JHVEPhoto

Up until now, 2023 is ending up being an excellent year for the marketplace. Since this writing, the S&P 500 is up about 15%. However among the business that is carrying out finest in this area is pharmaceutical giant E li Lilly and Business ( NYSE: LLY). Up until now this year, systems are up 27.7%, or almost double what the more comprehensive market has actually seen. This is an enormous benefit for a business that today has a market capitalization of $435 billion. Typically, it ends up being hard for companies of this size to publish such strong development that can validate significant share rate gratitude. This is specifically real beyond the innovation sector. Nevertheless, financiers appear to be exceptionally positive about the company’s potential customers moving on, thanks in big part to current development supplied by management relating to a few of its diabetes and weight problems medications. If all goes according to strategy, the business might stand to benefit rather substantially over the next couple of years. Naturally, there are particular dangers here that financiers ought to understand. However so long as none of those dangers hinder the image, I would argue that more benefit for the stock is not out of the concern.

A play on diabetes and weight-loss

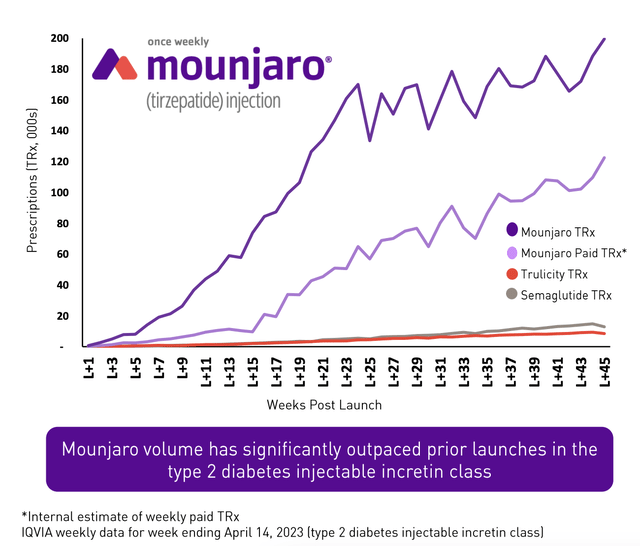

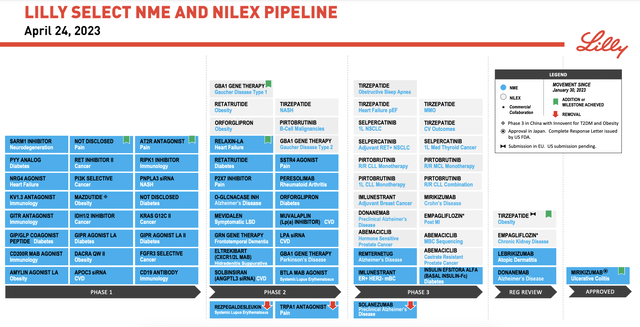

A great deal of the optimism focused around Eli Lilly and Business includes a few of the drugs that the business has actually established or remains in the procedure of establishing in order to deal with diabetes and weight problems. The most significant at this moment that has actually happened just recently is Mounjaro, which is more typically called Tirzepatide. Initially established to deal with diabetes, it ended up being clear extremely rapidly that the drug had considerable pledge in a variety of locations. In among the most current updates relating to the drug, the business revealed that, in the 2nd international Stage 3 medical trial that the business carried out for the drug, users of the treatment who were obese and who experienced type 2 diabetes lost as much as 15.7%, or 34.4 pounds, of their body weight thanks to the drug. A few of the best weight-loss impacts were seen in those who were overweight however did not have diabetes. The drug has actually likewise gone through screening for other conditions such as obstructive sleep apnea, cardiac arrest with maintained ejection portion, and nonalcoholic steatohepatitis.

Eli Lilly and Business

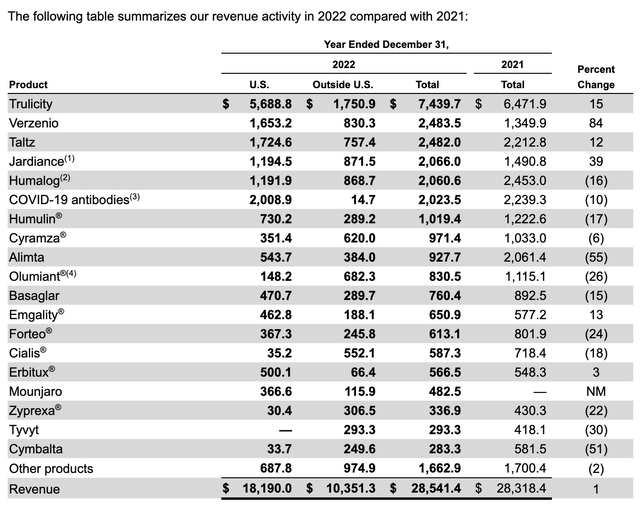

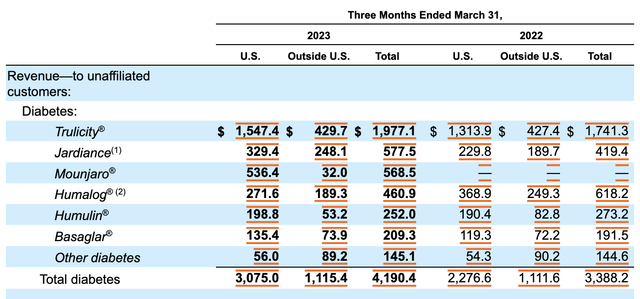

Management had the ability to begin offering Mounjaro in 2015. And currently, the drug is showing to be among the most effective in the history of medication. In the brief time that it was offered for sale in 2022, it created profits of $482.5 million. That equated to just 1.7% of the business’s total sales in 2015. In the very first quarter of this year, sales swelled to $568.5 million, which exercises to 8.2% of total profits for the business. Experts have actually had high expect this drug. Some have actually even presumed regarding approximate that, at its peak, that drug might be accountable for $25 billion a year of profits. That would make it the ‘greatest drug ever’ according to experts at UBS Group ( UBS).

Eli Lilly and Business

Eli Lilly and Business

Naturally, that image might effectively alter. On June 26th of this year, news broke that clients in a Stage 2 medical trial for another among the business drugs, called Retatrutide, reported a mean weight decrease of as much as approximately 58 pounds, representing 24% of their body weight. This was over a period of 48 weeks compared to the 72 weeks seen by Tirzepatide. What’s actually interesting is that, even at the end of that window of time, the business asserted that those dropping weight had actually not seen their losses plateau. So the supreme outcome might be a lot more remarkable. Much like with a few of its other drugs, there might be other favorable side impacts connected with Retatrutide. For example, management mentioned that in 9 out of 10 cases where those running the test likewise experienced non-alcoholic fatty liver illness, there seemed a ‘normalization of liver fat’ throughout the test. Thinking about that this is a condition that impacts as numerous as 24% of Americans, that alone might be a benefit for the business. Naturally, the sample size here was rather little at just 98 clients. So more screening is absolutely required.

Eli Lilly and Business

These news products came just days after Eli Lilly and Business revealed that a Stage 2 trial for its once-daily weight problems treatment, called Orforglipron, likewise provided some actually fascinating outcomes. This oral treatment is more tasty to those who do not desire an injection. And the business discovered that it led to as much as 14.7% weight-loss for those who took it compared to the 2.3% weight-loss experienced by those in the placebo group. In the image above, you can see some other medications in the pipeline, a few of which are concentrated on diabetes, while others are concentrated on other conditions. The business isn’t just concentrating on its own advancements. It is likewise working to take up appealing chances then it discovers.

On June 29th, for example, shares of Sigilon Rehabs ( SGTX) soared from just $3.93 to $21.15 after news broke that Eli Lilly and Business consented to acquire it in exchange for $14.95 per share, plus a non-tradeable contingent worth right that will entitle investors of the business to get as much as an extra $111.64 per share in money, depending upon how things go. Sigilon had actually formerly collaborate with Eli Lilly and Business to establish cell treatments for the treatment of type one diabetes.

Those who follow Eli Lilly and Business carefully all of us understand that the business has a long history concentrating on the treatment of diabetes. In truth, of its biggest profits generators, 6 are related in some method, shape, or type, to diabetes or weight-loss. This consists of Trulicity, which is utilized for type 2 diabetes and is the business’s biggest source of profits. In 2015, sales from it amounted to $7.44 billion. All informed in 2015, 48.5% of the business’s profits originated from treatments for diabetes and weight-loss. Naturally, the business does have other sources of profits too. The most considerable in regards to profits would be Verzenio, which is utilized for innovative or metastatic breast cancer treatment. The business likewise provides medications for things like autoimmune conditions and, for a time, a large source of profits including COVID-19 antibodies.

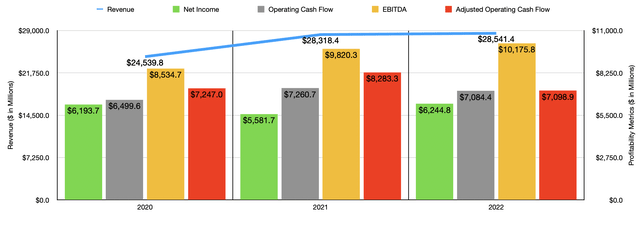

Author – SEC EDGAR Data

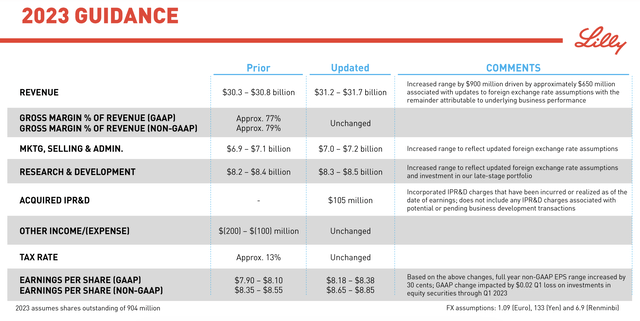

With diabetes and weight-loss as its primary source of profits, the business has actually constructed for itself and its financiers a rather big operation. From 2020 through 2022, sales for the business grew from $24.54 billion to $28.54 billion. Earnings broadened from $6.19 billion to $6.24 billion. As you can see in the chart above, other success metrics likewise typically enhanced. It deserves keeping in mind that a few of the volatility in outcomes is probably thanks to COVID-19. For a time, the business created considerable quantities of profits on this front. However those days do appear to be gone. In the very first quarter of this year, for example, it created no profits from COVID-19 antibodies. That compares to the $1.92 billion created the exact same quarter in 2015. According to management, profits for 2023 needs to vary in between $31.2 billion and $31.7 billion, while mid-point incomes per share assistance requires earnings to be around $7.48 billion. The bottom line, specifically, is remarkable, because it suggests a year-over-year development rate compared to 2022’s earnings totaling up to 19.8%.

Eli Lilly and Business

If Eli Lilly and Business can continue to bring out effective drugs to deal with weight problems, completion outcome for investors might be exceptionally favorable. In the United States alone, weight problems rates have tripled because 1975. 42.4% of grownups in the nation presently have it. In 2022 alone, over 5 million prescriptions were composed in order to deal with the weight problems epidemic. That’s up substantially from just 230,000 in 2019. Information from 2019 recommended that, each year, weight problems here in the house lead to $173 billion in medical expenses. Worldwide, an approximated 650 million individuals are medically overweight. Provided the truth that weight problems likewise leads to other health impacts such as an increased danger of cardiac arrest and stroke, sudden death by heart disease, and more, there is a great deal of cash to be made resolving it.

One source that I took a look at suggested that the weight problems drug market ought to deserve $54 billion by 2030. However other sources have actually suggested that the weight-loss market as a whole might be worth as much as $200 billion each year by 2030. For the many part, I see this as exceptional news for Eli Lilly and Business. However it’s likewise essential to remember that there are some dangers here. The most considerable that I can think about is a prospective cannibalization of its current offerings. If the business brings out weight problems and diabetes drugs that render its other offerings outdated which might even lead to an irreversible decrease in stated health conditions, the business might be losing out on long term profits in exchange for a short-term rise in sales. I do not believe that the possibility of this is awfully high. After all, the company currently has several effective drugs that deal with the exact same sort of condition. And on top of that, a constantly growing international population that is moving a growing number of individuals every year into the middle class is bound to lead to brand-new consumers as time goes on.

Takeaway

All things thought about, I should state that I am rather satisfied by all of the current advancements relating to weight problems and diabetes treatment. The truth of the matter is that Eli Lilly and Business is doing actually well and the benefit for financiers in the long run highly likely will suffice to validate more gratitude in the business’s stock rate. Provided these elements, I have no issue ranking the business a ‘purchase’ at this time.