franckreporter

2nd Half Playbook

On Friday, I signed up with Seana Smith on Yahoo! Financing where I went over the playbook for the next 6 months:

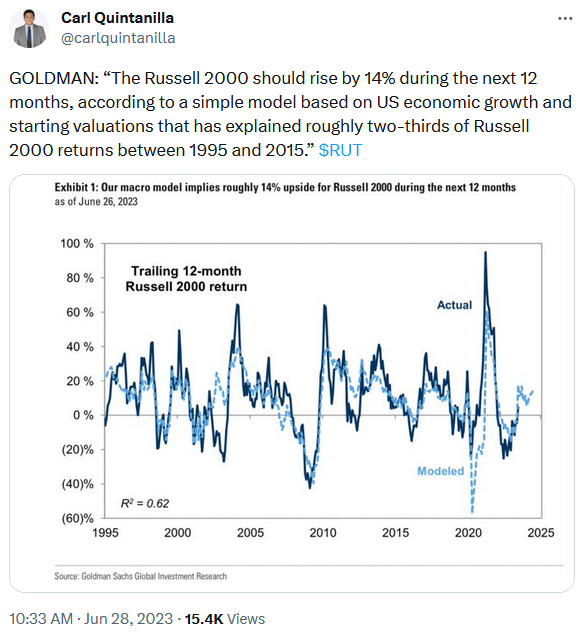

This chart incorporate among the bottom lines I made above:

Carl Quintanilla

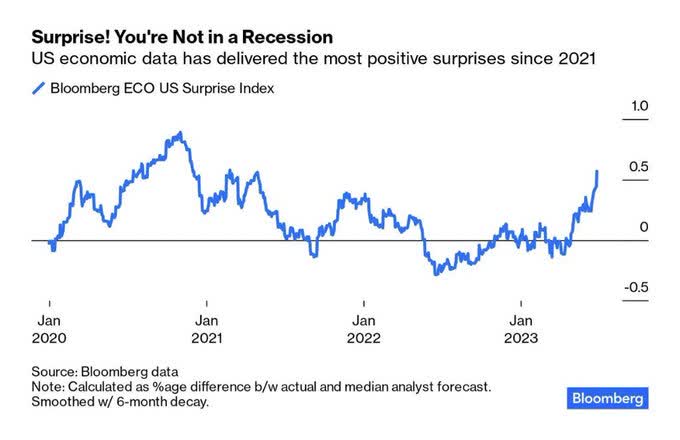

The function of the following charts and tables is to advise doubters that the information continues to can be found in much better than anticipated. While the back half of the year returns for the indices might be more soft than the very first half, there is still substantial chance. Nevertheless, the most cash will be made “under the surface area” with lots of private laggards that can be up 20, 30, 50 and even 100%+ in 2H.

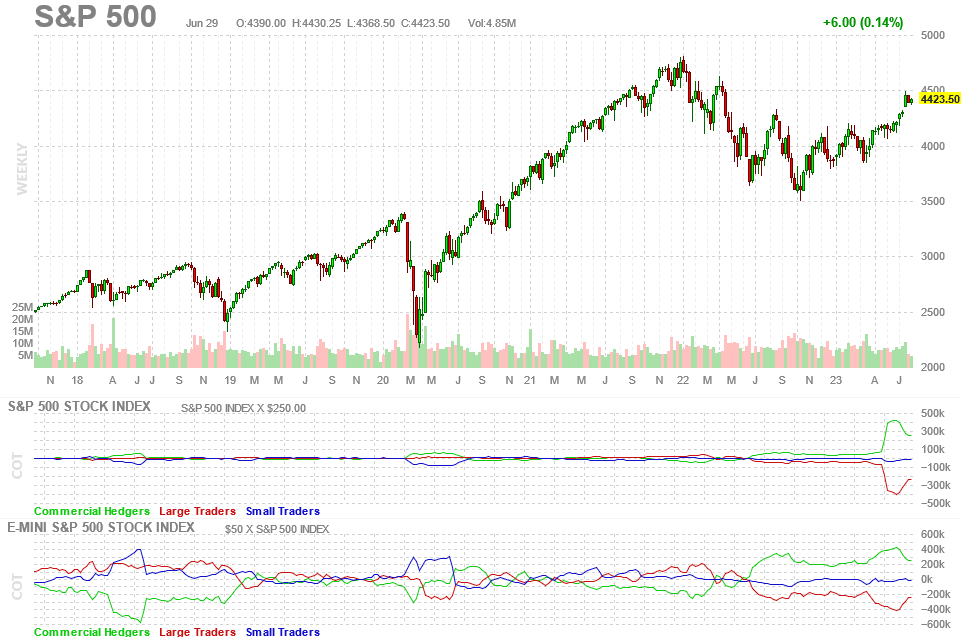

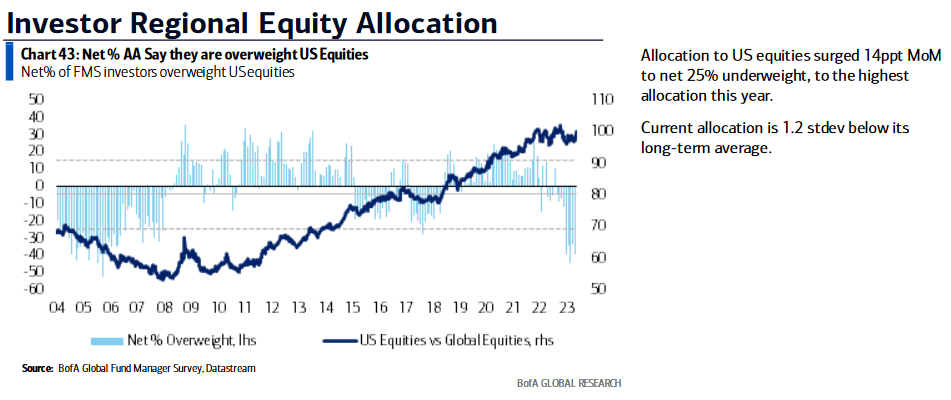

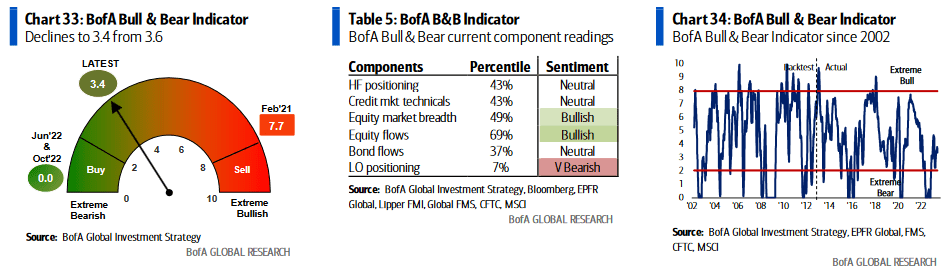

Positioning

Commercials still long, Hedge Funds still brief the entire method up! We continue to follow the commercials and neglect the big supervisors who informed you to cost the October lows.

Finviz BofA

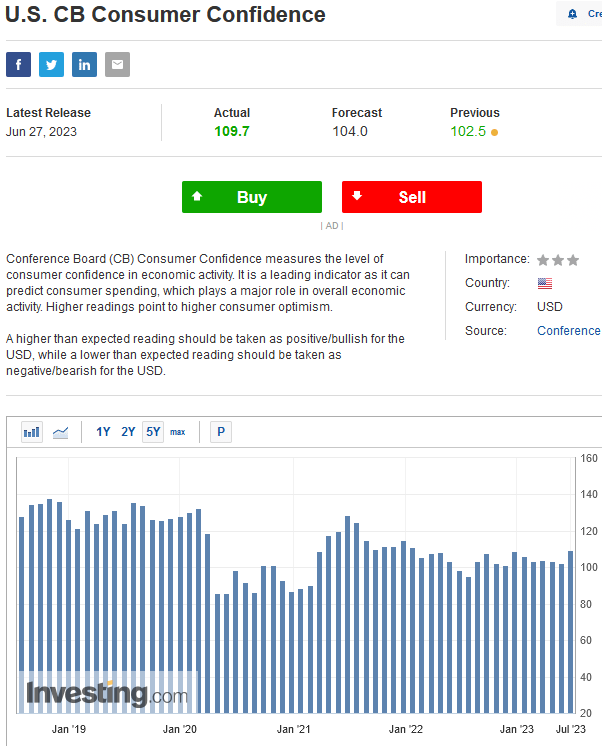

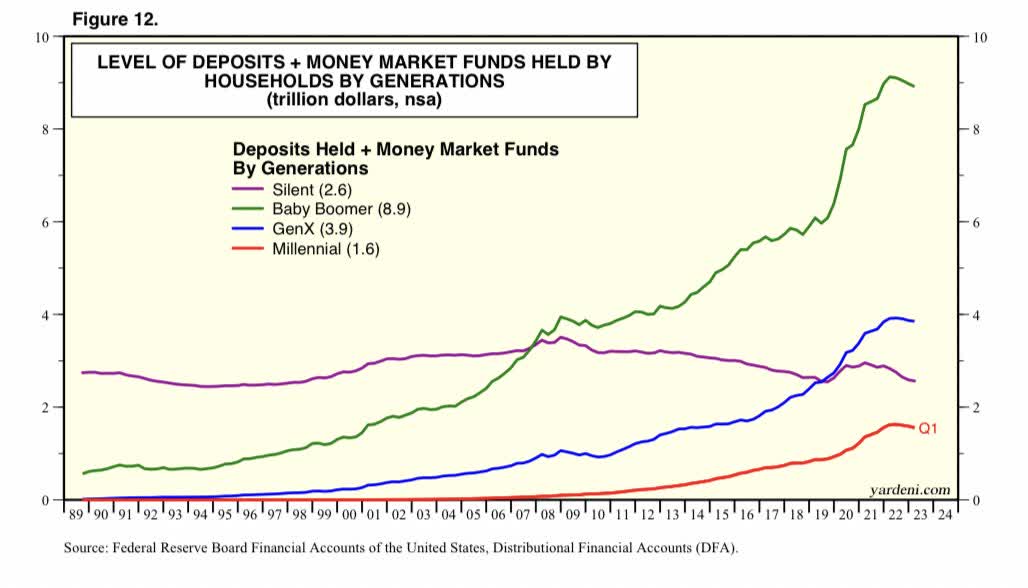

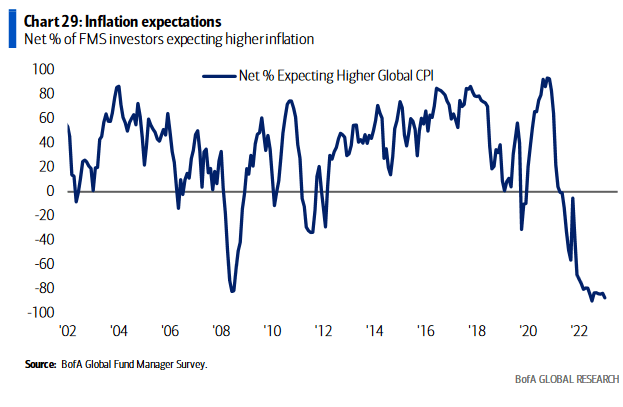

Belief

BofA BofA Investing.com Yardeni.com

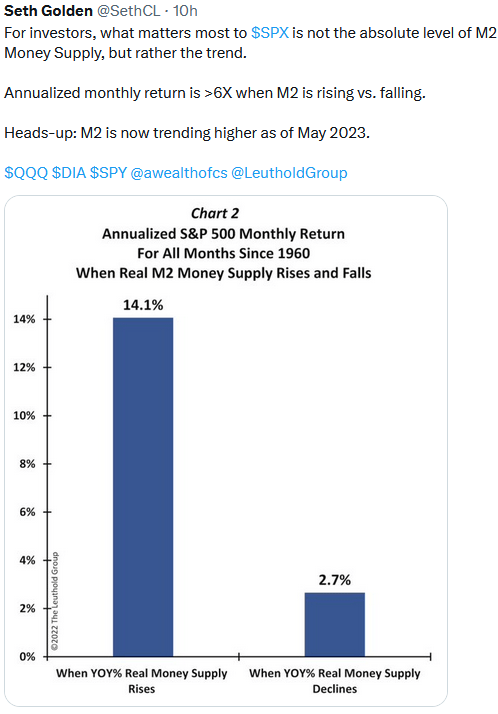

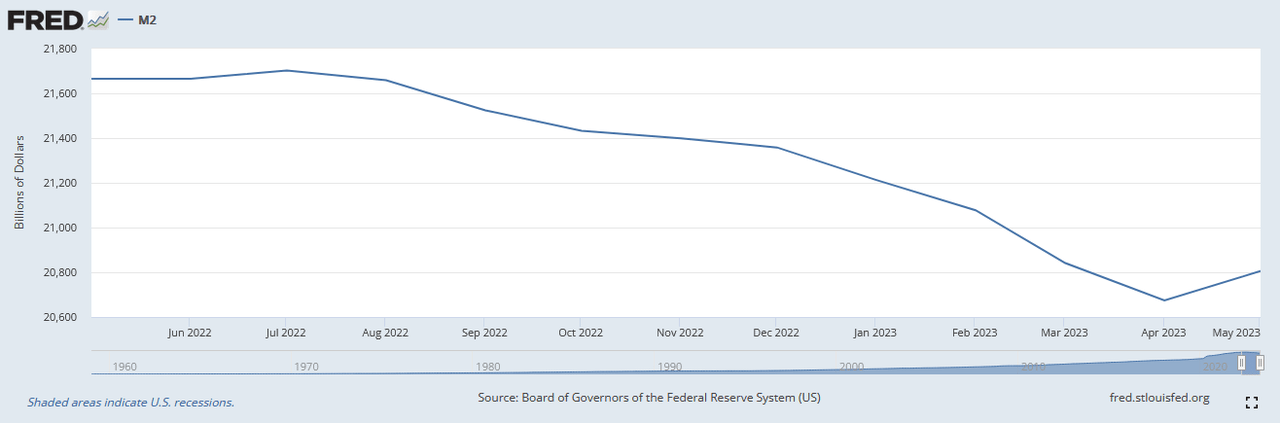

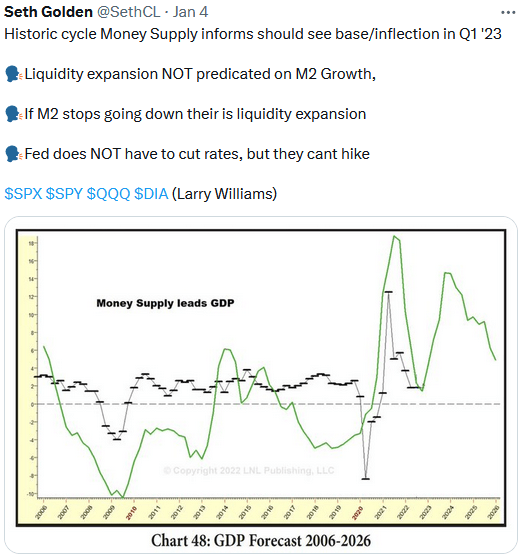

Cash Supply

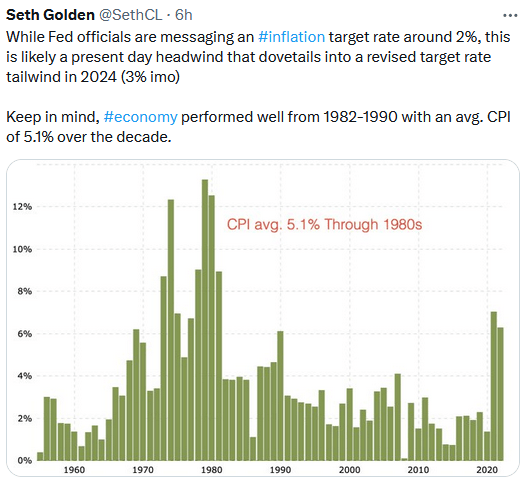

Seth Golden fred.stlouisfed.org Seth Golden

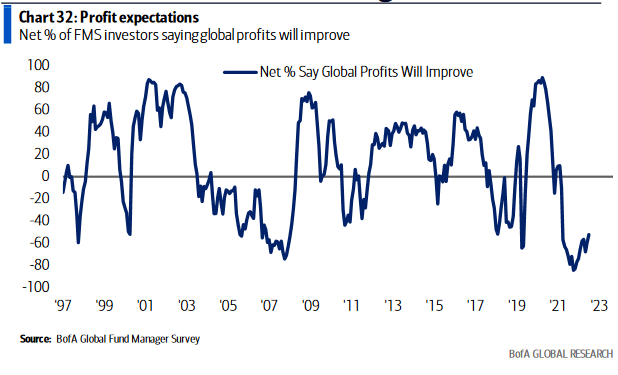

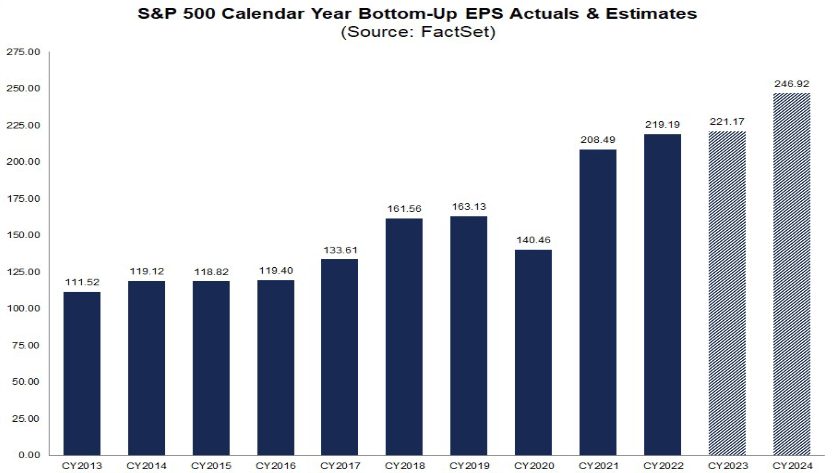

Profits Expectations

Profits: Establish entering into Q2 revenues season the like entering into Q1.

– For Q2, the approximated revenues decrease for the S&P 500 is -6.5%

– Q1 had a comparable set-up and wound up at -2%.

– Everybody has actually been requiring a 20% revenues decrease given that October. Rather, we got a 25% rally in the S&P 500.

– What now? 2024 price quotes are increasing in current weeks to ~$ 247.

FactSet

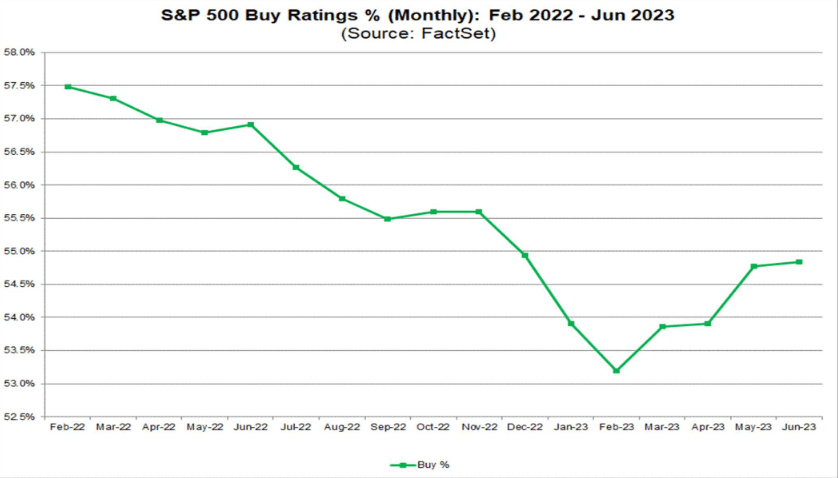

Experts playing “capture up” on buy rankings:

FactSet

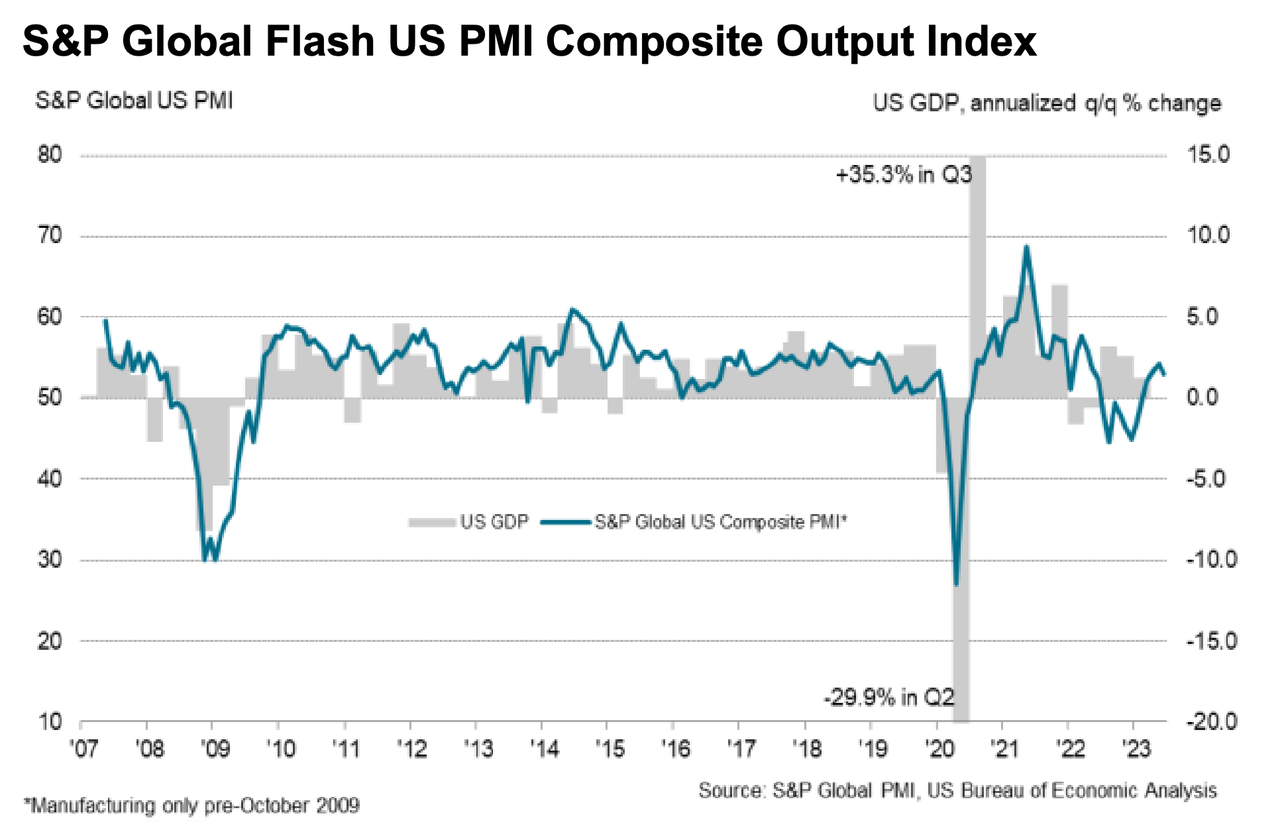

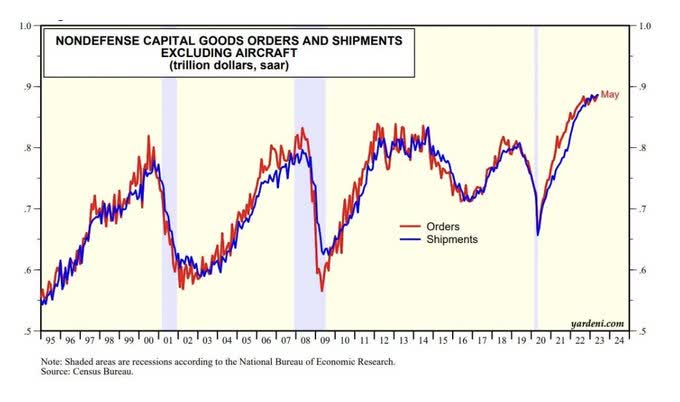

Economic Data

S&P Global PMI Yardeni.com Seth Golden Bloomberg BofA Bloomberg

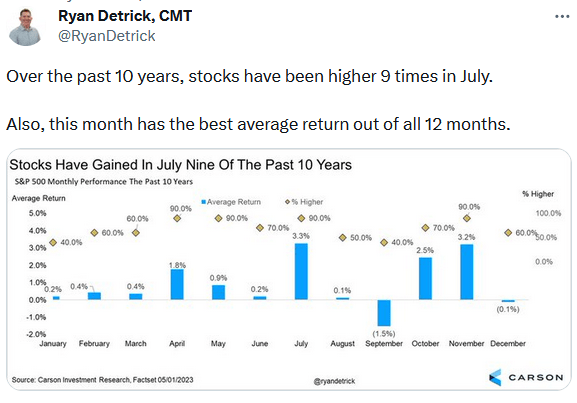

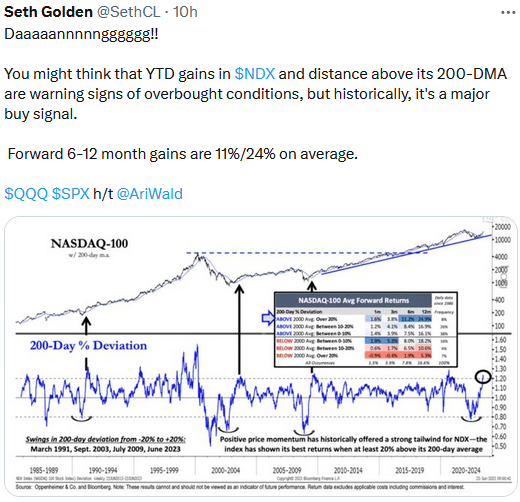

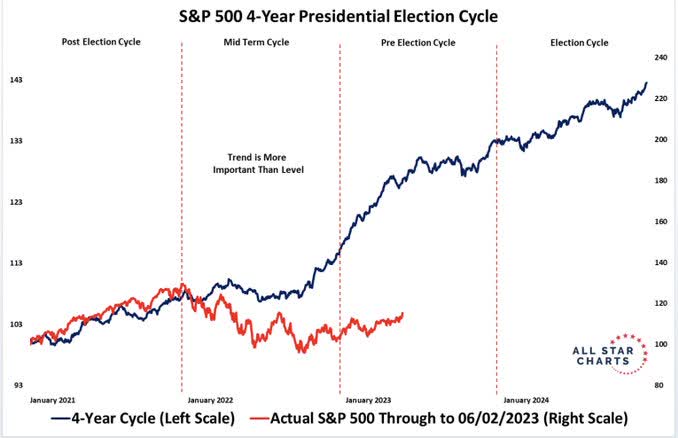

Seasonality

Ryan Detrick Seth Golden All Star Charts

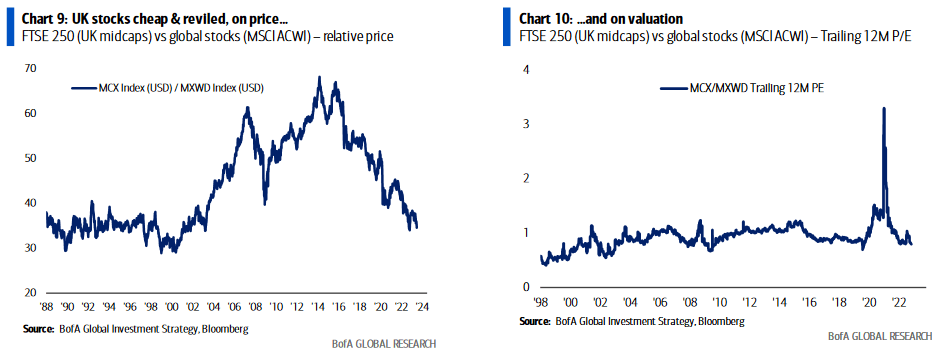

UK

BofA

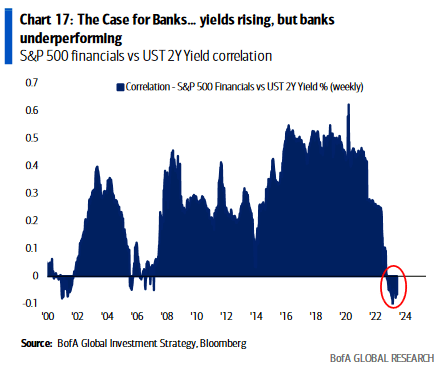

Banks

BofA

Now onto the much shorter term view for the General Market:

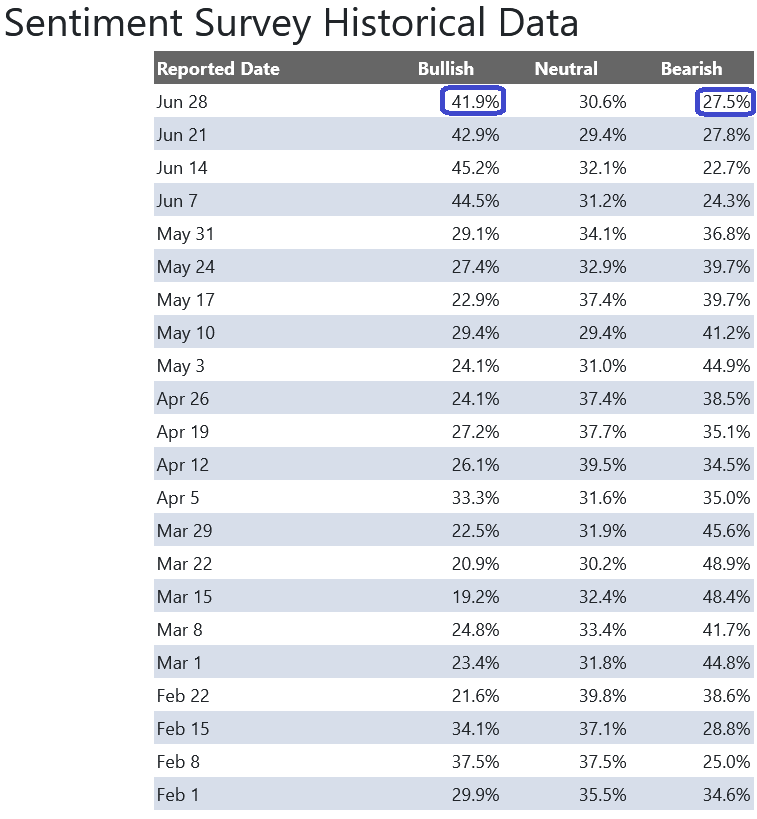

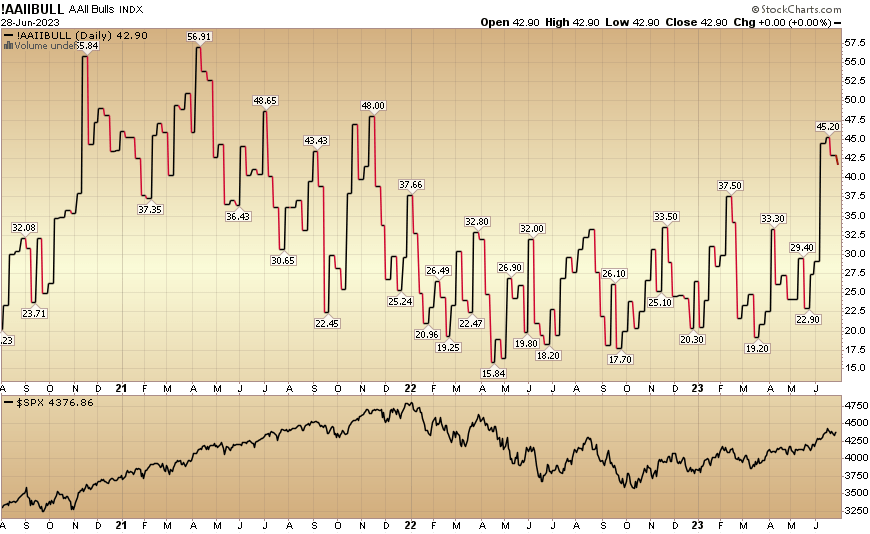

In this week’s AAII Belief Study outcome, Bullish Percent ticked down to 41.9% from 42.9% the previous week. Bearish Percent flat-lined at 27.5% from 27.8%. The retail financier is still positive. This can remain raised for a long time based upon placing entering these levels.

AAII.com Stockcharts.com

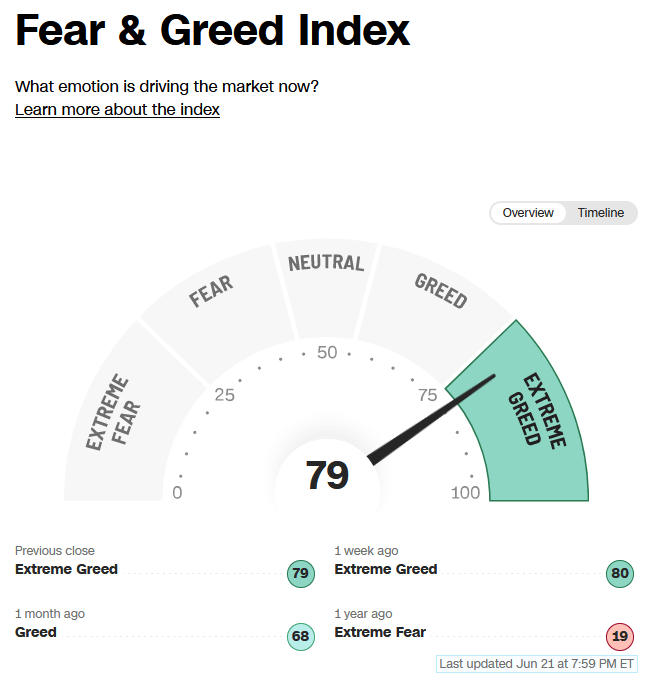

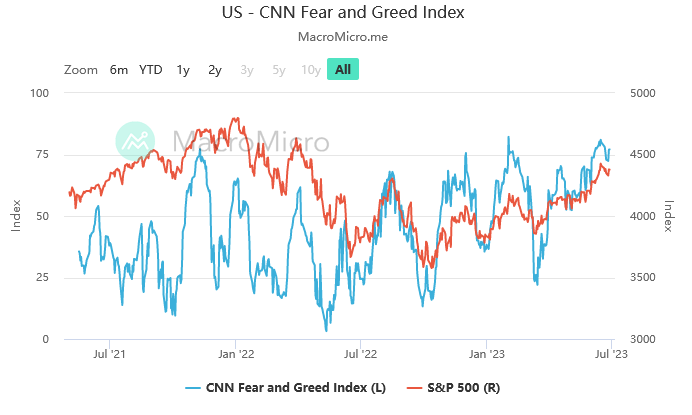

The CNN “Worry and Greed” flat-lined from 79 recently to 79 today. Belief is hot however it would not shock me if it remains pinned for a bit to require individuals out of their bunkers and back into the marketplace.

CNN MacroMicro.me

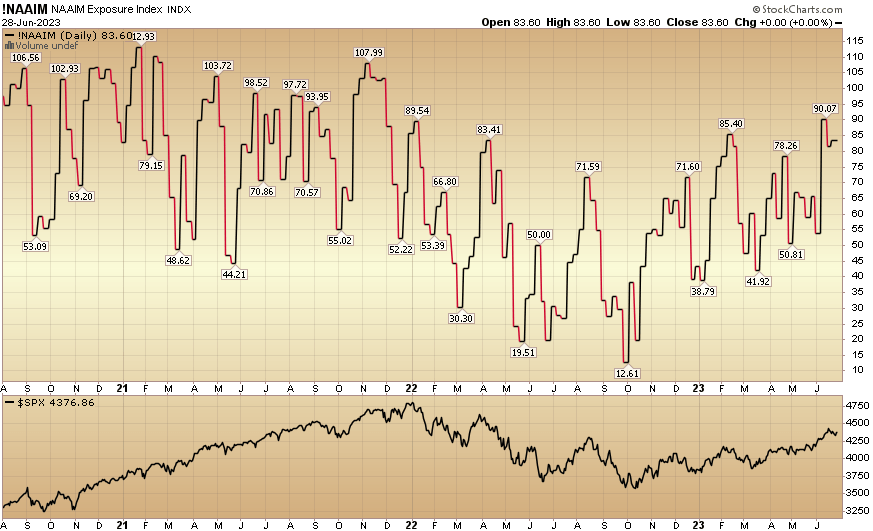

And lastly, the NAAIM (National Association of Active Financial Investment Supervisors Index) ticked approximately 83.60% today from 81.66% equity direct exposure recently. Supervisors have actually been going after the rally.

Stockcharts.com

* Viewpoint, not suggestions. See “terms” at hedgefundtips.com.