Pgiam/iStock through Getty Images

Financial Investment Summary

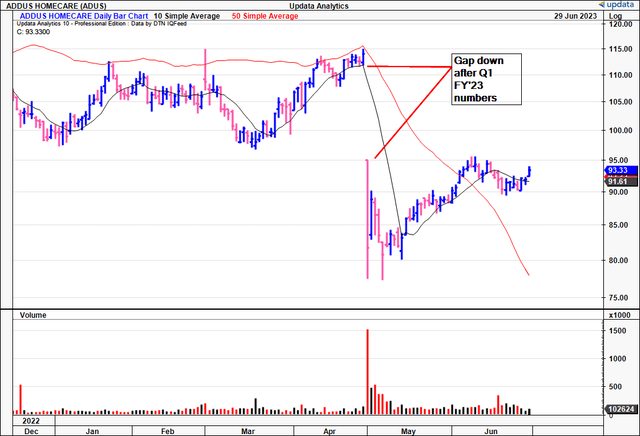

Following my April publication on Addus HomeCare Corporation ( NASDAQ: ADUS) financiers have actually left the stock en masse with the business now trading back in early FY ’22 variety.

The company’s Q1 FY ’23 numbers were the catalytic occasion for the most recent repricing, suggesting a minimized set of expectations from the marketplace on ADUS moving forward. I had actually pared back my position on ADUS to keep in April, keeping in mind a series of possible headwinds, that required more explanations to prevent unpredictability. Particularly, the 2 locations determined combine to:

- Pressures to present operations;

- Obstacles to future development.

If a company’s worth is comprised of its steady-state operations plus the contribution from its development efforts, then ADUS hasn’t passed this financial investment evaluation. Relying on today day, not a lot has actually altered on the basic outlook on the company.

Net-net, based upon the conclusion of findings provided in this report, there is inadequate proof to recommend that ADUS is a buy at its present levels. Not even a pullback to previous lows would have me interested, as there is nigh a factor to think ADUS might trade above previous highs without the financial attributes to back it up. Sadly, I restate that ADUS is a hold.

Figure 1.

Information: Updata

Crucial realities to ADUS hold thesis

Based upon the most recent information, there is no difficulty in repeating ADUS as a hold in my financial investment view. Findings from this analysis recommend there are basic, financial and evaluation aspects for factor to consider. Analysis of each element is informing on what financiers can get out of the business moving forward.

1. Basic aspects to the hold thesis

Close examination of the business’s system economics and Q1 financials, provided in May, expose plenty about the financial investment realities. It is very important to evaluate this since of the marketplace’s action later on[just take a look at Figure 2] Think about these extra information points.

System economics

- Same-store income development was up 11.4% YoY. Significantly– this development omits the income produced from access to the New york city CDPAP and American Rescue Strategy Act (” ARPA”) funds.

- Over the previous 3 years, the majority of ADUS’s same-store development in the individual care section has actually been driven by rate boosts.

- For this reason, the gains are mainly rate vs. volume (need) associated.

- In Spite Of the above, ADUS scheduled gains in same-store hours each day (” HPD”). In Q1 FY’ 23, ADUS clipped a 5.3% gain in HPD, with the exact same exemptions as above. Sequentially, this was up 1.7% from Q4 FY’ 22.

-

At the conclusion of Q1, days sales impressive (” DSOs”) stood at 43.7 days, a consecutive reduction from 45.1 days.

Monetary outcomes, consisting of development portions

- Net service income pertained to $251.6 mm in Q1, an 11% YoY development, on adj. EBITDA of $26.1 mm. The breakdown on this reveals that:

- Individual care incomes contributed ~ 75.5% ($ 190mm, or $11.87/ share) to the leading line

- Hospice care incomes stood at $49.1 mm or 19.5% of sales, and

- House health incomes totaled up to $12.5 mm (5% of turnover). Keep in mind the company’s long-lasting income and functional development listed below.

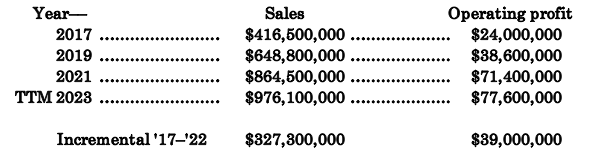

Table 1.

Information: Author, ADUS 10-K’s

- It pulled this to gross margin of 31.2%, up 20bps YoY. compared to 31% in the exact same quarter of the previous year. Historic gross is 29.18%, so there’s advantage on this at 31.2 points, nevertheless this is still well listed below the sector’s 55.8% mean gross.

- Even more, this spells some uncomfortable math for the business’s service economics. State it grows incomes by another 10% this year, the company clips 68– 70% COGS margin, implying you’re not likely to see any of the 10% in turnover lead to running take advantage of. For success to switch off its lows going on, income expenses and running expenses should be dealt with in overall to drive worth for investors, in my viewpoint.

- Additionally, the business’s gross success has actually wound withdraw 5-year variety, although it has actually revealed affordable uptick considering that FY’ 19. Still, on outright worths, you’re getting 33% gross return on possessions for the capital that has actually been dedicated to and after that by the service. These aren’t appealing economics in my viewpoint, and calls for a neutral view.

Figure 2.

Information: Author, ADUS 10-K’s

2. Financial aspects associated with ADUS’ operations

The company is driving financial investment into its individual care section, the department where it sees development capacity down the line. It scheduled a boost in working with in Q1, with approximately 84 brand-new hires per service day. That’s a 9.1% development from the exact same duration in 2015, and up from 77 hires in Q4.

I ‘d likewise mention the rate increases ADUS gotten in Illinois, its biggest market. I had actually covered these in information last analysis, so these were anticipated. It got a statewide rate boost of $0.70 per hour on January 1 of this year (once again, as anticipated). On the other hand, back in December, Illinois revealed a more boost of $1.26 per hour– for this reason, the $0.70 is on top of this. Subsequently, the business’s Illinois state repayment rate now stands at $26.92 per hour. The company thinks this boost will covers approaching wage boosts on July 1.

In addition to the above, think about the following points relating to the financial attributes of ADUS’ service:

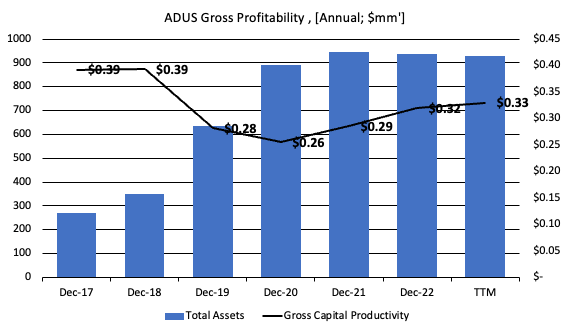

- Taking a long-lasting view, it’s apparent ADUS has actually had a difficult time fulfilling its expense of capital, and, more notably, a difficult time in beating the marketplace r eturn on capital

- The yearly return on ADUS’ capital has actually tightened up in to 9% in the TTM.

- You may be forgiven to believe this was a pandemic– caused affair, however these patterns were well in situ from 2017 a minimum of, and therefore were not likely triggered from the exact same.

- Most notably to this financial investment thesis, is the reality none of these returns have actually beaten the marketplace’s obstacle rate—- 12% in this analysis—- showing there’s been definitely no financial earnings produced for ADUS investors over the last 5 years to date. By all methods, my analysis recommends these patterns will continue moving forward.

These are greatly unappealing service economics. How can you anticipate ADUS to intensify its intrinsic evaluation, when financiers can ride the standard at a 10– 12% long-lasting average, whilst ADUS brings house a return less than this by itself (i.e. the investors) capital? The basic response is, you can’t. A lot of other rewarding chances exist, where the worth of $1 is better in the business’s hands than in the market’s hands. Subsequently, this supports a neutral view for ADUS.

Figure 3

Information: Author, ADUS 10-K’s

3. Evaluation aspects securing future worth

If it weren’t enough of an ask from the information raised up until now, financiers are offering their ADUS stock to you at 30x forward incomes and 17.5 x forward EBIT, whilst the business trades at 2.3 x book worth of equity.

Each of these are rather the premium to sector peers, and I simply can not get to promoting that ADUS must trade at a premium to peers, based upon what’s been talked about here. Predominately, it connects back to the second-rate returns on dedicated capital. The marketplace is a precise judge of reasonable worth with time and will weight itself towards companies where capital is valuing in their hands. This isn’t the case for ADUS, as discussed. It does not compound capital greater and faster than the marketplace return, therefore financiers are not likely—- extremely, extremely not likely in my view—- to be bullish on any company providing with these financial attributes.

What this states in evaluation terms is informing. You’re being asked to pay c. 18x forward, yet the possibility of this score greater is restricted by ADUS’ inability to produce extra earnings. For this reason, it is my company viewpoint the business must trade back in line with the sector at ~ 17x forward and this gets me to $67.6 per share on my FY ’23 EBIT price quotes[these were presented in the last publication, with no changes to date, see: Fig 12.] Even at 18x, you’re getting to $71.30. You’ll note this is well off previous price quotes of mine. To this, likewise keep in mind 1) I am utilizing a much greater discount rate here [12% vs. 7% previously, to account for the risk], and 2) when the information modifications, so too should the analysis.

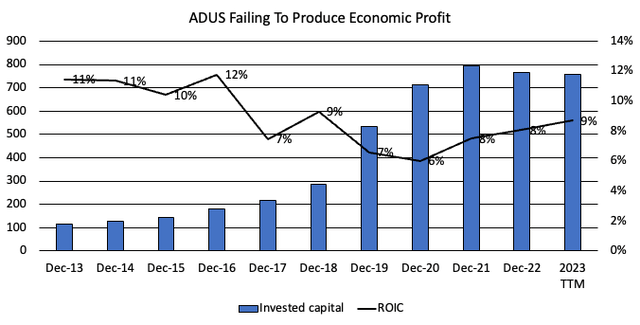

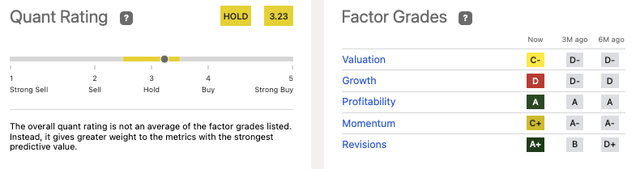

These findings are objectively supported by information displayed in the quant system, likewise promoting ADUS as a hold. It too determines powerlessness on evaluation and development, in line with my own findings. This includes a layer of self-confidence to the presumptions.

Figure 4.

Information: Looking For Alpha

Simply put

There’s been no modification to the financial investment suggestion on ADUS following the most recent important findings. Mathematical and data-based proof supports the company has an enormous effort ahead of itself in order to reverse the belief photo, and draw in major financial investment. Without the financial attributes though, i.e., driving greater returns on capital invested, there is trouble seeing ADUS rate greater. In my view, this would be the important element securing the business’s market price at present. As was talked about in the last publication, offered the method ADUS books incomes, the capital produces its earnings, implying returns on capital are definitely essential to see it trading at greater market evaluations. Sadly, with no catalytic indicate work from, the financial investment case is secured by basic, financial and evaluation aspects. Net-net, restate hold.