Sundry Photography/iStock Editorial through Getty Images

Today, as financiers return into risk-taking mode, the marketplace is all of a sudden re-discovering a great deal of downtrodden tech stocks that were trading at undersea evaluations far listed below their intrinsic worths. This group of stocks has been amongst the most significant rebounders over the previous couple of weeks, and in my view, continuing to concentrate on these “development at an affordable rate” names stays among the very best methods to beat the marketplace in this environment.

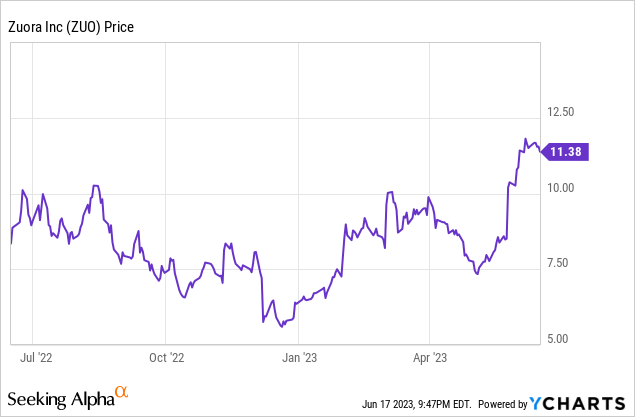

Zuora ( NYSE: ZUO) is an excellent example of this. This membership revenue-management software application business has actually seen its share rate dive ~ 75% year to date, with current momentum sustained by a really strong Q1 incomes cycle. In my view, there’s still lots of upside delegated go.

The bull case for Zuora resonates as it reveals fantastic execution in a difficult environment

Previously in April, I revealed a bullish viewpoint on Zuora with a $11.50 rate target on the business, at the time representing ~ 25% benefit. I stay at a buy ranking for Zuora stock and am raising my year-end rate target to $14, representing north of 20% additional benefit in this stock.

In my view, Zuora is an excellent example of clever execution in a tough macro environment. Though the business is not unsusceptible to slowing sales in the software application sector, it has actually rotated its sales force in addition to its channel partners to concentrating on smaller sized, faster offers that have more instant ROI – rather of chasing after the multi-year, bigger offers that are getting more executive analysis today. This technique has actually permitted Zuora to publish constant development rates that do not reveal much deceleration amidst macro pressures.

Here, in my view, is the complete long-lasting bull case for Zuora:

- Subscription-based company designs are ending up being dominant. Offered the truth that a growing number of organizations are embracing this kind of design, Zuora’s base of possible consumers has actually expanded substantially. Zuora’s originality in this regard is likewise crucial to mention: business can pick a routine ERP, however Zuora’s subscription-focused options assist to resolve typical discomfort points.

- Development performance history is strong; the item portfolio is broadening. There’s practically no other business that markets itself as a purpose-built platform for membership business. Zuora has actually likewise done a great task at expanding its portfolio of options, varying from earnings management to billing tools to CPQ (configure, rate and quote) applications.

- Zuora grows in addition to its consumers. As Zuora’s customers grow their customer bases, so does Zuora’s chance to generate income from and grow together with its consumers. The business has actually kept in mind that upsells have actually struck a “record rate”, and highlighted numerous crucial turning points like GoPro’s ( GPRO) subscription-based storage and insurance coverage program (a secret function of the business’s prepared turn-around) striking one million customers.

- Unloading services work to partners. As Zuora has actually scaled, it has actually likewise had the ability to increase its third-party suppliers and resellers to handle more of the unprofitable services/onboarding work that usually serves as a drag on software-company margins. Zuora’s mix of membership versus services earnings has actually grown over the previous numerous quarters, assisting improve gross margins and highlighting where Zuora would choose to be at scale.

- Acquisition possibility, specifically after the business struck breakeven. While I never ever like to base any financial investment choice based upon high hopes that the stock will get obtained, Zuora mark off a great deal of boxes for being obtained: it’s little with simply a ~$ 1.5 billion market cap; it provides a really distinct item that lots of bigger software application business might wish to get their hands on, specifically throughout times when natural development is fading; and it has favorable pro forma running margins.

Assessment examination and rate target

Even after Zuora’s current rally, the stock stays rather decently valued in my viewpoint. At existing share rates north of $11, Zuora trades at a $1.56 billion market cap. Netting off the $396.9 countless money and $212.3 countless financial obligation on Zuora’s latest balance sheet yields an business worth of $1.38 billion.

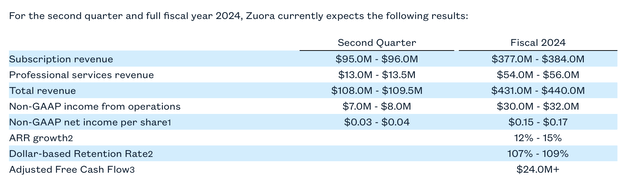

On The Other Hand, for the existing FY24 (the year for Zuora ending in January 2024), the business has actually assisted to $431-$ 440 million in earnings, representing 9-11% y/y development (thinking about the business’s 14% development in the very first quarter, this outlook might show light).

Zuora outlook ( Zuora Q1 incomes release)

Versus the midpoint of this earnings outlook, Zuora trades at 3.2 x EV/FY24 earnings. Once again, my upgraded rate target on the business is $ 14, which represents a 4.0 x EV/FY24 earnings numerous and ~ 22% upside from existing levels.

My suggestion is to continue riding the upward momentum here till Zuora strikes that limit.

Q1 download

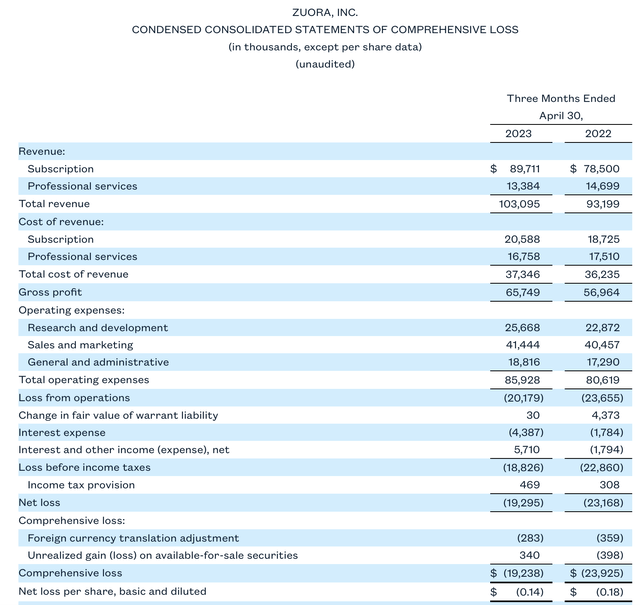

To hammer house the point that Zuora has actually performed well relative to expectations in addition to its own modest evaluation, we’ll now go into the information of Zuora’s newest quarter in more information. The Q1 incomes summary is revealed listed below:

Zuora Q1 outcomes ( Zuora Q1 incomes release)

Zuora’s overall earnings grew 11% y/y to $103.1 million, beating Wall Street’s $102.1 million (+10% y/y) expectations. Membership earnings continued to grow at a much faster rate, up 14% y/y to $89.7 million, while expert services earnings decreased. As a tip to financiers who are more recent to Zuora, the decrease in expert services is both deliberate and preferable: the business has actually continued to include more channel partners to do combination work for customers, which Zuora continues to do at a loss. Unlocking for channel partners to take control of this work provides Zuora access to a larger pipeline than its own sales group can manage, plus assists with margin growth.

Zuora’s execution method in Q1 was marked by a deliberate shift to smaller sized, higher-confidence offers. Per CEO Tien Tzuo’s remarks on the Q1 incomes call:

At the very same time, purchasers continue to beware, understanding this at the start of the year, we made some changes in the field to focus our sellers on smaller sized, quicker, brand-new logo design wins and these changes appear to be settling. In truth, we closed more brand-new logo designs in Q1 than we carried out in any quarter of 2023 […]

Now, naturally, our partners continue to be a vital part of our method. In truth, in Q1, over half of our go-lives consisted of an SI partner. Offered the macro background, we’re changing with our partners too. We’re focusing with them on closing smaller sized, quicker lands that supply a quicker ROI.

In an environment where these international SIs are seeing less need for big multiyear change offers. The bright side is that Zuora options are not specifically connected to such big tasks. In truth, our SI partners are producing more pipeline for us year-over-year.

So we’re seeing quicker lands, consisting of with our partners, however that’s just part of our land-and-expand method.”

Secret wins in the quarter consisted of TELUS ( TU), which is Canada’s second-largest telecom supplier, in addition to Gannett ( GCI), a leading news corporation with more than 2 million customers. The business still likewise kept a high net earnings retention rate of 108%, versus 110% in the year-ago quarter: suggesting that existing consumers are still upselling.

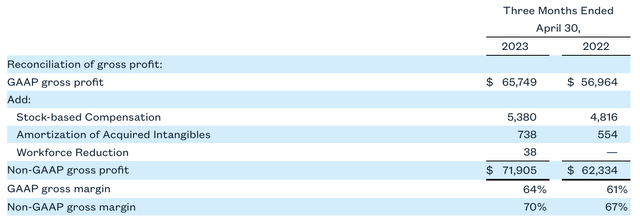

Zuora’s pro forma gross margins likewise inched up by 3 indicate 70%. This was driven both by a two-point increase in membership gross margins to 81%, in addition to a more beneficial earnings mix move far from loss-leading expert services and into memberships.

Zuora gross margins ( Zuora Q1 incomes release)

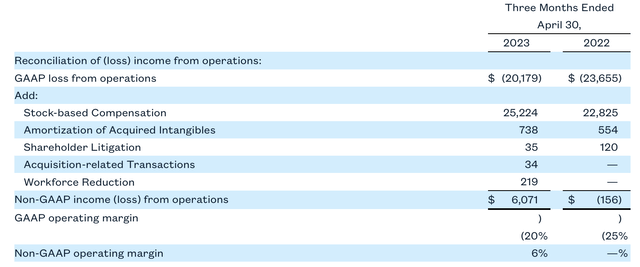

Pro forma running margins, on the other hand, broadened 6 indicate 6%, putting Zuora well above breakeven when omitting stock payment.

Zuora running margins ( Zuora Q1 incomes release)

It deserves keeping in mind too that FY24 complimentary capital is off to a great start, with $13.0 million in FCF in Q1 more than tripling the year-ago FCF of $3.7 million.

Secret takeaways

After seeing the soothing success of Zuora’s sales execution in this tough macro environment, I’m comfy keeping my Zuora stock and extending my rate target to $14 with ~ 20% additional runway. Stay long here as the business continues to inch closer towards its real evaluation worth.