Roman Tiraspolsky

Is the EV sell difficulty? Previously this month, Hertz ( NASDAQ: HTZ) revealed that it prepares to sell a 3rd of its electrical car fleet, deciding to purchase gasoline-powered vehicles with a few of the money earnings.

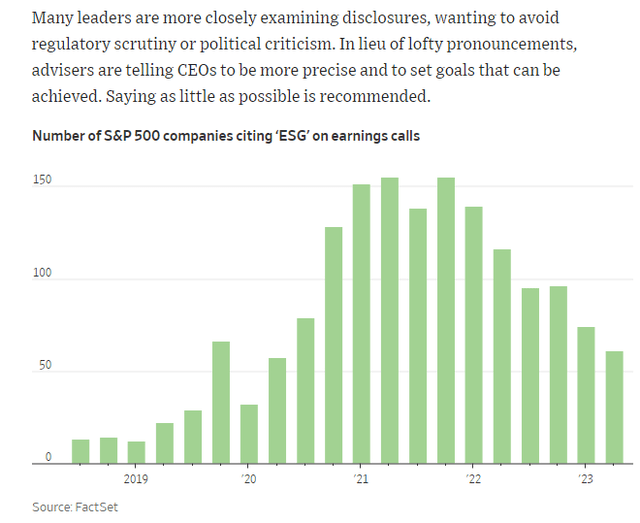

The company sees lower need for EVs while repair work expenses for that group of automobiles have actually skyrocketed. The choice followed a really bad stock efficiency in the in 2015. Larger image, the ESG motion, for which EV cars play a substantial function, might be revealing fractures, according to my analysis of the variety of ESG points out on quarterly teleconference.

I repeat my hold ranking on Hertz. I see its assessment as deservedly low while the technical image is weak as the stock makes another perform at $8 assistance.

EV Expenses Increase, ESG Losing Its Appeal Amongst C Suites

For background, HTZ runs as a lorry rental business. It runs through 2 sections, Americas Rental Vehicle and Global Rental Vehicle. The business supplies car rental services under the Hertz, Dollar, and Thrifty brand names from company-owned, licensee, and franchisee areas around the world.

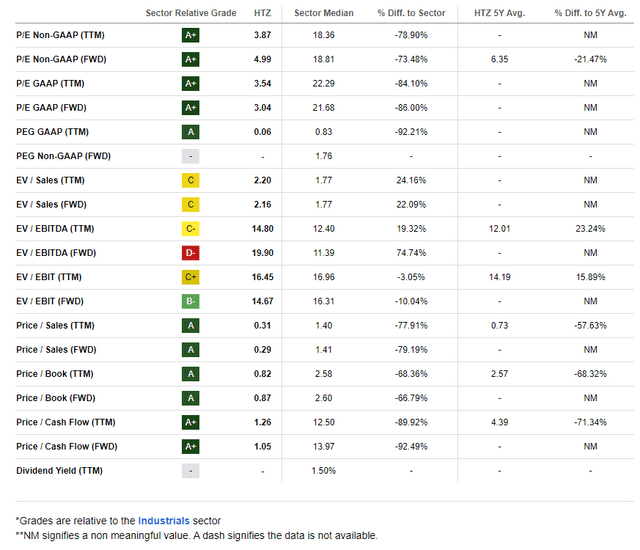

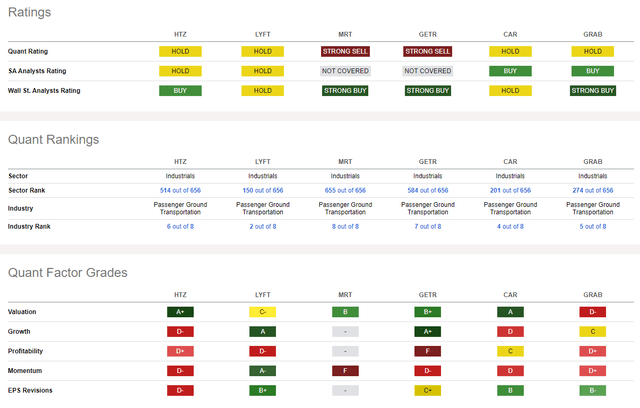

The Florida-based $2.8 billion market cap Guest Ground Transport market business within the Industrials sector trades at a low 5.0 forward non-GAAP price-to-earnings ratio and does not pay a dividend. Ahead of profits due out next month, shares trade with a high 65% suggested volatility portion while brief interest on the stock is exceptionally high at 16.8% since January 11, 2024.

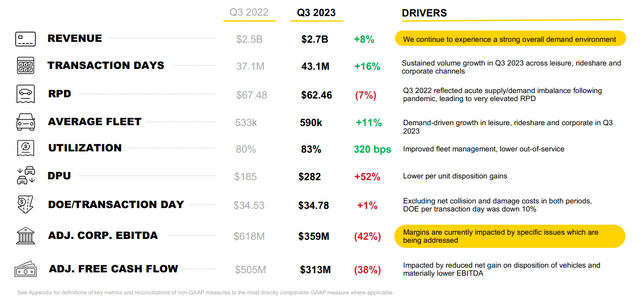

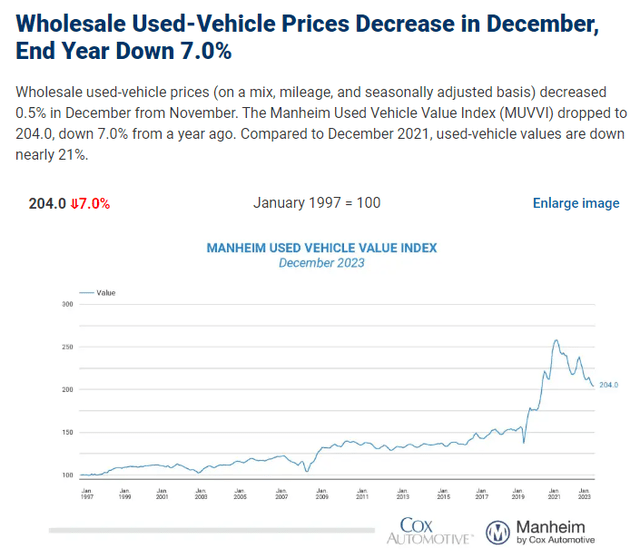

Back in October, Hertz reported a weak quarter. Q3 non-GAAP EPS of $0.70 missed out on the Wall Street agreement outlook of $0.83 while profits of $2.7 billion, up 8% from year-ago levels, missed out on decently. Shares fell around the report however ultimately supported in the $8 to $9 variety before rallying towards year-end. There was great news in its regular monthly profits per system metric which struck $1,596 in the middle of a strong 83% usage rate, up 320 basis points from the exact same duration in 2022. Still, lower secondhand automobile costs might be injuring the rental automobile operating– regular monthly fleet devaluation per system was $282, a 52% dive year-on-year.

International Outcomes– Year Over Year

Wholesale Used-Vehicle Costs Reduction in December, End Year Down 7.0%

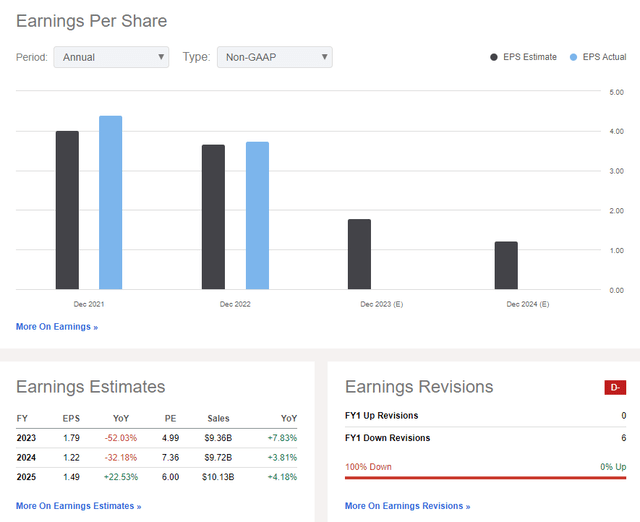

On assessment, experts anticipate a continued decrease in success. Per-share operating profits are anticipated to fall from $1.79 in 2015 to simply $1.22 in 2024. A modest uptick in EPS is then the expectation expecting 2025. With a variety of profits downgrades in the last 3 months, nevertheless, I fear that the profits outlook might dimmer even more, which 2025’s 23% non-GAAP EPS development advance might boil down.

Still, Hertz has favorable profits patterns to think about, however with dramatically unfavorable complimentary capital over the last 12 months (on the order of -$ 8.96), the business is burning through money today. Overall money per share is simply $1.92 compared to arrearage of more than $18 billion, leading to an overall debt-to-equity ratio of 534.

Hertz: Incomes, Appraisal, Bearish EPS Modification History

If we presume stabilized running EPS of $1.30 and use a profits multiple of 6, near its long-lasting average, then shares must trade near $7.80. Offered distressed principles and bad complimentary capital patterns, that assessment ought to be taken with low self-confidence. Even if we designate it that essential worth, the stock is decently misestimated today. I highlighted essential threats in my analysis a year ago

Hertz: A Low Appraisal Required, No Yield, Unfavorable Free Capital

Compared to its peers, HTZ includes a low assessment (though weak assessment metrics are most likely necessitated offered the really bad development outlook). Success patterns are also softer than its rivals while share-price momentum has actually been really weak over the in 2015. Lastly, as pointed out in the past, sellside experts have actually come out more bearish on HTZ’s profits outlook over the previous 90 days.

Rival Analysis

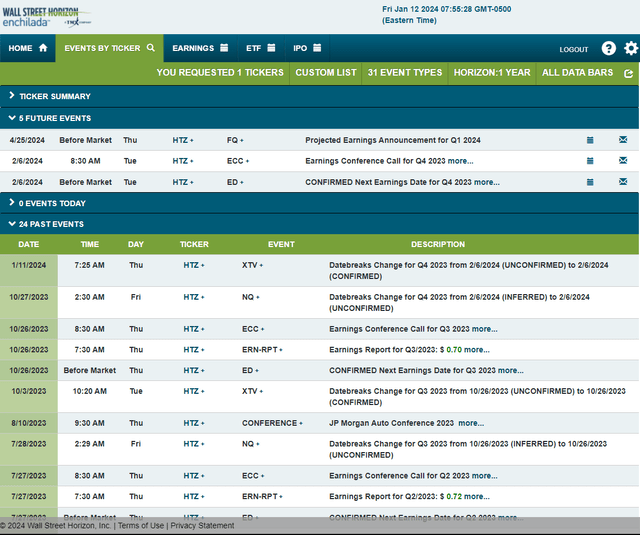

Looking ahead, business occasion information supplied by Wall Street Horizon reveal a validated Q4 2023 profits date of Tuesday, February 6 BMO with a teleconference right away after the outcomes cross the wires. You can listen live here

Business Occasion Threat Calendar

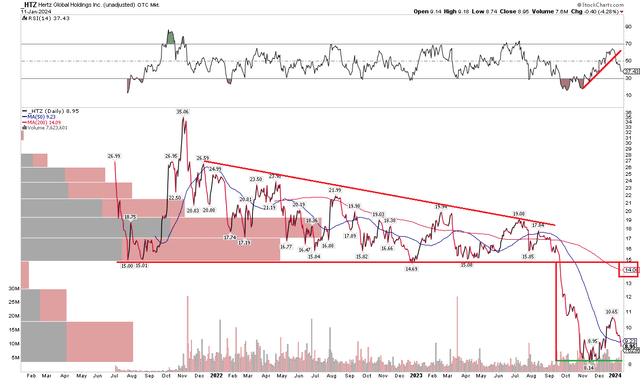

The Technical Take

HTZ is down about 50% given that I initially reported on the stock. Notification in the chart listed below that shares combined for numerous months following some meme-stock mania sometimes in 2021 right after its IPO. Then came a drawn-out trading variety with crucial assistance at the $15 mark. A series of lower highs produced a bearish coming down triangle pattern with a height of about $7 at the triangle’s beginning. That $7 height is crucial since when HTZ broke down under $15 assistance, a bearish determined relocation cost target to $8 was set off in September in 2015. Undoubtedly, that target played out practically to the cent.

HTZ struck $8 in November and after that recovered, backtracking about 50% of the September-November decrease. The stock has actually fallen back under $9 after breaking an uptrend in its RSI momentum oscillator at the top of the chart. With shares now retesting assistance, there is the possibility it might break down once again, however the technical indications have to do with well balanced. Long with a stop under $7.80 might work, however this is quite a ‘falling knife’ sort of stock, and resting on the sidelines is sensible here. Additionally, HTZ’s long-lasting 200-day moving average is adversely sloped, suggesting that the bears remain in control for the time being.

In General, I would prevent HTZ today in spite of the stock making another method of crucial assistance at $8 and high brief interest is constantly an essential danger for those seeking to short the stock.

HTZ: Shares Fall to $8 Assistance, Momentum Turns Lower

The Bottom Line

I repeat my hold ranking on HTZ. I highlighted the essential difficulties with the automobile rental business early in 2023, however was reluctant to designate it a straight-out sell ranking offered the depressed assessment. Still, the principles turned worse while the technicals broke down. Today, with a mid-single-digit P/E and shares near assistance, I when again see it as a hold.