Wirestock/iStock Editorial by means of Getty Images

Nintendo ( OTCPK: NTDOF) stock has actually come an excellent 30% below its all-time high of $16 in 2021, the year the Change made record sales. The release of the Change in 2017 began a four-year development spurt for Nintendo that had actually traded at simply $6 a share.

At existing levels, it might be a great time to begin collecting shares prior to a brand-new console is launched in 2024 (a reliable guesswork), in anticipation of a brand-new profits platform being developed by Nintendo.

Naturally, there is a threat of failure with every significant launch. To identify the possibilities of Nintendo providing, this short article takes a look at its previous record of maintenance item platforms and its capability to create investor worth from them.

Organization design

Nintendo began as a simple manufacturer of playing cards. After several modifications in service designs, it launched its very first video gaming console over half a century into service, in the 1970s.

Although a leader of video gaming, it went through its reasonable share of battles, losing along the method to rivals like Sega and Sony. At the low point in the early 2000s, Nintendo’s conserving grace was the appeal of its portable console Video game Kid. Then came the Wii, which re-established Nintendo into the leading tier of the video gaming market.

However what has actually constantly been intriguing about Nintendo’s service design is that it is both a console maker and a video game designer. So basically, it manages both software application and hardware sides of service. This resembles Apple’s method to brand-new product or services advancement, and the benefits of it appear.

Although hardware, software application and circulation are different departments, profits acknowledgment happens on a platform, or console, basis. Similar to Apple utilizes the iPhone platform to amplify sales by means of a whole community of associated product and services, Nintendo views consoles as differentiators to take advantage of and develop moats around.

Nintendo’s rule remains in portable and movement video gaming, a specific niche location. The Wii has actually ended up being the world’s most effective interactive video gaming system, which neither PlayStation nor Xbox had the ability to eclipse, even with more advanced hardware. The Change, Nintendo’s existing flagship, was the most popular video gaming console throughout portable and console classifications in the previous years.

Unlike the rivals, Nintendo deals with a various sector of players. PlayStation and Xbox concentrate on advanced tech needed for severe players, individuals in their late teenagers to early thirties. Nintendo, on the other hand, targets a casual player, everybody from kids to grownups.

Peer analysis

Considering that Nintendo makes both software and hardware, it takes pleasure in particular competitive performances. It begins with reliable console sales. Consoles are priced utilizing a razor-and-blade design, either at breakeven and even a loss, with the concept being that subsequent sales of video games and membership services will more than compensate.

In Between 2017 and 2022, console sales were topped by Nintendo by a big margin for 4 out of 6 years. In truth, Nintendo has actually controlled for a lot longer, with the Change being the most offered console over the previous 10 years (although more recent releases by competitors would usually take the spotlight and decrease the turnover).

|

Consoles |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Nintendo Change & & 3DS |

21.0 |

19.5 |

22.0 |

28.8 |

23.0 |

17.9 |

|

21.2 |

17.8 |

13.5 |

13.5 |

12.5 |

This contrast omits Xbox due to the unavailability of sales information.

Source: Different assembled by author

What is more crucial is that – and maybe this is where the combination of software and hardware contributes – the Change sales pay. On the other hand, Xbox costs a loss, and PlayStation hardly breaks throughout the release year.

Source: Different assembled by author

One factor is that Nintendo’s hardware is less graphic extensive and therefore less expensive to establish than that of huge rivals. While Xbox and PlayStation make every effort to fulfill the requirements of all type of video game designers, Nintendo – playing both the hardware designer and video game designer – does not require to accommodate as much. Plus, a lot of Nintendo devices consist of tricks, such as movement or hand-held video gaming, which draw the attention far from graphics.

In the video game

The marketplace leader in video game sales is PS4, with near to 1.6 billion titles offered; the Change has actually remained in 2nd location for the previous twenty years, with approximately 1.04 billion titles. However the designer advantages are reversed.

While Sony makes typically 30% from every video game offered, Nintendo takes a complete 100% cut. Amongst the leading 10 video games used the Change, Nintendo represent nearly 80% of system sales. In general, near to 40% of all video games offered on the Change can be securely presumed to be Nintendo’s. The very best part is that it still gets 30% from third-party video games.

|

Leading 10 titles |

System sales |

Designer |

|

|

1 |

Mario Kart |

53.8 m |

Nintendo |

|

2 |

Animal Crossing |

42.2 m |

Nintendo |

|

3 |

Super Smash Bros |

31.1 m |

Bandai Namco |

|

4 |

Legend of Zelda |

29.8 m |

Nintendo |

|

5 |

Pokemon Guard |

25.8 m |

Video Game Freak |

|

6 |

Super Mario Odyssey |

25.8 m |

Nintendo |

|

7 |

Pokemon Scarlet |

22.1 m |

Video Game Freak |

|

8 |

Super Mario Celebration |

19.1 m |

Nintendo |

|

9 |

Super Mario Deluxe |

15.4 m |

Nintendo |

|

10 |

Ring Fit |

15.4 m |

Nintendo |

Source: Fandom, Nintendo

A concern of performance

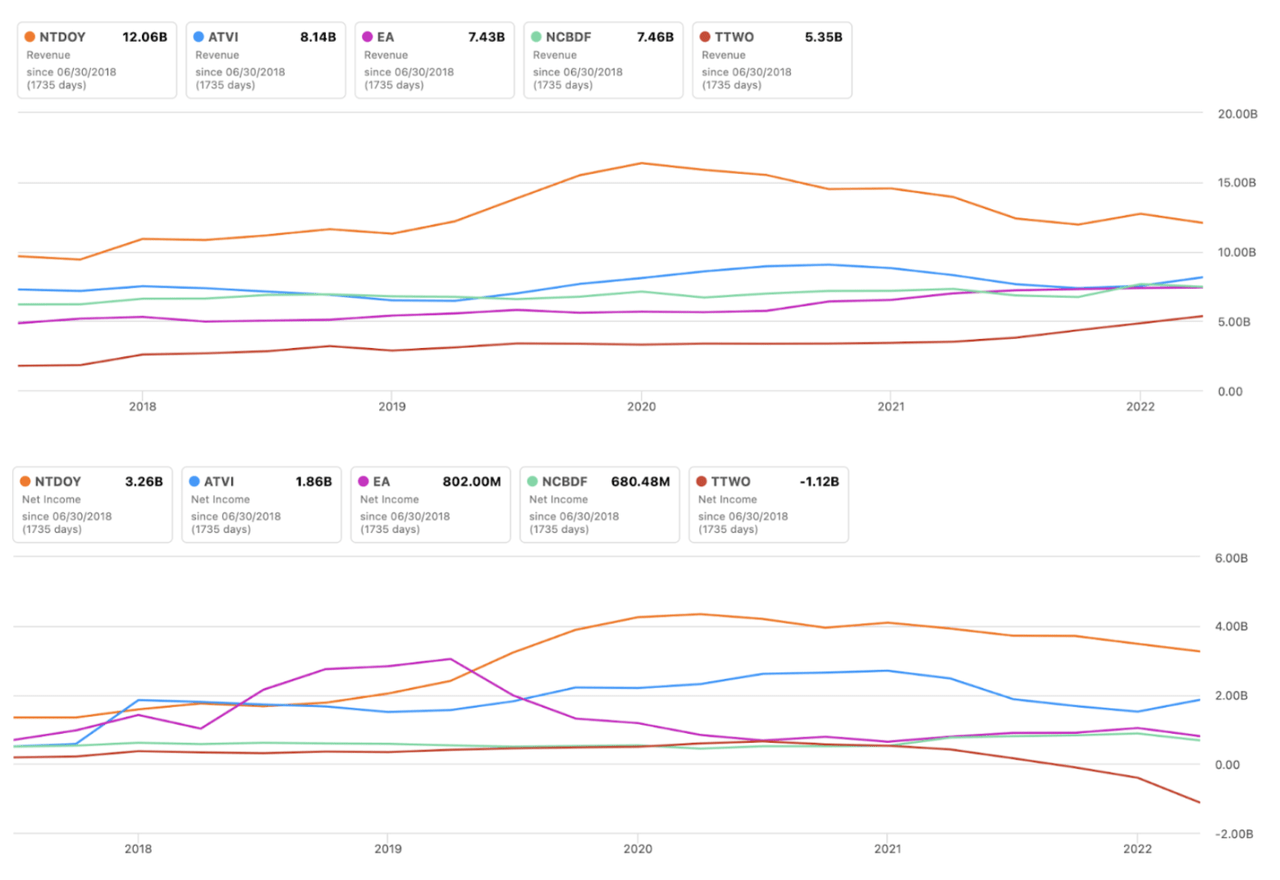

Does integrating software and hardware abilities sustain a greater overhead expense in Nintendo’s case? Initially, versus other console designers – Sony and Microsoft (though the latter reports just profits for its video gaming department). Sony generates the greatest profits however Nintendo’s control over its own community leads to higher success. Once again, it is Apple-like operating performance.

|

Video Gaming Profits ($ b) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Nintendo Profits |

9.93 |

10.83 |

12.17 |

15.84 |

13.92 |

12.06 |

|

Nintendo Operating earnings |

1.67 |

2.25 |

3.27 |

5.78 |

4.86 |

3.79 |

|

Sony Video Gaming Profits |

14.66 |

17.61 |

21.2 |

18.65 |

24.36 |

24.4 |

|

Sony Video gaming Operating earnings |

1.21 |

1.6 |

2.85 |

2.24 |

3.11 |

2.64 |

|

Microsoft Xbox Profits |

9.05 |

10.35 |

11.38 |

11.57 |

15.37 |

16.23 |

Source: Nintendo, Sony, Microsoft

Compared to the huge names in the video gaming market, Nintendo produces both greater cumulative profits and revenue than a lot of. Success, in specific, has actually paralleled the growing uptake of the Change.

This goes to reveal that Nintendo is not just a tested hardware manufacturer however likewise a capable video game designer that utilizes its platform benefits to offer both software and hardware at broader margins than peers.

Danger

The intro of a brand-new console in 2024 is an apparent threat. Nintendo has actually had a variety of prominent flops consisting of the Wii U, GameCube and Nintendo 64, which offered less than 50 million systems each. Just when Nintendo handled to place itself as a leader of sorts – whether it remain in movement video gaming with Wii, portable video gaming with DS, or a mix of portable and movement video gaming with the Change – did its consoles offer well.

Evaluation

Presently, Nintendo has the most affordable P/E amongst peers of 15.77; Sony has the 2nd most affordable P/E at 17.08. The discount rate to video game designers’ assessment is much more noticable. Provided the expectation of a brand-new console in the works, the share rate can be fairly anticipated to increase from here. For point of view, the stock increased nearly 3 times after the release of the Wii and once again with the Change.

Conclusion

Nintendo is the only console maker at the minute due for an upgrade. With a tested performance history having actually offered near to half a billion consoles over the previous twenty years, Nintendo can be depended succeed for itself. Like Apple of the video gaming area, it has actually showcased a capability to take advantage of its financial moats to keep users within the Nintendo community. An effective revenue maker, Nintendo is underestimated at existing levels and makes good sense as a long-lasting hold.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the threats related to these stocks.