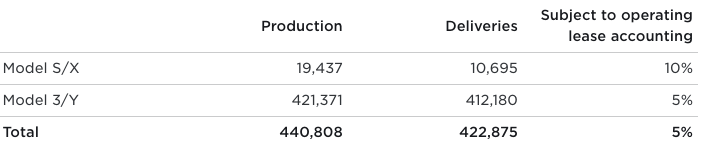

Tesla stated Sunday it delivered 422,875 electrical automobiles within the first quarter of 2023, simply beating Wall Side road estimates of round 420,000 gadgets. The corporate produced 440,808 automobiles in the similar duration.

The supply and manufacturing numbers are file effects for the EV maker. Within the fourth quarter of 2022, Tesla delivered 405,278 and produced 439,701 gadgets. The ones This autumn deliveries have been additionally file effects, however they overlooked Wall Side road expectancies.

It seems that that an enormous share of deliveries got here from automobiles produced by means of Teslaâs Shanghai gigafactory. The automaker has been issuing value cuts in all markets, together with China, the place the newest reductions have brought about a price cutting war amongst competition. The outcome is a rise of Tesla gross sales in China from ultimate 12 months, which means the East Asian nation helps to spice up Teslaâs world supply numbers.

Tesla doesnât smash down its supply and manufacturing numbers by means of area, however in step with information from the China Passenger Automobile Affiliation (CPCA), Tesla jointly bought 140,453 China-made automobiles in January and February. The CPCA hasnât but revealed Marchâs information. If Teslaâs March deliveries in China fit Februaryâs numbers, it will imply greater than 50% (or just about 215,000) of Q1 deliveries got here from Shanghai.

Â

Teslaâs Q1 2023 supply and manufacturing numbers. Symbol Credit score: Tesla, by way of screenshot

Tesla began slicing costs for its EVs in China in October. Maximum not too long ago, Tesla once more diminished the costs of Style 3 and Y there in January by means of between 6% and 13.5%, including gasoline to the hearth of a price cutting war within the nation. Competitors Xpeng and Nio, in addition to global manufacturers like Volkswagen and Mercedes-Benz, additionally discounted their costs to compete with Tesla vehicles, which are actually as much as 14% inexpensive than ultimate 12 months. In some circumstances, theyâre nearly 50% more cost effective than within the U.S. and Europe.

The automaker reflected an identical value cuts in Europe, Mexico and the U.S. over the last few months. This 12 months, Tesla dropped costs for Style Y and Style 3 automobiles within the U.S. by means of as much as 20%, and Style X and Style S automobiles by means of as much as 9%. Closing week, Tesla additionally relaunched its Eu referral program to check out to extend gross sales prior to the tip of the quarter.

Teslaâs percentage value rose 6.24% Sunday (in off buying and selling hours) following the automakerâs quarterly manufacturing and supply effects.

Tesla wanted a powerful consequence after a unstable previous few months in buying and selling. On the finish of 2022, Teslaâs percentage value plummeted amid CEO Elon Muskâs overhaul of Twitter. Traders have been additionally involved ultimate 12 months that the numerous reductions Tesla carried out throughout markets â together with a $7,500 bargain for U.S. patrons who took supply prior to 12 monthsâs finish â would possibly point out low call for from shoppers.

All over Teslaâs This autumn 2022 profits name in January, Musk attempted to appease traders by means of announcing that call for in reality exceeded manufacturing. On the time, Tesla said that the associated fee decreases and normal inflationary atmosphere would possibly have an effect on the corporateâs non permanent automobile margins, however that the corporate stated itâs extra fascinated by its running margin.

Weâll know extra about how the associated fee decreases globally have affected the whole industry when Tesla experiences first quarter profits on Wednesday, April 19. On the finish of ultimate 12 months, Tesla stated it expects to stay forward of the long-term 50% compound annual expansion fee with round 1.8 million vehicles for the 12 months.