rarrarorro

Live Oak Bancshares ( NYSE: LOB) runs as a bank holding business for Live Oak Banking Business; it was integrated in 2008 and is headquartered in Wilmington, North Carolina. After an all-time high at $99.89 per share reached in late 2021, an unlimited decrease started for this bank, and today it is trading about 75% lower: just $25.83 per share. What’s more, the banking crisis set off by SVB’s insolvency has actually definitely not assisted Live Oak to recuperate.

In this post I will reveal you my primary issues about this, and why I do rule out this bank a buy regardless of being underestimated based upon its book worth.

The image of the scenario

In my viewpoint there are a variety of rather considerable issues in this bank, which is why I would not buy it. In any case, all the issues originated from one in specific: the expense of deposits.

As long as loaning was possible at rates near 0% it was much easier to increase book worth per share and net interest earnings, now that scenario has actually totally altered and Live Oak is having a difficult time. Prior To the Fed Funds Rate escalated, depositors were pleased with getting a minimal rates of interest, however that is no longer possible. There are lots of options in the cash market whose yield is far greater than a deposit; for that reason, Live Oak has actually been required to provide a greater rates of interest on deposits to keep its clients.

Live Oak Q1 2023

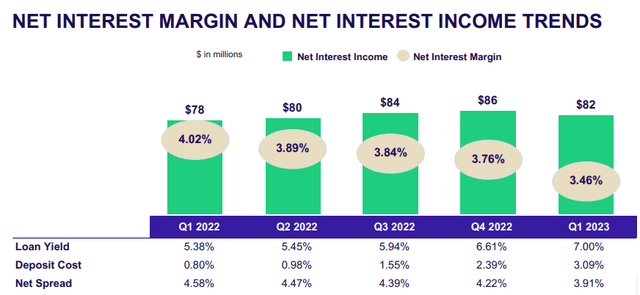

As can be seen from this image, in 12 months the expense of deposits increased from 0.80% to 3.09%, a substantial boost that was not shown proportionately in the loan yield. As an outcome, the collapse of the net interest margin was unavoidable, and what is most uneasy is that this pattern began as early as Q2 2022. At that time, the Fed Funds Rate was still low, yet Live Oak was currently paying 0.98% on deposits, which is an indication that its bargaining power is rather restricted. Its clients are primarily drawn in by the yield on deposits, and this can be harmful in a macroeconomic environment of increasing rates.

According to Fed approximates, there might be 2 more walkings in the 2nd half of 2023, and likely no cuts prior to 2024. This implies that Live Oak is most likely to suffer for a number of more months, if not years. 2 more walkings would raise cash market rates much more, consequently raising the expense of its deposits and minimizing the net interest margin. Undoubtedly, the assistance for 2023 is not rosy according to the words of CFO William Losch:

So the margin will be down in the 2nd quarter due to the fact that the 50 basis point boost we made in mid-March is going to have an outsized effect in the 2nd quarter. So 2nd quarter NIM will be down. However in the 2nd half, loan yields will begin to stream through the balance sheet. Deposit expenses will flatten is our expectation. And by 4th quarter, the margin will return up towards the lower to middle part of that 3.50% to 3.75% variety.

Simply put, according to management in the next quarter the net interest margin will be down about 20 basis points, however then towards completion of the year there will be a healing due to the flat expense of deposits.

I hope so, however in my viewpoint there are 3 reasons that I question this assistance:

- The very first is that we do not understand just how much and when the Fed will raise rate of interest. There are apparently 2 more walkings, however there might be more and we do not understand if there will not be any at the end of the year. Something we do understand, nevertheless: it is extremely not likely that rates will be cut in 2023. So, I believe the expense of deposits might increase even at the end of the year. This can not be dismissed if inflation continues to be high; I am referring specifically to core inflation.

- The 2nd factor is that in the last quarter alone, the expense of deposits increased by 70 basis points, excessive to think that this development will stop anytime quickly.

- The 3rd factor that leads me to question a recuperating net interest margin at the end of the year is that the bank in order to get a greater yield on possessions may make a lot of dangerous loans that would increase NPLs. In addition, it might precariously increase its loan to deposit ratio.

At this complex phase, I believe it deserves buying banks that have actually not accomplished excessive decrease in net interest margin, and are just just recently having problem with the increasing expense of deposits. Live Oak has actually currently been revealing indications of weak point for a number of quarters, which leads me to prevent buying it.

Live Oak Q1 2023

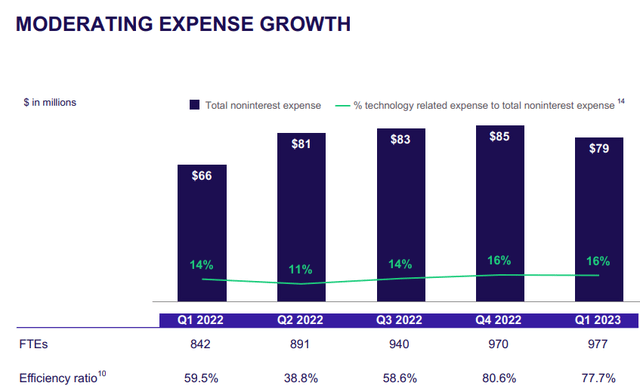

Lastly, success issues are likewise afflicting the effectiveness ratio, which is absolutely weakening. A worth of 77.7% indicates mismanagement of overhead.

Looking for Alpha’s projection

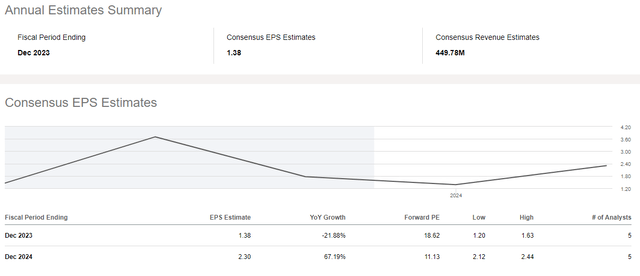

We have seen what management’s projection is for the expense of deposits, however what do experts anticipate for EPS?

Looking For Alpha

According to these quotes from Looking For Alpha, FY 2023 EPS is anticipated to be lower than FY 2022 by 38 basis points. Simply put, it will not be a rosy year moving forward.

Nevertheless, likewise in accordance with the CFO’s quotes, 2024 must be the year of healing and EPS will be 54 basis points greater than 2022. Nevertheless, EPS of $3.70 in 2021 will not be reached. Once again, as previously, I stay rather puzzled about the expediency of these quotes.

The most considerable unfavorable repercussions set off by limiting financial policy do not take place when rates are raised, however when they are kept high for a long period of time. In 2024 we will be more than a year into a tough macroeconomic environment, and we might be heading for an economic crisis that would definitely not benefit banks. Simply put, to think that 2024, the year when rates might be cut to restore the economy, is the year of healing, I discover rather not likely. I might be incorrect, however traditionally when rate of interest are high and banks hesitate to provide cash, the economy has actually barely prospered in the following months/years. In case of an economic crisis, EPS will dissatisfy expectations.

Appraisal

Up until now I have actually set out my primary issues about this bank; nevertheless, total I do rule out it a sell. The factor depends on the reality that, when examining the book worth, Live Oak appears extremely underestimated. This implies that the downturn suffered is unjustified thinking about the present level of equity.

The typical cost/ book worth ratio from the IPO to date has actually been 2.64 x; increasing this figure by the present book worth per share of $18.58, the reasonable worth total up to $49.05 per share. Simply put, a lot more than the present cost of $25 per share. Nevertheless, there is an essential indicate reference. I tend to examine the typical cost/ book worth over a longer timespan, 10-15 years, due to the fact that in this method the typical ratio is affected by several macroeconomic contexts that have actually happened throughout the years. In this case, nevertheless, it is not possible considering that the earliest offered information returns to the IPO in July 2015. As an outcome, this evaluation might be extremely focused based upon a historic context that does not represent the present one. Another assessment approach that may offer us some more insight into Live Oak’s assessment is to compare its present multiples with those of its rivals.

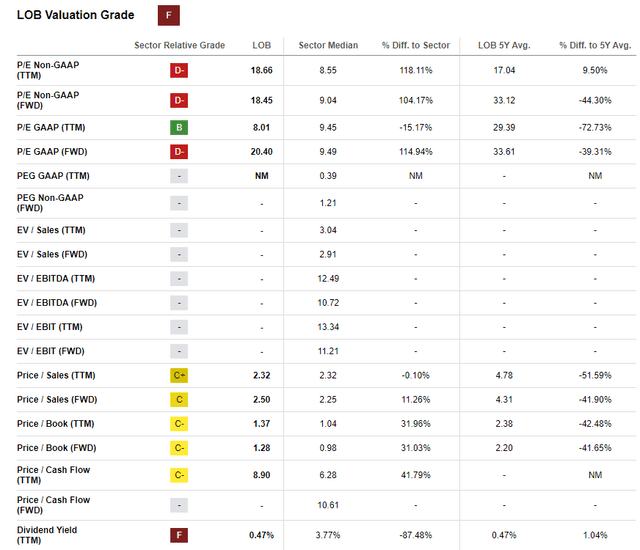

Looking For Alpha

From this viewpoint, Live Oak provides less than motivating outcomes. Other Than for GAAP P/E (TTM), in the other ratios it provides worths above the market mean. Distressed EPS in the coming months definitely does not assist, especially when it comes to GAAP P/E (FWD). Simply put, the issue is not the outcomes accomplished, however specifically the outcomes anticipated in the future. In my viewpoint, I believe the strong undervaluation on a book worth basis is partially balanced out by the frustrating ratios outcomes.

Conclusion and last ideas

Total, Live Oak is a bank in trouble due to the fact that its financing sources are more costly than its rivals. This is an essential indication of weak point, however the stock might not always continue to fall. The marketplace might have currently marked down a downhearted circumstance, definitely it has actually currently marked down the decreasing net interest margin for Q2 2023. Personally, regardless of being underestimated on paper, I choose to prevent it, partially due to the fact that its previous efficiency does not satisfy my financial investment requirements.

When I need to select whether to buy a bank, there are at least 4 conditions that need to be fulfilled even prior to evaluating whether it is underestimated or not:

- Long-lasting EPS need to be growing, potentially with a net interest margin that likewise tends to enhance or a minimum of stay steady in tough times such as the present one.

- Deposits need to be of quality and, above all, need to be low-cost. This particular is common of banks with bargaining power.

- Concrete Book Worth per share need to experience considerable long-lasting development.

- The dividend per share need to be increasing over the long term and potentially the dividend yield need to be above 3%.

At present, Live Oak shows just the 3rd particular, which by the method seems having a hard time in current months.

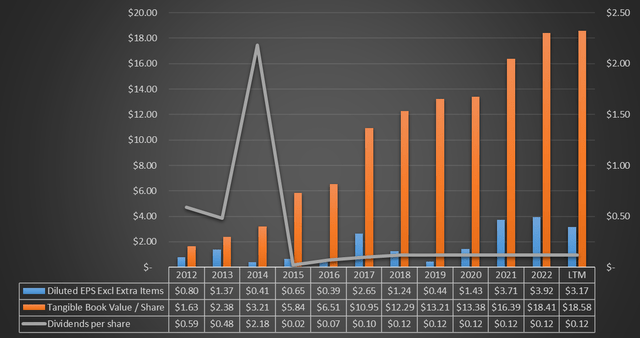

Looking for Alpha information

As can be seen, watered down EPS has actually never ever corresponded over the long term: there are great years and others absolutely not. In addition, the dividend per share has actually been stagnant considering that 2018 and far from its 2014 high.

Lastly, concrete book worth per share should have a different conversation. On the one hand, its consistent development considering that 2012 can not be rejected; on the other hand, it is great to explain in what macroeconomic context it has actually happened. Remembering the previous conversation, today it is no longer possible to believe like ten years back when rates were close to 0%. All it took was one year of tight financial policy to see concrete book worth per share decrease considerably. In my viewpoint, I would not be shocked to see it trending downward in the coming months and at that point the 3rd condition would not be fulfilled either. Concerning deposits, we have actually seen how their expense is a significant problem.