kropic/iStock through Getty Images

Intro

What’s the most disliked market to purchase today? While I do not have the information to offer you a clinical response, I make certain business workplace property is among the locations individuals prevent today.

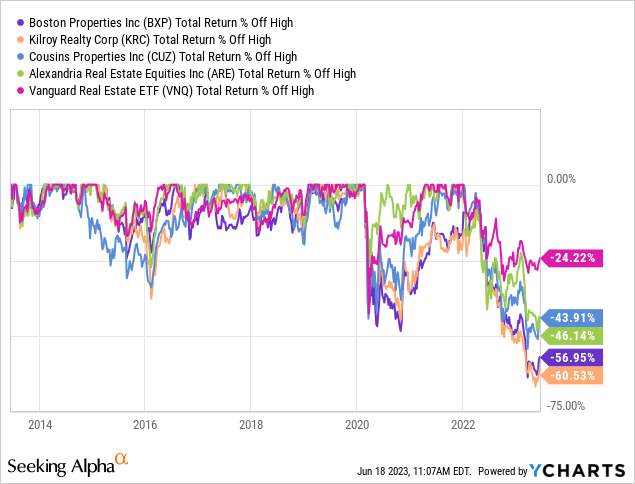

Looking at the chart below, we see that all significant workplace REITs in America have actually underperformed the Lead Property ETF ( VNQ) – which is currently carrying out badly – by a large margin.

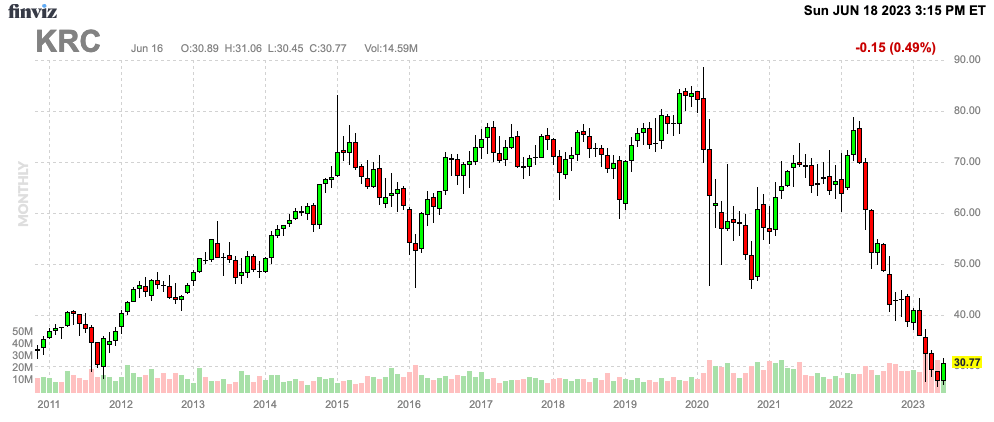

The worst entertainer of this group is the Kilroy Real Estate Corporation ( NYSE: KRC), a stock that presently yields 7% after falling 60% from its all-time high – consisting of reinvested dividends.

In this short article, we’ll evaluate the appearance of this business, which has the majority of its properties on the West Coast.

So, let’s get to it!

What’s Kilroy Real estate?

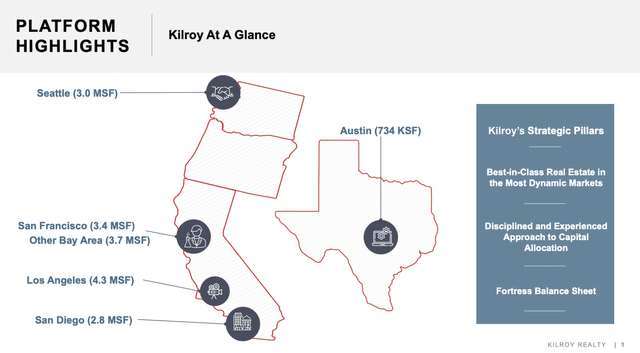

Kilroy is a workplace REIT. The business concentrates on leading workplace, life science, and mixed-use homes. The business owns, establishes, gets, and handles property properties, concentrating on Class A homes in essential markets like Greater Los Angeles, San Diego County, the San Francisco Bay Location, Greater Seattle, and Austin, Texas.

Kilroy Real Estate Corp.

Simply put, if we omit Texas, the business runs in a state that hasn’t been too popular given that the pandemic, generally since of the migration from blue to red states that featured the migration of some significant corporations.

Kilroy Real Estate Corp.

Since December 31, 2022 (and according to its 10-K), Kilroy Real estate’s supported portfolio consisted of 119 workplace homes, amounting to 16,194,146 rentable square feet.

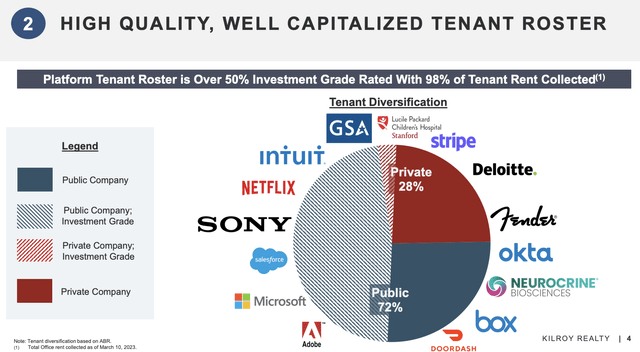

These homes had 406 renters and a total tenancy rate of 91.6%. The portion of rented area was 92.9%. The supported portfolio likewise consisted of 3 houses with 1,001 systems and a typical tenancy rate of 93.5%. Practically 75% of its renters are public business.

These numbers aren’t bad at all.

The issue is that the pattern is bad, that includes the basic health of the marketplaces it serves.

Issues Dealing With Industrial (Workplace) Property

Previously this month, I composed an short article concentrated on the looming crisis in business property.

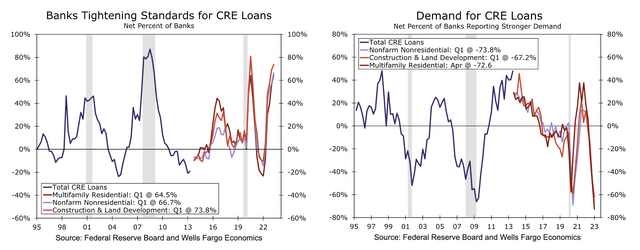

Because short article, I discussed that the shift to remote work reduced the worth of office, and with almost $1.5 trillion of business home financial obligation due for payment by the end of 2025, the increasing rates of interest have actually made numerous homes less important.

Workplace delinquency rates are quickly increasing, headed for 4% in the next couple of months – unless something modifications.

Wells Fargo

On the other hand, need for CRE loans has actually plunged, triggered by quick tightening up in loaning requirements. This makes it even harder to service financial obligation in the future, putting much more pressure on a currently deteriorating market.

Wells Fargo

Approximately one month back, this is what Bloomberg composed with regard to workplace CRE:

While the tension on the workplace sector might not be brand-new, the shift to working from house has actually intensified the issue. Nevertheless, much of the damage might currently be priced into the stocks after this most current selloff, experts stated.

In addition, fears about business property have actually contributed to the troubles of local bank stocks that generally money regional jobs like shopping center and little office complex. The sector has actually been pressed given that the collapse of Silicon Valley Bank in March triggered industrywide chaos. Now some financiers fear that its direct exposure to workplace weak point might be the next shoe to drop.

With that stated, KRC is down more than 60% from its pre-pandemic high, which implies a lot has actually been priced in.

Where’s The worth?

Kilroy presently yields 7%, which is covered by a forward FFO payment ratio of 49%. That is well listed below the sector average of 60% and a great number.

Over the previous 3 years, the typical yearly dividend development rate was 3.3%. The most current walking was revealed in September 2022, when the business treked by 3.8%.

This juicy yield, stable development, and low payment ratio got me thinking about covering this business.

Throughout its 1Q23 incomes call, the business highlighted the absence of certainty and obstacles in belief, especially in monetary stocks such as Silicon Valley Bank, which declared bankruptcy.

As we currently quickly gone over, the business kept in mind that the property market was (and still is) affected by decreased liquidity in financial investment sales, down pressure on renting basics, and a pullback in funding and financial investment activity within the banking and equity capital neighborhood, which is a larger problem in the Golden State than anywhere else in the United States.

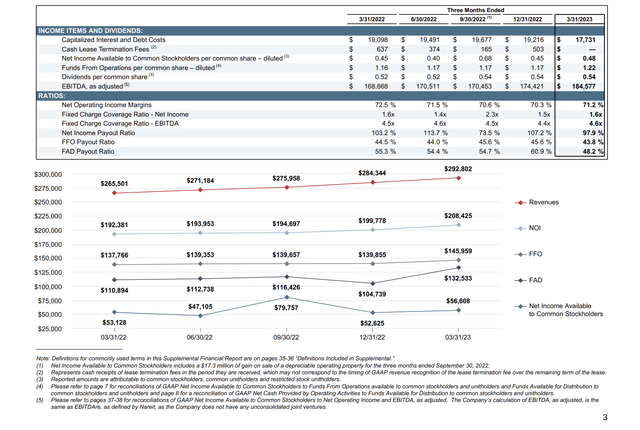

Nevertheless, in spite of these obstacles, Kilroy Real estate provided a strong quarter and accomplished a record FFO per share outcome, reaching $1.22 in FFO per share.

This boost of approximately $0.05 per share compared to the previous quarter was mainly credited to a complete quarter of profits from the Undoubtedly lease in Austin. In spite of this significant occasion, please know that the outcomes consisted of both favorable and unfavorable nonrecurring products, which mainly balance out each other.

Kilroy Real Estate Corp.

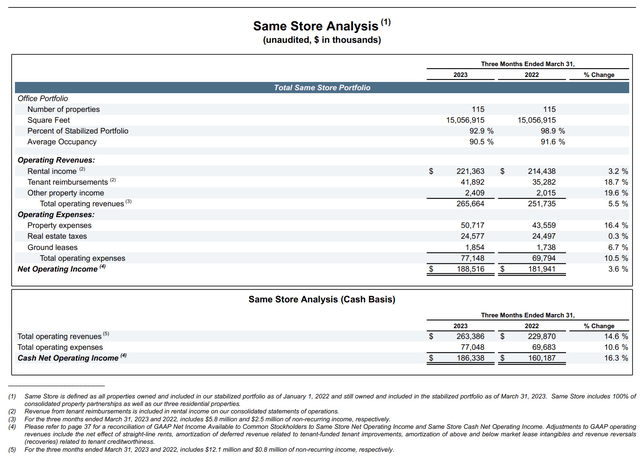

On a same-store basis, the money NOI (Net Operating Earnings) for the very first quarter saw an excellent 16% development. This figure integrated around $12 million in renter remediation payments related to 2 homes.

Omitting this nonrecurring profits, the same-store NOI would have still increased by roughly 9%.

The strong efficiency was driven by the burn-off of totally free lease at Stage 1 of KOP in South San Francisco and a boost in parking earnings. Please keep in mind that KOP means Kilroy Oyster Point

GAAP same-store NOI, changed for nonrecurring products, increased by roughly 2%. The supported portfolio, at the end of the quarter, preserved a tenancy rate of roughly 90% and a lease rate of 92%.

Kilroy Real Estate Corp.

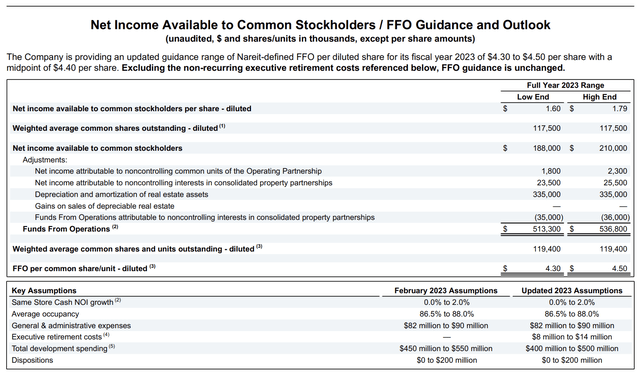

Even much better, the assistance was excellent – in spite of a small modification.

Throughout the incomes call, KRC offered an upgrade on its FFO assistance for 2023. The initial variety was $4.40 to $4.60 per share, with a midpoint of $4.50. While many hidden presumptions stayed the same, a modification was made to show one-time G&An expenses.

These expenses were approximated to be roughly $0.10 at the midpoint, leading to an upgraded series of $4.30 to $4.50, with a midpoint of $4.40 per share. Without the G&A change, the FFO assistance would have stayed the same.

Kilroy Real Estate Corp.

With this in mind, it’s reasonable to state that these numbers validate the business’s strength. It’s likewise excellent news for financiers. Utilizing this assistance and the reality that the business pays a $2.16 each year dividend, we’re handling a 49% payment ratio utilizing the assistance midpoint.

With this in mind, the business was inquired about the security of its dividend throughout the incomes call.

Caitlin Burrows

Okay. And after that possibly independently on the dividend. I indicate some peers have actually decreased suspended or commented that they might cut if the environment continues or compromises So could you simply talk about how you feel about Kilroy present dividend protection and under what situation Kilroy could think about customizing the dividend?

Eliott Trencher

So our payment ratio is rather low We believe our dividend is extremely well covered And undoubtedly, we have requirements to pay a specific part of gross income. So while eventually this is a Board choice, we’re comfy with where we are today

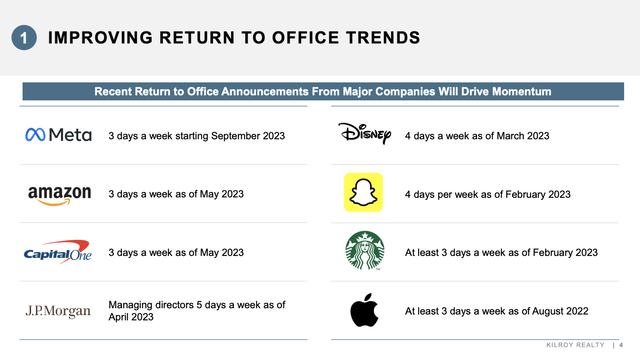

Contributing To that, the business feels tailwinds as significant corporations are gradually however progressively getting their staff members back to the workplace.

Kilroy Real Estate Corp.

Austin and San Diego blazed a trail in regards to physical tenancy, with both markets reaching over 70% at the end of the very first quarter.

The business signed roughly 338,000 square feet of leases with a typical regard to roughly 5 years, showing continuous need for workplace.

Particular lease arrangements discussed consist of a lease at Undoubtedly Tower in Austin and significant leases in the Bay Location and San Diego portfolios with business like Reddit, MediaTek U.S.A., and Intrepid Studios.

Additionally, the business intends to profit from the strength of AI and innovation, consisting of Life Sciences. The business intends to have at least 20% Life Science direct exposure after KOP Stage 2 is finished.

Furthermore, it requires to be stated that the business has an incredibly young portfolio. The typical age of its portfolio is 11 years, which is the youngest portfolio in its peer group. The average is close to 35 years.

This assists to bring in and maintain renters, as having a top quality workplace is a method for business to keep staff members delighted (to put it candidly). I have actually heard this from numerous significant operators in the market.

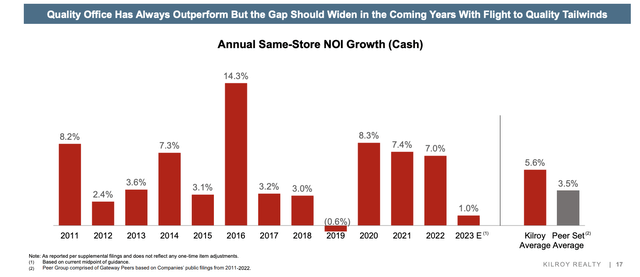

Kilroy Real Estate Corp.

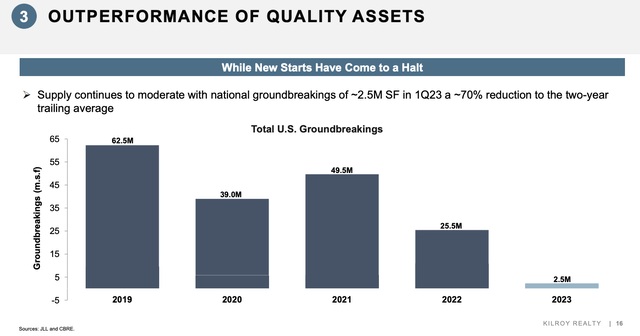

It likewise assists that building and construction of brand-new supply has actually imploded. That makes good sense, provided the terrible basics of workplace CRE, in basic.

Kilroy Real Estate Corp.

So, what to make from its evaluation?

Balance Sheet & & Appraisal

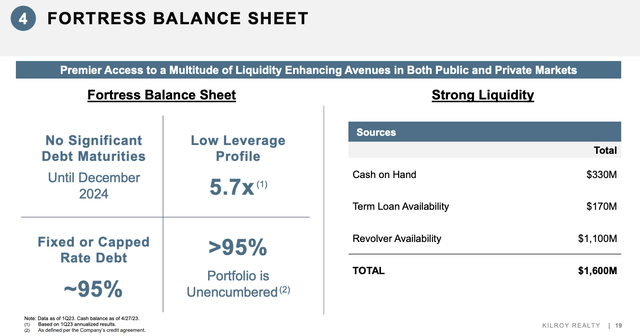

Another piece of excellent news is the business’s balance sheet.

KRC’s net financial obligation ratio stayed steady at about 6x EBITDA. Throughout its incomes call, the business likewise stressed its beneficial financial obligation maturity schedule, without any maturities till December 2024 and minimal rate of interest direct exposure, as over 90% of the financial obligation is repaired.

Kilroy Real Estate Corp.

Additionally, KRC reported strong liquidity at $1.6 billion, including $330 million in money, $170 million in future term loan profits, and $1.1 billion in capability on their credit line.

For the rest of 2023, KRC approximated capital requirements of $325 million to $425 million for advancement costs.

Keep in mind that the business is not anticipating any acquisitions.

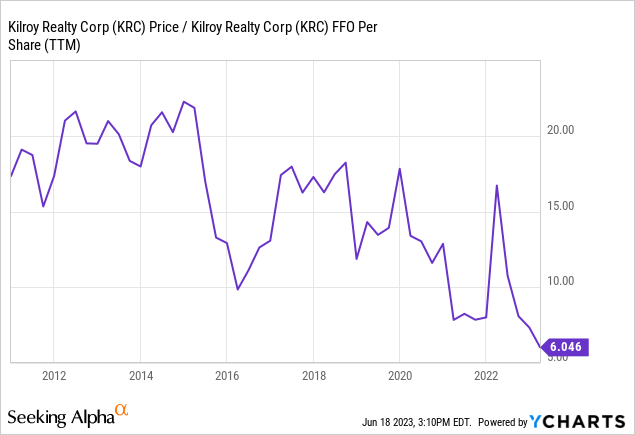

With regard to its evaluation, one may presume what we’re handling here. Shares have actually imploded while FFO continues to succeed. Thus, the business is trading at 7x 2023E FFO (based upon the business assistance midpoint).

The typical sector evaluation is 12.9 x FFO. Faster-growing REITs are trading near 17x FFO.

Taking a look at the business’s history, it utilized to trade above 15x FFO prior to the pandemic. That’s gone, and we will not see a go back to these appraisals anytime quickly.

It likewise requires to be stated that the marketplace is pricing in long-lasting dangers. For instance, while building and construction is down, mass personal bankruptcies in the location might make competitors fiercer and force business like Kilroy to avoid treking lease – and even cut lease eventually.

I likewise think that the Fed will keep rates greater for longer, as discussed in this short article The pressure on CRE is most likely to increase if that holds true.

With all of that stated, I simulate KRC shares at $30. A lot has actually been priced in, and as much as workplaces and California (in specific) are suffering, I believe KRC remains in an excellent position thanks to a few of the very best renters in business and outright top-tier properties.

FINVIZ

Nevertheless, I’m not going to be the man who gets individuals all delighted about workplace CRE in this environment.

While I do think that we’re handling considerable long-lasting worth, I advise everybody thinking about workplace REITs to be incredibly mindful. Do not go obese in any workplace stocks.

That stated, I need to state that I’m thinking about purchasing a couple of shares of KRC, as I simulate the risk/reward. Nevertheless, as I choose commercial REITs and REITs that can more quickly broaden their company, I will not take a big position in KRC if I choose to purchase it.

Takeaway

While the business workplace property market is presently dealing with considerable obstacles, Kilroy Real estate provides an interesting chance.

With its concentrate on leading workplace, life science, and mixed-use homes in essential markets, KRC has a durable portfolio with strong tenancy rates and a varied renter base, consisting of numerous public business.

In spite of the down pattern in the market, KRC has actually shown its capability to provide strong monetary outcomes, with record FFO per share and remarkable money NOI development.

Furthermore, the business’s low payment ratio and beneficial financial obligation maturity schedule supply stability.

Nevertheless, it is very important to approach workplace REITs carefully and not obese financial investments.

Thinking about the long-lasting worth and the quality of KRC’s properties, I personally discover it attractive and might think about a little position in the stock.