sshepard

Financial Investment Thesis

Very First Warranty Bancshares, Inc. ( NASDAQ: FGBI) is a U.S. local bank based in Louisiana. The bank has actually functioned considering that 1934 and has actually weathered numerous financial recessions and challenging macroeconomic environments.

While in the beginning look the bank’s success has actually suffered considerably in the last few years, I do not think any concrete damage has actually struck their basic banking operations.

The bank stays well capitalized and has actually concentrated on increasing loan originations at greater rate of interest while their total loan portfolio stays mainly safe in my viewpoint.

A huge 2023 selloff has actually left shares trading at around a 43% undervaluation and tangibly listed below book worth.

I rank Very first Warranty a Strong Buy.

Business Background

Very First Warranty is a Louisiana state-chartered local bank established all the method back in 1934. The bank uses consumers a wide array of monetary services such as examining accounts, cost savings accounts, loans and even some minimal small-business banking items.

Very first Warranty is remarkably varied geographically with the bank maintenance customers through thirty-six branches situated in Louisiana, Texas, Kentucky and West Virginia.

Very first Warranty has actually concentrated on structure resistant client relationships in order to develop a devoted client base to benefit their service.

Very first Warranty’s historical existence and capability to weather numerous various monetary conditions that have actually dealt with the U.S. economy over the last century even more recommend that the bank’s basic values and methods are robust and successful.

Existing CEO Alton Lewis continues to guide the First Warranty in what I think is a favorable instructions relating to the bank’s long-lasting success and stability.

Lewis’s concentrate on decreasing business expenses while increasing loan origination levels need to enable First Warranty to start broadening their NIM once again and continue to broaden their banking operations even more.

I likewise think Lewis’ ongoing focus on the significance of structure robust client relationships will assist produce exceptional self-confidence in the bank progressing.

The quality of First Warranty’s product or services is completely highlighted by the bank having actually attained a three-year streak of winning Newsweek’s Finest American Bank award

Financial Moat – Extensive Analysis

Very first Warranty runs with basically no financial moat due to their little scale and fairly mute set of monetary items available doing little to separate the company’s service from rivals on a nationwide scale.

Nevertheless, on a state-wide scale I think Very first Warranty has actually handled to create a narrow yet concrete financial moat thanks to their customer-oriented banking practices having actually constructed a reliable image and name for the bank.

Very first Warranty frequently outscores other local and across the country banks in client complete satisfaction studies. This customer-centric method enables First Warranty to develop more powerful more sticky relationships with their consumers which eventually need to increase the possibility of repeat service for the bank.

The core service functions of taking in deposits at low interest costs and using loans at fairly greater rate of interest in order to produce a revenue through a net interest margin (NIM) leaves little space for a lot of local banks to start distinguishing from an item arrangement viewpoint.

Thinking about that a lot of local banks for that reason use what can just be thought about to be a primarily homogenous item, the choice for First Warranty to distinguish their services through a concentrate on exceptional customer care seems an in theory sound service goal.

In general, I still can not designate any genuine across the country or internationally reaching financial moat to First Warranty. Nevertheless, on a local scale it appears the bank has actually become a preferred amongst customers for the quality and way in which the bank supplies their monetary product or services.

This community-oriented mindset is a quality of First Warranty which I think has and will continue to produce a concrete favorable result on the bank’s total service procedures.

I likewise like CEO Lewis’ concentrate on expense control and performance which need to in the mid- to long-lasting enable Very first Warranty to outearn its peers from a net margin viewpoint thanks to a total more economical banking design.

Monetary Circumstance – In-Depth Analysis

Over the last 5Y (covering from FY22-FY18), First Warranty has actually handled to produce typical ROA and ROE of 0.80% and 10.45% respectively.

While these returns might not be industry-leading, I do think that for their fairly little size, First Warranty has actually handled to be an extremely successful service undoubtedly. I like think that any service creating constant ROEs of around 10-12% is rather a healthy and flourishing business.

The bank has actually run for the majority of the previous years at a performance ratio of around 52-58% which is nearly perfect. Nevertheless, the previous 3 years have actually seen a consistent deterioration in performance with a ratio of 58% in Q3 2020 deteriorating to 87% in Q3 FY23.

While this might at first appear worrying, I do not eventually think any concrete damage has actually been done to the bank. The ups and downs of the natural financial cycle will lead to banks running to differing degrees of performance.

The unrelentingly contractionary financial policy being pursued by the Fed has actually led to a hard macro environment that has actually put pressure on the success of a lot of local banks.

As rate of interest increased quickly, customers rapidly relocated to greater interest-rate returning cost savings items as banks rushed to maintain consumers from changing to other banks.

This fast boost in interest costs suggested that the fairly lower interest earnings yielding credit and loans supplied by banks such as First Warranty no longer supplied a big NIM as they had actually done previously.

Nevertheless, the crucial active ingredient needed to alter this imbalance in interest earnings and costs is really basic: time. As rates are held greater for longer, local banks such as Very first Warranty are trying to stem as numerous greater rate of interest loans as possible.

This need to enable NIM to go back to pre-2023 levels someplace around 2024-2025 which, when integrated with Very first Warranty’s concentrate on decreasing non-interest associated costs need to see the bank’s earnings grow and net margins broaden.

By examining Very first Warranty’s FY23 Q3 report, it looks like though the bank might have turned the corner with regard to NIM and success deterioration.

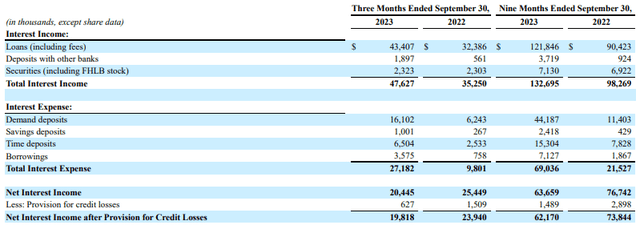

Very first Warranty saw their FY23 Q3 interest earnings boost significantly to simply over $476M compared to simply $352M in the very same quarter in 2015. This 35% boost is mostly due to a substantial boost in loan originations at greater rate of interest thanks to the ongoing upkeep of greater rates by the FED.

The speed at which First Warranty has actually handled to grow their interest earnings is excellent compared to some other underestimated local banks highlighting the proactive method to loan originations taken by First Warranty.

Nevertheless, First Warranty likewise saw their overall interest expenditure grow enormously with Q3 seeing an enormous 176% YoY boost. This has actually been because of Very first Warranty needing to raise the rate of interest provided to customers on deposits at a greater rate than loan originations due to the requirement to stay competitive in a primarily homogenous banking market.

This has actually left First Warranty with a considerably contracted NIM of 2.54% compared to highs of around 3.44% saw at the end of the fiscal year 2021.

Still, I see their development on coming from loans at greater rate of interest as favorable with the bank eventually producing $172M earnings in Q3 FY23. While this is considerably lower than the nearly $806M created in Q3 of FY22, the bank has actually most importantly attained success as soon as again which was a substantial issue in their Q2 report.

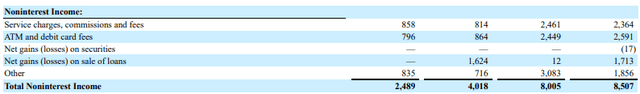

The bank likewise created around $25M in non-interest earnings which was down considerably YoY due mostly to the considerable variety of loans offered throughout Q3 of FY22. This reduction is of little issue to me particularly as their NII for the last 9 months ended September 30 saw earnings flatline without any concrete reduction existing.

The bank has actually handled to keep a performance ratio of 87% which while not outstanding is still sensible offered the boost in deposit financing expenses. The bank’s expense of funds has actually increased greatly to 4.19% however once again I do not see this as unexpected.

FGBI FY23 Q3 Handout

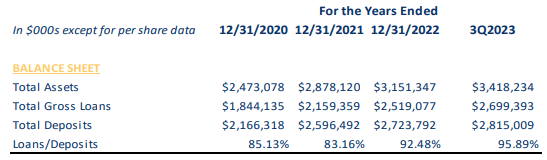

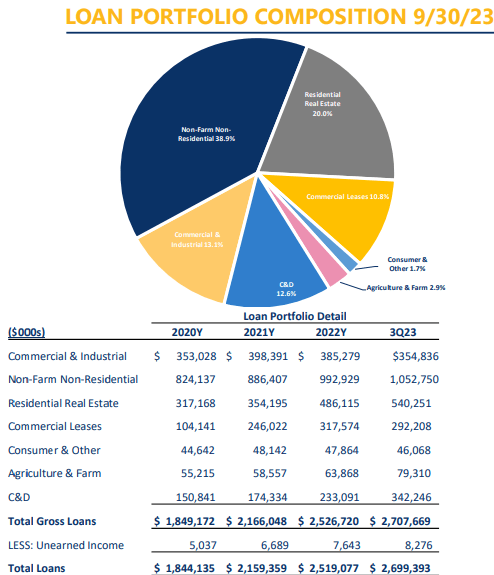

Overall gross loans continued to grow YoY by about 6% while the bank’s loan/deposit ratio continued to increase to 95.9%. While this ratio is a little above what I would typically like to see in a local bank, it should be kept in mind that the technique of quickly coming from loans at greater rate of interest in order to accomplish higher success is the source of this boost.

FGBI FY23 Q3 Handout

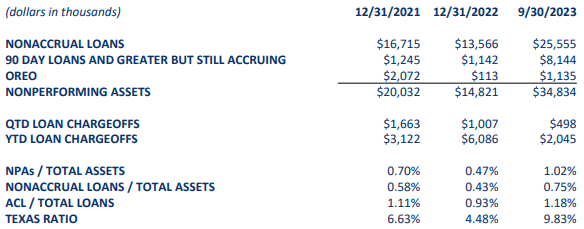

Nonperforming properties have actually increased rather considerably YoY with Q3 FY23 seeing a big $3.4 M in overall NPAs up from simply $1.4 M in Q3 FY22. The primary increase has actually remained in non-accrual loans and 90 days or higher however still accumulating loans.

FGBI FY23 Q3 Handout

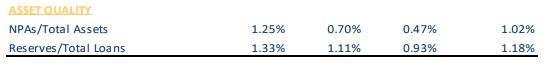

The bank’s Texas ratio has actually consequently increased to 9.83% from simply 4.48% at the very same time in 2015 while the bank’s NPAs/total properties have actually increased from 0.47% to 1.02%. The boost in NPAs is regrettable to see in spite of being mostly in line with a lot of other local banking peers.

I think that most of First Warranty’s loans stay reputable with the bank just having around 1.02% of NPAs relative to overall net properties. While nonperforming properties have actually continued to increase YoY considering that 2021, I think this to be mainly due to the present macroeconomic environment instead of any basic concerns in the bank’s threat evaluation operations.

FGBI FY23 Q3 Discussion

Very first Warranty’s loan portfolio is rather greatly exposed to CRE non-farm non-residential loans to the tune of 38.9% at the end of Q3. This comes as the bank has actually grown loans 11.7% YoY in order to increase their interest earnings with business leases representing 10.8% of the overall loan portfolio.

Office just represents 4.3% of the bank’s overall loan portfolio which is great to see thinking about a few of the problems experienced in workplace tenancy rates. Nevertheless, I do not think that workplaces will go totally uninhabited in the coming years with the problems ahead for the sector possibly alleviating as soon as rate of interest start to fall in 2024.

FGBI FY23 Q3 Discussion

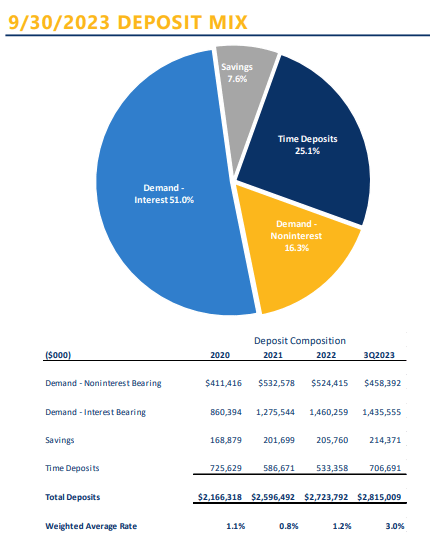

Very first Warranty has actually handled to grow their overall deposits by 3.93% YoY. New deposit item specials such as a 3.50% yielding cost savings account and a 7-month CD at 5.15% have actually likewise stimulated customer deposits at the bank.

I see the bank’s deposit mix as rather strong with a great 25% being assigned to CDs (time deposits). In basic, I think time deposits can work extremely well for banks with the ensured deposit durations increasing the dependability of capital for the bank.

The reduction in noninterest-bearing deposits has actually not been as noticable as some local banks which even more recommends Very first Warranty is succeeding to bring in service to their banking services.

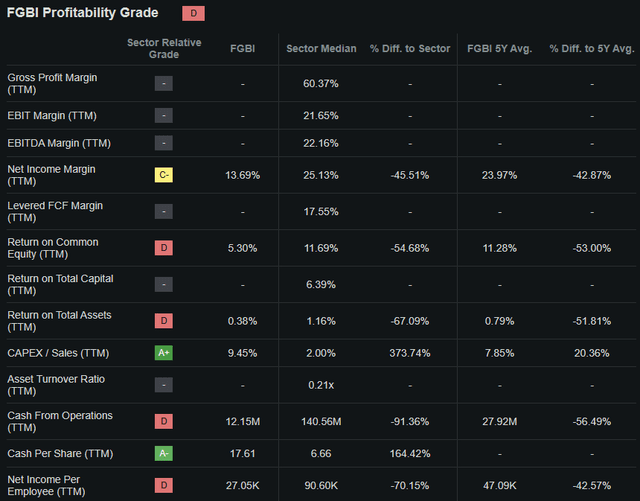

Looking For Alpha|FGBI|Success

Looking for Alpha’s quant designates First Warranty with a “ D” success ranking which I think to be a somewhat downhearted view of the bank’s present health.

While on an outright scale the bank is not producing revenues like they did a couple of years prior, the circumstance is extremely nuanced with basic assessment metrics not painting the complete image of today macroeconomic environment.

Cautious analysis of First Warranty’s balance sheet is definitely vital to comprehending what possible financial investment chance might depend on the bank’s shares.

At its really core I think Very first Warranty is among a choose handful of local banks that has actually continued to keep an outstanding requirement of capital allotment with their properties and liabilities seeming well handled in spite of the perhaps stagflationary macroeconomic environment presently present in the U.S.

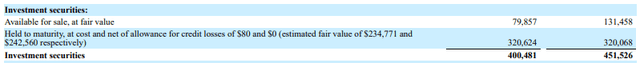

Very first Warranty’s AFS financial investment securities reduced 39% YoY when examined at reasonable worth which mainly was because of the increased rate of interest environment leading to their bond securities declining.

The bank has actually likewise selected to report their HTM securities on their balance sheet as examined at their amortized expense. I think this technique is basically inaccurate as the fast increase in rate of interest would imply most HTM securities have actually declined when represented at their right reasonable worth in my view.

Very first Warranty’s reasonable worth evaluation of their HTM securities reveals us the paper losses the bank has actually sustained of about $90M. While these losses imply that the bank’s total HTM securities have actually reduced by a quarter compared to their amortized expense, the YoY boost in paper losses is simply $10m.

While these paper losses are regrettable, I think that sound banking principles continue to underpin the technique being pursued by the management group initially Warranty.

While a few of the HTM and AFS securities held by First Warranty might be fairly low-yielding federal government and state bonds, these securities still protect the bank well from an extremely low rate of interest environment which eventually might manifest itself in the mid-term.

Very first Warranty’s overall properties (changing for reasonable worth accounting of their HTM securities) total up to $3.3 B while their overall liabilities are simply $3.18 B. The bank likewise has exceptional capitalization levels with their Tier 1 utilize ratio being a healthy 8.94%, their CET 1 capital ratio being 9.79% and their overall risk-based capital ratio being 10.72%.

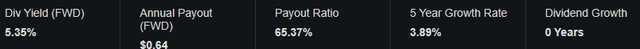

Looking For Alpha|FGBI|Dividend

Very first Warranty pays financiers a healthy dividend with an existing FWD yield of 5.35%.

The bank’s FWD yearly payment is anticipated to be $0.64 with a payment ratio of 65.37%. The 5Y development rate is 3.89% which while not excellent highlights an ongoing desire to reward the bank’s investors.

Very first Warranty seems a fairly well-run local bank that has actually dealt with some cyclical problems throughout their FY23. The hard macroeconomic environment stressed by both nonreligious decrease and an abrupt walking in rate of interest has actually put most local banks in a broken down success position.

This has actually sent out First Warranty’s shares into an enormous decrease with the bank apparently being lumped together with other more worrying local banks.

A more flexible macroeconomic environment with lower rate of interest and higher levels of financial development need to enable First Warranty to go back to exceptional levels of success as the bank has actually apparently not forgotten what makes up standard and sound banking practices.

Time needs to likewise assist First Warranty go back to higher levels of success as evidenced by their FY23 Q3 report which saw their technique of increased loan origination at greater rate of interest start to tangibly increase their net interest earnings.

Evaluation

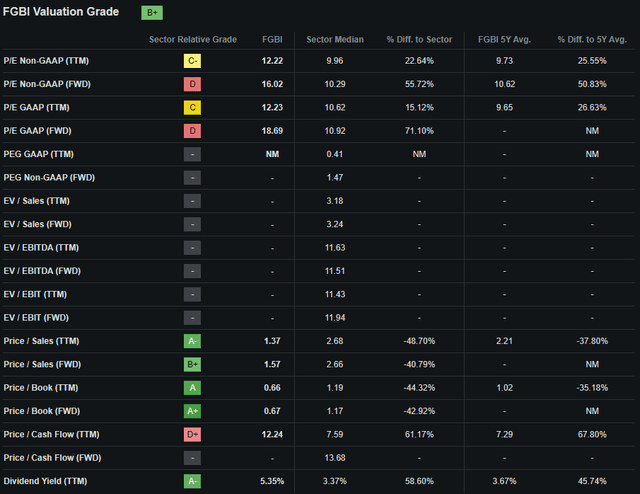

Looking For Alpha|FGBI|Evaluation

Looking for Alpha’s Quant designates First Warranty with a “ B+” Evaluation grade. I think even this fairly favorable assessment letter grade is still an exceedingly modest examination of the worth present in the bank’s shares.

Very first Warranty presently trades at a P/E GAAP TTM ratio of 12.23 x. First Warranty’s TTM Price/Book of simply 0.66 x is extremely reduced with the bank trading well listed below their concrete book worth per share.

Thinking about these crucial bank assessment metrics alone I think Very first Warranty needs to currently begin to appear underestimated offered the stock’s historical averages and considerable discount rate relative to book worth.

Looking For Alpha|FGBI|Advanced Chart

From an outright viewpoint, First Warranty shares are trading at a substantial discount rate relative to previous appraisals with present share costs of around $12.00 representing a four-year low for the stock.

While a small reduction in success at the tail-end of 2022 led to a small downside in share costs, the local banking chaos experienced in early 2023 definitely annihilated the bank’s stock cost.

When integrated with dull success as an outcome of the unexpectedly contractionary financial policy pursued by the Fed, it needs to truly be not a surprise that First Warranty’s shares dealt with such a hard 2023.

Nevertheless, I think this selloff has actually been extreme with considerable future investor worth generation existing at the bank.

The Worth Corner

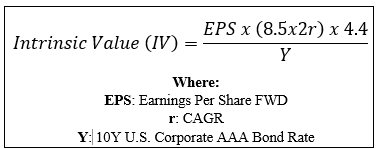

By using The Worth Corner’s specifically created Intrinsic Evaluation Estimation, we can much better comprehend what worth exists in the business from a more unbiased viewpoint.

Utilizing Very first Warranty’s present share cost of $11.96, an approximated 2023 EPS of $0.75, a practical “r” worth of 0.10 (10%) and the present Moody’s Seasoned AAA Business Bond Yield ratio of 4.74 x, I obtain a base-case IV of $21.00. This represents an enormous 43% undervaluation in shares.

When utilizing a more downhearted CAGR worth for r of 0.06 (6%) to show a circumstance where a worldwide covering economic downturn triggers First Warranty’s NIM to flatline, shares are still valued at around $15.10 representing a 21% undervaluation in shares.

It should likewise be kept in mind that Very first Warranty’s book worth per share is around $18.10 which even more highlights simply how inexpensively the bank’s shares are presently trading.

Thinking about the assessment metrics, outright assessment and intrinsic worth estimation, I think that Very first Warranty is peacefully selling what can just be thought about to be deep worth area.

In the short-term (3-12 months), I discover it hard to state precisely what might take place to appraisals. The basic unpredictability relating to the future instructions of both the U.S. and worldwide markets as an entire ways anticipating the instructions for a lot of stocks from a qualitative side is basically difficult in my viewpoint.

A continually hard macroeconomic environment in the U.S. moving even more into 2024 might restrict the hunger financiers need to purchase the bank. Nevertheless, considered that shares are so enormously underestimated, it is hard to see just how much more costs might fall.

In the long term (2-10 years), I see Very first Warranty gaining back excellent levels of success and continuing to turn into a trusted and steady local bank. Their concentrate on core banking practices is excellent to see particularly when integrated with sound capital allotment methods and a transparent management group.

Threats Dealing With Very First Warranty

Very first Warranty deals with some concrete dangers with the main risk occurring from a recessionary financial environment setting off considerable deposit outflows and lower loan origination levels.

Rather just, the most significant risk to any single bank is an abrupt or extended stream of outflows leading to dropping success and liquidity. First Warranty is rather an extremely little local bank which eventually indicates that their customer base is fairly more focused than that of bigger worldwide competitors.

A recessionary duration in the United States would likely lead to common customers dealing with extra pressures on their wallets therefore restricting the capability to conserve and transfer cash in banks.

This would lead to a substantial drop in success for the bank while all at once deteriorating the liquidity present on their balance sheet. An abrupt shock to the economy (as seen with the fall of SVB previously in 2023) might lead to a work on the bank.

This would be rather devastating although I do not think Very first Warranty would end up being illiquid thanks to their well-managed AFS and HTM securities portfolios.

Economic downturns likewise tend to increase the quantity of non-performing loans and properties present at banks due to customers being not able to fulfill payment due dates. This might even more reduce the success of their loan portfolio.

From an ESG viewpoint, First Warranty deals with no genuine concrete risks or dangers. I think the total absence of significant ecological, social or governance issues would make First Warranty an outstanding choice for a more ESG-conscious financier.

Obviously, viewpoints might differ and I urge you to perform your own ESG and sustainability research study before purchasing First Warranty if these matters are of issue to you.

Conclusion

Very First Warranty is an intriguing local bank, and in spite of its dull success, stays a primarily strong banks. Their robust balance sheet need to assist the bank to weather the hard macroeconomic environment with the chance for a go back to considerable long-lasting success a genuine possibility in my viewpoint.

A transparent management group and a diligent method to service which puts the client at the leading edge of their banking operations need to enable First Warranty to stay competitive in what is otherwise a primarily undifferentiated market environment.

Rather just, in spite of the bank’s current outcomes being much poorer than their historic averages, I think Very first Warranty stays a lovely service both from a quantitative and qualitative viewpoint.

The enormous discount rate presently present in shares both relative to the bank’s intrinsic worth and even compared to the book worth per share more boosts the appearance of this local bank in my mind as present appraisals appear to use an enormous 43% margin of security for deep-value oriented financiers.

For that reason, I with confidence designate a Strong Buy ranking for Very first Warranty and have actually started a position in the bank worth 8% of my overall portfolio worth. To put it soon, I truly like this local bank.