Sundry Photography

In our previous analysis of ServiceNow, Inc. ( NYSE: NOW) in 2022, we determined that ServiceNow held a dominant position in the IT Solutions Management (ITSM) market, catching an outstanding 39.6% market share. Nevertheless, we observed a worrying pattern in its stock-based settlement, which grew at an average rate of 57.2%– exceeding its profits development of 43.1%. This inconsistency raised issues about the possible disintegration of investor worth. Furthermore, the business dealt with obstacles with its fairly greater membership cost compared to rivals such as Microsoft, Atlassian, and LogMeIn. Our companied believe this rates variation might restrain the business’s capability to bring in smaller sized company customers. Subsequently, we appointed an Offer ranking to the business with a cost target of $463.92, representing a disadvantage of 16.5%.

Because our previous protection, ServiceNow’s stock cost has actually undoubtedly satisfied our predicted target, experiencing a decrease of 19.7% within the year following our analysis up until February 2023. Nevertheless, the stock cost has given that rebounded and presently reveals an impressive boost of 32% given that February 2023. For this reason, in this upgraded analysis, we assess the business to modify our appraisal and figure out if our outlook has actually moved. We concentrated on taking a look at the stability of ServiceNow’s ITSM market share by evaluating its modifications over the previous year. Furthermore, we evaluated its consumer additions and Typical Income Per User (ARPU) to establish which of these aspects has a more substantial influence on development. Finally, we will utilize our consumer addition and ARPU projections to forecast future incomes, allowing us to assess any noteworthy modifications in the business’s outlook given that our previous analysis.

Steady ITSM Market Share

|

ServiceNow Sector Income ($’ 000s) |

2018 |

2019 |

2020 |

2021 |

2022 |

5-year Typical |

Our 2022 Projection |

|

Membership |

2,421,313 |

3,255,079 |

4,285,797 |

5,573,000 |

6,891,000 |

7,074,651 |

|

|

Development % (YoY) |

39.2% |

34.4% |

31.7% |

30.0% |

23.6% |

31.8% |

26.9% |

|

Expert services and other |

187,503 |

205,358 |

233,687 |

323,000 |

354,000 |

389,254 |

|

|

Development % (YoY) |

4.8% |

9.5% |

13.8% |

38.2% |

9.6% |

15.2% |

20.5% |

|

Overall Income |

2,608,816 |

3,460,437 |

4,519,484 |

5,896,000 |

7,245,000 |

7,463,905 |

|

|

Development % (YoY) |

36.0% |

32.6% |

30.6% |

30.5% |

22.9% |

30.5% |

26.6% |

Source: Business Data, Khaveen Investments

Based upon the table, the business’s overall profits grew by 22.9% in 2022, which was listed below its 5-year average of 30.5% and the 2021 development of 30.5%. Nevertheless, it was likewise relatively in line with our anticipated development of 26.6%. This was because of the membership section (95.1% of 2022 profits) growing at 23.6%, fairly in line with our previous projection of 26.9%. Although management did not highlight the factors for the downturn in development rate, according to Gartner, “worldwide IT investing contracted 0.2% in 2022”, which our company believe might have affected the business’s development. The Expert services and other section grew at 9.6%, well listed below our projections of 20.5%, however it represents just 4.9% of overall profits.

In addition, we analyzed ServiceNow’s market share in the ITSM market. Although ServiceNow offers a wide variety of services under its Now Platform, more than 50% of profits in 2021 was from ITSM. According to Apps Run The World, ServiceNow was the marketplace leader in the $7.7 bln ITSM market with a 40.1% share in 2021. This corresponds to $3.09 bln straight from ITSM, 52.4% of 2021 overall profits. This is fairly the like ServiceNow’s ITSM market share from 2020 which was 39.5%. We anticipated the 2022 ITSM market size, by utilizing Technavio‘s 2022 market projection CAGR of 14.3% on the $7.7 bln 2021 ITSM market size, which is $8.8 bln. Then, dividing 52.4% of ServiceNow’s 2022 profits ($ 3.8 bln) by the anticipated 2022 ITSM market size ($ 8.8 bln), we obtained the business’s 2022 ITSM market share to be 43.1%. For that reason, based upon our anticipated 2022 (43.1%) and the previous 2 years (2021:40.1%, 2020:39.5%) ITSM market share, our company believe that the business has a steady market share in the ITSM market.

Gartner

Additionally, based upon Gartner’s Magic Quadrant, ServiceNow remains in the Leaders Quadrant, and it is better in regards to capability to perform and efficiency of vision when compared to other business providing ITSM services, even those within the leader’s quadrant. Furthermore, this is the ninth straight year that ServiceNow is a leader in the Gartner Magic Quadrant. According to Gartner, ServiceNow’s position in the quadrant is because of it having brand-new item improvements while launching “more native innovative functions than any other supplier”, and it “preserves a variety of innovative item distinctions”. This is shown by taking a look at the table listed below, with ServiceNow having the joint greatest ability rating of 4.5 and the greatest variety of evaluations (1,738) when compared to other ITSM business in the Leader and Opposition quadrant, according to Gartner Peer Insights.

|

Item Abilities |

Ability Rating (Out of 5) |

No. of Evaluations |

|

ServiceNow |

4.5 |

1,738 |

|

ManageEngine |

4.4 |

1,026 |

|

Atlassian ( GROUP) |

4.5 |

846 |

|

Ivanti |

4.4 |

844 |

|

Freshworks ( FRSH) |

4.5 |

732 |

|

BMC |

4.5 |

167 |

Source: Gartner, Khaveen Investments

Finally, according to Gartner’s market momentum index, which is determined by Gartner queries and web and social networks patterns, “ServiceNow preserves a strong neighborhood of users, as potential consumers frequently point out awareness or experience through their peers”, which shows it has a strong market existence. Our company believe its high market existence might be kept as its sales and marketing group increased headcount by 25.5% in 2022.

ServiceNow’s supremacy in the market is so strong that …

ITSM platform purchasers regularly point out issues that ServiceNow’s market supremacy is injuring their capability to renegotiate their agreements or minimize their ServiceNow footprint without greatly affecting their existing discount rates – Gartner

This shows it has strong bargaining power over purchasers. In conclusion, our company believe ServiceNow has a steady market share in the ITSM market when taking a look at our calculated market share of 43.1% in 2022, and Apps Run the World’s share of 40.1% and 39.5% in 2021 and 2020 respectively. We likewise determined it was a leader in the Gartner Magic Quadrant for 9 straight years due to item distinction and market existence in regards to social networks and web search patterns.

Development More Based On ARPU Development

|

ServiceNow Consumer Additions & & ARPU |

2018 |

2019 |

2020 |

2021 |

2022 |

5-year Typical |

|

Consumers |

5,400 |

6,200 |

6,900 |

7,400 |

7,700 |

|

|

Development%( YoY) |

22.7% |

14.8% |

11.3% |

7.2% |

4.1% |

12.0% |

|

Consumer Additions |

1,000 |

800 |

700 |

500 |

300 |

|

|

Development% (YoY) |

25.0% |

-20.0% |

-12.5% |

-28.6% |

-40.0 % |

-15.2% |

|

ARPU($ mln) |

0.483 |

0.558 |

0.655 |

0.797 |

0.941 |

|

|

Development %( YoY) |

10.8% |

15.5% |

17.4 % |

21.6% |

18.1% |

16.7% |

|

Consumers with >$ 1 mln ACV |

675 |

890 |

1,082 |

1,346 |

1,637 |

|

|

Development%( YoY) |

34.7% |

31.9% |

21.6 % |

24.4% |

21.6 % |

26.8 % |

|

Income Development %( YoY) |

36.0% |

32.6% |

30.6% |

30.5%(* )22.9% |

30.5% |

Click to expand(* )Source: ServiceNow, Khaveen Investments |

When we covered ServiceNow

formerly(* ), we determined that ServiceNow had the greatest membership cost compared to all its closest rivals in the ITSM area with $30,000 for its basic bundle and $50,000 for its expert bundle.

Consumers who stop working to spending plan for the needed add-ons and item upgrades frequently experience unwanted expenses when wanting to include extra platform abilities such as customized apps, ITOM functions, line-of-business applications, orchestration, AI/ML or extra workflow approvers– Gartner For that reason, ServiceNow likewise has a high expense of add-ons of other services aside from ITSM. Additionally, according to

Furthermore, according to ServiceNow (photo listed below), they serve 85% of business in the Fortune 500. For that reason, our company believe the factor for the continuous decrease in consumer additions is the more affordable options that smaller sized organizations have at their disposal to fulfill their workflow automation requires along with ServiceNow currently serving a high percentage of big business, which results in a reduction in the rate of consumer additions in time.

ServiceNow In regards to ARPU development, our company believe an essential element is the business’s cross-selling capabilities. ServiceNow successfully markets and offers throughout its more comprehensive platform and extended ITSM abilities to its consumers. Gartner frequently sees consumers buying items beyond ITSM to extend their platform usage in locations such as HR, CEC, GRC and more comprehensive ITOM –

Gartner

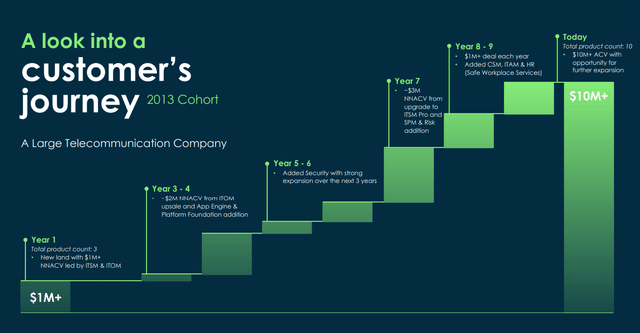

From the

ServiceNow In conclusion, our company believe ServiceNow is more based on ARPU development instead of consumer additions for total development. Many SMB organizations have actually more affordable options compared to ServiceNow for their workflow automation requirements and the business currently has 85% of Fortune 500 business as consumers. Therefore, our company believe this results in a lower rate of consumer additions in time. Nevertheless, the business has actually had a constant boost in ARPU development throughout the years due to cross-selling of their items that ultimately increase the consumer ACV. Low Consumer Additions as It Concentrates On Big Enterprises

For this area, we upgraded our projections for ServiceNow incomes for the next 5 years by forecasting consumer additions and ARPU along with describing the factors behind our forecasts.

In regards to consumer additions, ServiceNow’s technique seems choosing big business that can invest great deals of cash on a wide variety of services. According to ServiceNow, it currently offers its services to 85% of business in the Fortune 500. Furthermore, ServiceNow’s President and Chief Operating Officer CJ Desai mentioned that the business is “… extremely concentrated on top of your house of the pyramid, as you call it, in regards to

growth

technique” in the Q12023

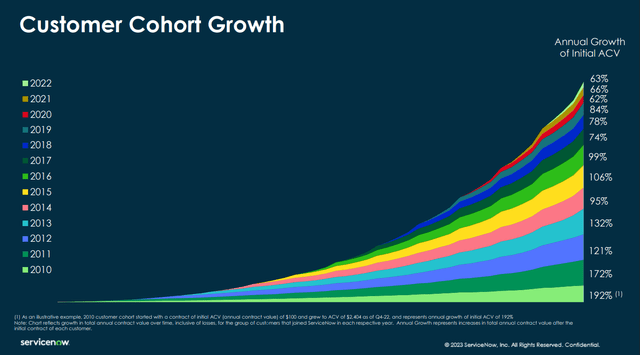

revenues rundown, describing business in the top of the pyramid as big business. Because the business has a growth technique that concentrates on including big business and currently has a huge percentage of big business as its consumers (85% of Fortune 500), we do not think it will have the ability to include consumers at the rate it was including formerly. In regards to ARPU, our company believe ARPU would continue to grow in time due to the different points mentioned above such as item distinction and cross-selling which leads to a boost of >>$ 1 mln ACV consumers. Additionally, according to ServiceNow ( photo listed below), the longer the consumer remains within the business, the greater their yearly ACV development compared to their preliminary ACV. For that reason, with regularly increasing ACV per consumer, we anticipate ARPU to reveal a constant boost over the next 5 years.

ServiceNow Income Projections 2023F 2024F

|

2025F |

2026F |

2027F |

Consumers |

7,954 |

8,170 |

|

8,353 |

8,508 |

8,639 |

Development % (YoY) |

3.3% |

2.7% |

|

2.2% |

1.9% |

1.5% |

Consumer Additions |

254 |

216 |

|

183 |

155 |

131 |

Development % (YoY) |

-15.2% |

-15.2% |

|

-15.2% |

-15.2% |

-15.2% |

ARPU ($ mln) |

1.120 |

1.333 |

|

1.587 |

1.889 |

2.248 |

Development % (YoY) |

19.0% |

19.0% |

|

19.0% |

19.0% |

19.0% |

Overall Income ($ mln) |

8,909 |

10,891 |

|

13,254 |

16,069 |

19,423 |

Development % (YoY) |

23.0% |

22.3% |

|

21.7% |

21.2% |

20.9% |

Click to expand |

Source: Business Data, Khaveen Investments |

Threat: Low Income Share in Asia Pacific |

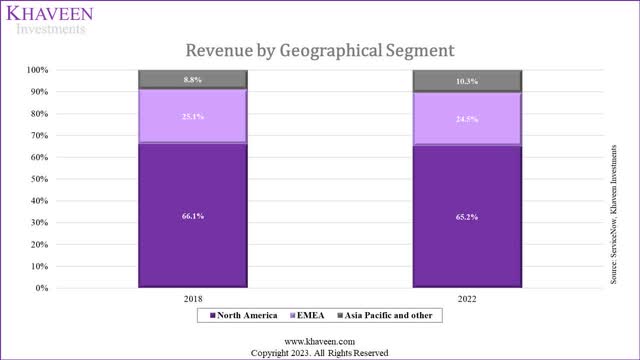

ServiceNow’s profits share in the Asia Pacific and other area in 2022 was 10.3%, lower than its profits share in EMEA (24.5%) and The United States And Canada (65.2%). The share in Asia Pacific and Other has actually just increased by 1.5% from 8.8% in 2018. According to

Mordor Intelligence

, the fastest-growing ITSM market over the next 5 years is Asia Pacific. For that reason, our company believe the restricted direct exposure (10.3%) to the Asia Pacific area is unfavorable to its profits development outlook.

Decision Khaveen Investments Looking For Alpha, Khaveen Investments

In summary, our company believe ServiceNow has actually kept a steady market share position in the ITSM market, with our anticipated 2022 market share of 43.1% comparing positively to Apps Run the World’s 2021 and 2020 shares of 40.1% and 39.5%, respectively. In addition, ServiceNow’s constant management in the Gartner Magic Quadrant for 9 successive years speaks with its item distinction and strong market existence.

Concerning consumer additions and ARPU development, we have actually observed a decreasing pattern in consumer additions, while ARPU has actually experienced stable development over the previous 5 years. We associate the decrease in consumer additions to the high membership rates, which might be less inexpensive for smaller sized companies, along with the business’s considerable existing consumer base of big business (representing 85% of Fortune 500 business). The development in ARPU can be credited to effective cross-selling efforts, evidenced by a 26.8% typical yearly development in consumers with an ACV surpassing $1 mln. Looking ahead, we anticipate a more decrease in consumer additions (-15.2% annual decrease) due to ServiceNow’s tactical concentrate on broadening its existence within big business. On the other hand, we expect ARPU to continue growing (16.7% annual development) due to its cross-selling efforts and a boost in ACV as consumers extend their period with the business.

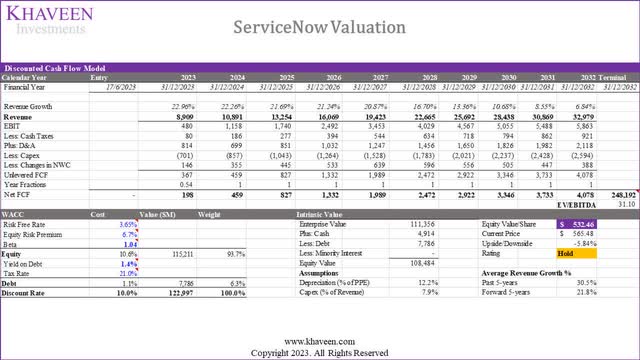

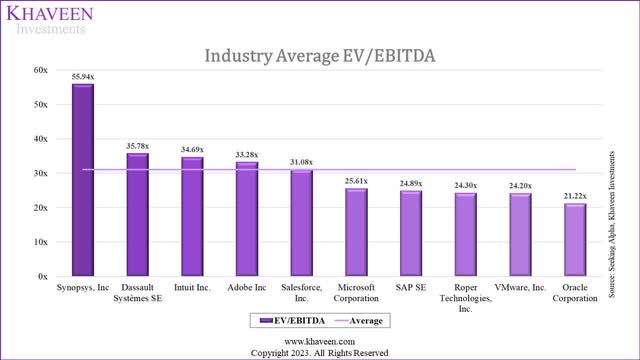

For our appraisal of ServiceNow, we utilized a DCF technique based upon our anticipated incomes. To figure out the terminal worth, we thought about the EV/EBITDA ratios of 10 out of the 13 highest-revenue software application business, leaving out ServiceNow, Palo Alto Networks (

PANW

), and Workday (

WDAY) due to their anomalous EV/EBITDA worths of 131.43 x, 200.31 x, and 314.79 x, respectively. The 10 business utilized for contrast consisted of Microsoft ( MSFT), Oracle ( ORCL), SAP ( SAP), Salesforce ( CRM), Intuit ( INTU), Adobe ( ADBE), VMware ( VMW), Dassault Systèmes ( OTCPK: DASTY), Roper Technologies ( ROP), and Synopsys ( SNPS). As an outcome, we obtained an EV/EBITDA worth of 31.1 x, which is lower than the previous protection’s EV/EBITDA worth of 54.61 x. In conclusion, we have actually developed a brand-new cost target of $ 532.46 with a disadvantage of 6%. This modified target is greater than our previous target of $463.92, showing our anticipated 5-year profits development of 21.8%, compared to the previous price quote of 18.2%. With a greater cost target, we now rank the business as a Hold