1. On the disparity in between ONS and HMRC quotes of organization R&D.

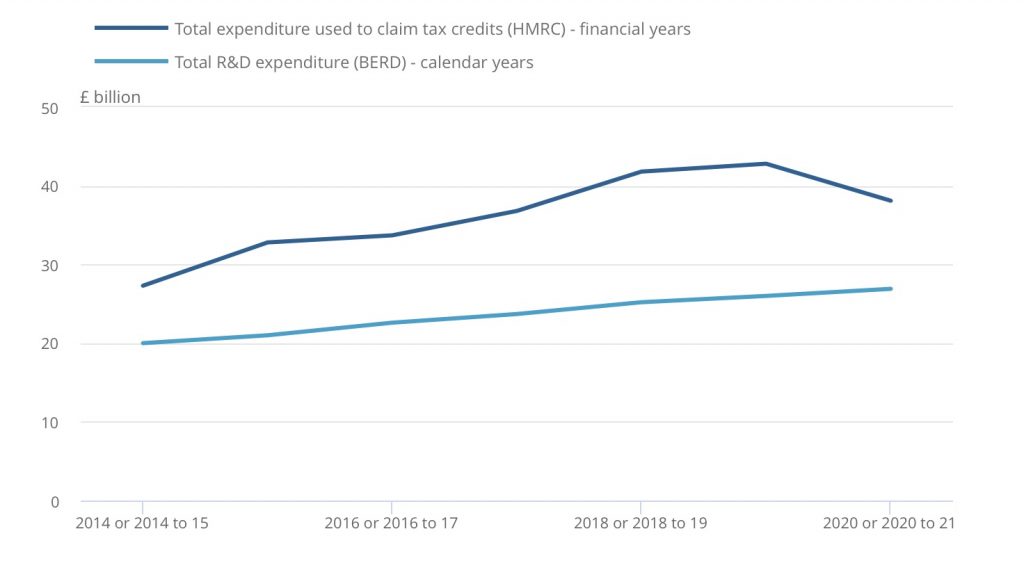

In the UK, there are 2 methods which the overall quantity of organization R&D (BERD) is determined. The Workplace for National Stats carries out a yearly study of organization, in which a sample of companies is asked to report just how much R&D has actually been performed. On the other hand companies can report what R&D they have actually performed to the taxman– HMRC– in order to claim R&D tax credits, which according to situations can be a decrease of their liability for corporation tax, or a real money payment. Over the last few years, the 2 procedures of organization R&D have significantly diverged, with significantly more R&D expense being declared for tax credits than is reported in the BERD study.

The divergence in between HM Income and Custom-mades (HMRC) and Organization business research study and advancement (BERD) quotes of research study and advancement (R&D) expense. Source: ONS.

The ONS has actually been checking out this divergence, and has actually just recently released a note which concludes that the main factor for the disparity is an undersampling of the small company population. On this basis, it has actually changed its previous price quote for organization R&D significantly upwards– in 2020, the modification is from ⤠26.9 bn to ⤠43 bn. In future years, ONS will present enhanced, more robust, methods that will consist of a broader series of SMEs in the sample they survey.

In concept, there might be 2 possible causes for the growing divergence in between the overall organization R&D tape-recorded by the ONS BERD study and the quantities underlying claims to HMRC for R&D tax credits:

a. The rewards of R&D tax credits have actually triggered companies to extend the meaning of R&D so they can get cash for activities that become part of typical organization (e.g. marketing research, exercising how to utilize brand-new devices). This is intensified by the development of a market of experts using their services to companies to assist them declare this cash (in return for a %).

b. The ONS study of companies (the BERD study) has actually methodically undersampled a population of little and medium business (SMEs), which end up to have more R&D activity than formerly thought.

In favour of (a)– the disparity in between the 2 procedures hasn’t been completely fixed, as you ‘d anticipate if it was just a concern of missing out on a population of companies who had actually constantly been doing R&D at a consistent rate, however who have actually only simply been found. The space has actually increased from ⤠7.3 bn in 2014, to ⤠16.6 bn in 2018. So for this description to hold, we require to think not just that there is an existing population of SMEs performing R&D that has actually formerly been undiscovered, however that this population has actually been significantly growing. Is R&D development in the SME sector at a rate of ⤠2.3 bn a year possible? I’m uncertain.

Furthermore, the rewards for extending the meaning of R&D to declare complimentary cash are apparent. HMRC accept that some claims are straight-out deceitful, approximating that 4.9% of the expense of the plan is attributable to mistake and scams. However there’s a huge grey location in between straight-out scams and innovative analysis of the ” Frascati” meanings of R&D

ONS argues in favour of (b), backing this up with an in-depth contrast of the microdata from the ONS study and HMRCs returns. To include some anecdotal assistance, operate in Greater Manchester in cooperation with an information science consultancy does appear to have actually determined a population of ingenious SMEs in GM which has actually formerly stayed unnoticeable, in the sense that they are companies who do not engage with universities or with Innovate UK.

In fact, the genuine response is most likely some mix of the 2. We’ll find out more once the brand-new method has actually produced a total information set determining the sectors and geographical places of R&D carrying out companies.

2. Policy ramifications

Figures for overall R&D costs (consisting of both organization and public sector R&D) as a percentage of GDP supply a helpful procedure of the total research study strength of the UK economy and form the basis for worldwide contrasts. The previous figure for R&D strength– about 1.7%– put the UK in between the Czech Republic and Italy. The brand-new quotes recommend a modified figure of 2.4%, which would put the UK approximately on a par with Belgium, a little above France, however behind the U.S.A. and Germany, and still a long method behind leaders like Korea and Israel. Naturally, when making these worldwide contrasts, a natural concern is how precise are the R&D stats in these other nations. This is an excellent concern that might be examined by OECD, who look at worldwide R&D stats.

The worldwide contrast has actually driven a target for R&D strength that the federal government devoted to– that it would accomplish an R&D strength equivalent to the OECD average. At the time when the target was developed this average was certainly equivalent to 2.4%. Nevertheless, the OECD average is a moving target considering that other nations are increasing their own R&D– it’s now above 2.5%. One can likewise ask whether a target to accomplish worldwide mediocrity is extending enough.

There are more basic concerns with the concept of having an R&D strength target at all. One peculiarity of revealing the target as a % of GDP is that a person can accomplish it by driving down the denominator; definitely GDP development in the UK has actually been frustrating for the last 12 years, as the Prime Minister has actually advised us. One might argue that a mathematical target for R&D is approximate and one need to focus more on the important results one wishes to accomplish from the research study– greater development, more fast and expense reliable development towards internet no, much better population health results and so on. As I composed myself just recently in my study of the UK R&D landscape:

” An R&D target need to be considered not as an end in itself, however as a way to an end. We need to begin by asking what sort of economy do we require, if we are to fulfill the huge tactical objectives that I went over in the very first part of this series. Offered a clearer view about that, we’ll have a much better comprehending the essential portion of nationwide resources that we need to dedicate to research study and advancement. I do not understand if that would produce the specific figure of 2.4%, however I would not be amazed if it was considerably greater.”

Possibly the most troublesome ramification of a BERD upgrade is the withstanding puzzle that efficiency development stays really sluggish. This additional, formerly unrecorded R&D, does not appear to have actually equated into efficiency development as we would anticipate.

This raises the wider concern of why we believe the federal government must support organization R&D at all, whether through R&D tax credits or through other ways. The classical argument is that economic sector R&D causes broader gain from the economy that aren’t recorded by the companies that make the financial investments, so in the lack of federal government companies will invest less in R&D that would be socially optimum. This causes the concern of whether all sort of R&D, in all sort of business (e.g. big and little) cause equivalent degrees of broader spillover results (and the exact same concern can be asked of intangible financial investments more normally). If the sort of R&D that are now being exposed with the brand-new method do have smaller sized spillovers than other types, one may ask what sort of interventions might enhance those.

3. Political ramifications

As others have actually observed, the chief threat of the modification is that in times of financial retrenchment, the federal government might state “objective achieved” and postpone or cancel boosts in public R&D. This threat appears really genuine offered the instructions of the present federal government. The opposition, on the other hand, has actually required an R&D target of 3% of GDP, so there is a lot of space there.

There is an argument that the modification recommends that public R&D is a lot more reliable than we believed in producing economic sector R&D– the utilize result is more powerful than we believed. For this argument to be persuading, we ‘d require to comprehend the degree to which the business doing this R&D are linked to the broader development system. However it does not then support the broader argument for R&D as a chauffeur of efficiency development– we have the R&D strength we desired, so why aren’t we seeing the advantages in the efficiency figures?

There are possible arguments that our focus in organization R&D has actually been excessive on the huge incumbents– the GSKs and Rolls Royces– whose R&D is really noticeable. On the other hand, this links to the long-running concern of why we do not have more of those huge incumbents? At this moment, we need to remember that there are just 2 UK business in the world top-100 of R&D entertainers— AstraZeneca and GSK. So why aren’t a few of these formerly hidden R&D extensive business scaling as much as end up being the brand-new huge gamers?

There is much yet to comprehend here.