Steve Jennings

Financial investment thesis

Fastly ( NYSE: FSLY) has actually been among the most popular stocks this year given that the share rate nearly doubled given that January. My appraisal analysis recommends there is still space for stock rate gratitude, however the level of unpredictability is really high. The business’s income development has actually been excellent over the previous 6 years, however success metrics weakened which appears like a warning for me. Additionally, the level of financial obligation is significant and I consider it is really dangerous since the business is far from recovering cost from the operating money streams point of view. After thinking about all benefits and drawbacks together I designated FSLY a “Hold” score.

Business details

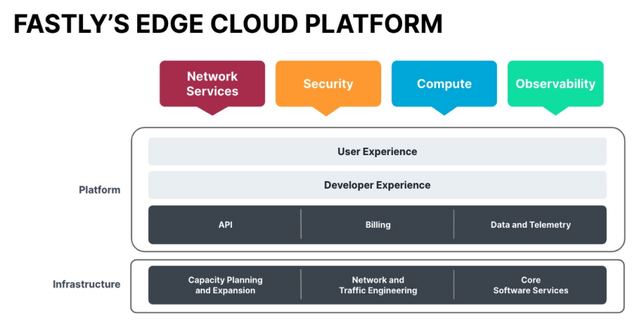

Fastly is an innovation business concentrating on material shipment and edge cloud computing services. Fastly’s service offerings are diversified, consisting of material shipment, video and streaming velocity, image optimization, load balancing, real-time logging and analytics, and security abilities.

Fastly’s most current 10-K report

The business’s ends on December 31. About 90% of overall sales were produced from business clients. According to the most current 10-K report, about 75% of sales were produced in the U.S.

Financials

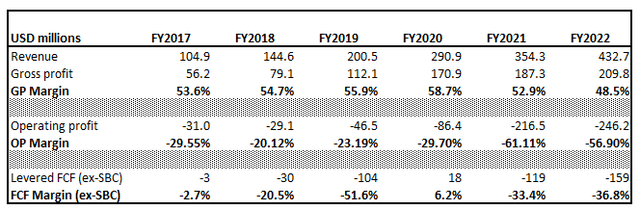

Fastly went public in 2019, so I have a fairly brief horizon for long-lasting analysis. We have financials offered for the last 6 years when the business showed a remarkable 33% income CAGR. Still, a huge warning for me is that success metrics softened as business grew. It needs to be vice versa. Otherwise, there is no point in providing income development. The business did not attain a sustainable favorable complimentary capital [FCF] margin.

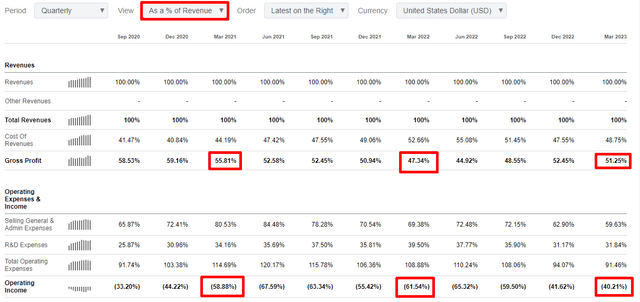

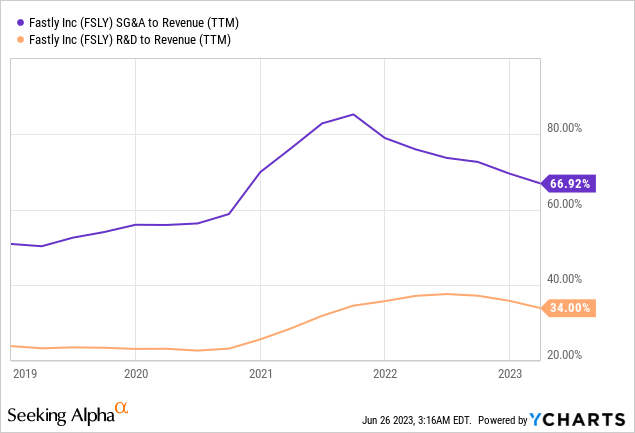

The business invests a significant part of sales into R&D, which is excellent. However, the part of sales invested in SG&A is two times more comprehensive than the R&D. When I see such a percentage, the very first thing that pops into mind is that the business will not sustain a remarkable development rate if it cuts costs on SG&A. A 67% SG&A to income ratio implies the business is far from producing a strong brand name with the aid of word-of-mouth.

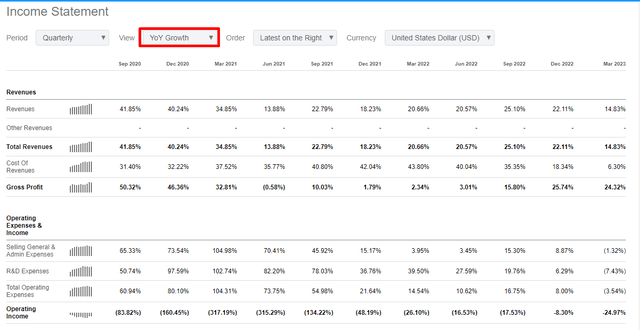

Now let me narrow it to quarterly efficiency. The business reported its most current quarter on Might 3, providing above-the-consensus incomes. Earnings grew about 15% YoY which is excellent. On the other hand, in the listed below table, we can see that the income development slowed down compared to previous quarters.

Success metrics enhanced significantly on a YoY basis. The gross margin was lower sequentially and significantly lower than all-time highs. Throughout the last quarter, the business showed a strong dedication to development with an above 30% R&D to income ratio. Operating earnings enhanced considerably YoY however is still far from recovering cost with minus 40%.

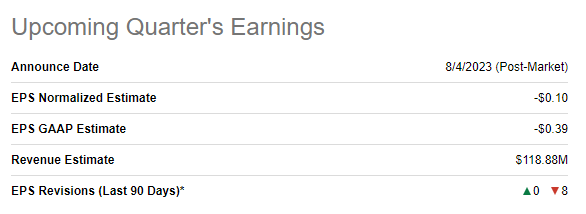

The approaching quarter’s incomes are anticipated to be launched on August 4. Earnings is anticipated at about $119 million, showing about 16% YoY development, showing that income development momentum is still strong. Changed EPS is anticipated to enhance however is still predicted to be unfavorable.

Looking For Alpha

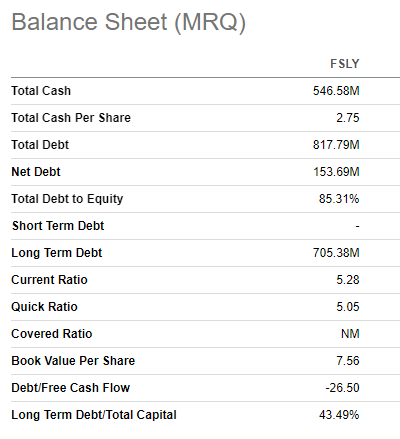

The business has actually produced unfavorable levered FCF for 3 quarters in a row. Money from operations is unfavorable, and the business greatly offers valuable securities to fund its operations. That stated, the business’s balance sheet is not a fortress. This is since of a high level of take advantage of, which is a threat for the business given that capital are unfavorable. Strong liquidity ratios do not encourage me that the balance sheet is strong.

Looking For Alpha

Assessment

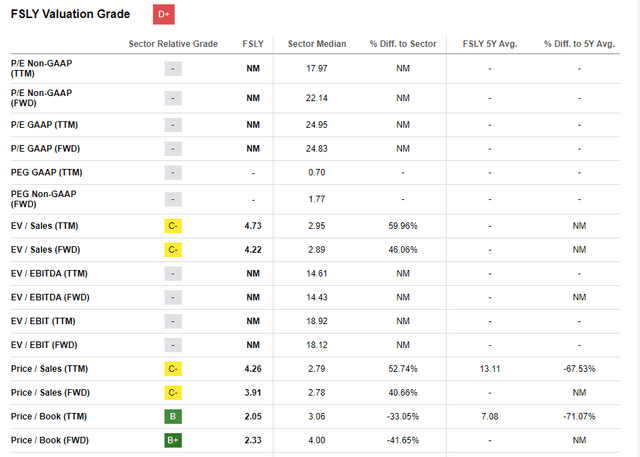

FSLY stock surpassed the more comprehensive market this year with a 92% year-to-date rally. Looking for Alpha Quant designated the stock a “D+” appraisal grade, showing that multiples are high. Certainly, price-to-sales and EV-to-sales ratios are significantly greater than the sector average. On the other hand, other multiples look appealing.

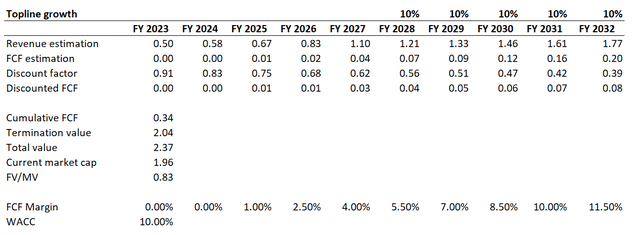

Fastly is a development business. For that reason, I utilize affordable capital [DCF] appraisal method. I utilize a 10% discount rate near the WACC predicted by valueinvesting.io For future income, I have agreement price quotes as much as FY 2027. For the years beyond, I execute a 10% income CAGR. FCF margin is challenging to job since the business is still losing money. I believe that executing a 1% FCF margin in FY 2025 and additional annual 150 basis points growth is reasonable.

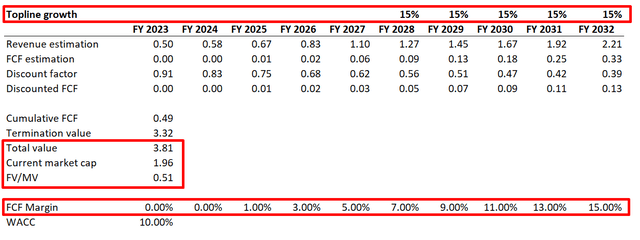

Under these presumptions, the stock looks about 17% underestimated, however the level of unpredictability is really high. Now let me imitate a 15% income CAGR for the years beyond and 200 basis points FCF margin growth from FY 2026.

Under the positive situation, we can see that the stock is significantly underestimated. Business’s reasonable worth under positive simulation is almost $4 billion, while the present market cap has to do with $2 billion. If we talk simply from the figure’s point of view, the stock is magnificently valued. However, the level of unpredictability relating to future development and FCF margin enhancement is significant.

Threats to think about

Buying FSLY is really dangerous due to a number of factors. Initially, there is very little certainty about when the business will begin creating favorable FCF. As we saw in the “Financials” area, business does not show a clear course of margin enhancement as the business scales up. Additionally, success metrics even softened over the long term. The business’s EPS is stagnating, and a significant SG&A to-revenue ratio near 70% appears inefficient in sustaining sustainable development.

The 2nd substantial danger is the significant take advantage of ratio, particularly offered the business’s “money burn” mode. The longer FSLY will be unprofitable in regards to the FCF, the greater the credit danger for the business will be.

The 3rd significant danger is competitors and shallow barriers to entry. Business design is not capital-intensive and does not include really advanced algorithms that can not be reproduced. That stated, brand-new rivals for FSLY may appear quickly and the business’s market share will be at danger.

Bottom line

FSLY’s appraisal looks really appealing, however I am not investing due to the really high level of unpredictability relating to the underlying presumptions. I likewise do not like the truth that success metrics do not enhance while business scales up at a rather quick rate. A high take advantage of ratio is likewise a significant danger, particularly offered the unfavorable FCF. For that reason, I designate FSLY stock a “Hold” score.