MichaelRLopez

One year earlier, I released “ Valero Is Misestimated As Fracture Spreads Are Unlikely To Sustain Extreme Highs,” concerning my bearish outlook on the refinery huge Valero ( NYSE: VLO). Ever since, the stock has actually decreased by ~ 15% as the fracture spread, or the distinction in between refined gas and oil costs has actually narrowed. The business has actually likewise dealt with a moderate boost in running expenses, although that aspect is greatly balanced out by its ongoing decrease in capital investment.

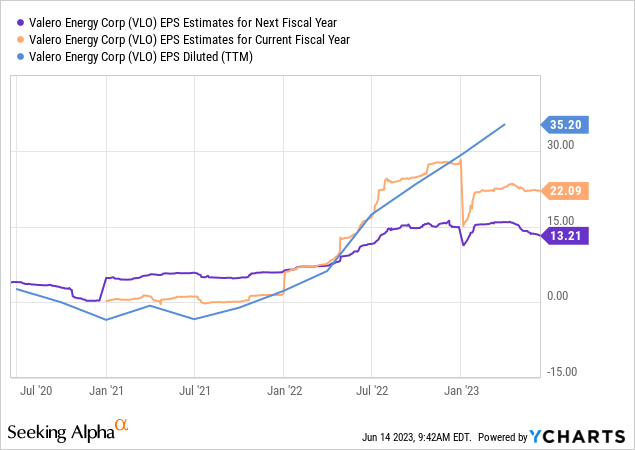

My bearish outlook on Valero was released within days of its cyclical peak of $135. Today, the stock trades at $114, with a depressed outlook, as its forward EPS price quotes decrease well listed below its TTM level. On a TTM basis, VLO is trading at an extremely low “P/E” of ~ 3.5 X; nevertheless, its forward “P/E” for 2023 is 5.2 X, while its 2024 profits assessment is 8.75 X. Appropriately, the marketplace is valuing VLO as if its EPS, eventually connected to split spreads, will go back to typical pre-shortage levels. See modifications to its EPS outlook listed below:

I think this scenario unlocks to a possible longer-term bullish chance on the stock. The business is no longer valued on somewhat unreasonable profits expectations relating to fracture spreads. Even more, the significantly extended nature of the Russia-Ukraine dispute and continued decreases in refiner CapEx costs considering that 2022 has most likely enhanced the basic outlook for fracture spreads. To streamline the matter, essentially all refinery giants are responding to the “green-energy shift” and the unsteady worldwide geopolitical and financial environment by greatly decreasing their long-lasting financial investments, rather concentrating on unfavorable money streams from funding to boost capital stability (financial obligation decreases, dividends, and buybacks).

In 2015, I believed this decrease would not continue. Still, considering that it has actually, fine-tuned fuel items are significantly most likely to fall under a a lot more substantial lack over the coming 1-5 years (or more). In the instant term, the business might deal with pressure from a financial recession, especially if integrated with an OPEC cut, as that might reduce gas costs while increasing oil expenses – straight hurting Valero’s earnings. Nevertheless, from a longer-term viewpoint, I think a strong bullish chance is forming in VLO today.

Refiners Are Quiting Oil Refining

The large bulk of Valero’s earnings is stemmed from its refinery operations. While the company wishes to broaden its “eco-friendly” section, well over 90% of its common earnings originates from oil refining. Even more, the business does not own “Valero” retail areas, having actually offered them off some years earlier. Hence, for the coming years, the majority of its earnings will continue to be connected to split spreads, with the majority of other elements being of relatively little repercussion. Nevertheless, like its peers, the business is thinking about slowing its capital expense in its refinery organization while broadening financial investments into renewables.

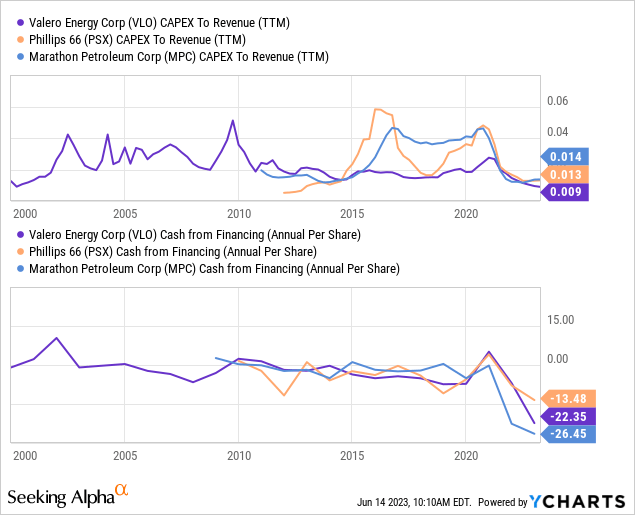

Its total capital investment level is shallow today, indicating it does not look for to broaden refinery operations and is rather pursuing very little “upkeep” capital spending levels. See listed below:

As you can see, Valero’s scenario is not distinct and is carefully mirrored in its peers Phillips 66 ( PSX) and Marathon ( MPC). All 3 business have actually greatly decreased capital investment levels while pressing “money from funding” to considerably unfavorable levels. These modifications suggest a broad shift towards returning worth to investors rather of reinvesting earnings into future operations. “Money from funding” consists of financial obligation and equity raises (which are favorable money from funding), and dividends, equity, and financial obligation buybacks (which are unfavorable money from funding). Valero’s business worth is presently ~$ 49B (of which ~$ 41B prevails equity), while its TTM money from funding is -$ 9.6 B, indicating the company has actually basically paid a 20% “dividend” on itself over the previous year. The majority of that is from a ~ 13% decrease in shares and a ~$ 5B decrease in net financial obligation (or a ~ 50% decrease) considering that 2022, while its real dividend yield is not incredibly high at 3.6%.

Looking forward, the business will unlikely continue such enormous go back to investors over 2023 and 2024; nevertheless, the basic pattern needs to continue to exist. Even more, these modifications, especially its financial obligation buybacks, will enhance its stability in the future must split spreads take a hit due to an economic crisis. Most significantly, due to the fact that Valero and its peers are all “surrendering” on future oil refining financial investments, likely, the supply of gas in the United States (and most likely abroad) will weaken as not all running capital (factories, and so on) is changed.

In theory, the decreases in gas supply must equal boosts in renewables. Nevertheless, most research study recommends that gas need will continue near peak levels through ~ 2037 and continue to increase till completion of this years. Even more, those designs do not suggest that gas need will fall listed below existing levels till a minimum of 2050. At the exact same time, Valero and its peers are taking instant actions to lower supply over the coming years. Most importantly, a preliminary refinery financial investment takes 10- 15 years to repay itself (with that timeline increasing with brand-new policies, increased labor and products inflation, and rates of interest).

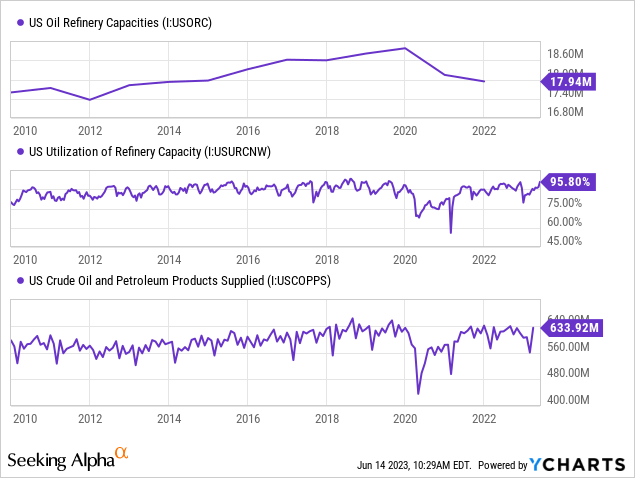

According to Chevron’s ( CVX) CEO, this most likely suggests no brand-new refineries will ever be developed in the United States, with none developed considering that the 1970s (significance most today are aging rapidly). As such, the peak for United States oil refinery capability was most likely hit in 2020, with that pattern being mirrored around the world The decreases in capability have actually been met normally significant usage of capability; nevertheless, fuel “items provided” stay listed below pre-COVID levels. See listed below:

In general, the outlook for United States refined item output levels is rather unfavorable. Over the coming years, it promises that the United States, and the majority of nations, will see their gas and diesel fuel schedule weaken. In the United States, falling capability is being offseted by high usage; nevertheless, weather condition modifications or other variations might quickly distress usage and push offered output much lower.

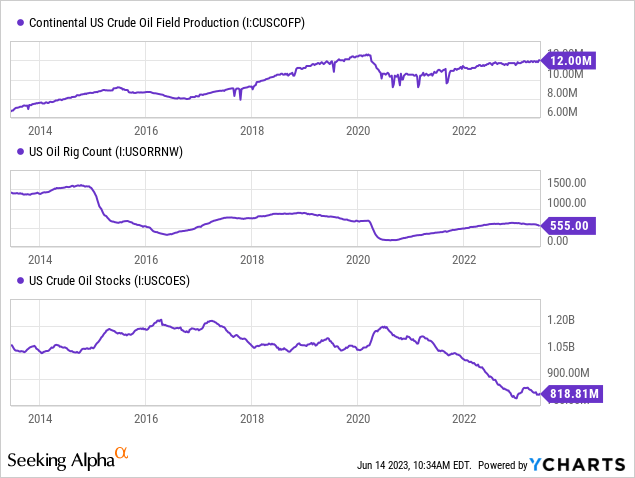

Obviously, the outlook for United States petroleum products is likewise fairly unfavorable, possibly benefiting oil costs. United States petroleum production stays listed below pre-COVID levels in spite of a considerable boost in the rig count (a motorist of the future output). Even more, the rig count is trending lower due to low oil costs today (and increasing production expenses), indicating that future oil production must decrease. At the exact same time, United States petroleum in storage is shallow due to the SPR release, indicating that crude might fall under extremely brief supply needs to production decrease without an equivalent drop in oil need. See listed below:

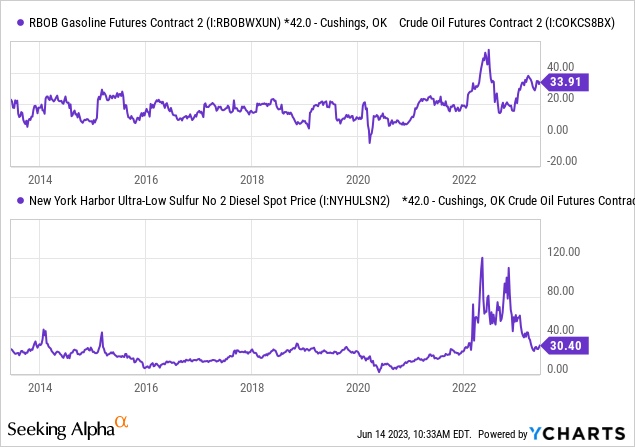

In the instant term, fracture spreads stay raised, especially for gas and less for diesel. Diesel fell under very brief supply in 2015, pressing costs up and reducing today’s diesel need levels. The enhancement in capability usage has actually likewise increased extract products; nevertheless, the spread is still on the upper end of its historic variety. Even more, the RBOB fracture spread has actually ticked back up due to extended greater gas need, indicating that refinery output might still be inadequate. See listed below:

These figures recommend that Valero will continue to make a really high margin over the coming quarters if these spreads stay raised. While the business needs to not make as much as it carried out in 2022, its profits outlook is still extremely strong, and its assessment is low, so long as fracture spreads do not decrease even more.

Putting Everything Together

Valero deals with 2 main dangers to its 2023-2024 EPS. One is an adequately big economic downturn that reduces fuel need. The 2nd is a considerable decrease in petroleum schedule. Valero likewise deals with a strong long-lasting driver of an international decrease in refinery capability (especially in trade-friendly Western nations), catalyzed by very low CapEx investing. In addition, Valero’s greatly unfavorable money from funding compared to its rate suggests investors will get a really high return on their financial investment.

Concerning the very first danger aspect, we need to bear in mind that not all economic downturns considerably obstruct refined fuel intake, as in the 2000 crash. In 2007, oil and gas need decreased however had actually succumbed to years due to very high costs. Today, while numerous grumble about high costs, fuel is more affordable than in the 2000s on an inflation-adjusted basis, around 25% for gas and almost 50% for petroleum of ~ 2005 inflation-adjusted costs. Those figures suggest that petroleum and gas might require to increase well above the 2022 peak levels prior to we see a product decrease in need. Even then, beyond exogenous shocks like pandemic lockdowns, fuel intake normally increases and decreases gradually as it takes a good deal of time for individuals to alter routines (purchasing more effective automobiles, taking a trip less, and so on).

In general, I think the “demand-side” danger aspect is not as substantial as numerous may think today. That stated, it promises that Valero might deal with lower petroleum schedule, thinking about today’s low domestic production levels, the falling rig count (indicating even lower domestic output), very low oil in storage (and a mainly drained pipes emergency situation reserve), and yet another possible OPEC output cut. Without a doubt, unpredictability relating to Russia and Ukraine contributes to a possible bullish driver for oil. Russia is the world’s second-largest exporter, with the controversial Black Sea being a considerable trade vector.

Thinking about these elements, there is an unique possibility that Valero deals with greater input expenses over the coming year, which might not always be met more exceptional fine-tuned fuel costs must the economy continue to slow. This possible produces some disadvantage capacity for Valero, which I think is mostly balanced out by its lower assessment and enhanced solvency level. That stated, I believe any decreases to split spreads will become met a more substantial boost due to huge underinvestment in the refinery sector, based upon an obvious overestimation of the shift speed to renewables. While Valero’s disadvantage danger is significant, I think it will likely attain EPS near its existing and TTM levels ($ 20-$ 30 – based upon fracture spreads) over most of the coming 5-10 years.

I am slightly bullish on VLO today and would be even more bullish must VLO decrease even more due to recessionary and oil schedule dangers. In addition, I choose VLO to PSX and MPC today considering that it trades at a ~ 15% discount rate to those 2 peers based upon its assessment. Nevertheless, most macroeconomic points are extremely appropriate and encouraging of PSX and MPC.