marchmeena29

Intro

I own 2 health care stocks. AbbVie ( ABBV), which is a high-yield drug producer, and Danaher ( DHR), a varied manufacturer of health care devices. Danaher is likewise the biggest rival of Thermo Fisher Scientific ( NYSE: TMO), which is the star of this short article.

In the previous couple of days, I decided to make health care a huge part of my portfolio. I wish to include a minimum of 2 more stocks in the market, as I am a huge follower in the worth premium health care stocks can give the table.

Not just since of nonreligious tailwinds however likewise since some included remarkable rates power, monetary stability, and methods to let investors take advantage of their success.

In this short article, we’ll talk about Thermo Fisher. Although the stock has an ultra-low yield of 0.3%, I still think it’s an excellent dividend development stock. The business is a great wealth compounder thanks to development, anti-cyclical clients, and its capability to create worth.

For this reason, I will describe why I put TMO on my watchlist, in spite of the truth that I currently own DHR. I’m most likely to purchase the stock for a variety of portfolios that I handle too.

So, let’s dive into the information!

A Glimpse Back

In my previous short article, I currently quickly talked about the business’s company design – specifically because of its 1Q23 revenues and moneying dangers associated with raised rates.

Additionally, Danaher kept in mind some financing has a hard time amongst its biotech customers. After all, biotechnology is extremely capital-intensive. Thermo Fisher didn’t state that it saw these concerns. Nevertheless, it discussed that the financing environment is an element worth tracking.

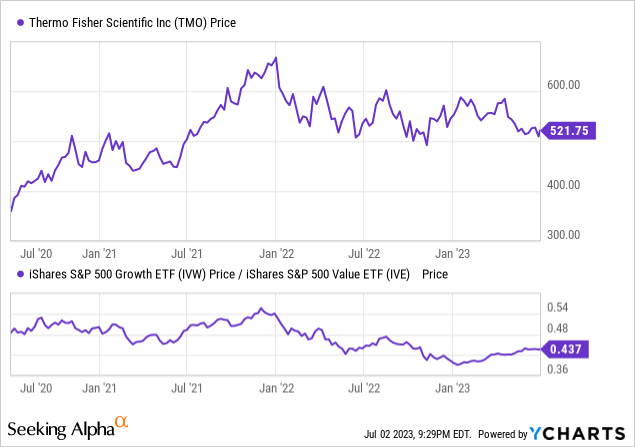

Ever Since, the stock has actually fallen by another 6% – in spite of the rotation from worth to development stocks that began in January.

While I will cover business design once again in this short article – it’s too essential to the business’s success – I will shed some extra light on its procedures to grow, as this continues to be type in a tough company environment. Not just since the business adheres to really enthusiastic development targets, as restated at current financial investment conferences, however likewise since of its more appealing assessment and my choice to consist of the stock in numerous portfolios that I handle.

Thermo Fisher’s Superior Organization Design

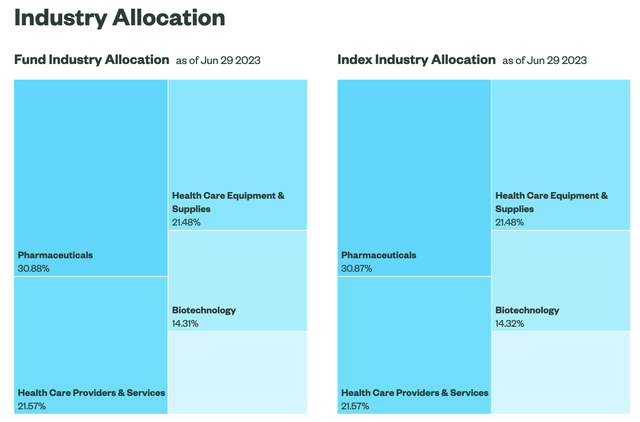

Health care is an extremely intricate sector. Taking a look at the holdings of the significant health care ETF ( XLV), we see that it includes pharmaceuticals, health care devices providers, biotechnology, doctor, and life sciences.

While each and every single among these markets has great business, I like to purchase providers. In basic, I think in the power of providers. It might have something to do with my background in acquiring & & supply management, however I think that purchasing providers decreases competitors danger, since providers offer to a wide variety of purchasers that take on each other.

That’s where Thermo Fisher is available in. With a market cap of $201 billion, this Waltham-MA-based health care giant is among the greatest health care providers on the planet.

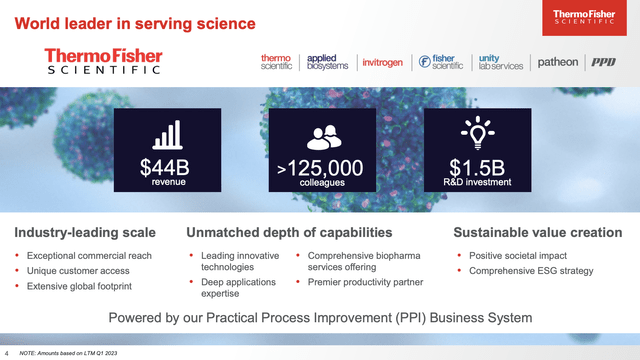

The business is a world leader in serving clinical clients, with strong brand names, $44 billion in earnings, and 125,000 staff members. The business invests greatly in research study and advancement and capital investment to guarantee that it remains on top of the video game.

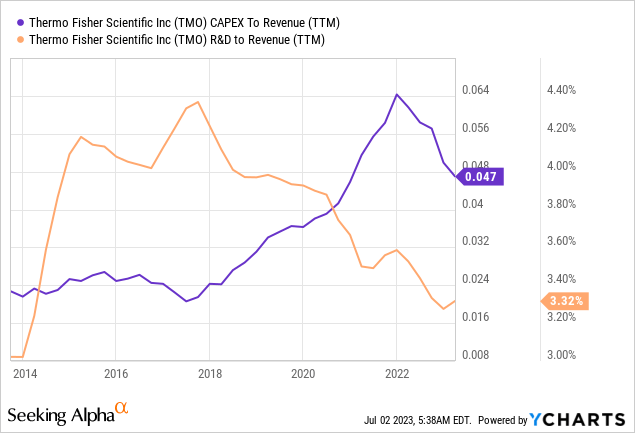

The business presently invests near 5% of its earnings on CapEx and 3.3% of its earnings on R&D.

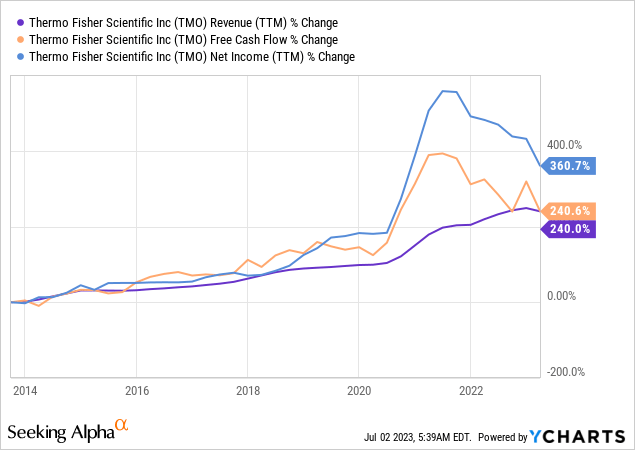

While R&D costs as a portion of earnings is down, it requires to be stated that earnings development has actually been wild. Over the previous 10 years, earnings have actually grown by 240%. Earnings has actually skyrocketed by 360%, thanks to greater margins. These numbers are wild and an indication of considerable tailwinds in its market.

Thermo Fisher thinks that its objective is to make it possible for clients to make the world healthier, cleaner, and much safer by supporting essential operate in fields such as cancer research study, diagnostics, and products science.

The business’s items are targeted at making that possible, with a considerable part of its portfolio serving pharmaceutical, biotech, scholastic, and federal government clients.

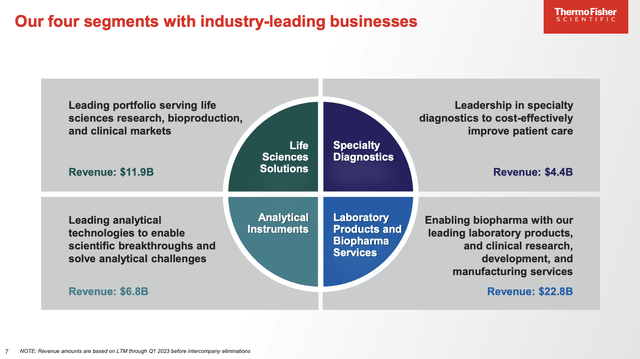

This is done through 4 sectors:

- Life Science Solutions

- Specialized Diagnostics

- Lab Products and Biopharma Solutions

- Analytical Instruments

When it concerns the previously mentioned rise in earnings and margins, the business is basically making the case that this is triggered by its capability to innovate and strong client relationships. While that might appear apparent, it’s not apparent. Having strong relationships with purchasers is what being a great provider is everything about. While TMO will never ever show us how it attains strong client relationships, it requires to be stated that scientists have actually invested years determining what drives strong relationships.

Basically, it can be stated that purchasers that have great relationships with providers take advantage of much better development. That is type in health care.

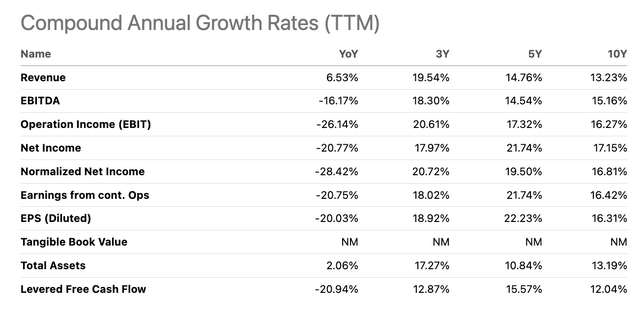

So, while the business has actually faced short-term headwinds (post-COVID), we see that the business has actually done significantly well in the past. Utilizing Looking for Alpha information, we see a couple of astonishing numbers over the previous 10 years:

- 13.2% intensified yearly earnings development.

- 15.2% intensified yearly EBITDA development.

- 17.2% intensified yearly earnings development.

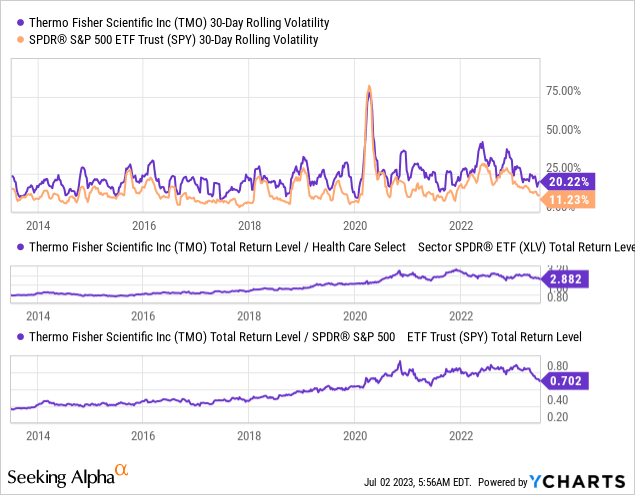

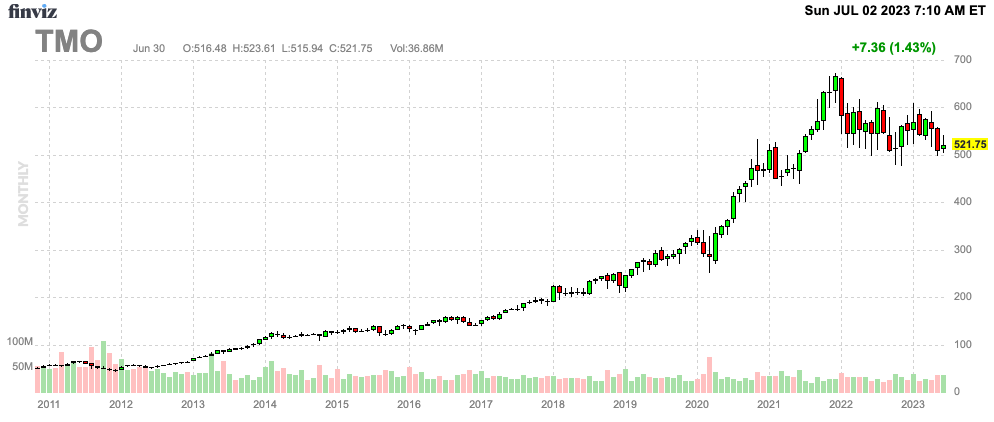

As an outcome of this anti-cyclical company design and excellent outcomes, the business has actually outshined the S&P 500 and the health care sector by a broad margin and on an extremely constant basis. The chart listed below likewise reveals that the business is doing this with suppressed volatility, that makes it ideal for long-lasting portfolios.

With that in mind, what can we anticipate moving forward?

What’s Next?

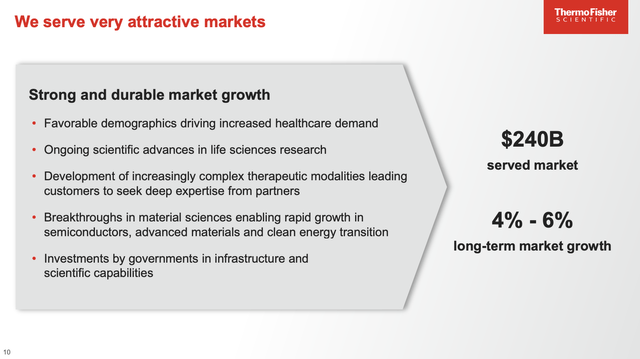

Throughout this year’s Bernstein Strategic Choices Conference, the business highlighted 5 essential elements that are anticipated to sustain future development.

- Initially, the marketplaces it serves have long-lasting development possible driven by increasing health care need, clinical research study improvements, intricate medications, and financial investments in facilities. That’s nonreligious development.

- 2nd, Thermo Fisher’s development method is based upon high-impact development, being a relied on partner to clients, and leveraging its unequaled business engine. This is based upon the previously mentioned strong provider advantages.

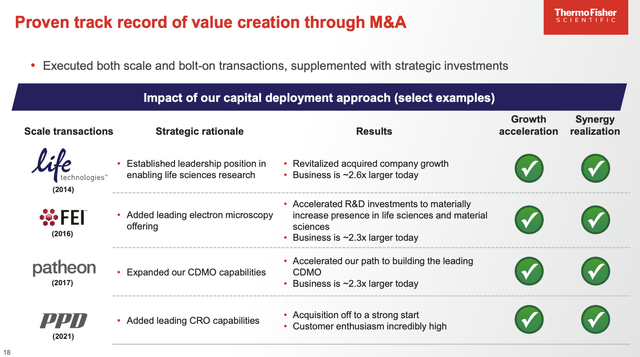

- Third, the business’s capital implementation technique, with a concentrate on M&A and investor circulations, produces investor worth. Thermo Fisher has a disciplined technique to picking and incorporating acquisitions, with a strong performance history of success.

- 4th, the business’s PPI Organization System supports constant enhancement and provides a competitive benefit.

To allow our clients’ success in a progressively competitive worldwide environment, we take advantage of our PPI ( Practical Process Enhancement) Organization System, a deeply deep-rooted approach of functional quality which permits us to enhance procedures, resolve obstacles and decrease ineffectiveness. – Thermo Fisher Scientific

- Lastly, Thermo Fisher’s ESG method guarantees accountable company practices and worth production while reducing danger. I would not call this a chauffeur of development, however I believe preserving stringent ESG requirements makes certain that the business can end up being a part of ESG-focused supply chains.

The business likewise provided us a couple of numbers. Thermo Fisher intends to attain long-lasting development targets of 7% to 9%

Development method, right, which is based upon 3 components. Our long-lasting development targets are 7% to 9% We have actually grown much faster than that in the last couple of years, however we believe this is a great proxy for what our long-lasting development will be.

TMO approximates that the market it serves sees 4% to 6% yearly development, backed by the previously mentioned (frequently nonreligious) elements. It intends to surpass its market utilizing its five-pillar method.

Additionally, throughout its Bank of America Securities Health Care Conference in Might, the business elaborated on its capital implementation and M&A technique, which is an essential consider its success.

Basically, the business clarified that the business’s long-lasting core development target of 7% to 9% is unassociated to its capital implementation activities. The 7% to 9% development target has to do with its existing portfolio.

The business highlighted its history of changing its outlook following M&A activities, such as the acquisition of Life Technologies. Thermo Fisher prepares to continue being selective and disciplined in its M&A technique, thinking about chances that line up with its method and create beneficial returns for investors.

The business prepares for releasing $40 billion to $50 billion on M&A in the upcoming years, showing the fragmented nature of the marketplace.

With regard to its M&A strategies, it requires to be stated that rates on financial obligation are much greater. Nevertheless, since TMO has a healthy balance sheet, it has the ability to take on business with less beneficial balance sheets. That opens M&A chances in spite of rates of interest headwinds.

In addition, with regard to natural development, the business intends to enhance its margins by 40 to 50 basis points annually, resulting in mid-teens changed EPS development annually, which would suggest that TMO anticipates to continue the aggressive development streak we have actually seen in the past.

It likewise assists that the business has a fantastic balance sheet. The business ended the very first quarter with $3.5 billion in money and $35.3 billion in overall financial obligation. The take advantage of ratio was 3.2 x gross financial obligation and 2.9 x based upon net financial obligation.

The business takes pleasure in an A- credit ranking.

TMO has a 0.3% dividend yield, which is backed by 15.2% yearly intensifying dividend development over the previous 5 years. Nevertheless, due to this really low yield, I chose not to concentrate on the dividend in this short article.

Appraisal

1Q23 was a hard quarter for TMO – however not unanticipated. After all, the tailwinds associated with the pandemic are now rapidly loosening up.

In 1Q23, overall earnings decreased by 9%. Organic earnings development was unfavorable 8% (changed for acquisitions of 1% and 2% currency headwinds).

COVID-19 screening earnings was down 14%. Core natural earnings development, changed for COVID, was up 6%, which is a great indication.

Thus, in spite of a somewhat more difficult macro environment, Thermo Fisher preserved its enthusiastic full-year outlook. The business anticipates earnings of $45.3 billion and changed EPS of $23.70 for 2023. The business likewise stays positive in its tested development method and the power of its PPI Organization System to browse the vibrant environment and provide separated efficiency.

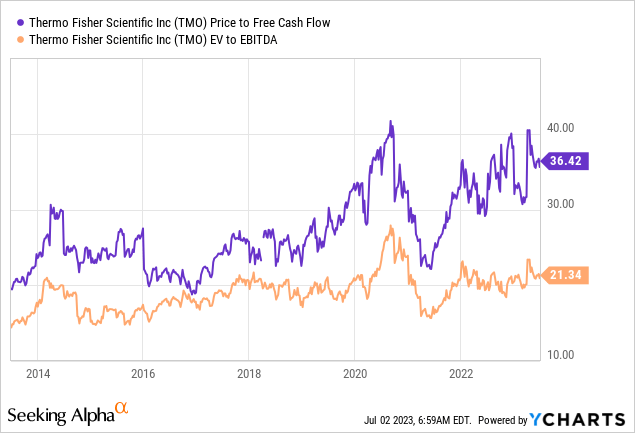

With that stated, TMO is trading at 17.3 x 2024E EBITDA. While I am utilizing next year’s EBITDA price quote, the mix of a 25% stock cost decrease from its all-time high and greater development expectations after 2023 provides the stock a better assessment. While 17.3 x EBITDA isn’t inexpensive, expectations of long-lasting double-digit yearly revenues development validate this assessment.

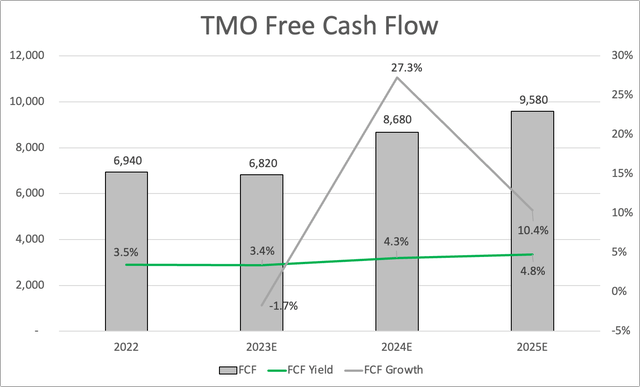

The exact same chooses totally free capital. Taking a look at the chart below, we see that post-pandemic headwinds will likely keep a cover on development in 2023, followed by a (most likely) sustainable rise in totally free capital beginning in 2024.

The business is trading at 23.2 x 2024E totally free capital, which isn’t inexpensive in the conventional sense, however a multi-year low.

Based upon this context, the agreement stock cost target is $626, which is 20% above the present cost.

FINVIZ

TMO isn’t inexpensive, however I do think that costs listed below $500 are buyable. I’m seeking to include TMO to a couple of portfolios that I handle if it dips listed below $500.

I’m not purchasing it for myself, as I own Danaher. The 2 are extremely associated.

Nevertheless, if TMO were to unexpectedly and all of a sudden drop for whatever factor, I may purchase it anyhow.

With all of this in mind, I think that TMO will stay a strong long-lasting compounder with a high possibility of considerable outperformance.

Takeaway

Thermo Fisher Scientific is an amazing wealth-compounding chance with its remarkable company design.

With a market cap of $200 billion, the business’s dedication to development, strong client relationships, and worth generation make it a standout in the market.

Regardless of its low dividend yield of 0.3%, TMO’s historic earnings development of 240% and earnings development of 360% over the previous years display its capacity for long-lasting wealth compounding.

TMO’s concentrate on nonreligious development elements, high-impact development, capital implementation, functional quality, and ESG requirements even more strengthen its position as a leader in the health care sector.

While TMO’s assessment might not be inexpensive, its anticipated double-digit yearly revenues development validates the cost.

As a financier, I think TMO has the capacity for considerable outperformance and would think about including it to my portfolios if the cost dips listed below $500.