- Approximately 4 in 5 house owners with home loans have a rate of interest listed below 5%, and almost one-quarter have a rate listed below 3%.

- With rates now near to 7%, lots of house owners aren’t moving, which is magnifying a lack of houses for sale.

- Rates would require to fall a fair bit to encourage house owners to put their house on the marketplace. Approximately one-quarter of most likely house sellers state they would feel more seriousness to offer if rates were to drop to 5% or lower, according to a current Redfin study. The share increases to almost 80% if rates were to 3% or lower.

- A great deal of sellers are likewise sitting tight due to the fact that they purchased just recently; a record 60% of home loan holders have actually resided in their house for 4 years or less, even more adding to the supply scarcity.

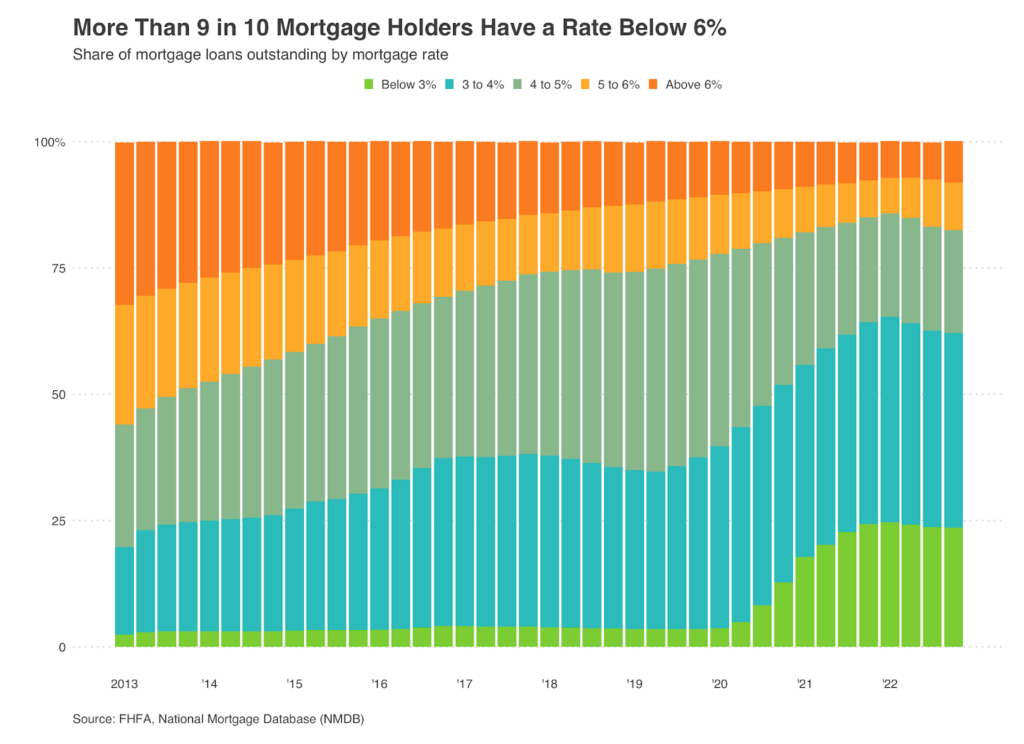

More than 9 of every 10 (91.8%) U.S. house owners with home loans have a rate of interest listed below 6%. That’s down simply a little from the record high of 92.9% hit in mid-2022.

That implies well over 92% of house owners with home loans have home loan rates listed below the present weekly average of 6.71%, which is near the greatest level in over twenty years. Property owners keeping their relatively low home loan rates is the primary factor for today’s significant scarcity of brand-new listings.

This is according to a Redfin analysis of Federal Real estate Financing Firm (FHFA) information since the 4th quarter of 2022, the most current duration for which information is offered. This analysis is restricted to families with exceptional home loans. See the bottom of this report more on method.

Here’s the complete breakdown of where today’s house owners fall on the mortgage-rate spectrum:

- Listed Below 6%: 91.8% of U.S. mortgaged house owners have a rate listed below 6%, below a record high of 92.9% in the 2nd quarter of 2022, as kept in mind above.

- Listed Below 5%: 82.4% have a rate listed below 5%. That’s below a peak of 85.7% in the very first quarter of 2022.

- Listed Below 4%: 62% have a rate listed below 4%, likewise below a record high (65.3%) hit in the very first quarter of 2022.

- Listed Below 3%: 23.5% a rate of interest listed below 3%, near the greatest share on record. The greatest was 24.6% in the very first quarter of 2022.

Lots of potential sellers are sitting tight instead of noting their house to prevent handling a much greater home loan rate when they acquire their next home. This “lock in” result has actually pressed stock to tape lows this spring. New listings of houses for sale and the overall variety of listings have both dropped to their most affordable level on record for this time of year, which is sustaining property buyer competitors in some markets and avoiding house rates from falling even more even in the middle of lukewarm need.

Despite the fact that the share of house owners with home loan rates listed below 5% or 6% has actually boiled down a little due to the fact that more individuals have actually purchased houses with today’s raised rates, it’s still real that almost every property owner would handle a greater home loan rate if they moved. That’s making many people who do not requirement to move sit tight, which implies it’s slim pickings for purchasers. Pending house sales are down about 17% from a year earlier.

” High home loan rates are a double whammy due to the fact that they’re preventing both purchasers and sellers– and they’re preventing sellers a lot that even the purchasers who are out there are having difficulty discovering a location to purchase,” stated Redfin Deputy Chief Economic Expert Taylor Marr “The lock-in result is not likely to disappear in the future. Home mortgage rates most likely will not drop listed below 6% prior to completion of the year, and the majority of house owners would not be encouraged to offer unless rates dropped even more. A few of them just do not wish to handle a 6%- plus home loan rate and some can’t manage to.”

Simply over one-quarter (27%) of U.S. house owners who are thinking about noting their house in the next year would feel more seriousness to offer if rates dropped to 5% or listed below. That’s according to a Redfin study performed by Qualtrics in early June. Approximately half (49%) would feel more seriousness if rates were to drop to 4% or listed below, and the share increases to 78% if they were to drop to 3% or below– a circumstance that is extremely not likely whenever in the future.

” The only individuals offering today are the ones who require to,” stated Atlanta Redfin Premier representative Jasmine Harris “The last 3 possible sellers I have actually fulfilled are individuals who are vacating the nation. I’m likewise dealing with somebody who’s vacating town for a brand-new task and another individual who requires a smaller sized house for health factors. So there are some houses beginning the marketplace, however not almost as lots of as there would be if rates weren’t so high. In more normal times, we ‘d likewise have individuals offering just due to the fact that they wished to transfer to a various area or desired a larger house and/or one with various functions.”

It deserves keeping in mind that for some house owners, the reality that house rates skyrocketed throughout the pandemic methods they have enough equity to validate selling and handling a greater rate. House rates have actually boiled down from the peak they struck in 2022, however the average U.S. list price is still more than 30% greater than it was right before the pandemic begun. Individuals who are purchasing a more economical house than the one they’re offering, maybe due to the fact that they’re moving to a more budget friendly part of the nation or downsizing, might be most likely to move even if it implies handling a greater rate.

The normal month-to-month home loan payment has actually increased $1,000 over the last 3 years as rates have actually increased from record lows and house rates have actually increased

The normal property buyer acquiring today’s median-priced U.S. house (approximately $380,000) at the present typical 6.7% home loan rate would handle a regular monthly payment of approximately $ 2,600, a record high. That’s up more than $300 from a year ago and up more than $1,000 from 3 years earlier, utilizing the average list price and typical home loan rates from those period.

Almost everybody has a home mortgage rate listed below the one they would get if they purchased a house today, however the distinction in month-to-month payments differs depending upon each private scenario. A home mortgage holder in the 3% to 4% variety is most likely to feel handcuffed to their house than somebody in the 5% to 6% variety, for example.

Think about these theoretical house owners:

- Purchased in 2018: Purchaser A purchased their house when the average U.S. house cost was around $280,000 and the typical 30-year set home loan rate was around 4.5%. Their month-to-month home loan payment has to do with $ 1,540, more than $ 1,000 lower than the $2,600 it would be if they purchased a house at today’s average house cost with today’s rate.

- Purchased in late 2020: Purchaser B purchased their house when the normal house was costing around $320,000 and the typical rate had to do with 3%. Their month-to-month payment is likewise around $ 1,540 monthly, more than $ 1,000 lower than it would be if they purchased a house with today’s rates and rates.

- Purchased in mid-2022: Purchaser C purchased their house when the normal house was costing about $425,000 and rates were around 5%. Their month-to-month payment is around $ 2,400 monthly. That’s simply $ 200 lower than it would be today, as house rates have actually boiled down ever since and rates were currently increasing. That purchaser might not feel secured by their home loan rate, however they’re likewise not most likely to think about offering their house, as they simply purchased it one year earlier.

A record share of home loan holders have actually resided in their house for 4 years or less, even more keeping back supply

Over half of (59.7%) house owners with home loans have actually resided in their house for 4 years or less, a record high and up from 47.3% throughout the 4th quarter of 2019, right before the pandemic started.

The part of individuals who have not resided in their house long has actually soared due to the fact that many individuals bought houses throughout the pandemic, encouraged by record-low home loan rates and remote work. That implies that even if rates were to drop considerably, it might not cause a flood of brand-new listings. Many individuals are most likely to sit tight just due to the fact that they moved just recently and aren’t in a rush to move once again.

Method

This report is based upon a Redfin analysis of 4th quarter 2022 information from the FHFA’s National Home Loan Database, which is a nationally representative 5% sample of domestic home loans in the U.S. The 4th quarter is the most current duration for which information on exceptional home loans is offered. Property buyer home loan rates do not generally alter considerably from quarter to quarter, as the majority of property buyers get 30-year home loans.

Redfin used FHFA’s information to the approximately 80 million owner-occupied families we approximate existed in the U.S. in 2022 based upon Census information. We describe these families as “house owners” throughout this analysis. Approximately 60% of house owners have an exceptional home loan.