John Lamparski

AT&T Is Not A Great Company

Warren Buffett is understood for stating:

It’s far much better to purchase a fantastic business at a reasonable cost than a reasonable business at a fantastic cost.”

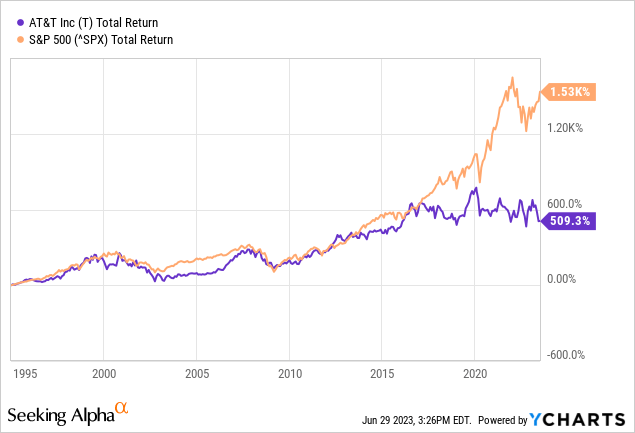

AT&T ( NYSE: T) falls under the latter classification. And while I believe the marketplace has actually taken Buffett’s ideas on a “terrific business” too far, we still require to go into what has actually triggered AT&T to underperform so substaintially over the previous years:

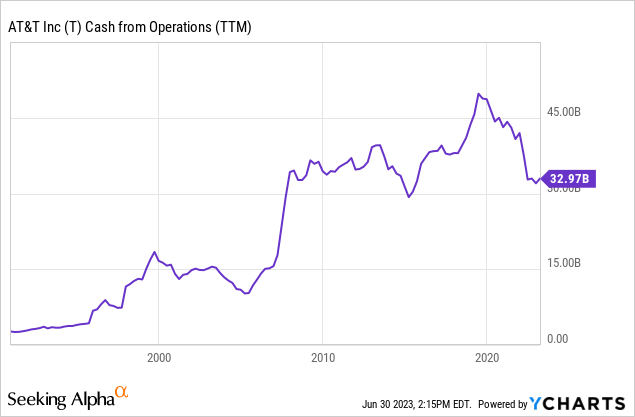

The issue is, AT&T is a really capital-intensive service. At the end of 2022, the business had $127 billion of home, plant, and devices and $124 billion in licenses on its balance sheet.

In contrast to its $400 billion in possessions, AT&T had simply $16.2 billion in totally free capital ( In 2022). This explains what Warren Buffett would call an awful service – one that is required to invest a lots of cash and after that makes extremely little returns (Revenues).

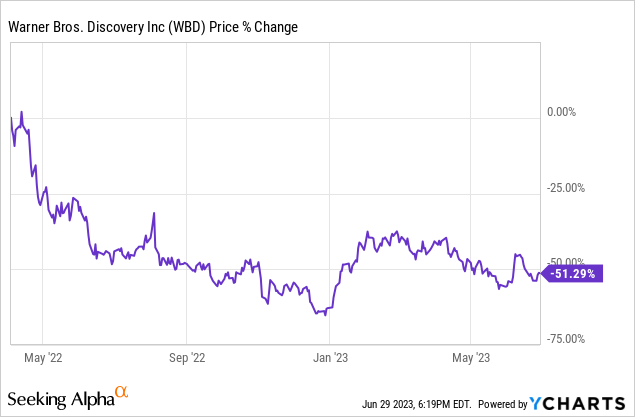

Warner Bros. Spinoff Was The Right Move

Moving over to the financial obligation circumstance, I believe AT&T’s management made an excellent relocation spinning off Warner Bros. Discovery ( WBD) in 2022. This erased a big piece of AT&T’s long-lasting financial obligation. Naturally, Warner Bros. was encumbered this financial obligation, however if you offered WBD at the spinoff, you constructed alright:

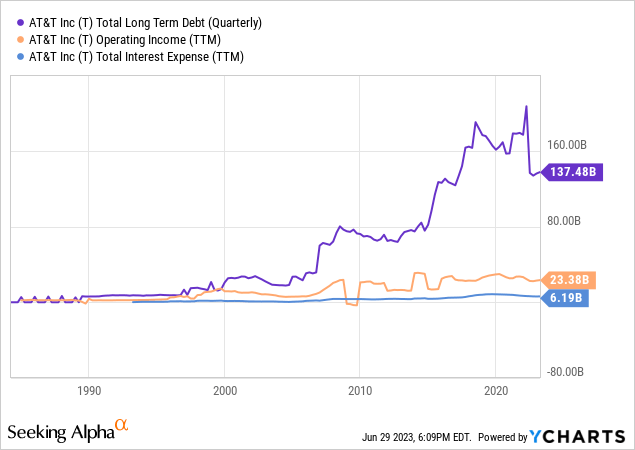

So, AT&T’s financial obligation is down, however is it down enough? No. AT&T’s long-lasting financial obligation is still 6x bigger than its operating earnings (I like to see this number at less than 3x). AT&T’s financial obligation has actually grown at a rate quicker than earnings for rather a long time:

The interest expenditure on this financial obligation is currently high (at 25% of running earnings) and might be headed greater. The longer rates of interest stay raised, the more financial obligation AT&T needs to roll over at greater rates.

The Dividend Is Covered

| ___________________ | Routing 12 Months |

| Operating Capital | $ 34.9 Billion |

| Capital Investment | ($ 19.4 Billion) |

| Free Capital | $ 15.5 Billion |

| Dividends Paid | ($ 8.1 Billion) |

However There’s A Hole In The Balance Sheet

AT&T has a huge hole in its balance sheet:

| ______________ | Q1 2023 |

|

Existing Properties |

$ 29.9 Billion |

| Existing Liabilities | ($ 58.1 Billion) |

| Working Capital | ($ 28.2 Billion) |

I see this $28 billion hole as a hinderance to AT&T. Since the business is not likely to produce sufficient totally free capital to cover dividends and its operating capital hole, it might need to select amongst these similarly dismal alternatives:

- Offer possessions

- Problem shares (water down investors)

- Handle more financial obligation

The Rate Is All The Bulls Have

AT&T is low-cost, no matter how you take a look at it:

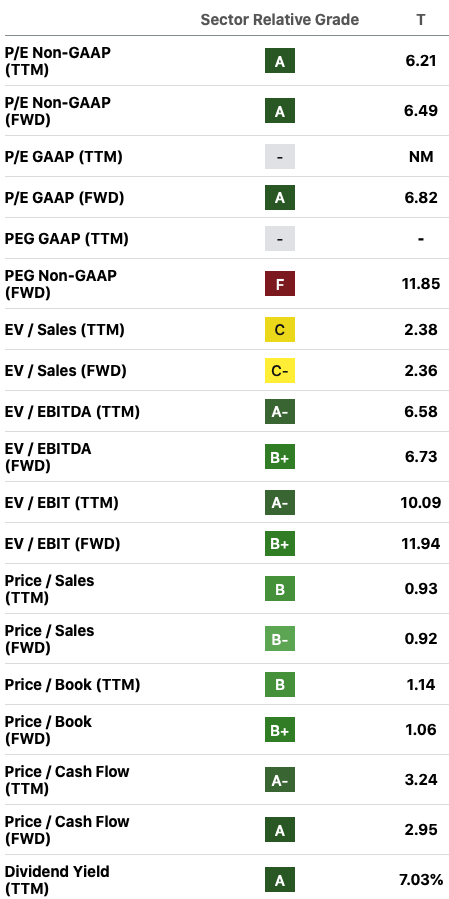

Assessment Grades ( Looking For Alpha)

This is the main factor to own AT&T.

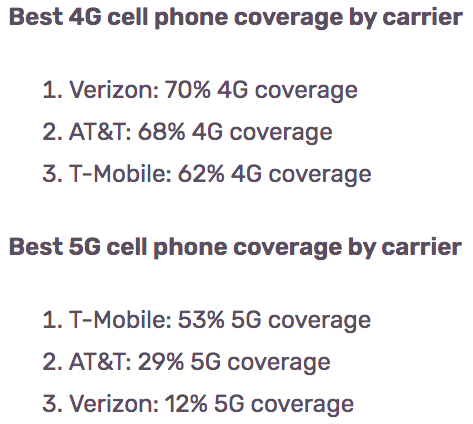

Taking a look at AT&T’s competitive position, it isn’t precisely a leader. AT&T remains in the middle of the pack in 4G and 5G mobile phone protection:

4G And 5G Protection ( Reviews.org)

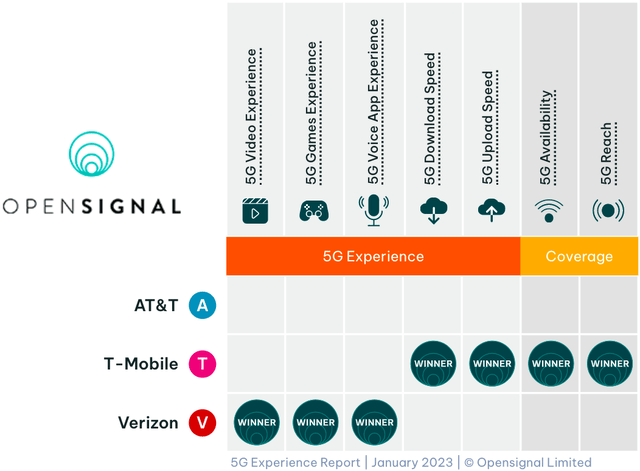

AT&T likewise has a hard time to separate itself when it concerns mobile 5G speeds, accessibility, and experience:

5G Awards ( OpenSignal)

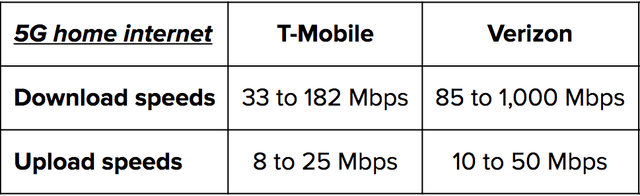

The business simply got in the 5G house web area; however with download speeds in between 40 and 140 Mbps and a $55 cost that’s greater than rivals, AT&T routes both Verizon ( VZ) and T-Mobile ( TMUS) in 5G house web:

5G House Web Contrast ( 9TO5Mac)

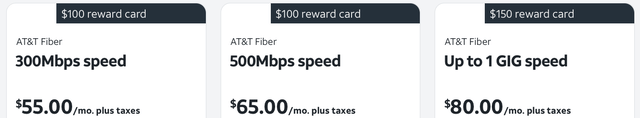

To compensate, AT&T’s CEO John Stankey was talking up the business’s customer care and position in fiber at the business’s 2023 yearly conference Here are the business’s fiber web offerings:

AT&T Fiber Offerings ( AT&T)

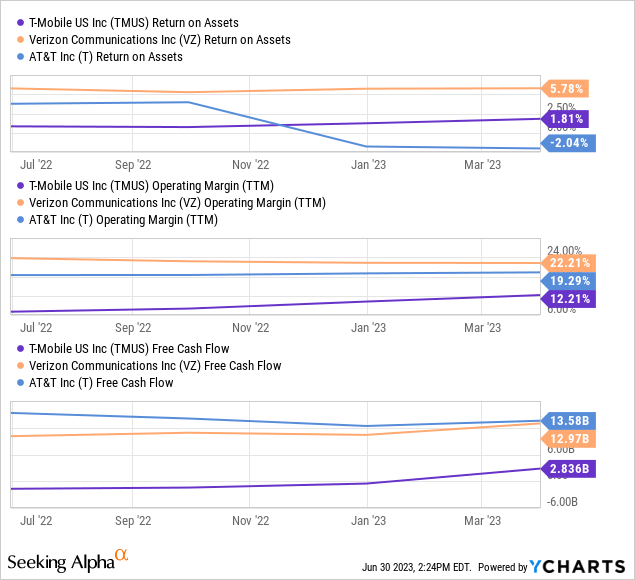

Taking a look at AT&T’s position in the above classifications, I stress over the business’s competitiveness. Encumbered great deals of financial obligation, AT&T can’t precisely pay for to make the financial investments required to reach Verizon and T-Mobile. The business likewise can’t pay for to decrease its costs provided the holes in its balance sheet. For that reason, AT&T might be required to lean on its customer care and promos. This can be expensive for investors.

AT&T Is Still A Buy

There’s just excessive pessimism around AT&T for it to be a “Hold” or “Offer.” AT&T owns important facilities and licenses. This makes its money streams more foreseeable and resilient than much of today’s high-flying tech business.

I anticipate the costs of American phone strategies to increase in the years ahead. I believe oligopoly gamers AT&T, Verizon, and T-Mobile will have no option however to increase costs in unison. There are 3 factors for this. Initially, share costs have actually been falling and this ought to put pressure on these business to increase success. Second, T-Mobile, Verizon, and AT&T have excessive financial obligation not to increase their costs. Third, financiers have extremely high expectations for T-Mobile, which makes beside no revenues:

A black swan threat to this thesis would be if Amazon ( AMZN) chose to sign up with forces with meal Network Corporation ( MEAL); having a 4th significant gamer might possibly mess up market success. I believe this is not likely.

AT&T has actually a stabilized PE ratio of simply 7x. In the years ahead, I forecast overall returns of 11% per year for AT&T:

| Stabilized EPS | $ 2.27 |

| Existing Dividend | $ 1.11 |

| Substance Yearly Development Rate | 1.5% |

| Year 10 EPS | $ 2.63 |

| Terminal Numerous | 10x |

| Year 10 Rate Target | $ 26.30 |

| Annualized Returns ( Dividends Reinvested) | 11% |

Note: This is a base-case situation price quote. The “compound yearly development rate” is for dividends and profits. Stabilized EPS was computed utilizing $35 billion of running capital, minus $18 billion of upkeep CapEx (the like 2022 devaluation), divided by the diluted shares exceptional 7.474 billion

The low development rate can be credited to the quantity of profits AT&T needs to burn to enhance its balance sheet, the threat of dilution, along with my view on the business’s competitive position.

Why I Choose Verizon

My choice for Verizon is extremely basic. I like Verizon’s items, its balance sheet, and its success. Verizon has the mobile 5G edge in significant cities, which it just recently blanketed with blazing-fast mmWave. If you’re going on a cross-country journey, Verizon still has the very best overall protection due to the fact that of its 4G network. And, Verizon has the fastest 5G house web, which it packages in for simply $ 25 each month. As you saw previously, Verizon likewise has industry-leading success. Finally, Verizon has much better interest protection, much better debt-to-income ratios, and a much better operating capital position than AT&T.

Warren Buffett purchased VZ stock in 2020 at around $60 per share, and the stock now trades at simply $37 per share (Note that Buffett offered out right prior to the current decrease). Still, I take a little convenience understanding that I paid 40% less than Warren Buffett. As Benjamin Graham when stated:

Challenged with a difficulty to boil down the trick of sound financial investment into 3 words, we venture the slogan, Margin of Security“

In Conclusion

AT&T is low-cost, which is why I have a “Buy” score on the shares. I’m bullish on the market and anticipate the oligopoly gamers will ultimately need to increase costs in unison. Still, I do not like the $28 billion hole in AT&T’s balance sheet, nor am I extremely keen on its competitive position. I choose Verizon in this regard. After all, AT&T is last in 5G house web, last in mobile 5G awards, and middle-of-the-pack in protection. Improving the balance sheet will be a difficulty, which ought to weigh on development. However, at a stabilized PE of 7, you do not require it.

For more on my preferred financial investment in the telecom market, click on this link

Up until next time, pleased investing!