MicroStockHub/iStock by means of Getty Images

The Sun Shines on Japanese Stocks, Expecting Secret Occasions to End Up the First Half

While the Spectacular 7 stays in the spotlight, worldwide financiers might be losing out on an interesting program in Japan. We discussed it previously this month, however the Nikkei’s huge run-up has actually taken another leg greater recently.

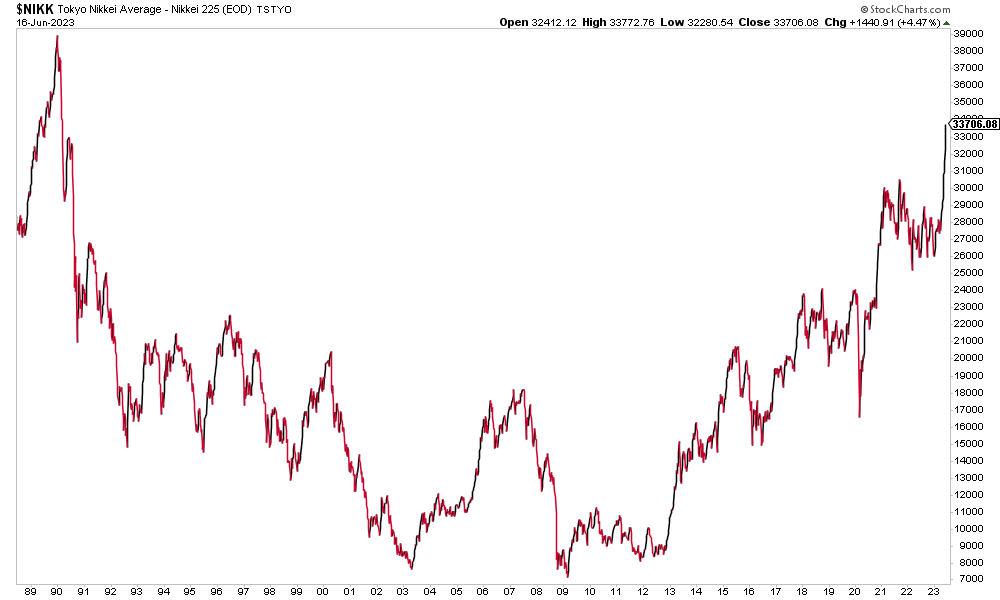

The mom of all booming market and bubbles grew in the 1970s and ’80s in Japan. Its realty sector, together with the nation’s equities, rose to assessment ratios that would make today’s U.S. tech stocks blush. Sadly, all advantages appear to come to an extreme end when worry and greed are at play.

The Nikkei 225 peaked simply shy of 39,000 quickly in advance of the go-go ’90s. Right prior to American financiers would delight in a tech boom and bust, the land of the increasing sun was on the brink of among the most gut-wrenching bears of perpetuity.

Closing In on a Big Salami

The Nikkei’s drawdown reached 80% by early 2003. The bearishness then damaged that low at the depths of the worldwide monetary crisis in 2009. Twenty years of lower highs and lower lows is the embodiment of despondency. Japanese stocks were undoubtedly left for dead, and a significant rally would not start up until 2013. In the middle of an aging population and consistent financial flirts with deflation, financiers were none too thinking about being obese a country doing not have development drivers.

Nikkei 225 Index: From Big Bear to a Rock-Solid Brahma Bull

Source: StockCharts.com

A New Global Market Leader

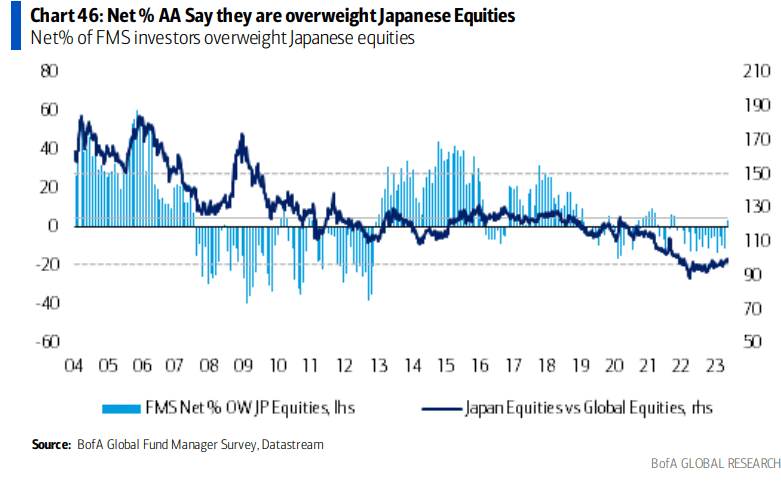

However a booming market has actually been raving for about a years. Flying under the radar provided the consistent alpha seen amongst domestic equities, Japan’s Nikkei 225 is up more than three-fold over the last ten years. The index’s last 5 thousand points have actually lastly captured the attention of huge cash supervisors. According to the most recent BofA Global Fund Supervisor Study, Japanese stock allotments are the greatest considering that late 2021. In addition, “long Japan equities” is viewed as the No. 3 most congested trading amongst worldwide portfolio supervisors.

International PMs Turning Bullish on Japan

Source: BofA Global Research Study

Going Micro

Remarkable macro patterns, no doubt, however what can specific business occasions inform us about where the land of the samurai may go next? While completion of the very first half is typically a peaceful time on Wall Street, there are essential information points provided by a handful of Japanese companies over the last 2 weeks of June.

Automobile Data Velocity Ahead

After the Juneteenth vacation weekend, Honda Motor ( HMC) held its yearly investors’ conference on Tuesday night, June 20. The car manufacturer then reports June month-to-month sales on the 30th. It’s not the only vehicle OEM with essential information on the horizon, however. Subaru ( OTCPK: FUJHY) paid a 38 JPY dividend on Thursday, June 22 after its investor collecting the day prior. Mazda ( OTCPK: MZDAY) and Subaru problem interim sales information on the last Friday of June while the previous hosts its investors’ conference on Tuesday the 27th. Possibly the most significant information point of all originates from Toyota’s June sales report which likewise takes place on June 30th.

Other Industries Deal Cyclical Ideas

Beyond the vehicle market, wider essential sales month-to-month sales and production figures cross the wires over the coming days:

-

June 26: NH Foods Limited ( OTCPK: NIPMY) (Packaged Foods and Meals)

-

June 26: Japan Hotel REIT Financial Investment Corp. ( OTCPK: NIPOF) (Hotel & & Resort REITS)

-

June 26: Invincible Financial Investment Corp. ( OTC: IVINF) (Hotel & & Resort REITs)

-

June 28: Askul Corporation (Web Retail)

-

June 29: Wacoal Holdings Corp ( OTC: WACLY) (Garments, Devices, and High-end Product)

-

June 30: Trusco Nakayama Corporation (Industrial Circulation)

Completion of H1 likewise marks lots of semi-annual dividend pay dates amongst these business.

The Bottom Line

Thirty-three years to regain 33,000 on the Nikkei 225 Index is a memorable summary to get financiers’ attention. After withstanding an extended duration of decrease and stagnancy, Japanese stocks have actually experienced a substantial rally over the previous years, and big cash supervisors are progressively designating funds to Japanese equities, according to one current study. Upcoming essential occasions, such as investor conferences and sales reports from popular Japan-domiciled business, are anticipated to offer more insights into the instructions of the Nikkei and TOPIX as the very first half of the year ends.

Editor’s Note: The summary bullets for this post were picked by Looking for Alpha editors.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.