FatCamera

Intro

On the whole, all locations are growing really gradually, however not too gradually. From a local viewpoint, the Medtronic plc’s ( NYSE: MDT) most steady development characteristics remain in the United States, however other areas are not far behind either. In general, the possible approval of the MiniMed 780G item will not have a substantial favorable influence on earnings: initially, it belongs to the Diabetes section, which itself produces just 7% of earnings. Second, within the Diabetes section, it takes about 15-17%, which yields about $100 m$ of quarterly earnings at finest. Raised the dividend for the 46th successive year, which’s a good idea. The bad thing is that at $900 m$ of quarterly payments, the yearly FCF of $4 b$ is hardly sufficient to cover them, and the payment ratio is greater than others. To be reasonable, this has to do with 2023, which generated the tiniest FCF in the last 5 years. Possibly 2024 can do much better, which will decrease payment ratios. Especially, the business was among the very first to reveal interest in executing AI and has actually currently signed a tactical collaboration arrangement with Nvidia. Today, it will not bring any monetary return, however it’s favorable that management is keeping its finger on the pulse and attempting to stay up to date with existing patterns.

The business revealed great lead to a seasonally strong quarter, however whatever was ruined by the projection, which did not offer complete impact to the favorable characteristics of quotes. Macroeconomic elements such as inflation, currency exchange rate and tax rates will have an unfavorable influence on the business’s efficiency in 2024, that makes its outlook weak. Development needs enhancement in monetary efficiency, which is not occurring today. Falling listed below $80 is likewise baseless from both an appraisal and monetary viewpoint.

Item advancement

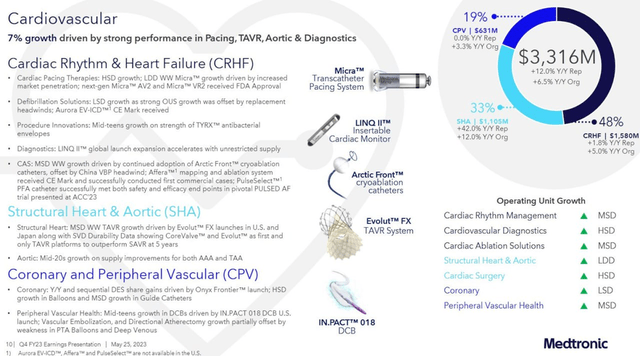

In regards to item advancement, the business is plainly a success here. For instance: got FDA approval for the next-generation Micra AV 2 and VR 2 pacemakers, which extend battery life by 40% to an approximated 16 and 17 years, respectively. In March, the PULSE AF standard research study, which analyzed the PulseSelect PFA single catheter, revealed exceptional outcomes. Have actually sent a PMA application to the FDA and anticipate to be among the very first business with a PFA catheter on the U.S. market. Gotten CE marking for the Affera mapping and ablation system, consisting of the Sphere-9 catheter, and started a restricted release to the marketplace. Gotten FDA approval for the MiniMed 780G system with Guardian 4 transducer. These items have actually caused double-digit sales development in Western Europe. Will start delivering them to customers in the U.S. next week. LINQ II expert system innovation, called AccuRhythm AI, won the MedTech Advancement Award 2023 for Finest Brand-new Technological Tracking Service. Revealed a tactical partnership with NVIDIA and Cosmo Pharmaceuticals to permit third-party designers to train and verify AI designs that might ultimately run as applications on the GI Genius platform. They’re preparing substantial expense decreases, consisting of labor force decreases. It’s clear that everybody is attempting to put AI anywhere today to get attention, however how it will work and with what success is still uncertain. However great lead to research study and item approvals are constantly a plus and a chauffeur for long-lasting development.

We can see strong development in both ischemic and hemorrhagic stroke, with double-digit development in a number of classifications, consisting of goal and circulation diversion. Stroke is the second cause of death worldwide, and integrated with low penetration treatments see terrific chances for neurovascular modifications in stroke treatment. Surgical robotics continues to acquire momentum with the intro of the Hugo separated robotic system in worldwide markets. Made development in the U.S. as they perform an essential Expand URO trial. They continue to actively establish the diabetic field, seeing terrific gain from using the EOPatch non reusable spot in mix with the MiniMed 780G system with Guardian 4 sensing unit, for which they have actually simply gotten FDA approval.

service (financier discussion)

Financials

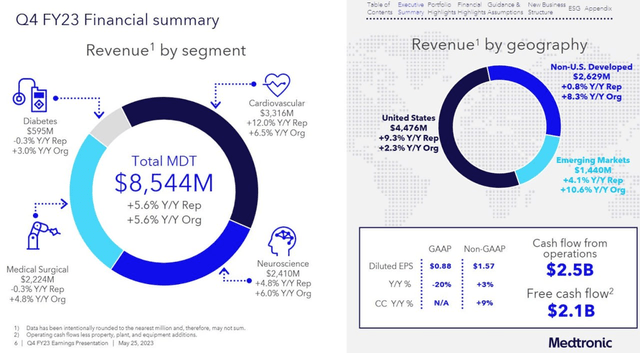

General steady report. Profits increased 5.6% to $8.54 bn, ahead of expectations. The business provided a really weak projection for the existing year, and right away cautioned about the lower limit. Possibly this is since they did not fulfill their projection for 2023 and are now intentionally providing a weaker projection to be sure to beat it. A minimum of now there is not even half of the issues that remained in FY 2023, from supply chain to currency headwinds, so it is uncertain why such a weak projection, considered that the chauffeurs of earnings development on the contrary exist. In reaction to direct concerns about this at the teleconference and the arguments of experts, they might not state anything particular, restricting themselves to the basic reasons. Taking a look at earnings by location, worldwide markets stay strong – industrialized markets in Western Europe grew 8% in consistent currency, and Japan went back to development after the effect of COVID last quarter, +5% y/y. Emerging markets, which represent 17% of earnings, went back to double-digit development, +11% y/y. China likewise published 3% development as treatments recuperated from previous quarantines. Capital stays sturdily strong, where FCF was $2.08 b/y, including 25% y/y. The balance sheet is challenging, with good net financial obligation of $16.34 bn, Goodwill and intangibles at half of the business’s capitalization.

In general, all line of work are really sluggish however growing. From a local viewpoint, the most stable-growth characteristics remain in the U.S., however other areas are not far behind.

Q4 Financials (financier discussion)

Appraisal and possible threats

The business revealed great lead to a seasonally strong quarter, however whatever was ruined by the projection, which did not offer complete impact to the favorable characteristics of quotes. The CEO restated that macroeconomic elements such as inflation, foreign exchange rates and, to a lower degree, interest and tax rates, will have an unfavorable influence on incomes in financial 2024. That stated, continue to focus on financial investment in research study and advancement and anticipate R&D costs development to go beyond earnings development. Really, we can see this in the really weak yearly EPS projection.

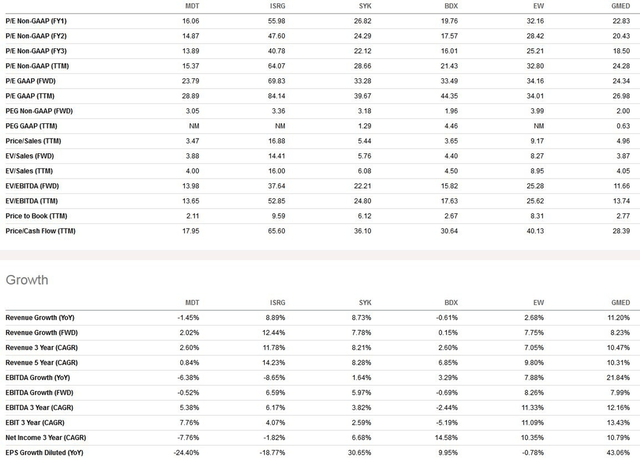

Compared to rivals (screen listed below), the business looks more affordable than the huge bulk, while having a few of the most affordable development rates, much better dividends and equivalent success. By historic mid-range, the 3-year earnings GAGR is 3%, and this year anticipate about 4%. Dividend yield of 3.4% p.a., with high payment ratios from both incomes (GAAP) and FCF over 80%.

Forward monetary projection (Looking for Alpha)

Bottom line

From a financial investment viewpoint, the business continues to be at 2015-2018 levels in both financials and quotes. Present levels above $80 can be thought about a small undervaluation. The apparent undervaluation lies at levels around $70, and if quotes come down there, that would be an excellent financial investment chance. Likewise, MDT can barely aggravate the scenario from the viewpoint of monetary indications, however it can enhance it. We suggest to HOLD this stock for the next 6 months.