We are presently waiting on the UK federal government to release its semiconductor technique. As context for such a technique, my previous 2 blogposts have actually summed up the worldwide state of the market:

Part 1: the UK’s location in the semiconductor world

Part 2: the past and future of the worldwide semiconductor market

Here I consider what a practical and helpful UK semiconductor technique may consist of.

To sum up the worldwide context, the vital countries in sophisticated semiconductor production are Taiwan, Korea and the U.S.A. for making the chips themselves. In addition, Japan and the Netherlands are important for essential aspects of the supply chain, especially the devices required to make chips. China has actually been committing considerable resource to establish its own semiconductor market– as an outcome, it is strong in all however the most sophisticated innovations for chip manufacture, however is susceptible to being cut off from essential aspects of the supply chain.

The innovation of chip manufacture is approaching maturity; the really quick rates of boost in calculating power we saw in the 1980s and 1990s, related to a mix of Moore’s law and Dennard scaling, have actually considerably slowed. At the innovation frontier we are seeing lessening returns from the ever bigger financial investments in capital and R&D that are required to preserve advances. Additional enhancements in computer system efficiency are most likely to put more premium on custom-made styles for chips optimised for particular applications.

The UK’s position in semiconductor production is limited in an international viewpoint, and not a relative strength in the context of the general UK economy. There is in fact a somewhat more powerful position in the larger supply chain than in chip manufacture itself, however the most considerable strength is not in manufacture, however style, with ARM having a worldwide considerable position and newbies like Graphcore revealing guarantee.

The history of the worldwide semiconductor market is a history of significant federal government interventions paired with huge economic sector R&D costs, the latter driven by drastically increasing sales. The UK basically pulled out of the race in the 1980’s, given that when Korea and Taiwan have actually developed worldwide leading positions, and China has actually ended up being a quick broadening brand-new entrant to the market.

The harder geopolitical environment has actually resulted in a return of commercial technique on a substantial scale, led by the U.S.A.’s CHIPS Act, which appropriates more than $50 billion over 5 years to restore its worldwide management, consisting of $39 billion on direct aids for production.

How should the UK react? What I’m speaking about here is the core company of making semiconductor gadgets and the surrounding supply chain, instead of info and interaction innovation more extensively. Initially, however, let’s be clear about what the objectives of a UK semiconductor technique might be.

What is a semiconductor technique for?

A nationwide technique for semiconductors might have numerous objectives. The UK Science and Innovation Structure recognizes semiconductors as one of 5 crucial innovations, evaluated versus requirements including their fundamental character, market capacity, along with their value for other nationwide top priorities, consisting of nationwide security.

It may be useful to identify 2 a little various objectives for the semiconductor technique. The very first is the concern of security, in the broadest sense, triggered by the supply issues that emerged in the pandemic, and increased by the growing realisation of the value and vulnerability of Taiwan in the worldwide semiconductor market. Here the concerns to ask are, what markets are at danger from additional disturbances? What are the nationwide security concerns that would occur from disruptions in supply?

The federal government’s newest refresh of its incorporated foreign and defence technique assures to ” make sure the UK has a clear path to ensured gain access to for each [critical technology], a strong voice in affecting their advancement and usage worldwide, a handled technique to provide chain dangers, and a strategy to safeguard our benefit as we construct it.” It reasserts as a design presented in the previous Integrated Evaluation the ” own, work together, gain access to” structure.

This structure is a welcome acknowledgment of the the truth that the UK is a medium size nation which can’t do whatever, and in order to have access to the innovation it requires, it should in many cases work together with friendly countries, and in others gain access to innovation through open worldwide markets. However it deserves asking exactly what is implied by ” own” This is specified in the Integrated Evaluation therefore: ” Own: where the UK has management and ownership of brand-new advancements, from discovery to massive manufacture and commercialisation.”

In what sense does the country ever own an innovation? There are still a couple of cases where entirely state owned organisations keep both an useful and legal monopoly on a specific innovation– nuclear weapons stay the most apparent example. However innovations are mainly managed by economic sector business with a complex, and frequently worldwide ownership structure. We may believe that the innovations of semiconductor incorporated circuit style that ARM established are British, due to the fact that the business is based in Cambridge. However it’s owned by a Japanese financial investment bank, who have a good deal of latitude in what they make with it.

Possibly it is more useful to speak about control than ownership. The UK state maintains a specific quantity of control of innovations owned by business with a significant UK existence– it has actually been able in impact to obstruct the purchase of the Newport Wafer Fab by the Chinese owned business Nexperia. However this brand-new assertiveness is a really current phenomenon; till really just recently UK federal governments have actually been totally unwinded about the acquisition of innovation business by abroad business. Certainly, in 2016 ARM’s acquisition by Softbank was invited by the then PM, Theresa May, as remaining in the UK’s nationwide interest, and a vote of self-confidence in post-Brexit Britain. The federal government has actually taken brand-new powers to obstruct acquisitions of business through the National Security and Financial Investment Act 2021, however this can just be done on premises of nationwide security.

The 2nd objective of a semiconductor technique is as part of an effort to conquer the UK’s consistent stagnancy of financial efficiency, to ” produce innovation-led financial development”, in the words of a current Federal government reaction to a BEIS Select Committee report. As I have actually blogged about at length, the UK’s efficiency issue is major and consistent, so there’s definitely a requirement to determine and support high worth sectors with the capacity for development. There is a local measurement here, acknowledged in the federal government’s goal for the technique to produce ” high paying tasks throughout the UK” So it would be totally suitable for a technique to support the existing cluster in the Southwest around Bristol and into South Wales, along with to produce brand-new clusters where there are strengths in associated market sectors

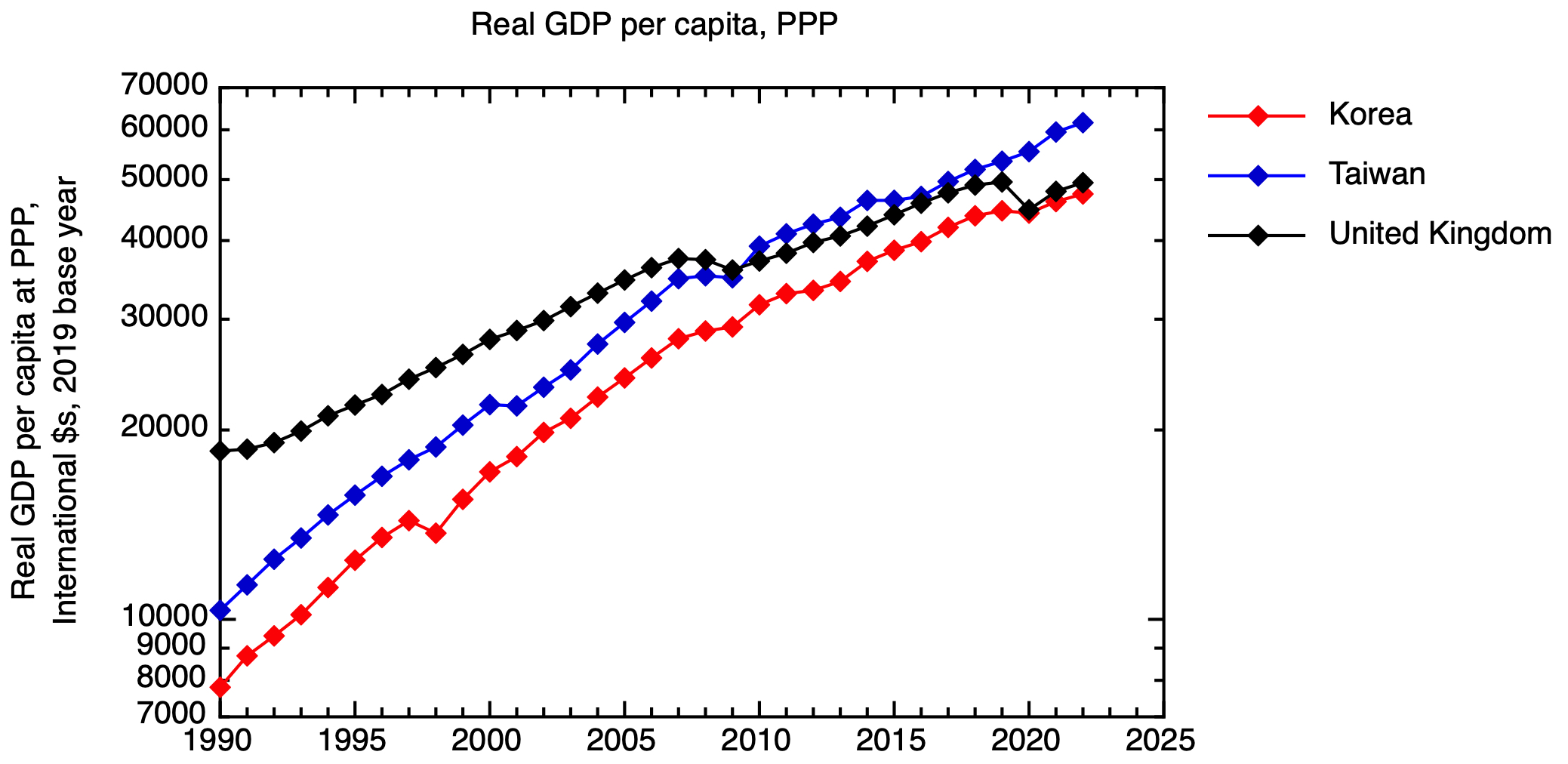

The economies of Taiwan and Korea have actually been changed by their really reliable implementation of an active commercial technique to make the most of a market at a time of quick technological development and broadening markets. There are 2 concerns for the UK now. Has the UK state (and the larger financial agreement in the nation) conquer its ideological hostility to active commercial technique on the East Asian design to step in at the required scale? And, would such an intervention be prompt, offered where semiconductors remain in the innovation cycle? Or, to put it more provocatively, has the UK left it far too late to catch a substantial share of an innovation that is approaching maturity?

What, reasonably, can the UK do about semiconductors?

What interventions are possible for the UK federal government in designing a semiconductor technique that deals with these 2 objectives– of increasing the UK’s financial and military security by minimizing its vulnerability to shocks in the worldwide semiconductor supply chain, and of enhancing the UK’s financial efficiency by driving innovation-led financial development? There is a menu of alternatives, and what the federal government selects will depend upon its hunger for investing cash, its determination to take properties onto its balance sheet, and just how much it is prepared to intervene in the market.

Could the UK develop the production of leading edge silicon chips? This appears implausible. This is the most advanced production procedure worldwide, immensely capital extensive and making use of a substantial quantity of proprietary and indirect understanding. The only method it might occur is if among the 3 business presently at or near to the innovation frontier– Samsung, Intel or TSMC– might be lured to develop a factory in the UK. What would remain in it for them? The UK does not have a huge market, it has a labour market that is high expense, yet doing not have in the required abilities, so its only opportunity would be to advance big direct aids.

In any case, the attention of these business is in other places. TSMC is developing a brand-new plant in Arizona, at an expense of $40 billion, while Samsung’s brand-new plant in Texas is costing $25 billion, with the United States federal government utilizing a few of the CHIPS act cash to subsidise these financial investments. In spite of Intel’s well-reported troubles, it is preparing considerable financial investment in Europe, supported by incentives from EU and its member states under the EU Chips act. Intel has actually devoted EUR12 billion to broadening its operations in Ireland and EUR17 billion for a brand-new fab in the existing semiconductor cluster in Saxony, Germany.

From the perspective of security of supply, it’s not simply chips from the leading edge that are very important; for numerous applications, in autos, defence and commercial equipment, tradition chips produced by procedures that are no longer at the leading edge suffice. In concept developing production centers for such tradition chips would be less tough than trying to develop production at the leading edge. Nevertheless, here, the economics of developing brand-new production centers is really tough. The expense of producing chips is controlled by the requirement to amortise the huge capital expense of establishing a fab, however a brand-new plant would remain in competitors with long-established plants whose capital expense is currently totally diminished. These tradition chips are a commodity item.

So in practise, our security of supply can just be ensured by dependence on friendly nations. It would have been useful if the UK had actually had the ability to take part in the advancement of a European technique to protect semiconductor supply chains, as Hermann Hauser has actually argued for However what does the UK need to contribute, in the production of more durable supply chains more localised in networks of dependably friendly nations?

The UK’s essential property is its position in chip style, with ARM as the anchor company. However, as a company based upon copyright instead of the huge capital expense of fabs and factories, ARM is possibly footloose, and as we have actually seen, it isn’t British by ownership. Rather it is owned and managed by a Japanese corporation, which requires to offer it to raise cash, and will look for to accomplish the greatest return from such a sale. After the proposed sale to Nvidia was obstructed, the most likely result now is a floatation on the United States stock exchange, where the normal appraisals of tech business are greater than they remain in the UK.

The UK state might look for to preserve control over ARM by the gadget of a ” Golden Share”, as it presently makes with Rolls-Royce and BAE Systems. I’m not exactly sure what the system for this would be– I would envision that the only proven method of doing this would be for the UK federal government to purchase ARM outright from Softbank in a predetermined sale, and after that consequently drift it itself with the golden share in location. I do not expect this would be low-cost– the concurred rate for the warded off Nvidia take control of was $66 billion. The UK federal government would then try to recover as much of the purchase rate as possible through a subsequent floatation, however the existence of the golden share would most likely decrease the marketplace worth of the staying shares. Still, the UK federal government did invest ⤠46 billion nationalising a bank.

What other levers does the UK need to combine its position in chip style? Smart usage of federal government acquiring power is frequently pointed out as a component of an effective commercial policy, and here there is a chance. The federal government made the welcome statement in the Spring Spending plan that it would devote ⤠900 m to construct an exascale computer system to produce a sovereign ability in expert system. The procurement procedure for this center must be developed to drive development in the style, by UK business, of specialised processing systems for AI with lower energy intake.

A strong public R&D base is a needed– however not enough– condition for an efficient commercial technique in any R&D extensive market. As a matter of policy, the UK diminished its public sector research study effort in mainstream silicon microelectronics, in reaction to the UK’s general weak position in the market. The Engineering and Physical Research Study Council reveals on its site that: ” In 2011, EPSRC chose not to support research study targeted at miniaturisation of CMOS gadgets through gate-length decrease, as big non-UK commercial financial investment in this field implied such research study would have been not likely to have actually had considerable nationwide effect.” I do not believe this was– or is– an unreasonable policy offered the truths of the UK’s worldwide position. The UK preserves scholastic research study strength in locations such III-V semiconductors for optoelectronics, 2-d products such as graphene, and natural semiconductors, to offer a couple of examples.

Provided the elegance of cutting-edge microelectronic production innovation, for R&D to be pertinent and translatable into business items it is essential that open gain access to centers are readily available to permit the prototyping of research study gadgets, and with pilot scale devices to show manufacturability and assist in scale-up. The UK does not have research study centres on the scale of Belgium’s IMEC, or Taiwan’s ITRI, and the concern is whether, offered the shallowness of the UK’s market base, there would be a client base for such a center. There are a variety of university centers concentrated on supporting scholastic scientists in numerous specialisms– at Glasgow, Manchester, Sheffield and Cambridge, to offer some examples. 2 centres are related to the Catapult Network– The National Printable Electronic Devices Centre in Sedgefield, and the Substance Semiconductor Catapult in South Wales.

This existing facilities is definitely inadequate to support an aspiration to broaden the UK’s semiconductor sector. However a choice to improve this research study facilities will require a mindful and reasonable assessment of what specific niches the UK might reasonably want to construct some existence in, developing on locations of existing UK strength, and comprehending the scale of financial investment in other places worldwide.

To sum up, the UK should acknowledge that, in semiconductors, it is presently in a reasonably weak position. For security of supply, the focus should be on remaining near to similar nations like our European neighbours. For the UK to establish its own semiconductor market even more, the focus should be on finding and establishing specific specific niches where the UK’s does have some current strength to construct on, and there is the possibility of quickly growing markets. And the UK ought to take care of its one real location of strength, in chip style.

4 lessons for commercial technique

What should the UK do about semiconductors? Another appealing, however unhelpful, response is ” I would not begin with here” The UK’s present position shows previous options, so to conclude, maybe it deserves drawing some more basic lessons about commercial technique from the history of semiconductors in the UK, and worldwide.

1. Fundamental research study is inadequate

The historian David Edgerton has actually observed that it is a long-running routine of the UK state to utilize research study policy as an alternative for commercial technique. Fundamental research study is fairly low-cost, compared to the pricey and lengthy procedure of establishing and carrying out brand-new items and procedures. In the 1980’s, it ended up being traditional knowledge that federal governments must not get associated with used research study and advancement, which must be delegated personal market, and, as I just recently gone over at length, this has exceptionally shaped the UK’s research study and advancement landscape However quality in standard research study has actually not produced a competitive semiconductor market.

The last considerable act of federal government assistance for the semiconductor market in the UK was the Alvey program of the 1980s. The program was not without some technical successes, however it plainly stopped working in its tactical objective of keeping the UK semiconductor market worldwide competitive. As the main assessment of the program concluded in 1991 [1]: ” Assistance for pre-competitive R&D is a needed however inadequate ways for boosting the competitive efficiency of the IT market. The program was not moneyed or geared up to handle the various stages of the development procedure efficient in being attended to by federal government innovation policies. If boosted competitiveness is the objective, either the financing or scope of action must be commensurate, or expectations must be decreased appropriately”.

However the ideal R&D organizations can be helpful; the experience of both Japan and the U.S.A. reveals the worth of market consortia– however this just works if there is currently a strong, R&D extensive market base. The production of TSMC reveals that it is possible to produce an international giant from scratch, and this stresses the function of translational research study centres, like Taiwan’s ITRI and Belgium’s IMEC. However to be reliable in developing brand-new services, such centres require to have a concentrate on procedure enhancement and production, along with discovery science.

2. Big is stunning in deep tech.

The modern-day semiconductor market is the embodiment of ” Deep Tech”: difficult development, typically in the product or biological domains, requiring long term R&D efforts and big capital expense. For all the love of garage-based start-ups, in an organization that requires up-front capital expense in the $10’s of billions and yearly research study budget plans on the scale of medium size country states, one requires major, big scale organisations to prosper.

The ownership and control of these organisations does matter. From a nationwide perspective, it is essential to have big companies anchored to the area, whether by ownership or by considerable capital expense that would be difficult to reverse, so making sure the permanence of such companies is the genuine company of federal government. Naturally, huge companies frequently begin as quick growing little ones, and the UK ought to make more effort to hold on to business as they scale up.

3. Getting the timing right in the innovation cycle

Technological development is unequal– at any offered time, one market might be going through really remarkable technological modification, while other sectors are fairly stagnant. There might be a minute when the state of innovation assures a duration of quick advancement, and there is a matching market with the capacity for quick development. Companies that have the capability to invest and make use of such ” windows of chance”, to utilize David Sainsbury’s expression, will have the ability to produce and catch a high and increasing level of included worth.

The timing of interventions to support such companies is essential, and unquestionably challenging, however history reveals us that countries that have the ability to provide considerable levels of tactical assistance at the ideal phase can see a product influence on their financial efficiency. The current quick financial development of Korea and Taiwan is a case in point. These nations have actually exceeded catch-up financial development, to equivalent or go beyond the UK, showing their reaching the technological frontier in high worth sectors such as semiconductors. Naturally, in these nations, there has actually been a much closer entanglement in between the state and companies than UK policy makers are comfy with.

Genuine GDP per capita at acquiring power parity for Taiwan, Korea and the UK. Based upon information from the IMF. GDP at PPP in worldwide dollars was considered the base year of 2019, and a time series built utilizing IMF genuine GDP development information, & & then revealed per capita.

4. If you do not pick sectors, sectors will pick you

In the UK, so-called ” vertical” commercial technique, where specific options are made to support particular sectors, have actually long run out favour. Choosing in between sectors is tough, and being viewed to have actually made the incorrect options harms the track record of people and organizations. However even in the lack of a clearly articulated vertical commercial technique, policy options will have the impact of favouring one sector over another.

In the 1990s and 2000s, UK picked oil and gas and monetary services over semiconductors, or certainly advanced making more usually. Our present financial scenario shows, in part, that option.

[1] Assessment of the Alvey Program for Advanced Infotech. Ken Guy, Luke Georghiou, et al. HMSO for DTI and SERC (1991 )