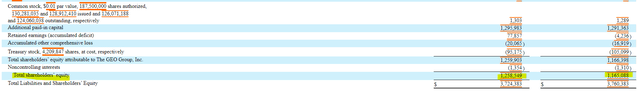

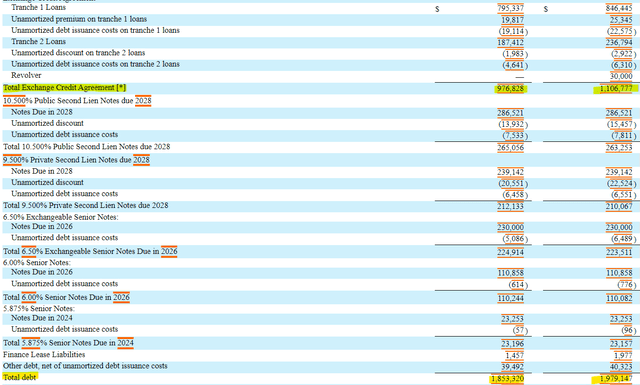

On the balance sheet side, Geo Group invested the very first 3 quarters of 2023 reinforcing its capital position. The business had the ability to increase its money position from $95 million approximately $141 million while all at once reducing its long-lasting financial obligation from $1.93 billion to $1.79 billion. Investor equity has actually increased by roughly $100 million from $1.16 billion to $1.26 billion.

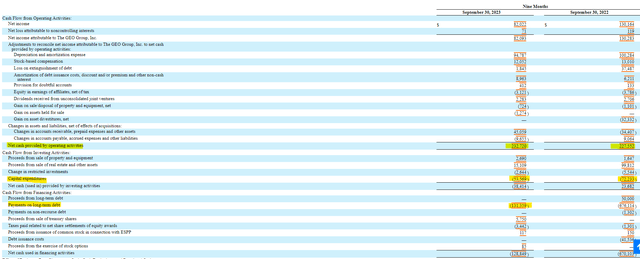

The most engaging case for purchasing Geo Group’s bonds originates from examining the capital declaration. For the very first 3 quarters of 2023, Geo group created $232 million in running capital, which was $5 million greater than the exact same duration a year back. After subtracting capital investment, totally free capital was likewise greater at $179 million versus $155 million a year back. The generation of strong totally free capital has actually permitted Geo Group to all at once construct its money balance and pay for long-lasting financial obligation.

Geo Group utilized the totally free capital to settle its revolving credit line and decrease the balances on 2 of its tranche loans. The business has a modest quantity of financial obligation due in 2024 and $340 million in exchangeable and senior notes due in 2026. In between the business’s money balance and almost $200 million in capability on the revolving credit line, Geo Group has roughly $340 million in liquidity. Their liquidity, integrated with the speed of totally free capital generation, ought to need no refinancing till the tranche loans come due in 2027. Already, the level of financial obligation decrease ought to position Geo Group into a much better credit score and able to get beneficial refinancing terms.

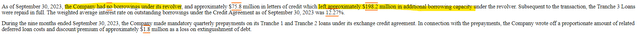

One threat that Geo Group has actually been handling for the last 3 years has actually been the loss of the federal government agreements associated with business. In January 2021, President Biden signed an Executive Order removing the capability of the Department of Justice to perform service with personal reformatory owners. Geo Group has actually handled to remove its Bureau of Prisons agreements and is down to 3 USMS agreements. Regardless of the loss of service, Geo Group is still showing the capability to produce the capital required to decrease financial obligation principal.

Geo Group continues to produce healthy money streams to browse a hard market. The business has actually had the ability to construct money and pay for financial obligation following its financial obligation exchange. Furthermore, the business’s liquidity suffices to bring it through 2026. Financiers ought to anticipate the business’s 4th quarter results to reveal extra totally free capital generation, enough to clear the liquidity limit through 2026 maturities. With a higher than 10% return priced into both 2028 notes, set earnings financiers ought to discover an appealing return with Geo Group’s long-lasting financial obligation.

CUSIP: 36162JAD8

Rate: $96.75

Discount Coupon: 9.5%

Maturity: 12/31/2028

Yield to Maturity: 10.37%

Credit Score (Moody’s/ S&P): B3/B