akinbostanci

Ambac ( NYSE: AMBC) is a complicated business with numerous activities, and our company believe the marketplace is stopping working to appropriately assess it. We believe that comparing it with the just openly noted “rival” might work to shed some clearness over its monetary assurances company. MBIA Inc, certainly, just recently paid an unique dividend that was higher that its market cap, after the regulators permitted the release of additional liquidity in their subsidiaries. Will this hold true for Ambac too? Let’s look more detailed.

The great and the unsightly: Ambac’s brand-new and old company

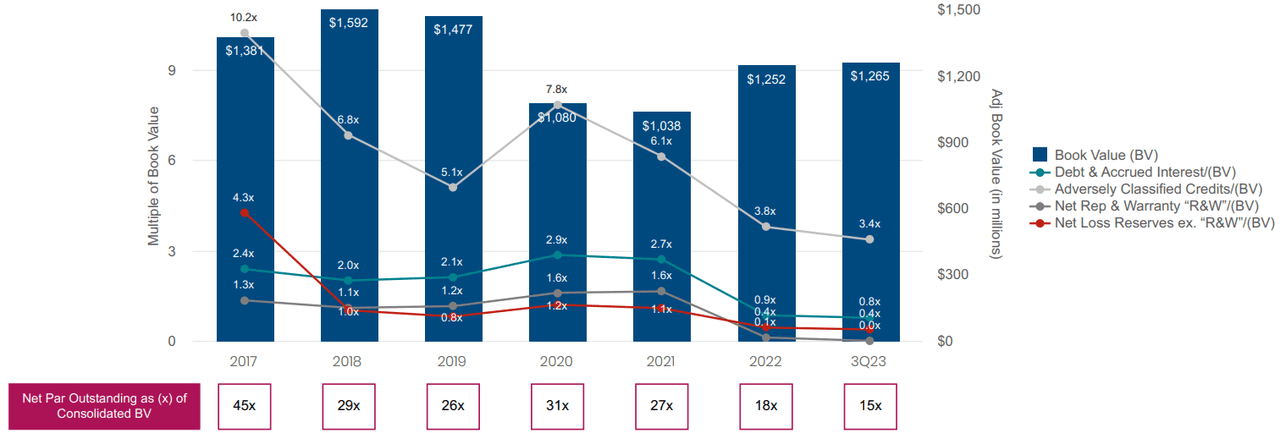

Ambac was really active in the years before the GFC selling generous monetary assurances in the type of insurance coverage to bonds, structured items, and other monetary instruments. Picture AIG CDS company, however thankfully much smaller sized. After the crisis struck they were entrusted to a substantial stack of issues that are difficult to eliminate. Financial assurances are severe responsibilities and even after Chapter 11 from which they emerged in 2013 (after 3 years) they still have this old department of business as stopped on their balance sheet. Nevertheless, we can state that AMBC did an excellent task of de-risking the portfolio by reorganizing numerous positions and taking part in reinsurance, assisted likewise by the maturity of numerous responsibilities. Let’s take a look at the Financial Guarantees subsidiary’s position: book worth stands at $1.2 billion with $29 billion of gross par (max direct exposure) impressive. Negatively categorized credit to BV is around 3.4 x times. This is a huge distinction compared to the 10.2 x times of just 5 years earlier.

Riskiness of FG Tradition Organization ( Newest Discussion)

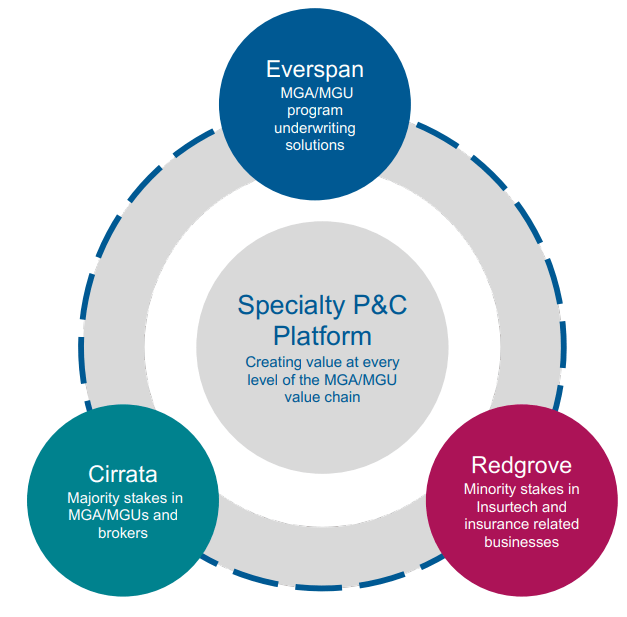

However management is putting some effort into structure something brand-new. They discovered a specific niche in which they feel skilled sufficient to run effectively, that is specialized P&C insurance coverage. They are constructing a combined company with both an underwriting and a brokerage sector that will look after complicated customers’ requirements.

Ambac Organization Design ( Newest Discussion)

This is an excellent summary of what the brand-new platform appears like. A series of 3 various subsidiaries will handle (1) underwriting danger, (2) supplying unique circulation channels (brokerage), and (3) getting tactical insurance-related stakes. Our company believe there is an authentic chance to construct a strong business handled by specialist insurance providers that can run a rewarding underwriting company and gather sufficient money to scale. Let’s dive into both cases, the passing away FC sector and the increasing P&C insurance provider.

A tough however needed contrast: MBIA and Ambac

For some business, it is actually difficult to discover real comparables that provide comparable attributes. When it comes to Ambac it’s even harder since the practice of guaranteeing complicated structured items actually lessened after 2008. Today there is one comparable stock, that is MBIA Inc. ( MBI). The news is really current of a unique dividend that MBIA paid to investors which was higher than the real market cap. This triggered a rise of more than 100% in the stock cost. Numerous hypothesized that Ambac might be next considered that they revealed a tactical evaluation and designated Moelis as unique consultant in the last incomes release. This might increase the possibilities of a sale, a liquidity release, or other resolutions that might benefit investors. So let’s see if what took place at MBI might be reproduced here.

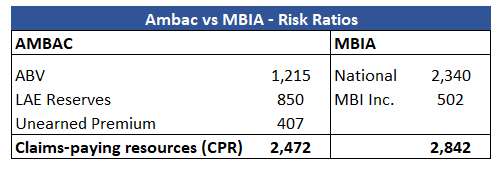

First Off, we require to compare the direct exposures and book worths, to be sure of utilizing apples-to-apples metrics.

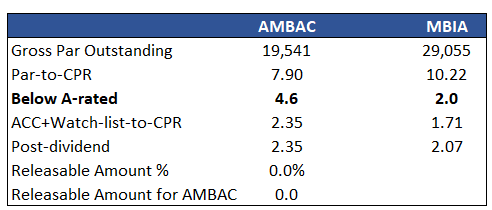

AMBC v. MBI Contrast ( Author’s price quotes)

For liquidity sources, we utilize a non-GAAP metric called “Claims-paying-resources” (CPR). This is a procedure that takes book worth, includes back reserves and unearned premiums. This is since reserves are on the liability side however are opened when a loss happens, and premiums that are due are deducted from payables. The overall quantity at AMBC is $2.5 billion, and at MBI is $2.8 billion. National and MBI are the 2 insurance coverage subsidiaries at MBIA, and the release originated from National’s reserves.

2nd, we wish to examine direct exposure.

AMBC v. MBI Contrast ( Author’s price quotes)

We take numerous metrics here as the 2 business do not supply specific disclosures in their filings. Gross Par represents the overall par worth of the insured possessions and works to calculate the optimum level of losses if defaults were to take place. We see that MBIA take advantage of greater CPR however has gross par direct exposure 50% above Ambac’s. Then we wish to look much deeper and see the number of of these insured possessions have a top quality score (above IG). We see that the below-A-rated to CPR is much greater for AMBC, which stands at 4.6 x times compared to 2x of MBI.

Lastly, we utilize a main metric of riskiness which is the watch list + Negatively Categorized (ACC). This consists of a series of possessions that are put under stringent watch as default is thought impending, took place, or a minimum of at high danger. The ratio is once again greater for Ambac, especially if compared to the pre-dividend MBI, which was just 1.7 x times.

We conclude that no liquidity releases can be done at this time for Ambac, a minimum of not by keeping the very same riskiness as its rival, which is lower at this time. However not all hope is lost. Our company believe that worth can still be opened under 2 conditions: (1) Ambac is permitted greater ratios, or (2) a purchaser of the possessions would pay a premium. While the latter is possible however not likely provided the existing high rates, our company believe that it is possible that insurance coverage regulators enable “greater danger”. This might be validated by the general lower par, and the shown capability of the business to gradually however efficiently remove liabilities at really low expense through reinsurance/restructurings. The Puerto Rico case is an example of this, and Ambac got away with a much smaller sized commitment compared to MBI.

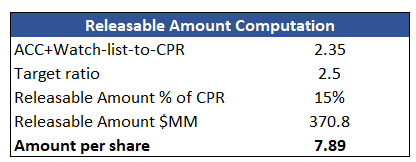

Let’s examine just how much can be launched if the business is permitted a ratio of ACC+W atch list over CPR of 2.5 x compared to the existing 2.35.

AMBC Releasable Quantity ( Author’s price quotes)

The calculation is easy. We take the distinction in the 2 ratios and increase by the CPR. We see that this suggests launching 15% of the existing CPR, which is around $370 countless additional money. If dispersed to investors, it would equate into an unique dividend of around $7.90 per share. However this is not all, since there is likewise the “brand-new” company to assess.

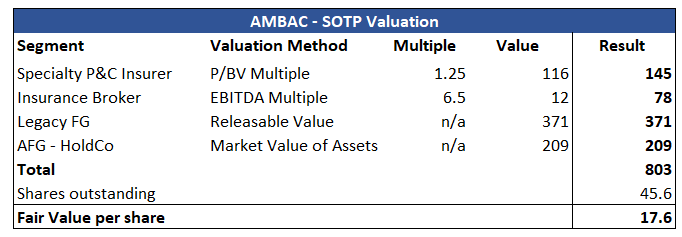

A SOTP technique to Ambac’s aggregate evaluation

Breaking their company into numerous pieces can be effective if they feel they do not have considerable synergy gains in between subsidiaries. Plus it increases the quality of compliance. Nevertheless, it makes the task of assessing the business a bit harder. We will utilize a Sum-Of-The-Parts analysis to assess their numerous subsidiaries individually, and after that sum them completely to obtain the worth of the group.

Let’s see a summary of what we will do.

AMBC Evaluation Design ( Author’s price quotes)

This table sums up: (1) the sector assessed, (2) the evaluation technique, and (3) the multiple/metric connected. For the P&C underwriting company we utilized a BV numerous, as it is the requirement in the market. We feel a 1.25 x numerous is agent of their proficiency and concentrate on a specific niche P&C, and the great outcomes achieved up until now. For the broker we just take an EBITDA numerous, because they are not a balance sheet company. The tradition FG department will be assessed based upon the existing releasable quantity that we formerly calculated. Lastly, we take what’s left at the HoldCo level in regards to money and the marketplace worth of the liquid possessions, as reported in the filings.

The general outcome is a reasonable worth of around $800 million, which is currently net of financial obligation as the bulk of the responsibilities is currently represented at the FG sector level. Nonetheless, this represents a reasonable worth per share of around $17.5-18, and therefore an upside capacity of 15%.

Conclusion

Ambac is a complex insurer with both an “old” and a brand-new company department. In the last months, numerous speculations about the contrast with MBI and a tactical evaluation attempted to assess if something comparable might take place at Ambac. Our company believe that the business might gain from some type of release, however that the bulk of the worth appears spread out throughout their brand-new services. The last aggregate worth appears to be around $18 per share.