3alexd

Eastman Chemical Corporation ( NYSE: EMN) is a specialized chemicals business that runs in 4 sectors: Advanced Products, Additives and Practical Products, Chemical Intermediates, and Fibers. It is headquartered in Tennessee however has plants in twelve nations and takes on a a great deal of other chemicals business.

The business’s dividend yield is 3.8%.

It divides profits from markets as

* 15% transport (with a lean towards EVs).

* 12% customer durables and electronic devices.

* 12% structure and building and construction.

* 50% steady end markets.

Financiers must understand that at its 1Q23 financier contact April 2023, it anticipated ongoing weak point in practically all of its markets in 2Q23.

Eastman’s tracking twelve-month revenues per share is $5.61. Nevertheless, the average of experts’ anticipated 2023 EPS is 40% greater, at $7.85/ share. Furthermore, the average of experts anticipated 2024 EPS is 60% greater, at $8.97/ share.

While need in the building and construction sector has actually lagged, need in the automobile and fiber sectors are holding up. Additionally, Eastman, just like other business, deals with enhanced margins with lower feedstock (specifically petrochemicals) expenses and energy expenses compared to 2022.

I suggest Eastman Chemical as a buy to financiers in specialized chemicals looking for capital gratitude as the economy recuperates.

The business’s 2Q23 revenues date is the recently of July 2023.

Very First Quarter 2023 Outcomes and Assistance

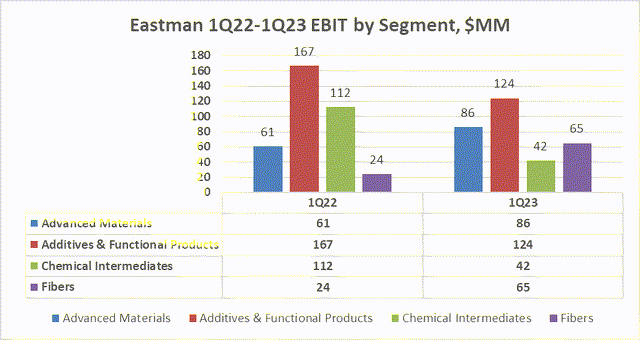

For the very first quarter of 2023, Eastman Chemical reported sales incomes of $2.4 billion, compared to $2.7 billion for 1Q22. Revenues prior to interest and taxes were $246 million, compared to $333 million for the very same quarter a year earlier. Revenues per share (EPS) for the quarter was $1.12, compared to $1.80 for 1Q22.

The business reported a consecutive (4Q22 to 1Q23) enhancement in revenues due to decrease expenses, the capability to hold rates consistent in spite of consumer destocking, and effective operations.

It anticipates to minimize expense structure by more than $200 million, web of inflation. And among its brand-new efforts is the “circular economy platform,” innovations that utilize recycled products, like waste plastics.

Operating outcomes remain in the 4 departments kept in mind above: Advanced Products, Additives and Practical Products, Chemical Intermediates, and Fibers.

Eastman Chemical and Starks Energy Economics, LLC

Eastman Chemical’s need is economy-dependent; the business anticipates a still-subdued 2nd half. Mark Costa, Eastman’s Board Chair and CEO mentioned the $200 million expense structure cost savings, together with recognizing lower basic material, energy, and circulation expenses. “We likewise provided strong first-quarter lead to Fibers and stay well placed for considerable full-year revenues enhancement in this section as margins recuperate to more sustainable levels. Nevertheless, need in a lot of our end markets is challenged, consisting of customer durables and structure and building and construction, where we see stock destocking continuing in the 2nd quarter. Taking all of this together, we continue to anticipate to grow adjusted 2023 EPS in between 5 and 15 percent, leaving out a roughly $0.75 pension headwind. We likewise stay concentrated on taking a variety of actions to provide $1.4 billion of running capital in 2023.”

Operations

Eastman Chemical has 35 production centers in twelve nations. They lie as follows:

* United States: 16.

* Europe: 9.

* Asia: 6.

* Latin America: 2.

While interested financiers might describe the business’s latest 10-K for information, a couple of functional thumbnails are provided listed below. These are extremely condensed samples and do not profess to represent a provided commercial procedure.

Advanced Products: a) advanced interlayers utilize essential products like vinyl acetate monomer to make automobile shatterproof glass; b) efficiency movies utilize essential products like polyethylene terephthalate movie to make paint security movies; c) specialized plastics utilize essential products like cellulose and waste plastic to make customer product packaging.

Ingredients and Practical Products: a) animal nutrition utilizes essential products like lp for conservation and health; b) care ingredients utilize essential products like alcohols for individual and house intake; c) covering ingredients utilize essential products like propylene in architectural finishes; d) specialized fluids and energy utilize essential products like benzene in industrial air travel.

Chemicals Intermediates: a) practical amines utilize essential products like ethanol in energy; b) intermediates utilize essential products like lp and ethane to make commercial chemicals; c) plasticizers utilize essential products like propylene in product packaging.

Fibers: a-c) acetate tow, acetate yarn and fiber, and acetyl chemical items utilize essential products like methanol in cigarette filters; d) nonwovens utilize essential products like resins for aerospace applications.

Product Feedstocks and Expenses

As explained above, Eastman Chemical depends upon a wide range of feedstocks, a lot of them petrochemicals stemmed from gas liquids produced with gas and oil.

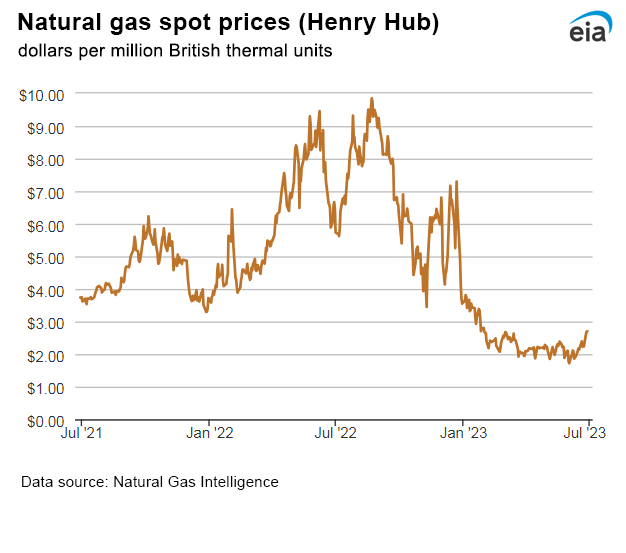

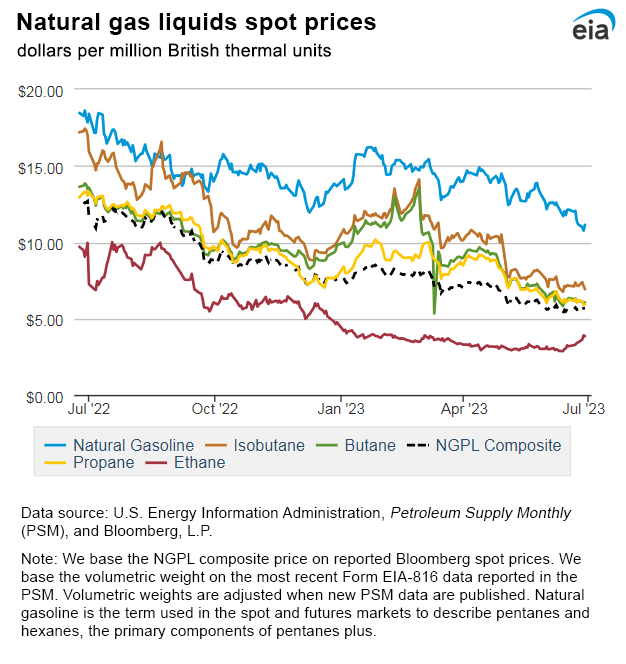

These expenses increased noticeably in the in 2015 due to the rearrangement of hydrocarbon exports following Russia’s intrusion of Ukraine and especially the scarcity of gas in Europe. They have actually given that settled lower. Nevertheless, the Federal Reserve raised rate of interest to fight inflation, which has actually slowed the economy. So, Eastman is gaining from lower expenses however is challenged by lowered need in some markets.

The charts listed below reveal the significant enhancements (reduced expenses) for gas (2 years) and gas liquids (one year). Due to the fact that gas is a substantial input to the expense of electrical energy, lower gas rates likewise minimize electrical energy expenses.

EIA EIA

Rivals

Eastman Chemical Business is headquartered in Kingsport, Tennessee.

Rivals are many and vary by line of product. They consist of Dow ( DOW), the chemicals department of ExxonMobil ( XOM), 3M ( MMM), BASF ( OTCQX: BASFY), Huntsman ( HUN), Corteva ( CTVA), Celanese ( CE), Trinseo ( TSE), Bayer ( OTC: BAYN), Luxi Chemical Group, Ineos Group Holdings, LG Chem, Oxea GmbH, Sekisui Chemical ( OTCPK: SKSUY, OTCPK: SKSUF), Kingboard Specialized, Chang Chun Petrochemical, S.K. Chemical, Saudi Basic Industries (SABIC), and Daicel Chemical.

Governance

Institutional Investor Provider (ISS) ranks Eastman’s total governance on June 1, 2023, as a 5, with sub-scores of audit (3 ), board (6 ), investor rights (6 ), and settlement (6 ). On the ISS scale, 1 represents lower governance danger and 10 represents greater governance danger.

Eastman’s ESG scores from Sustainalytics in January 2023 were “medium” with an overall danger rating of 25 (43rd percentile). Part are ecological danger 12.0, social 5.4, and governance 7.2. Debate level is 2 (moderate) on a scale of 0-5, with 5 as the worst. The only kept in mind danger location is animal screening.

Shorts were 1.35% of drifted shares at June 15, 2023.

A really little portion of shares (0.69%) is held by experts.

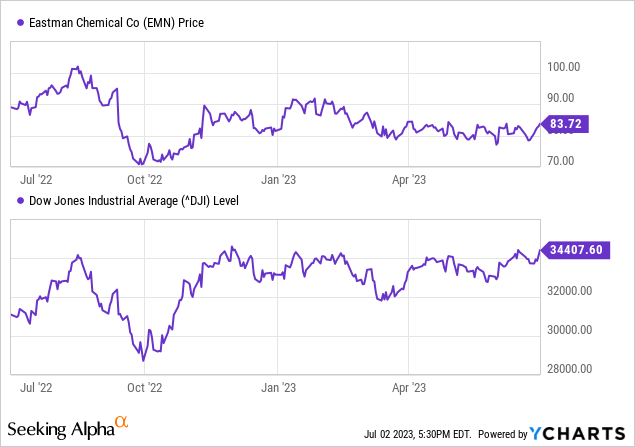

The business’s beta is 1.52: the stock moves directionally with the total market however with more volatility, as can be anticipated from a cyclical chemicals business.

The 6 biggest institutional holders at March 30, 2023, were: Lead at 12.6%, BlackRock at 7.2%, JPMorgan Chase at 6.8%, State Street at 4.2%, Putnam Investments at 3.5%, and Morgan Stanley at 3.3%. A few of these organizations represent index fund financial investments that match the total market.

Financial and Stock Emphasizes

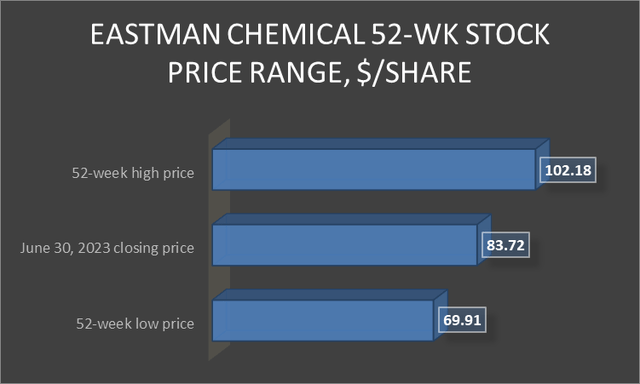

Market capitalization is $10.0 billion at June 30, 2023, stock closing rate of $83.72.

The 52-week rate variety is $69.91-$ 102.18 per share, so the closing rate is 82% of its 52-week high. It is 89% of the typical 1 year target of $94.14/ share.

Tracking twelve-months (TTM) EPS is $5.61 for a routing price/earnings ratio of 14.9. The average of experts’ quotes for 2023 EPS is $7.85 and 2024 EPS of $8.97. This provides a forward price/earnings ratio variety of 9.3-10.7.

TTM return on possessions is 5.0% and return on equity is 12.4%.

TTM operating capital is $956 million and leveraged complimentary capital is $1.3 billion.

At March 31, 2023, the business had $ 9.72 billion in liabilities and $14.98 billion in possessions, offering Eastman a substantial liability-to-asset ratio of 65%.

Of the liabilities, $3.0 billion was present liabilities and $4.6 billion was long-lasting financial obligation.

The ratio of financial obligation to EBITDA is 3.4.

The book worth per share of $43.54 is simply over the marketplace rate, suggesting favorable financier belief.

The charts listed below compare 3 years of Eastman’s stock rates to the Dow Jones Industrial Average ( DJI). Although Eastman Chemical is most impacted by the total financial health of the economy, it does disappoint as big a current healing.

The business’s ratio of business worth ($ 14.9 billion) to tracking twelve months EBITDA of $1.7 billion is 8.7, listed below the favored ratio of less than 10 and hence suggesting a deal.

The dividend of $3.16/ share supplies a 3.8% yield.

Eastman has an opportunistic share redeemed program to balance out dilution.

The business’s mean expert ranking is a 2.3, closer to “purchase” however favoring “hold,” from eighteen experts.

Favorable and Unfavorable Dangers

Eastman Chemical’s significant danger is the sluggish healing of worldwide economies as its items are cyclic with vehicles, real estate, and so on

It likewise has direct exposure to greater expenses in Europe, along with the currency danger that features global operations.

Favorable danger originates from present and anticipated lower (than in 2015) gas, gas liquids, and petrochemicals feedstock expenses.

Lastly, the competitive danger from other chemicals business in the United States and abroad is relentless. Eastman addresses this with brand-new and development innovations and customer-specific options.

Suggestions for Eastman Chemical Corporation

In spite of drooping 1Q23 revenues and some headwinds for 2Q23 outcomes, I suggest that financiers thinking about specialized chemicals purchase shares of Eastman Chemical.

The business has a strong United States grip with global diversity; additionally, it is experiencing and will experience tailwinds from lower gas, gas liquids, and electrical energy expenses. It is intensifying this advantage with a program to get rid of $200 million from its expense facilities.

It acknowledges first-half 2023 headwinds due to consumer destocking and soft need, especially in building and construction. Much of its profits originates from steady markets, and it is executing a brand-new markets (circular economy) program.

While the dividend yield of 3.8% is lower than the two-year Treasury rate, the approximated EPS benefit to the tracking twelve months is 40% for 2023 and 60% for 2024.

Eastman Chemical

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.