mustafaU/iStock through Getty Images

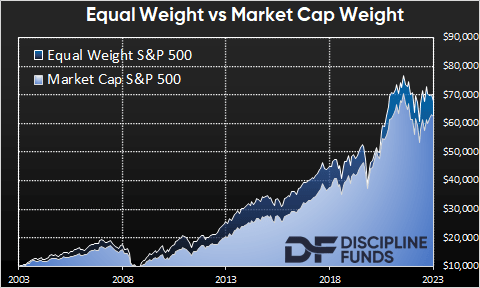

There’s been a great deal of chatter this year about the breadth of the stock exchange’s efficiency. While the S&P 500 is up 8.5% this year, most of that efficiency is being driven by simply a handful of the stocks. For instance, the equivalent weight S&P 500 (which purchases an equivalent weighting of the 500 business rather than letting the marketplace cap float) is really DOWN -0.5% this year. However the marketplace cap weighted S&P 500 index (the index you see on the news) is being driven mostly by a handful of megacap tech stocks since the Nasdaq 100 (which is mainly tech business) is up 28% this year. What do we make from all this?

Well, firstly, I believe we should not check out excessive into all this short-termism. It’s enjoyable to speak about the stock exchange in the short-term, however something I enjoy about my All Period investing method is that it particularly specifies the stock exchange as an 18-year instrument. It offers financiers a crystal clear understanding of the particular time horizon over which all their properties work for them. So while it’s enjoyable to speak about what stocks perform in 18 minutes or 18 months, it ought to truly be insignificant to your short-term monetary strategy since your stock allowance is serving a naturally long-lasting objective in your portfolio.

However zooming out really offers us a much better point of view on this story also. And when we zoom out, we see a much various story. We now have twenty years of real-time market information from live market cap and equivalent weight ETFs (SPY vs RSP). The efficiency is fascinating since the equivalent weight index has actually surpassed by nearly 1% annually. However it’s likewise included included threat along the method where the basic discrepancy has actually been 2% greater and the optimum drawdown was 5% much deeper. On the entire they have actually looked really comparable though, however to make that small premium you required a little more powerful stomach.

The factors for this are rather questionable, however the fundamental essence of what takes place in an equivalent weight index is that you underweight the bigger capitalization companies since of the method the fund rebalances. So, for example, if you owned 10 stocks in an equivalent weighting and you simply let them drift, then the very best entertainers get bigger and bigger. If you continue to let them drift (rather than rebalancing them back to equivalent weight), then your efficiency ends up being progressively manipulated by the larger business. When it comes to the marketplace cap weighted S&P 500, the current efficiency has actually been driven mainly by this alter due to the megacap tech business like Amazon ( AMZN), Microsoft ( MSFT) and Apple ( AAPL).

This isn’t precisely typical though. Generally, the equivalent weight index has actually carried out a bit much better since it has what is basically a smaller sized cap tilt and overstated momentum impact. So while Apple and Microsoft comprise 7% each in the S&P 500 MC, they are simply 0.25% in the equivalent weight index. Historically, tilting far from the drifting market cap has actually included a bit of threat by keeping greater relative direct exposure to smaller sized riskier business (that can possibly grow more). However this year, the specific reverse is occurring. The bigger business are exceeding and including an out of proportion go back to the marketplace cap weight. This is great unless it ends up being bad. By being more focused in particular companies, you expose yourself to more single-entity threat. So there’s presently more of a momentum impact in the market cap weighted ETF and when momentum is great, it’s truly great. And when it’s bad, it can be truly bad.

In the past, I have actually spoken about how the charm of a methodical equity index fund is that you have some ingrained momentum impact in the intrinsic fund structure. Some companies diminish and naturally fall out of the index and others turn into the index. Usually, the equivalent weight index intensifies this impact since smaller sized business displace bigger business. However in a year like 2023, the larger companies are growing much faster than the smaller sized companies, so the momentum impact, while still existing in both, is reversed. Whether this is great or bad is unidentified, however we understand that the marketplace cap weighted S&P 500 is focusing increasingly more threat in the larger business. That would naturally lead us to think that that indicates the S&P 500 is currently riskier than the equivalent weight index.

What to do, what to do?

Here at Discipline Funds, we tend to believe that financiers overcomplicate a great deal of these things. You can invest great deals of time attempting to select the very best stocks, finest sectors or finest index funds. And often you’ll surpass and often you will not, however in the long run it will not make a substantial distinction after taxes and charges. In truth, the SPIVA scorecards make it quite clear that 85%+ of the more active financiers will wind up underperforming (this is most likely greater if you really computed your after tax, after cost, after tension returns). And while we do not have an issue with element tilting and attempting to surpass the marketplace, we do tend to believe that easier is much better. 1 And in this case, as my partner likes to state, it’s “6 of 1 or half lots of another”.

The bottom line is, in the long run, these are really comparable indices on a danger changed basis and there’s absolutely nothing incorrect with owning the equivalent weight index as long as you understand you’re utilizing an element tilt that takes a bit more threat. At the exact same time, it works to comprehend that while this holds true in the long run, it’s not constantly real in the short-term. And now is among those times where the marketplace cap weighted S&P 500 is creating that 8.5% return by taking a far more focused threat relative to other broad markets.

1– I have actually been rather important of element investing throughout the years regardless of being a worth financier at heart. That’s not since I do not think the element proof. It’s since I believe choosing the best aspects at the correct time is really tough and not constantly worth the warranty of greater charges. And if you simply purchase the marketplace cap index, then you own all the aspects all the time instead of attempting to decide on when particular aspects will do much better. So I tend to simply accept basic is much better and in this case the marketplace cap weight is easier.

Editor’s Note: The summary bullets for this short article were selected by Looking for Alpha editors.