littleny/iStock by means of Getty Images

Telephone and Data Systems, Inc. ( NYSE: TDS) has actually been publishing some dangerous figures recently (unprofitability, increasing financial obligation, unsustainable dividends), however deep worth candidates will no doubt be weighing up the prospective chance establishing (appealing assessment vs. the sector, history of constant profits development, big property base to count on).

We’ll check out TDS’ financials and make contrasts to the Communications Sector, to evaluate simply how dangerous a bet on TDS is for financiers, and attempt to discover the risk-reward profile of the company.

TDS Introduction

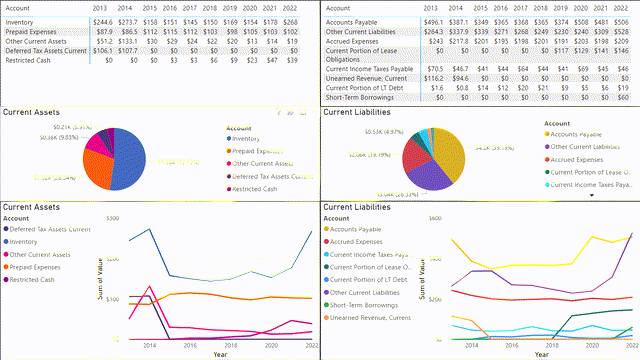

To begin with, let’s take a visual peek at TDS’ financials. Readers acquainted with my previous works will acknowledge the below as my basic monetary medical examination, however in a brand-new format.

Instantly we acknowledge that TDS is not presently a lucrative company and the healthy 10% yielding dividends presently available are consuming into what little totally free capital the company is creating. Without any earnings to pay and an unfavorable effect on capital, these dividends take a look at danger.

While TDS’ financial obligation to equity ratio is low (compared to a sector average of 2.17), we do see worry about interest protection at 0.49, and these commitments are covered just by a 1.55 present ratio.

Total I would state TDS looks relatively “unhealthy” in its own right, and compared to the sector.

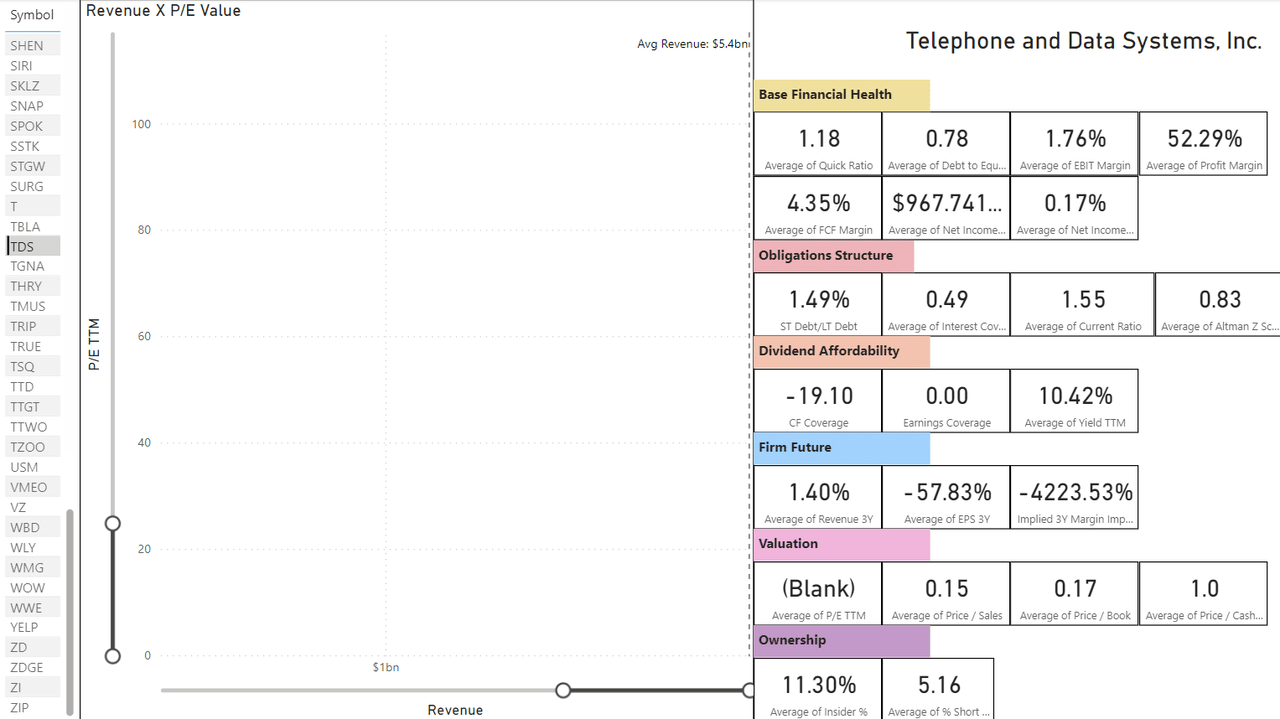

TDS’ Base Financial Health. Keep in mind that TDS does not have a reportable P/E ratio, so it does not appear in our profits X P/E ratio chart. (Author’s Chart Load) The Communications Sector averages (Author’s Chart Load)

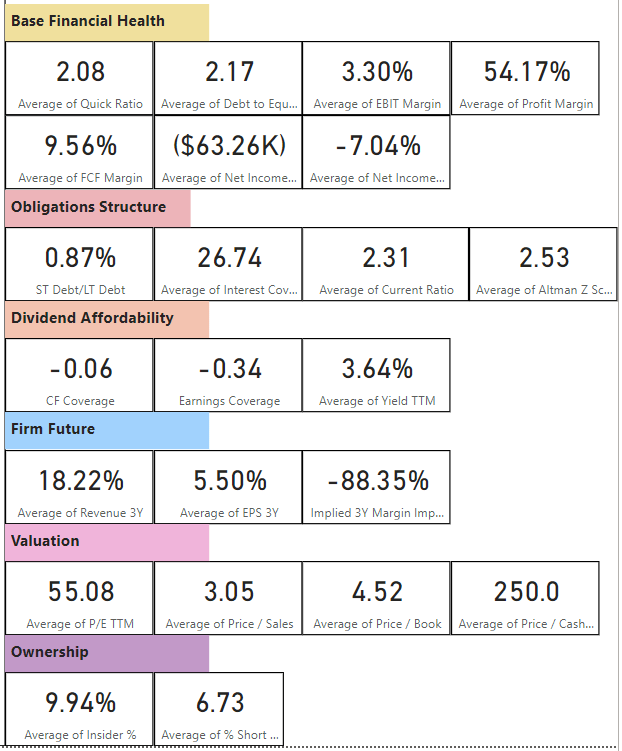

Next, let’s peek at the P&L and balance sheet. Gross margins for TDS appearance fairly strong at ~ 52% (vs. 54% for the sector), however business expenses are reducing success and are noisier compared to profits development.

TDS’ balance sheet and P&L summary (Author’s Company Analyser)

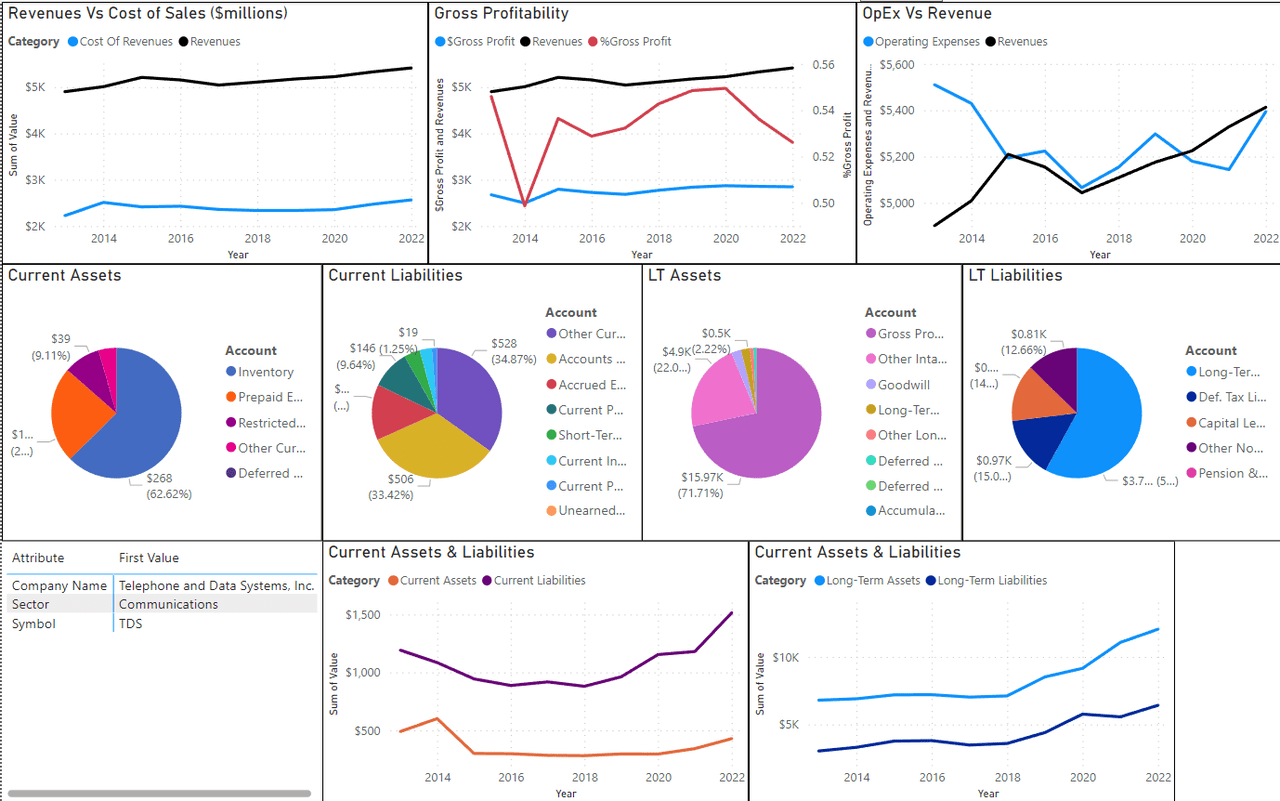

Taking a much deeper take a look at the balance sheet, we initially take a look at present liabilities and properties to evaluate the short-term for the company.

We can see that short-term liabilities surpass short-term properties considerably thanks to a substantial accounts payables balance and “other present liabilities”. We likewise see that stock is accumulating which is likewise an issue.

TDS’ present assets/liabilities patterns (Author’s Company Analyser)

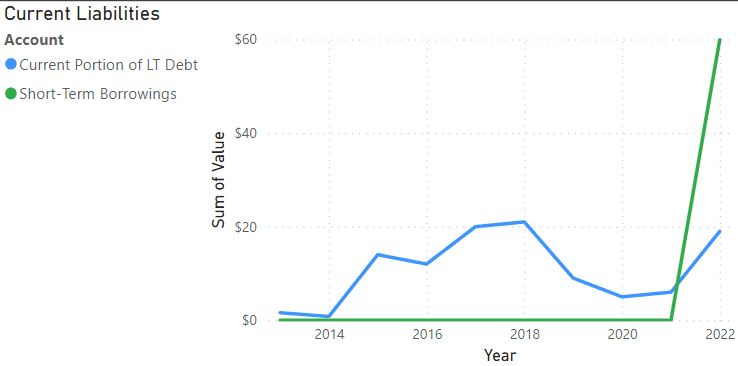

A relatively small information on the balance sheet in contrast to the size of other products, however worth keeping in mind, is how short-term loanings are proliferating and outsizing the present part of long-lasting financial obligation liabilities. While small in scale compared to other balance sheet products, this is a possible warning that management might be turning to costly financial obligation to keep business operating, and this is definitely not sustainable monetary management.

While small in scale, this might be an early signal of problems for the company. (Author’s Company Analyser)

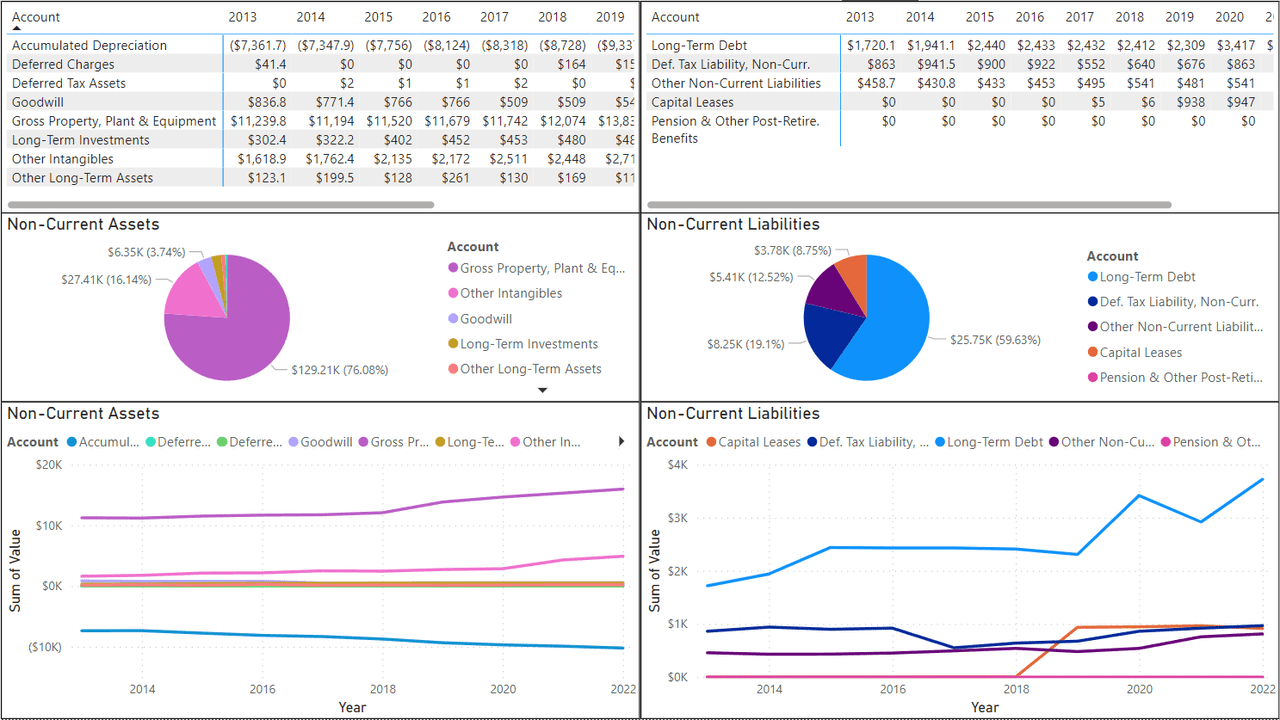

Next, we’ll evaluate long-lasting properties and liabilities, where there is a bit more positivity to be discovered.

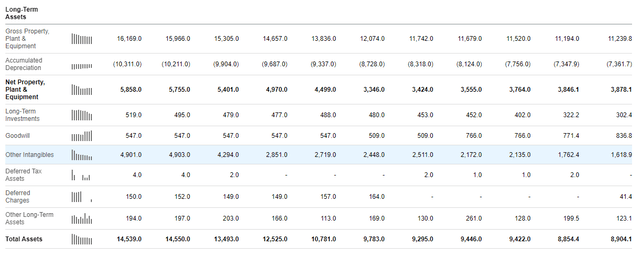

TDS has a substantial PPE balance on the books, comprising the lion’s share of the company’s concrete worth. With that stated however, we see a growing long-lasting financial obligation balance and a substantial “Other Intangibles” balance which requires more examination.

TDS’ Balance Sheet including a substantial “other intangibles” balance, (Looking for Alpha)

While this balance sheet provides TDS a minimum of some monetary cushioning, I would dislike to see financial obligations versus these properties continue to accumulate in the next 3 to 5 years.

TDS’ non-current assets/liabilities (Author’s Company Analyser)

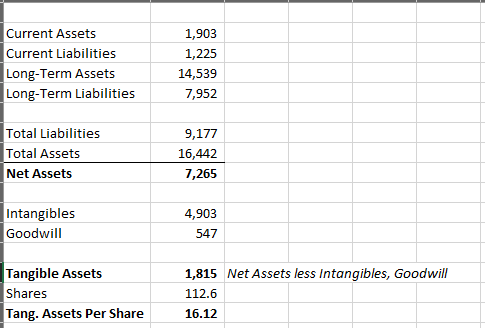

Breaking down these properties in a net-tangible properties form, we see there is still rather some substantial cushioning here on a per-share basis (using a 120% premium on the present share rate), though these numbers are not changed for “fire sale” worths.

A breakdown of TDS’ balance sheet to net concrete worths, priced at present worth. (Author)

The Great

-

Really magnificently priced compared to the Communications Sector assessment averages.

-

History of constant profits development.

-

Gross margins are appropriate.

-

Concrete properties per share are strong, though at danger of disintegration due to onboarding financial obligation.

-

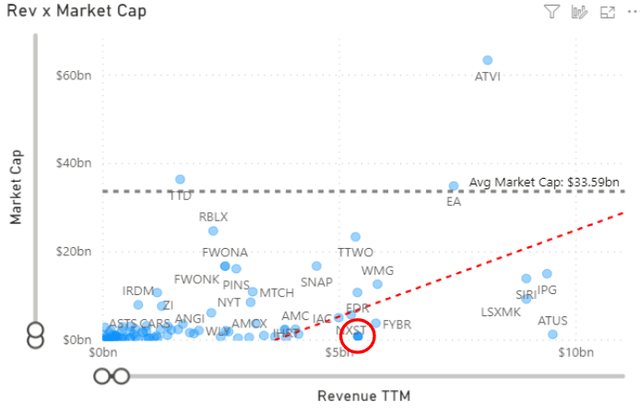

Revenue/Market Cap is well listed below the pattern for the sector.

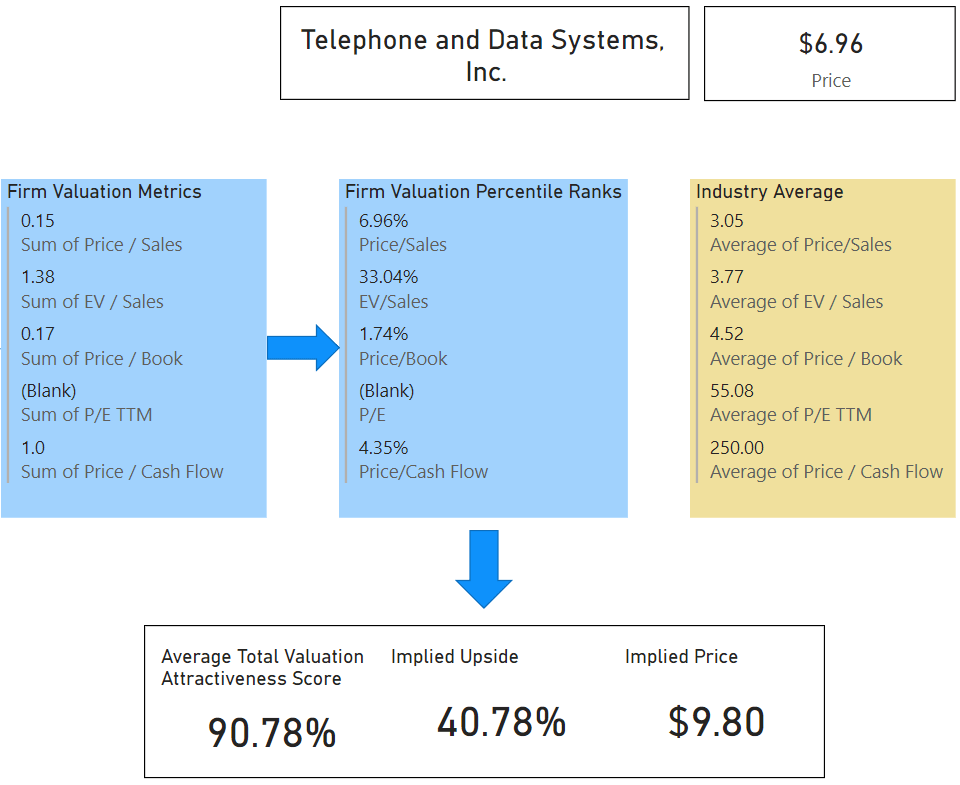

TDS is priced magnificently compared to the Communications sector, if we reverse engineer a “reasonable rate” from the company’s percentile rank of assessment metrics, we get to a suggested “reasonable rate” of $9.80 per share, albeit this “reasonable rate” neglects the present absence of success for the company and focuses totally on book worth and profits metrics.

TDS’ reasonable rate calculator, which reverse-engineers a reasonable rate for a company based upon its assessment metrics vs the sector average. (Author’s Chart Load)

Another assessment technique we can utilize is market cap to profits, to see how the company’s overall market price compares to its profits generation, and see that in contrast to all other companies in the market.

TDS’ profits levels vs the company’s total market cap recommend the marketplace might be marking down the company’s profits generation (Author’s Chart Load)

TDS seems rather underestimated provided its profits generation, though we need to by now have a reasonable concept of what is driving that.

We likewise kept in mind that TDS has a history of strong profits development over the last couple of years, and possibly management is wanting to grow their method back into success.

The Bad

-

Not presently a lucrative company.

-

The commitment structure is relocating an unfavorable instructions.

-

Short-term financial obligations are growing, having actually surpassed the present part of long-lasting financial obligation.

Undoubtedly, we have issues around success. Without strong EBITs, it’s difficult to enjoy TDS and this requires us to think about whether our company believe this is momentary and simply an indication of a modification in business’ running rhythm, or possibly a longer-term scenario where there are some systemic concerns in business.

Taking A Look At historical success, this seems a little bit of a blip in the company’s history, and projections reveal an anticipated go back to favorable EPS figures by Q1 2024.

Another issue we exposed was the shifts in the company’s commitments structure, where short-term and long-lasting financial obligations are offering warnings, and short-term financial obligation commitments are exceeding the present part of long-lasting financial obligation.

Getting financial obligations under control might be a sign of enhancing the company’s success, however I definitely see this as the concern for longer-term monetary sustainability.

The Drivers

-

A go back to success would see this stock deal financiers outsized returns.

-

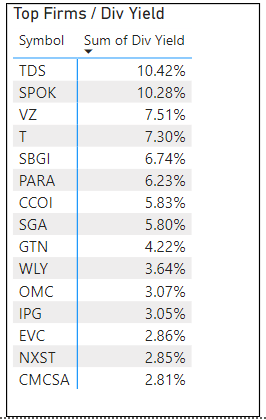

The extraordinary dividend yield of 10.42% is leading of the sector, however likely to be cut in order to return the company’s financials to sustainability.

In general, I see a go back to success would be the single greatest chauffeur of financier returns, while dividends will require to be cut to fortify a medium-term future for business.

A list of the leading dividend-yielding stocks in the interactions sector. Keep in mind TDS is at the top of the list for yield. (Author’s Chart Load)

In general, TDS uses financiers a 40% benefit on its suggested “reasonable rate”, and looking behind the P&L and balance sheet at the cashflow declaration we can see strong money streams from operations, nevertheless, these have actually been gnawed at by capital expense ($ 1,269 m, up 78% considering that 2017) which seems the primary perpetrator in unfavorable totally free capital.

Taking A Look At the most current financier discussion we can see TDS definitely has a strategy to profit from these substantial capital expense (which are mainly facilities financial investments), though we can see this strategy is definitely positive and will require to count on a durable market for its product or services over the next 2 years.

The Takeaway

The risk/reward ratio for TDS definitely uses a tasty 40% benefit danger, nevertheless, the company faces its reasonable share of headwinds in order to go back to success.

In the face of increasing financial obligation expenses, inflation, and a looming United States economic crisis, one needs to think about if the company’s strategy to go back to success leans simply a touch too greatly on favorable financial environment presumptions, and insufficient is being done internally to turn things around.

In general, I like TDS. I recommend financiers may consider this a dangerous financial investment, however for those with the hunger or a requirement to expose themselves to upside run the risk of TDS may be ideal.