LPETTET/iStock Unreleased by means of Getty Images

Intro

” Las Vegas is the only location I understand where cash truly talks, it bids farewell,” Frank Sinatra as soon as stated this and having actually checked out Las Vegas every year the last 9 years, I would need to state I concur. However in this case, your cash states hi. I have actually checked out Las Vegas several times a year because 2014. My very first time checking out, I immediately fell for Sin City. There was simply an aura of looseness amongst the tourists there. Everybody existed to have a good time and let go some steam. Great deals of it! Whether it was betting, partying, or a mix of both. My friends and family appear to believe that I’m a big bettor or partier. While I simulate to strike the gambling establishments and bars from time to time, I normally invest my time by the swimming pool, delighting in discussions with random complete strangers, and sometimes going to the programs. In 2014, I discovered just how much cash individuals were investing there. Individuals were truly biding farewell to their cash and didn’t appear to care one bit. The city of Las Vegas understands this, which’s why they will use passionate bettors complimentary spaces. When you exist, they understand you’re going to invest great deals of cash! I will confess that because taking a trip to Vegas because the COVID-19 pandemic, things do appear a bit various. There does not appear to be as much foot-traffic as pre-COVID, however that hasn’t stopped VICI Residence ( NYSE: VICI) down one bit. So, let’s dive into why I’m purchasing more VICI.

Why I’m Purchasing Now

Considering That February of this year, VICI Residence has actually seen its share cost drop from a high of practically $35 to an existing cost of $31.40 at the time of composing. Back in March, the stock touched a low of near $30, less than a dollar from its 52-week low. Although some REITs have actually dropped more than 30%, VICI prospered throughout the banking crisis, dropping an overall of almost 6% prior to recovering more detailed to its 52-week high of almost $36. Considering that VICI typically sells a brief cost window of $33-$ 35, I believe the stock is a buy under $32. Financiers who currently own the stock needs to think about dollar expense averaging in at this cost, getting more shares at a great entry point, in my viewpoint.

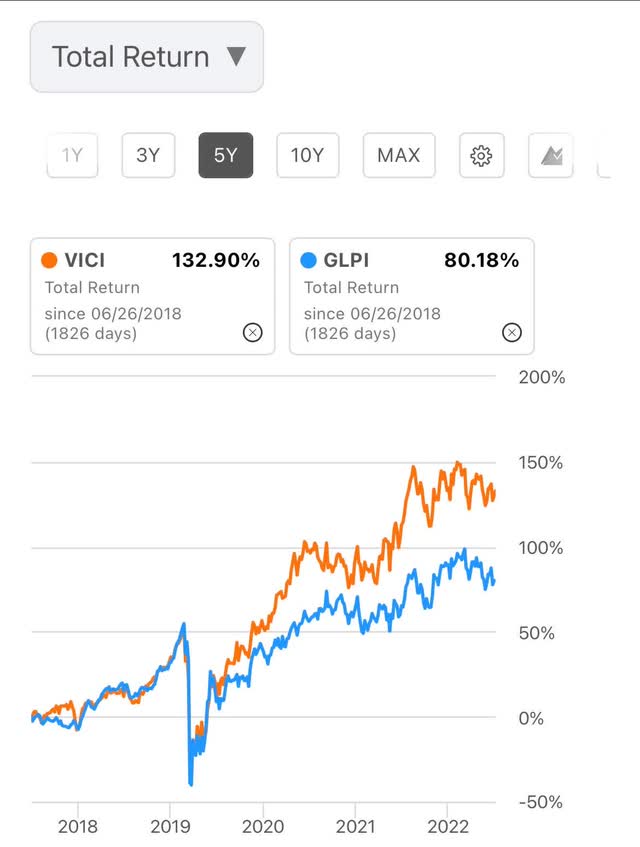

Video Gaming 5 Year Overall Return

Here you can see VICI’s overall return versus its closest rival Video gaming and Leisure Residence ( GLPI):

Although both remain in the video gaming sector, VICI considers itself more of an experiential REIT. And this appears in their current acquisitions and collaborations into other locations.

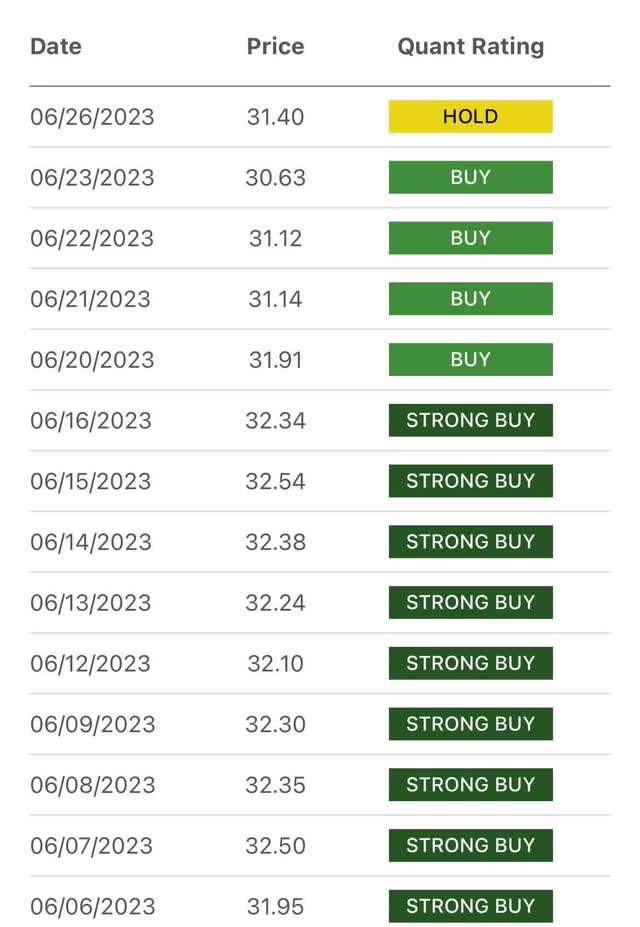

Quant States Hold

As seen here, the Quant score system had actually designated a Buy score for VICI on the 23rd of June. It just recently dropped to a hang on June 26th. For the entire month of June, Quant had a strong buy/buy score for the stock till just recently. The last hold score was back on February second when the stock was trading much closer to its 52-week high at $34.55.

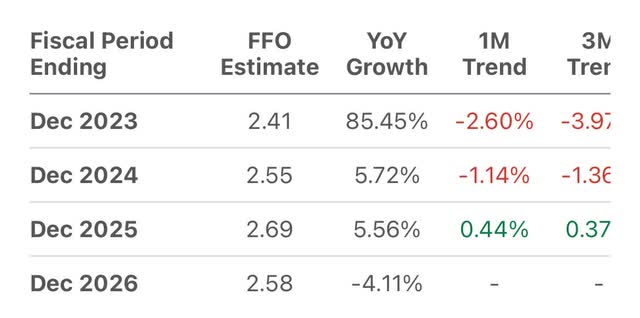

In the last 3 months, the r evisions grade has actually dropped from an A- to a D. This might be due to VICI’s huge development in the last 5 years. Perhaps Quant believes VICI’s development will slow in the future, to which I disagree. I believe VICI will continue to broaden its portfolio beyond the U.S., particularly in the U.K. in the future. Or perhaps obtain a stake in among the last best residential or commercial properties on the Vegas Strip, the Bellagio hotel and gambling establishment. As current as June 26th, 2023, it was reported that Blackstone ( BX) was thinking about deals for half its stake in the realty in the high-end gambling establishment. This acquisition would raise their currently remarkable portfolio that consists of the similarity Caesar’s Palace and Venetian. Below are Looking for Alpha FFO approximates for 2024 through 2026.

Overall Return vs. SPY

Here is a take a look at VICI’s overall return vs. SPY. Considering that their IPO in 2018, VICI has practically doubled the overall return of the S&P. The REIT ended up being the fastest ever to go from IPO to S&P addition in a little under 5 years.

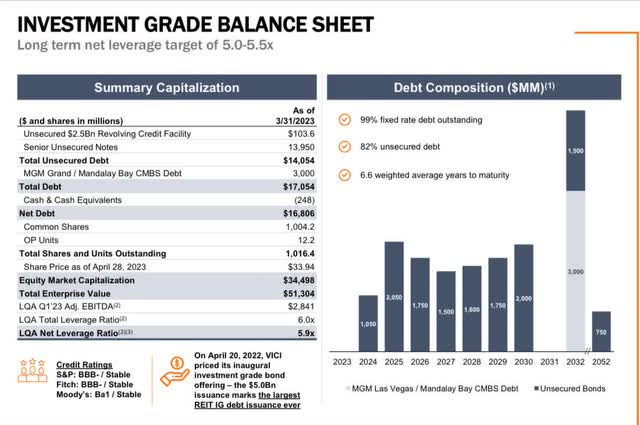

Balance Sheet

Aside from being a development device, VICI is likewise well-prepared for the existing state of the economy. In Q1 VICI handled to grow its AFFO by 18.6% year-over-year compared to almost 4% unfavorable for numerous S&P business. AFFO was available in at $0.53 for the quarter, covering the dividend of $0.39 quickly.

Ninety-nine percent of VICI’s financial obligation is repaired rate, with 82% of unsecured financial obligation and a weighted average of practically 7 years. Advantage that VICI has no financial obligation developing in 2023. Management likewise mentioned throughout its Q1 revenues call that it had around $650 million in money.

Threats

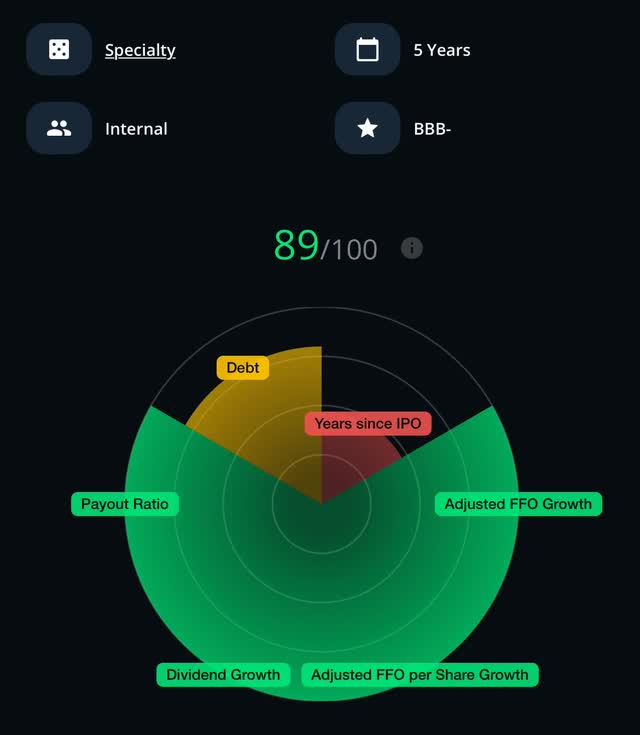

Although VICI has no financial obligation developing this year, they do have a good quantity developing in 2024 and double that entering into 2025. As financiers can see below, Alreits.com offers VICI an 89/100, the 2 critics being financial obligation and years because IPO. Being that VICI noted in 2018, the detraction for this is reasonable.

If I were a wagering guy, my bet would be that the FED will continue high rate of interest entering into next year. They might begin to slash rates beginning in the very first half of 2024. Depending upon if they cut rates as quick as they raised them, which is not most likely, VICI might not feel the effect of the high rates as much.

Conclusion

With VICI trading $2 above its 52-week low, I rank VICI a buy. Financiers get a safe, and growing dividend from a financial investment grade REIT that owns renowned hotels. Although there are talks of an economic crisis, VICI has actually shown their strength throughout financial recessions with 100% lease collection throughout the COVID-19 pandemic. My viewpoint is that VICI will continue to broaden its portfolio and diversify beyond the United States, developing long-lasting worth for investors.