martinrlee

Western Union ( NYSE: WU) shares have actually lost almost half of their worth in the last 2 years due to issues about decreasing monetary numbers and increased competitors. Nevertheless, I think it is time to profit from the substantial selloff due to the fact that WU’s shares have the prospective to create stable cost gratitude in the long run. It likewise appears that the stock has actually currently bottomed out, with just a minimal quantity of drawback threat staying. Moreover, the business’s healthy dividend yield of more than 8% will motivate financiers to hold the stock for the long term and await its cost to reverse the losses.

Improving Basics Supports Dip Purchasing

WU Rate Modification in 2 Years (Looking For Alpha)

Issues about monetary development and intensifying competitors have actually triggered shares of Western Union to pattern downward over the last 2 years. The payment deal & & processing services sector has actually seen a considerable increase of brand-new fintechs over the last few years, a lot of which utilize innovative approaches to streamline payment processing for consumers. The Western Union Business, on the other hand, is a popular international leader in cash transfer and payment services, providing its items through representative areas and banking channels in more than 200 countries. In addition to the entry of brand-new gamers, it appears that a person of the earliest business in the sector took a long period of time to adjust to altering market conditions, such as a shift towards online services instead of physical areas. As an outcome, over the previous 5 years, the business’s profits has gradually reduced, falling from about $5.5 billion in 2018 to an awaited $4.13 billion in 2023. Likewise, its profits per share, capital, and other monetary metrics have actually all suffered.

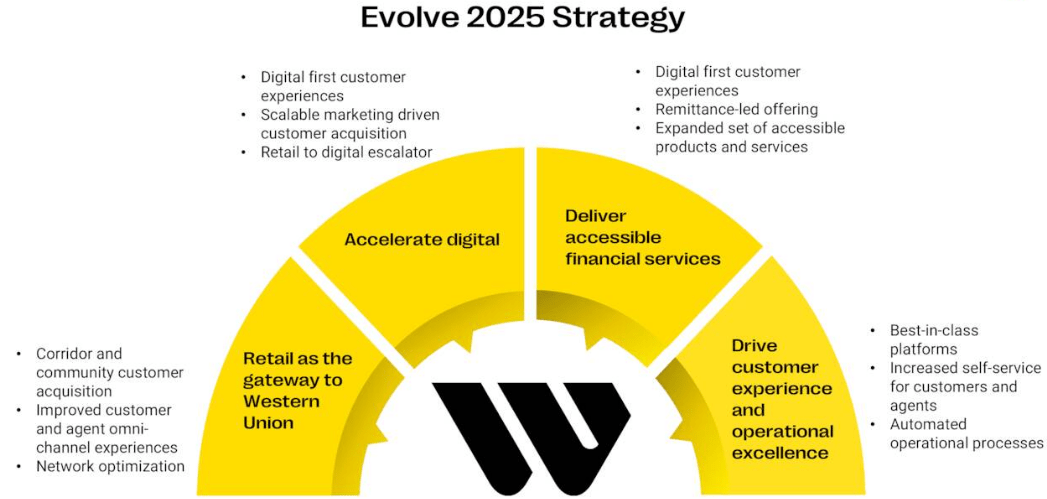

Develop 2025 Technique (Q1 Discussion)

However, 2023 might be the in 2015 of monetary and organization wear and tear. Western Union’s brand-new organization technique, which stresses drawing in brand-new consumers, enhancing client retention, and enhancing core functional efficiency, has actually begun to settle. The monetary figures for the last 2 quarters show that the business has actually made development towards attaining its main objective of supporting its retail organization and speeding up development in its digital organization. For example, the business knowledgeable favorable deal development in The United States and Canada for the very first time in almost 2 years, while its Middle Eastern and European operations (leaving out Russia) experienced a 200 basis point boost from the previous quarter. Deals in Latin America increased 100 basis points sequentially and by 9% year over year.

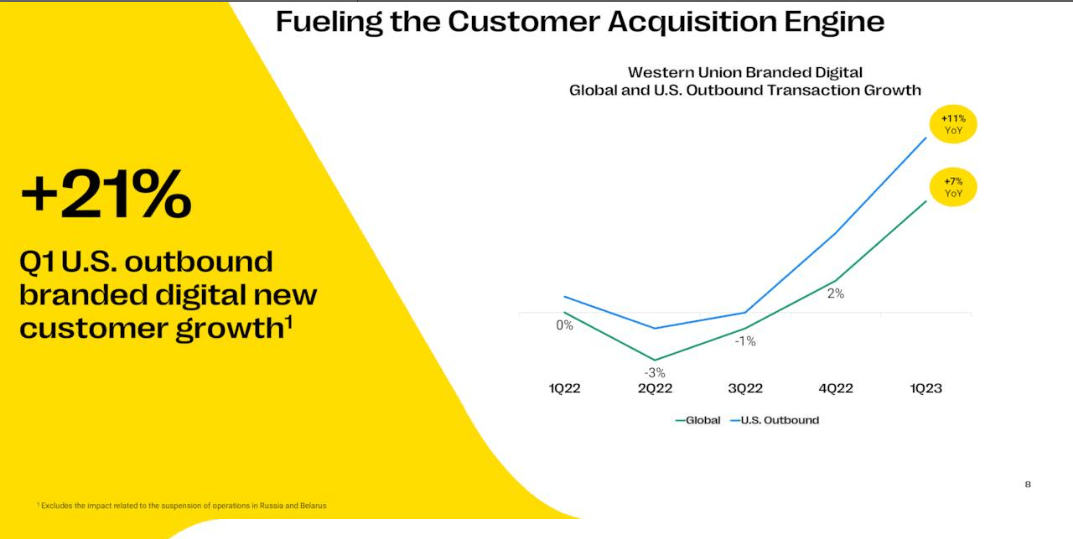

United States Outbound Digital Consumer development (Q1 Discussion)

Especially, the business’s top quality digital go-to-market program has actually assisted to accelerate development in the digital organization and overall deals. Following a 30% year-over-year boost in the 4th quarter of 2022, the business saw a 21% year-over-year boost in United States outbound branded digital consumers in the very first quarter of 2023, with deals increasing 11%. In general, other than for Russia and Belarus, the business’s international top quality digital deals increased by 7% year over year in the quarter. Outcomes are still soft in the retail section. Nevertheless, the business is now pursuing a strong strategy to support its retail organization. Rather of merely including more active areas, the business is looking for to improve its existing organization by lowering transactional friction by presenting brand-new services and products, incorporating commitment programs, enhancing phase and payment alternatives, and enhancing refunds.

In addition to increased deal volume, enhanced core functional efficiency has actually benefited incomes and margins. The business reported $1.03 billion in profits in the very first quarter, the slowest decrease in the previous 3 quarters. Income reduced by just 1% year over year in the March quarter, regardless of a 3 portion point unfavorable effect from the suspension of operations. Additionally, the business’s profits per share of $0.43 was the greatest in the last 2 quarters and represent a little boost on a year-over-year basis if we omit a contribution of $0.05 from organization options and $0.04 from operations in Russia and Belarus. For the complete 2023, Wall Street’s average projection of $1.62 per share represents a mid-single-digit decrease from 2023. Nevertheless, Wall Street expects stable profits development in the upcoming years, constant with the business’s Evolve 2025 technique. In general, it appears that the business’s brand-new organization technique is most likely to reverse the monetary wear and tear and return it to a development trajectory from 2024. For that reason, I think the effect of unfavorable occasions has actually currently been priced in WU’s stock in the last 2 years and there may be a consistent healing in the year ahead.

Dividend is Safe

The high dividend yield of over 8% used by Western Union does not seem a dividend yield trap. This is due to the fact that the dividend is totally moneyed by profits and capital. Presently, the business pays a quarterly dividend of $0.24 per share. With profits per share forecasted to be $1.62 in 2023, the business’s yearly forward payment ratio based upon profits is around 55%. Although its dividend payment ratio is greater than the historic average in the 40% variety, it appears workable due to the fact that the business does not run in a capital-intensive market. Moreover, as the business’s profits are most likely to grow in the future, the payment ratio will more than likely go back to historic levels.

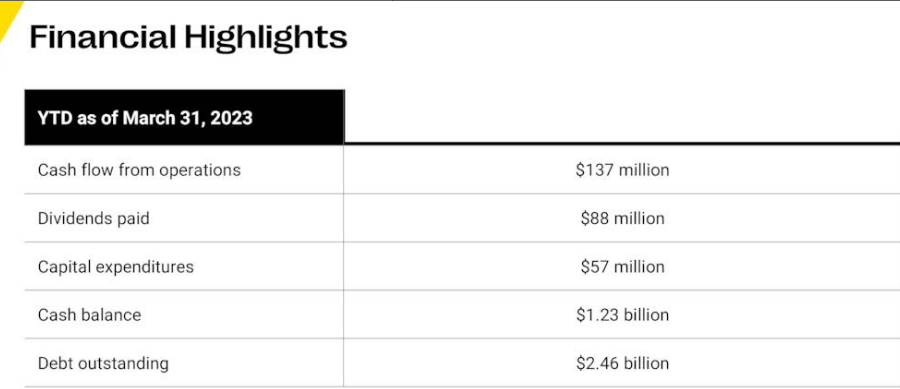

Very First Quarter Discussion (Looking For Alpha)

Its money streams was up to $137 million in the March quarter from $200 million the previous year’s quarter, owing mostly to one-time payments associated with previous duration costs. In spite of this, capital from operations covered both capital investment and dividend payments. There will be more capital protection as the capital are most likely to enhance in the upcoming years as an outcome of increased profits. Quantitative analysis likewise reveals that the business’s dividends are safe. Its dividend gotten high quant grades throughout the board, consisting of development, consistency, security, and yield.

Appraisal and Quant Ranking

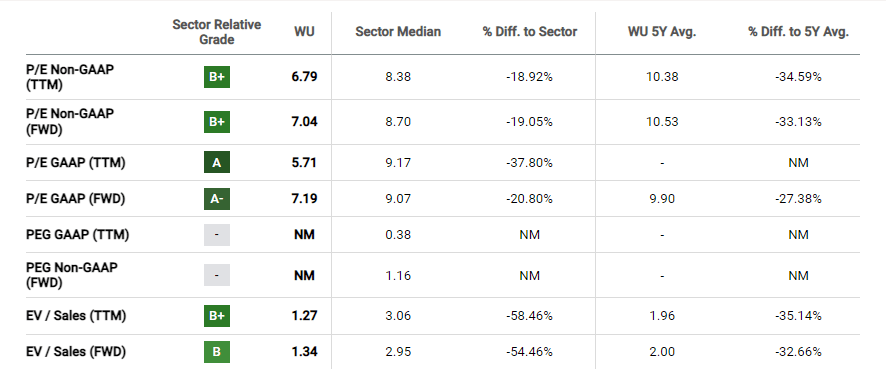

Evaluations (Looking For Alpha)

Western Union appears considerably underestimated based upon assessments. For instance, the stock appears underestimated based upon both forward price-to-sales and profits ratios due to the fact that shares fell faster than experts’ quotes for profits and profits. Moreover, the 2024 forward price-to-earnings ratio is even lower, at 6.90 times, showing the probability of greater profits because year. This recommends that Western Union stock has a much greater worth than its present cost, making the selloff a purchasing chance.

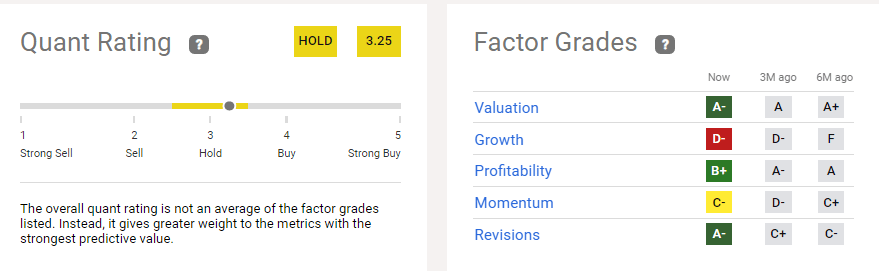

Quant Ranking (Looking For Alpha)

Based upon quantitative analysis, Western Union stock is on the edge of getting in the purchasing zone. Its stocks got a hold score with a quant rating of 3.25. 3 crucial aspects, consisting of assessments, success, and modifications, got high quant rankings. Quant rankings show that WU stock is trading at an appealing evaluation, which remains in line with what I currently stated above about assessments. The quant grade for profits modifications likewise increased to unfavorable A from C plus 3 months back, which amply shows that Wall Street has actually increased its expectations for profits development. On the drawback, the business got a D on the development aspect due to the fact that of the decrease in profits and profits over the previous quarter. Its momentum rating has actually enhanced in the last 3 months, and I anticipate it to enhance even more due to the fact that shares now have actually restricted drawback and much better long-lasting development potential customers.

Threat Elements to Think About

There are varieties of threat aspects to think about when it concerns buying Western Union. The greatest threat is increasing competitors from standard and digital gamers. If the business stopped working to execute its Evolve 2025 Technique, it would produce volatility in its shares cost and dividends. Economic crisis is another threat that might harm remittances and other C-to-C deals in the quarters ahead.

In Conclusion

Western Union’s stock cost drop of around 50% from current highs represents an appealing purchasing chance due to the fact that its basics have actually started to enhance as an outcome of its brand-new organization technique. Its forward assessments have actually likewise been flashing buy signals as the probability of stable development and success has actually increased. Western Union’s high dividend yield is another essential aspect that makes it a great stock to hold for the long term and await its cost to go back to its current highs.