Edwin Tan/ E+ through Getty Images

Although I consider myself a worth financier, I simulate to keep looking into my financial investments and my financial investment potential customers on a relatively routine basis. I require to understand if the image is altering for the much better or for the worst for a business, particularly if it is attaining monetary efficiency that is deviating materially from what I expect. One business that has actually just recently underperformed that I was bullish on is Gentex Corporation ( NASDAQ: GNTX), a business that produces and offers digital vision, linked vehicle, and dimmable glass items, in addition to fire security items. Shares of the business were never ever precisely inexpensive. Nevertheless, it’s strong performance history since late, integrated with the lack of financial obligation and a considerable quantity of money on hand, has actually led me to think that the business can and ought to exceed the more comprehensive market. Nevertheless, that outperformance has actually stopped working to emerge. Going into the numbers, I think that my bullish thesis still stays undamaged. So rather of altering my position on the business, I will argue that extra perseverance and time will likely be needed for the business to genuinely provide.

Fantastic outcomes just recently

A little over 3 months back, in March of this year, I chose to appearance when again at Gentex to see precisely how the business was occurring. From the time I had blogged about the company formerly in October of in 2015, through the date that I chose to look into it in March, shares were up 11.8% compared to the 6.1% seen by the S&P 500. This outperformance what is motivating. And what I discovered upon reviewing the business is an organization that did certainly have a rather rocky 2022 . However completion of the year was especially appealing and the projection for 2023 struck me as bullish in nature. Include on top of this that shares were simply hardly inexpensive adequate to call for some optimism, and I had no issue score the business a ‘purchase’. Ever since, the stock has actually continued to value, climbing up by 4.3%. Such a return over a brief window of time would usually be thought about favorable. However compared to the 13.4% seen by the S&P 500 over the very same duration, outcomes have actually been frustrating.

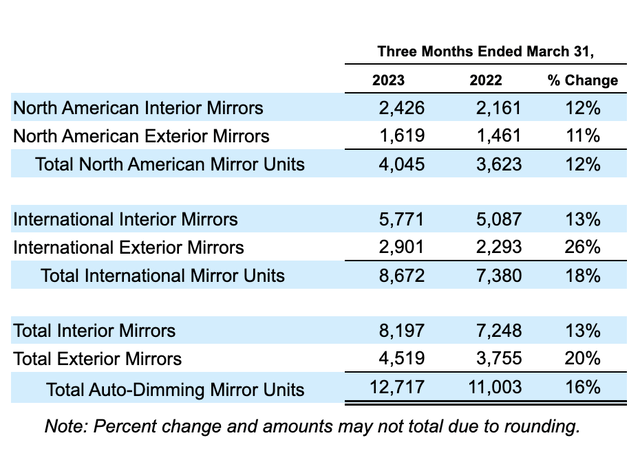

If you focus entirely on the most current monetary information covering Gentex, you would most likely be amazed to see that shares have actually underperformed the more comprehensive market. Profits throughout the very first quarter of the business’s 2023 , for example, was available in at $550.8 million. That’s 17.6% above the $468.3 million created one year previously. There were a couple of various chauffeurs behind profits modifications from year to year. However something that the business certainly took advantage of was an approximately 15.6% rise in the variety of auto-dimming mirror systems. This number grew from 11 million to 12.7 million. A lot more remarkable was the 17.5% boost in the variety of global mirror systems offered, with the number climbing up from 7.4 million to 8.7 million. Even in The United States And Canada, the business experienced a great little bit of development, with a variety of mirror systems growing 11.6% from 3.6 million to 4 million. Although an extremely little part of the pie, it is notable that the profits that the business created related to dimmable airplane systems increased 118% from $1.9 million to $4 million. And beyond this classification totally, fire security sales likewise increased, growing by 10% from $8.4 million to $9.3 million.

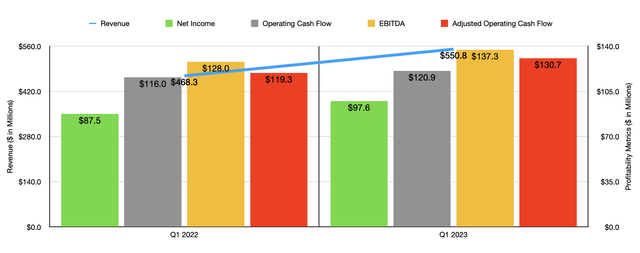

This boost in sales brought with it greater success too. Earnings, for example, soared 11.5% from $87.5 million to $97.6 million. According to management, the company did suffer some from a decline in its gross revenue margin from 34.3% to 31.7%. This was driven mostly by greater basic material expenses, prior dedications that the business had actually made to yearly consumer rate decreases, an undesirable item mix, and greater labor expenses. The image would have been even worse had it not been for a decrease in freight costs. Other success metrics likewise enhanced for business. Running capital, as one example, inched up from $116 million to $120.9 million. If we change for modifications in working capital, we would have seen this number enhance a lot more from $119.3 million to $130.7 million. And lastly, EBITDA for the business broadened from $128 million to $137.3 million.

When it concerns the 2023 in its whole, management does have high wish for business. Profits is anticipated to come in at around $2.2 billion. If this concerns fulfillment, it would represent a substantial boost over the $1.9 billion reported for 2022. Price quotes relating to the business’s expense structure shows the earnings for the year ought to be around $378 million. Those very same price quotes indicate running capital of $483 million and EBITDA of $555 million.

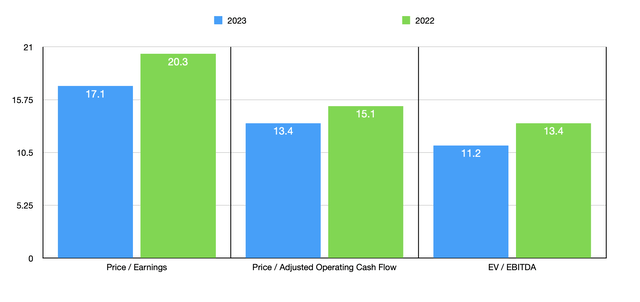

Utilizing this information, it ends up being rather simple to value the business. As you can see in the chart above, shares are trading at a forward rate to profits multiple of 17.1. This is below the 20.3 reading that we get utilizing information from in 2015. The rate to changed running capital several ought to decrease from 15.1 to 13.4, while the EV to EBITDA multiple of the business ought to drop from 13.4 to 11.2. Relative to comparable companies, shares are not precisely inexpensive. As you can see in the table listed below where I compare it to 5 comparable business, 4 of the 5 business are less expensive than Gentex on a cost to profits basis and on an EV to EBITDA basis. Utilizing the rate to running capital technique, 3 of the 5 business wound up being less expensive than our target.

| Business | Cost/ Profits | Cost/ Running Capital | EV/ EBITDA |

| Gentex | 20.3 | 15.1 | 13.4 |

| Autoliv ( ALV) | 17.3 | 12.1 | 8.5 |

| Lear Corp ( LEA) | 19.4 | 10.7 | 7.6 |

| Fox Factory Holding Corp ( FOXF) | 20.8 | 15.7 | 14.9 |

| Requirement Motor Products ( SMP) | 16.8 | 14.3 | 8.2 |

| Modine Production ( MOD) | 10.9 | 15.4 | 9.7 |

Beyond the appraisal information, there are some other products that I believe are notable. As I discussed previously in the post, the business has no financial obligation. It likewise boasts $245.1 million in money and money equivalents. This is on top of $229.4 million worth of long-lasting financial investments that it has at its disposal. Management is likewise extremely ingenious. Although the market in which the business runs might not appear like one that would include a great deal of possible modifications, the company released 18 net brand-new exterior and interior automobile dimming mirrors and electronic functions throughout the very first quarter of 2023 as a whole.

While innovating, the business is likewise committing resources towards growing its physical footprint. For example, in the very first quarter of 2022, the business started building and construction on a 350,000 square foot production center in Michigan that it approximates will cost in between $80 million and $90 million in all. That is anticipated to be functional by the last quarter of this year. They have actually likewise begun dealing with 2 structure growths, with one including the addition of 300,000 square feet to among its warehouse, all at an expense of $40 million to $45 million. The other growth task is of among its production centers for an additional 60,000 square feet that it approximates will cost in between $20 million and $30 million. If management is making these relocations, then the company likely will benefit. Nevertheless, it deserves keeping in mind that its existing structure capability ought to enable it to produce in between 34 million and 37 million interior mirror systems each year and 15 million to 18 million outside mirror systems each year. That’s a considerable quantity of volume in and of itself.

Takeaway

From what I can see, Gentex is on strong footing. The business’s monetary condition is great and development continues to impress. I comprehend that shares of business are not precisely inexpensive, particularly relative to comparable companies. However some business do call for some premium over the competitors. And Gentex is, I think, one such example of that. Since of this, I have actually chosen to keep the business ranked a soft ‘purchase’ at this time.