Armastas/iStock through Getty Images

3M Settlement with United States water energies

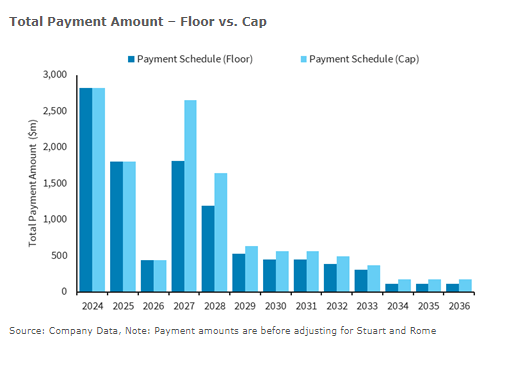

Fairly constant, if a little even worse, with the settlement tentatively revealed previously this month, 3M ( NYSE: MMM) formally revealed a $10.3 billion present worth settlement with the multi-district litigants of the U.S. water energy swimming pool. The payments will start in 2024 and will be paid over 13 years. I do not understand the discount rate utilized to determine the “present worth” of $10.3 billion, however over $2.8 billion will be paid in 2024 and $1.8 billion will be paid in 2025. Payments are arranged for a little break ($ 440 million) in 2026 prior to increasing once again in 2027. The overall payments can grow depending upon litigants’ sustained expenses.

Payment Set Up for MDL Settlement (Barclays)

Crucial to keep in mind, this settlement ONLY covers United States water energies. I have actually not seen any information on the number of of the energies in the MDL have actually signed onto this offer or the number of are permitted to pull out of the settlement prior to it ends up being space. For simpleness and conservative sake (from the brief point of view), let’s presume this settlement goes through, there are still a lot of issues for 3M. My brief thesis on this business stays the same from my very first post on the business, ” 3M Stock: Drivers for a Possible Insolvency.”

Naturally, they will not cover the dividend for the foreseeable future unless money streams materially enhance. I have actually seen a number of sell side reports that hypothesize there will be a draw out of the health care service that will money the dividend deficiency. Call me insane, however I simply do not see how any spinoff can take place while this understood liability is out there. Furthermore, if the spin happens, the balance sheet may be less leveraged in advance however future capital will show up even much shorter covering future dividends.

In addition to the dividend deficiency brought on by this settlement alone, it does not cover a host of other celebrations with present or extremely most likely future claims versus 3M. They consist of State Lawyer Generals, Injury, residential or commercial property damage, United States military, foreign federal governments, locations around MMM PFAS producing websites and most notably, the EPA and its power to state websites Superfund locations. Whatever I have actually checked out recommends that these liabilities integrated will be much bigger than the water energies. I think the $10 billion is just 20-30% of the overall ultimate liabilities from this problem.

Furthermore, the earplug liability is still hanging over the business. I believe a bull case is a $5 billion settlement, which I would be amazed if that quantity did not need to be paid in advance or over a brief duration of years. Those payments make the dividends even less covered.

Dangers

The primary threats to the brief are an earplug liability less than $5 billion and the other PFAS liabilities disappearing for some factor. I do not see either of those scenarios occurring, however anything is possible.

Conclusion

I believe this settlement is a sell the news occasion. It’s inline to a little even worse than the tentative settlement revealed previously this month. The business deals with much bigger liabilities in the instant and intermediate future, take advantage of will increase and the dividend will not be covered by revenues for several years to come. Disallowing a significant enhancement to profits development and margins, this business remains in serious risk on numerous fronts.