The efficient date of the Measured and Indicated (“M&I”) Mineral Useful resource and Mineral Reserve Estimate is June 30, 2022 . The monetary fashion and Lifetime of Mine (“LOM”) manufacturing plan, factoring within the processed and depleted ore as much as December 31, 2022 , begins on January 1, 2023 . The effects introduced on this information free up are in comparison to the ones disclosed in a previous technical file dated January 4, 2021 (the “2021 Feasibility Find out about” or “2021 FS”) filed on SEDAR February 2, 2021 titled “NI 43-101 Technical Record & Feasibility Find out about on The Las Chispas Venture”. On this Record, silver similar (“AgEq”) references are in line with an up to date silver (“Ag”) to gold (“Au”) ratio of 79.51:1 (previously 86.9:1 within the 2021 FS). The 2021 Feasibility Find out about is not present, the 2021 Feasibility Find out about outcomes are not supported by means of the leads to the Record and will have to no longer be relied upon.

Up to date Technical Record Highlights

- Tough Manufacturing Profile with Sturdy NPV of $549.9M at Base Case – The Record has showed robust economics for an eight-year operation producing moderate annual manufacturing of 57 thousand (“okay”) oz. (“ounces”)/yr Au and 5.5 million (“M”) ounces/yr Ag (10.0 Moz/yr AgEq) right through the primary seven complete years. The use of a 5% cut price charge and moderate gold and silver costs of $1,800 /ounces and $23.00 /ounces respectively because the Base Case, Las Chispas generates a post-tax internet provide price (“NPV (5%)”) of $549.9M .

- Sturdy Money Flows, Debt Unfastened, Wholesome Steadiness Sheet – The Operation is estimated to generate moderate annual post-tax loose money waft of roughly $84.3M from 2023 to 2029 on the Base Case. SilverCrest has paid off 100% of its $90M debt since business manufacturing was once introduced in November 2022 and on the finish of Q2, 2023 had gathered a treasury property 1 stability of $59.0M .

- Record Main points Supported by means of Present Operational Efficiency – The Record is in line with precise running knowledge from the mine and procedure plant, together with value fashions supported by means of precise running prices, of completion of greater than 16 kilometres (“km”) of underground construction ( January 2021 to December 2022 ) and recovered steel of 17.8 koz Au and 1.74 Moz Ag (3.2 Moz AgEq) since procedure plant startup in early June 2022 till the top of 2022.

- Up to date Mineral Reserve Estimate – The up to date Confirmed and Possible Mineral Reserve Estimate of 78.6 Moz AgEq (3.4 Mt grading 4.08 gpt Au and 395 gpt Ag, or 719 gpt AgEq) is a 13% aid in AgEg oz. from the 2021 FS. This aid contains the up to date gold to silver ratio, up to date modelling for narrower and extra broadly dispersed veins than in the beginning modelled, build up in cut-off grades because of higher business prices, revised geotechnical requirements, and mining manner adjustments.

- Simplified Underground Manufacturing Plan – The up to date manufacturing plan reaches rather above 1,200 tonnes consistent with day (“tpd”) in 2026 and is in large part supported by means of long-hole stoping (77%) with the stability being lower and fill (17%), and resue (6%). This means considerably simplifies the mine plan throughout the aid of running faces, apparatus and labour, whilst additionally addressing protection and productiveness problems. The usage of this bulk mining manner, when mixed with narrower veins, has resulted in a discount in LOM mined grade of roughly 18%.

- Metallurgical Recoveries Advanced – The Record is in line with precise accomplished procedure plant metallurgical recoveries of an estimated 98.0% Au and 97.0% Ag, each stepped forward from the recoveries of 97.6% Au and 94.3% Ag estimated within the 2021 FS.

- Upper Maintaining Capital Displays Greater Prices and Expanded Mine Footprint – LOM maintaining capital of $219.9M has higher by means of 77.5% in comparison to the 2021 FS as construction unit prices and the volume of infrastructure required higher because of the expanded mine footprint.

- Lowest Quartile 2 AISC Stays – The Record estimates all-in maintaining prices 3 (“AISC”) to moderate $11.98 /AgEq payable ounces over the LOM, unique of company stage G&A and maintaining exploration prices. For the duration of H2, 2023 via 2024, the AISC is estimated to moderate roughly $13.50 /AgEq payable ounces which is the perfect value duration within the LOM because of an sped up spend in maintaining capital to make stronger ramp-up of mine throughput.

- Instant and Longer-Time period Expansion Alternatives – Instant expansion shall be centered via a $10M exploration program keen on concentrated on 40% of the up to date Inferred Mineral Useful resource (1.3 Mt grading 566 gpt AgEq or 24.1 Moz AgEq) for conversion to M&I Mineral Assets for long run Mineral Reserve attention. The point of interest is on upper grade Mineral Reserve substitute objectives proximal to present and deliberate infrastructure. Previous level exploration alternatives at Las Chispas shall be pursued in parallel.

|

1 Treasury property is a Non-IFRS measure. See “Non-IFRS Measures” segment underneath. On the finish of Q2, 2023, treasury property come with money of $53.4M and bullion purchases held at present marketplace price of $5.6M. |

Pierre Beaudoin , COO, commented, “The effects from the Record ascertain our self assurance in Las Chispas, which has additionally been demonstrated via robust operational efficiency since commissioning was once undertaken in Q2, 2022. The Record displays up to date prices and manufacturing expectancies, and despite the fact that those have modified because the 2021 Feasibility Find out about, we view them to be executable, in particular as they’re supported by means of contemporary running enjoy. We thank our operations crew and a lot of self sufficient experts who complicated this paintings, whilst additionally concurrently executing on the Las Chispas Operation.”

N. Eric Fier , CEO said “The discharge of the consequences from the Record is a vital milestone and the newest of a protracted record of de-risking occasions for our Corporate. Given the present international inflationary surroundings and site-specific adjustments, our up to date Mineral Assets and Reserves, manufacturing and costing estimates higher replicate the present running parameters at Las Chispas. Â The operational efficiency and money waft generated so far at Las Chispas make stronger the findings of the Record which define a excessive margin operation that generates vital loose money waft. The hot good fortune of the Operation has allowed us to pay off all $90M of debt since business manufacturing was once accomplished in November of 2022, whilst additionally development a powerful treasury property stability of $59.0M on the finish of Q2, 2023. We look ahead to freeing complete main points of our Q2, 2023 operational and monetary efficiency subsequent week. We’re very inspired to now be capable of refocus the Corporate’s human and monetary assets to the following section of expansion and accountable capital allocation.”

Desk 1 â Up to date Technical Record Review

|

Las Chispas Up to date Technical Record Abstract as of Jan. 1, 2023 |

|

|

Moderate Procedure Plant Throughput (2023 to 2029) (tpd) |

1,200 |

|

Mine Existence (years) |

8.0 |

|

Moderate Gold Procedure Plant Head Grade (gpt Au) |

4.02 |

|

Moderate Silver Procedure Plant Head Grade (gpt Ag) |

396.1 |

|

Moderate Silver Identical Procedure Plant Head Grade (gpt AgEq) |

716.1 |

|

Contained Gold in Mine Plan (koz Au) |

422.7 |

|

Contained Silver in Mine Plan (koz Ag) |

41,615.5 |

|

Contained Silver Identical in Mine Plan (koz AgEq) |

75,227.5 |

|

Moderate Gold Metallurgical Restoration (% Au) |

98.0 |

|

Moderate Silver Metallurgical Restoration (% Ag) |

97.0 |

|

Payable Gold (koz Au) |

421.6 |

|

Payable Silver (koz Ag) |

41,005.5 |

|

Payable Silver Identical (koz AgEq) |

74,525.4 |

|

Moderate Annual Manufacturing (2023 to 2029) |

|

|

Gold (Au koz/12 months) |

57.0 |

|

Silver (Ag koz/12 months) |

5,503.5 |

|

Silver Identical (AgEq koz/12 months) |

10,036.0 |

|

Mining Price ($/t mined) |

108 |

|

Procedure Price ($/t processed) |

47 |

|

G&A Price ($/t processed) |

21 |

|

Overall Working Price ($/t processed) |

168 |

|

LOM Maintaining Capital Price ($M) |

219.9 |

|

Closure Prices ($M) (2030 to 2032) |

6.8 |

|

Money Prices (1) ($/ounces AgEq â Payable) LOM |

7.84 |

|

AISC (1) ($/ounces AgEq â Payable) LOM â Mine Stage |

11.98 |

|

Au Value ($/ounces) |

1,800 |

|

Ag Value ($/ounces) |

23.00 |

|

Pre-Tax NPV (5%, $M) |

706.5 |

|

Publish-Tax NPV (5%, $M) |

549.9 |

|

Undiscounted LOM internet loose money waft (1) ($M) |

654.1 |

|

LOM AISC Margin (%) |

48Â % |

|

Notes: |

|

1.      Money prices, AISC and internet loose money flows areNon-IFRS measures. See ” Non-IFRS Measures ” segment underneath |

|

2.      All numbers in desk pertain to complete LOM (2023-2030) except in a different way said. Numbers are rounded |

|

3.      Reserve depleted by means of 3.4 MozAgEq representing ore processed from July 1, 2022 to December 31, 2022 |

|

4.      Payable steel contains oz. bought from stock |

|

5.      Mine Stage AISC does no longer come with Company Stage G&A, share-based reimbursement or exploration |

Mineral Useful resource Estimate

The Up to date Mineral Useful resource Estimate is supplied in Desk 2. This estimate was once finished for underground mining of in-situ vein deposits on the Babicanora and Las Chispas Spaces and for floor extraction of stockpiles from historic and present operations. All drilling, surveying and assay databases have been equipped by means of SilverCrest together with knowledge as much as the time limit of June 30, 2022 for M&I Useful resource Estimates and March 21, 2023 for the Inferred Mineral Useful resource Estimate.

The Up to date Mineral Useful resource Estimate benefited from the enhanced working out of the deposit won via SilverCrest’s 18 months of construction and manufacturing mining. Incorporating this information and information resulted in a number of key adjustments within the Corporate’s solution to Mineral Useful resource modelling as mentioned underneath.

The Mineral Useful resource Estimate fashion was once up to date to replicate: narrower veins positioned over a bigger space, thus requiring higher underground construction, higher constraints on geologic, statistical, and geostatistical modelling parameters leading to discounts in assets principally in Babicanora Major and Babicanora Norte Major veins and higher assets within the Babi Vista Vein, together with the Babi Vista Splay. Moreover, there is a rise within the selection of Mineral Useful resource veins and the veins are extra broadly dispersed. The Up to date Inferred Mineral Useful resource Estimate is lowered from the 2021 FS because of conversion to M&I Mineral Assets and alertness of the similar stricter constraints as implemented to M&I Mineral Assets.

Desk 2 â Mineral Useful resource Estimate

|

Space |

Classification |

Tonnes (okay) |

Au (gpt) |

Ag (gpt) |

AgEq (gpt) |

Contained (koz) |

Contained Ag (koz) |

Contained AgEq (koz) |

|

Babicanora Space Veins |

Measured |

206.6 |

13.67 |

1,289 |

2,376 |

90.8 |

8,561 |

15,779 |

|

Indicated |

1,726.3 |

7.09 |

658 |

1,222 |

393.6 |

36,540 |

67,832 |

|

|

M&I |

1,932.9 |

7.79 |

726 |

1,345 |

484.3 |

45,101 |

83,611 |

|

|

Las Chispas Space |

Indicated |

441.6 |

4.22 |

552 |

888 |

60.0 |

7,835 |

12,605 |

|

Overall Undiluted Veins |

M&I |

2,374.5 |

7.13 |

693 |

1,260 |

544.3 |

52,936 |

96,216 |

|

Historic Stockpiles |

Indicated |

151.8 |

1.14 |

112 |

203 |

5.6 |

546 |

990 |

|

Run of Mine (“ROM”) |

Measured |

168.1 |

5.56 |

428 |

869 |

30.0 |

2,311 |

4,699 |

|

Overall (Veins + |

M&I |

2,694.4 |

6.69 |

644 |

1,176 |

579.9 |

55,794 |

101,905 |

|

Babicanora Space Veins |

Inferred |

953.5 |

4.49 |

267 |

624 |

137.5 |

8,188 |

19,123 |

|

Las Chispas Space |

Inferred |

373.6 |

1.81 |

274 |

418 |

21.7 |

3,296 |

5,024 |

|

Overall Undiluted Veins |

Inferred |

1,327.1 |

3.73 |

269 |

566 |

159.2 |

11,484 |

24,147 |

|

Notes: |

|

|

1. |

The efficient date for M&I Useful resource estimates of the veins and stockpiles was once June 30, 2022, whilst Inferred Useful resource estimates for the veins was once efficient March 21, 2023. |

|

2. |

Mineral Assets don’t seem to be Mineral Reserves and should not have demonstrated financial viability. |

|

3. |

The estimate of Mineral Assets could also be materially suffering from environmental, allowing, prison, name, taxation, socio-political, advertising and marketing, or different related problems. |

|

4. |

The Inferred Mineral Useful resource on this estimate has a decrease stage of self assurance than that implemented to an Indicated Mineral Useful resource and will have to no longer be transformed to a Mineral Reserve. It may be slightly anticipated that almost all of the Inferred Mineral Useful resource may well be upgraded to an Indicated Mineral Useful resource with endured exploration. |

|

5. |

Mined spaces as of June 30, 2022, have been got rid of from the wireframes and block fashions. |

|

6. |

AgEq is in line with Ag:Au ratio of 79.51:1 calculated the usage of $1,650/ounces Au and $21/ounces Ag, with moderate metallurgical recoveries of 97.9% Au and 96.7% Ag, and 99.9%Â payable for each Au and Ag. |

|

7. |

Mineral Assets are inclusive of the Mineral Reserves. |

|

8. |

Minimize-off grade (“COG”) used for vein subject matter is 150 gpt AgEq and, for Historic stockpiles is 110 gpt AgEq. No cut-off grade was once implemented to the ROM stockpile as it’s in line with subject matter mined. |

|

9. |

Totals won’t upload because of rounding. |

Mineral Reserve Estimate

The Mineral Reserve Estimate is supplied in Desk 3. The estimate was once finished for underground mining of in-situ vein deposits on the Babicanora and Las Chispas Spaces and for floor extraction of stockpiles from historic and present operations. All drilling, surveying and assay databases have been equipped by means of SilverCrest, together with knowledge as much as the time limit of June 30, 2022 for Measured and Indicated Mineral Assets.

Desk 3 â Confirmed and Possible Mineral Reserve Estimate

|

Space |

Tonnes (okay) |

Au (gpt) |

Ag (gpt) |

AgEq (gpt) |

Contained Au (koz) |

Contained Ag (koz) |

Contained AgEq (koz) |

|

|

Babicanora |

Confirmed |

345 |

7.03 |

665 |

1,224 |

78 |

7,382 |

13,589 |

|

Babicanora |

Possible |

2,334 |

3.90 |

370 |

679 |

292 |

27,734 |

50,987 |

|

Las Chispas |

Confirmed |

– |

– |

– |

– |

– |

– |

– |

|

Las Chispas |

Possible |

401 |

3.09 |

399 |

645 |

40 |

5,152 |

8,323 |

|

Babicanora + Las Chispas |

Confirmed + |

3,081 |

4.14 |

407 |

736 |

410 |

40,269 |

72,899 |

|

Historic Stockpile |

Confirmed |

150 |

1.14 |

112 |

203 |

6 |

541 |

980 |

|

ROM Stockpile |

Confirmed |

168 |

5.56 |

428 |

869 |

30 |

2,311 |

4,699 |

|

Overall Stockpile |

Confirmed |

318 |

3.47 |

279 |

555 |

36 |

2,852 |

5,679 |

|

Overall Mineral |

Confirmed + |

3,399 |

4.08 |

395 |

719 |

446 |

43,121 |

78,579 |

|

Notes: |

|

|

1. |

The efficient date of the estimate is June 30, 2022. |

|

2. |

The Mineral Reserve is estimated the usage of the 2019 CIM Estimation of Mineral Assets & Mineral Reserves Perfect Apply Pointers and 2014 CIM Definition Requirements for Mineral Assets & Mineral Reserves. |

|

3. |

The Mineral Reserve is estimated with a 372 gpt AgEq absolutely loaded COG for the deposit and an 85 gpt AgEq Marginal COG for construction. |

|

4. |

The Mineral Reserve is estimated the usage of long-term costs of $1,650/ounces for gold and $21.00/ounces for silver. |

|

5. |

A central authority gold royalty of 0.5% is integrated within the Mineral Reserve estimates. |

|

6. |

Stockpile values have been equipped by means of SilverCrest and account for about 7% of mineral reserve oz.. |

|

7. |

The Mineral Reserve is estimated with a most mining restoration of 95%, with discounts in make a selection spaces in line with geotechnical pointers. |

|

8. |

The Mineral Reserve offered contains each inside and exterior dilution. The exterior dilution features a mining dilution of 0.5 m width on each the striking wall and footwall for the lengthy gap mining manner (1 m general), and a nil.2 m width on each the striking wall and footwall for the resue mining strategies (0.4 m general). Minimize-and-fill mining was once assumed as breasting in all instances, the usage of the ore sill force width of three.3 m at least mining width inclusive of dilution. Further exterior dilution was once implemented in make a selection spaces in line with geotechnical suggestions. Backfill dilution may be integrated and represents 4% for the lengthy gap mining manner and seven% for cut-and-fill and resue mining strategies. |

|

9. |

A minimal mining width of one.5 m, 3.3 m and zero.5 m was once used for the long-hole, cut-and-fill and resue mining strategies, respectively. |

|

10. |

Moderate metallurgical recoveries implemented are 97.9% Au and 96.7% Ag. |

|

11. |

The industrial viability of the Mineral Reserve has been demonstrated. |

|

12. |

AgEq(gpt) = (Au(gpt) * 79.51 + Ag(gpt)). AgEq calculations imagine steel costs, metallurgical recoveries, Mexican Govt gold royalty and tax charge. |

|

13. |

Estimates use metric devices (metres (m), tonnes (t), and gpt). Steel contents are offered in troy oz. (metric tonne x grade / 31.103475). |

|

14. |

The self sufficient Certified Individual isn’t acutely aware of any recognized environmental, allowing, prison, title-related, taxation, socio-political or advertising and marketing problems, or another related factor that might materially impact the Mineral Reserve Estimate. |

|

15. |

Totals won’t upload because of rounding. |

The Mineral Reserve has a 48 kt build up and a 12.3 Moz AgEq (13%) lower between the 2021 FS and 2023 Mineral Reserve Estimates as proven in Desk 4. It will have to be famous that after evaluating Mineral Reserve Estimates to the 2021 FS, the aid in AgEq ounces contains the up to date gold to silver ratio alternate ( -3.8M AgEq ozs) as famous in Desk 4. Additionally, the aid contains; up to date useful resource modelling for narrower and extra broadly dispersed veins than in the beginning modelled, an build up in cut-off grades because of higher business prices, revised geotechnical requirements, and mining manner adjustments. In spite of the aid in oz., the operational knowledge lets in for higher self assurance on a go-forward foundation.

Desk 4 â Mineral Reserve Variance

|

Mineral Reserve Estimate |

Tonnes (okay) |

Au (gpt) |

Ag (gpt) |

AgEq (gpt) |

Contained Au (koz) |

Contained Ag (koz) |

Contained AgEq (koz) |

|

2021 FS at 86.9 AgEq |

3,351 |

4.81 |

461 |

879 |

518 |

49,679 |

94,704 |

|

2021 FS at 79.51 AgEq |

3,351 |

4.81 |

461 |

843 |

518 |

49,679 |

90,875 |

|

2023 TR (June 30, 2022) |

3,399 |

4.08 |

395 |

719 |

446 |

43,121 |

78,579 |

|

Distinction |

48 |

(0.73) |

(66) |

(124) |

(72) |

(6,558) |

(12,296) |

|

Be aware: The 2021 FS is not present and the 2021 FS outcomes are not supported by means of the result of the 2023 Mineral Reserve Estimates within the Record and will have to no longer be relied upon. |

The processed and depleted ore, from July 1, 2022 to December 31, 2022 was once deducted from the Mineral Reserve within the LOM monetary fashion.

Reconciliation

The Corporate applied a Mineral Reserve to plant international reconciliation program when the plant started operations in June 2022 . The Up to date Reserve Estimate was once in comparison to precise plant manufacturing from June 2022 to April 2023 which reconciled to inside of 5% of the 6.8 Moz AgEq oz. processed. The reconciliation outcomes point out the Mineral Reserve Estimate is easily represented and is inside of a suitable vary for a slim and high-grade vein deposit. The use of this 10-month duration from the efficient date of the Mineral Reserve Estimate to check the assumptions within the fashion along precise mine and plant manufacturing has additional de-risked Las Chispas.

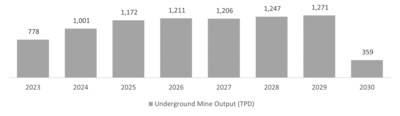

Underground Mine

The Record outlines a ramp-up as consistent with Determine 1. For 2023, the Record estimates a mean underground mine manufacturing of 778 tpd, consistent with present operational efficiency and expectancies. The mining charge will get started expanding in Q1, 2024 and is predicted to moderate roughly 1,000 tpd right through 2024. Beginning in 2026, the mining charge is predicted to succeed in above 1,200 tpd. This charge is predicted to be maintained via to 2029. This new design lets in for a extra conservative use of the skin stockpiles that complement ore mined from the underground. The stability of the Las Chispas present Mineral Reserve is predicted to be exhausted in 2030, right through which period mining charges are anticipated to scale back significantly as manufacturing spaces are depleted.

Determine 1 â LOM Mining Charges

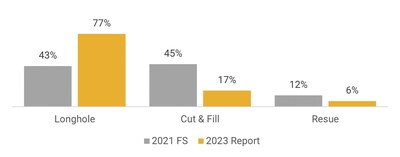

Studying from 18 months of ramp up manufacturing has helped to simplify the mine plan to a more secure and extra sustainable operation by means of lowering lower & fill and resue mining strategies and depending extra at the long-hole mining manner as proven in Determine 2.

Determine 2 â Exchange in Proportion of Mining Strategies

As in the past disclosed in November 2022 , SilverCrest’s present operational plan lowered using the resue mining manner. This technique was once in the beginning integrated to restrict dilution, then again, protection and productiveness problems led to lowered operational and financial efficiency. The brand new LOM considerably reduces using resue mining and shall be essentially changed by means of the lower price and extra productive long-hole mining manner. The trade-off is higher dilution which can also be observed by means of the decrease head grade. The stability of stoping manufacturing will use the lower and fill mining manner in spaces of deficient flooring prerequisites.

The have an effect on of the brand new LOM is a much less complicated operation with fewer running faces, much less apparatus and labour, higher productiveness and a discount in consistent with tonne mining prices. The trade-off is extra dilution and a connected aid in head grade.

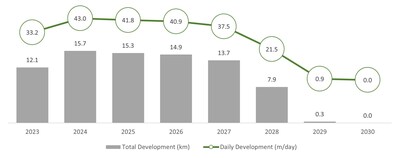

The mining time table contains construction charges of 34 m /day in H2, 2023, a degree this is very similar to Q2, 2023 efficiency. In 2024, the advance charge is predicted to extend to roughly 43 m /day. This higher construction charge shall be conceivable with the hot status quo of a 3rd portal on the Las Chispas Space.

Determine 3 â Lateral Construction Fee

Procedure Plant

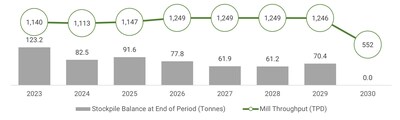

The Las Chispas procedure plant has been designed to succeed in nominal throughput of one,250 tpd. The running outcomes so far point out that this throughput charge can also be accomplished with higher than to start with anticipated metallurgical recoveries. The Record contains up to date and stepped forward recoveries of 98.0% Au and 97.0% Ag over the LOM. The simplified plant procedure diagram has now stopped using the flotation circuit which was once decided to be pointless to succeed in the enhanced recoveries. The method plant efficiency so far has additionally equipped self assurance that it could successfully function with quite a lot of grade and clay content material. The method plant is predicted to function at a mean throughput of one,200 tpd from 2023 â 2029.

Determine 4â Procedure Plant Throughput and Stockpile Steadiness at Finish of Duration

Desk 5 â AgEq Mill Head Grade (gpt)

|

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|

761.1 |

750.6 |

734.8 |

708.5 |

649.4 |

706.1 |

766.6 |

591.5 |

|

Be aware : Unique of oz. bought from stock. |

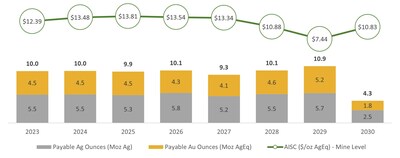

Manufacturing Profile

The manufacturing profile for the LOM is proven underneath. The LOM time table has targeted first at the basis equipped by means of a innovative mine ramp-up supported by means of confirmed construction charges. The strong steel manufacturing throughout the LOM advantages from the versatility equipped by means of the early mine construction and by means of the reliance at the floor stockpile. The outside stockpile has confirmed to be an ideal benefit to stabilize plant feed grade and manufacturing and this adaptability is being maintained below the up to date manufacturing plan. The brand new manufacturing plan lets in SilverCrest to care for floor stockpiles throughout the LOM. It’s now anticipated that floor stockpiles will supply roughly two months of procedure plant feed right through the LOM, which may well be processed previous than scheduled if the mining ramp-up plays higher than proposed within the Record or supply procedure plant feed within the match of a mine manufacturing shortfall.

Determine 5 â Manufacturing Profile

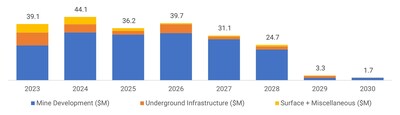

Maintaining Capital Prices

Lifetime of mine maintaining prices are estimated to be $219.9M with 93% of those prices in relation to underground mining and infrastructure. It is a 77.5% build up in value estimated within the 2021 FS. Overall maintaining construction over the LOM is predicted to be 50.3 km which represents the core of the maintaining capital for the underground mine ( $175.5M ). The price of underground maintaining construction has higher because of a mixture of upper construction unit charges and further infrastructure for an expanded mine. The underground infrastructure totals an estimated $28.3M . The stability of the maintaining capital totals $16.2M and covers the wishes for the skin necessities together with the method plant, the tailings facility and the skin infrastructures.

It’s anticipated that maintaining capital prices shall be extra increased in H2, 2023 than in H1, 2023 on account of construction of underground air flow infrastructure and the status quo of underground cellular repairs amenities. The 2024 maintaining capital will build up from 2023 ranges as underground construction is higher.

Determine 6 â Maintaining Capital Price Profile

Closure prices of $6.8M that are anticipated to be incurred right through the duration of 2030 to 2032 don’t seem to be integrated in Determine 6.

Working and All-in-Maintaining Prices

Prices for the Las Chispas Operation have been up to date to replicate the revised value construction, in large part in line with a Q1, 2023 foundation. As highlighted previous to the discharge of the Record, plenty of spaces of the operation have skilled considerable value inflation with manpower and consumables experiencing essentially the most vital affects.

Underground mining prices additionally replicate the alternate to long-hole mining because the most important mining manner in addition to the usage of extra strict flooring keep watch over requirements and enlargement of the footprint of the mine which calls for further running construction metres, apparatus and further and dearer group of workers and hard work. Each lower and fill and resue strategies require breasting construction which additionally contributes to better running prices.

Procedure value will increase can also be attributed at first to an build up in repairs provides, consumables and to an build up within the selection of manpower and wages of this manpower. You will need to observe that one of the consumables’ will increase can also be connected to the rise in gold and silver restoration from the plant.

Website online basic and administrative value has been up to date to replicate higher manpower, and higher wages of this manpower. It additionally replicate using the camp throughout the LOM.

Mining contract discussions have been paused in Q2, 2023 and can resume in earnest now that vital main points defined within the Record are to be had. It’s anticipated that those negotiations shall be finalized in H2, 2023. Prices starting in 2024 come with an allocation for possible value higher connected to those negotiations.

Desk 6 â Working Prices

|

Merchandise |

$/t |

|

Mining Price ($/t mined) |

108 |

|

Procedure Price ($/t processed) |

47 |

|

G&A Price ($/t processed) |

21 |

|

Overall Working Price ($/t processed) |

168 |

Desk 7 â Mine Stage AISC Breakdown

|

Merchandise |

$M |

$ According to Payable AgEq ounces |

% of AISC |

|

Mining |

325.4 |

4.37 |

36Â % |

|

Processing + TCRC |

178.6 |

2.40 |

20Â % |

|

G&A |

69.9 |

0.94 |

8Â % |

|

Stock Changes |

10.3 |

0.14 |

1Â % |

|

Money Prices |

584.2 |

7.84 |

65Â % |

|

Maintaining Capital |

219.9 |

2.95 |

25Â % |

|

Closure (1) |

6.8 |

0.09 |

1Â % |

|

Govt Royalties |

82.0 |

1.10 |

9Â % |

|

AISC |

892.9 |

11.98 |

100Â % |

|

Be aware: |

|

(1)Â Â Â Closure prices from 2030 to 2032 |

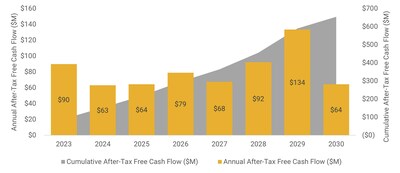

Las Chispas Operation Economics

Making an allowance for three-year trailing costs of $1,800 /ounces Au and $23.00 /ounces Ag because the Base Case, Las Chispas is predicted to generate moderate annual after-tax loose money waft of $84M from 2023-2029. At spot costs as of July 26, 2023 of $1,963 /ounces Au and $24.92 /ounces Ag the typical annual after-tax loose money waft is estimated to be $97M over the similar period of time.

As of January 1, 2023 , SilverCrest had $71M of internet running losses to be had which helped cut back taxes payable right through 2023. It’s estimated, on the Base Case, that those running losses shall be absolutely used by the top of 2023 and in consequence, give a contribution to the aid in after-tax loose money waft in 2024.

Determine 7 â LOM Unfastened Money Drift (FCF)

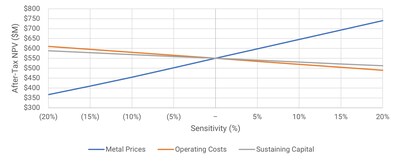

The Las Chispas Operation is maximum delicate to steel costs; then again, the money waft profile would no longer be considerably impacted by means of a lower on this metric.

Determine 8 â After-Tax NPV Sensitivities

The LOM mine stage AISC margin isn’t considerably impacted by means of a metamorphosis in steel costs. At Base Case steel costs, the mine stage AISC margin is 48%. Desk 8 underneath presentations the have an effect on on mine stage AISC margin for each and every 5% alternate in steel costs.

Desk 8 â Mine Stage AISC Sensitivity to Steel Costs

|

Steel Value Sensitivity % |

Mine Stage AISC Margin % |

|

(20) |

36 |

|

(15) |

40 |

|

(10) |

43 |

|

(5) |

45 |

|

â |

48 |

|

5 |

50 |

|

10 |

52 |

|

15 |

53 |

|

20 |

55 |

Alternatives

Probably the most vital supply of upside for Las Chispas stays the possible conversion of Indicated and Inferred Mineral Assets to Mineral Reserves and discovery of extra mineralization that can make stronger long run possible mine lifestyles expansion.

There’s an estimated 24.1 Moz AgEq (1.3 Mt grading 3.73 gpt Au and 269 gpt Ag, or 566 gpt AgEq) of Inferred Mineral Assets outlined within the Record. Nearly all of Inferred Mineral Assets are positioned within the Babicanora Sur, Babicanora Major and FW, El Muerto Splay and the Babicanora Norte Vein NW Extension. Specializing in upper likelihood conversion alternatives, there’s an estimated 15.0 Moz AgEq, together with 10.0 Moz AgEq of which can also be right away drilled as a possibility for possible upper grade Mineral Reserve substitute proximal to deliberate mining spaces for higher mine lifestyles or plant throughput. Exploration of a number of underexplored objectives on web site is already underway. The extra upper grade Inferred Mineral Assets shall be centered as soon as further underground construction has been finished.

There may be an estimated 23.3 Moz AgEq of Indicated Mineral Assets that weren’t integrated within the Mineral Reserve or manufacturing profile. There’s possible for a portion of those oz. to be integrated with additional drilling and engineering research.

Floor exploration has recognized over 23 km of possible vein strike period that stay underexplored, no longer together with objectives at intensity. Long term drilling will focal point on step-out drilling inside the recognized mineralization zones and checking out deeper host lithologies, parallel veins and newly recognized spaces. There additionally stay a number of blind veins with more than 100 drill intercepts grading greater than 500 gpt AgEq that require additional exploration consideration.

Along with exploration alternatives, endured checking out of long-hole stoping design (among others, AVOCA) will assessment the possible to scale back dilution and come with marginal oz. that weren’t transformed within the stope design and choice procedure. There can also be a possibility so as to add oz. by means of re-assessing the geotechnical requirements on pillar dimensions throughout the choice of further geotechnical knowledge. Different alternatives come with additional optimization of the mine design to scale back the specified construction metres and related prices, and in addition possible to extend procedure plant throughput if the mine ramp-up hurries up past the present proposed ranges.

Concerning the up to date Technical file

The Record, together with an up to date Mineral Useful resource Estimate and an up to date Mineral Reserve Estimate, shall be filed below the Corporate’s SEDAR+ profile inside of 45 days of this information free up.

Ausenco controlled the Record with a number of different engineering firms and experts contributing to sections of the Record. The companies and experts who’re offering Certified Individuals liable for the content material of the Record are, in alphabetical order, Ausenco Engineering Canada Inc., BBE Team Canada, Entech Mining Ltd., Hydro-Assets Inc., Knight Piesold Ltd., P&E Mining Specialists Inc., WSP Canada Inc., and WSP/Wooden Mine Products and services. The next self sufficient Certified Individuals with related companies have reviewed and authorized this information free up as outlined by means of Nationwide Tool 43-101 â Requirements of Disclosure for Mineral Tasks (“NI 43-101”):

- Kevin Murray , P. Eng, Ausenco

- Patrick Langlais , P.Eng, Entech Mining Ltd.

- Eugene J. Puritch , P.Eng., FEC, CET, P&E

- Benjamin Peacock , P.Eng., Knight Piesold

- Michael Verreault , P.Eng., M.Sc.A., Hydro-Ressources Inc

- Wynand Marx , BBE Team Canada

- Christopher Lee , P.Eng. WSP Canada Inc.

- Humberto Preciado , PhD, PE, WSP/Wooden Mine Products and services

This information free up has additionally been reviewed and verified by means of N. Eric Fier , CPG, P.Eng, CEO of SilverCrest and a Certified Individual as outlined by means of Nationwide Tool 43-101 â Requirements of Disclosure for Mineral Tasks (“NI 43-101”).

Convention Name

A convention name to talk about the result of the Record shall be held Tuesday, August 1, 2023 at 8:30 a.m. ET / 5:30 a.m. PT . To take part within the convention name, please dial the numbers underneath.

|

Date & Time: |

Tuesday, August 1, 2023 at 8:30 a.m. ET / 5:30 a.m. PT |

|

Phone: |

Toronto: Â +1-416-764-8624 |

|

Webcast: |

https://silvercrestmetals.com/traders/shows/ |

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian valuable metals manufacturer headquartered in Vancouver, BC , with an ongoing initiative to extend its asset base by means of increasing present Mineral Assets and Mineral Reserves, obtaining, finding and growing excessive price valuable metals initiatives and in the long run running more than one silver-gold mines within the Americas. The Corporate’s important focal point is working its Las Chispas Operation in Sonora, Mexico . The Corporate is led by means of a confirmed control crew in all facets of the dear steel mining sector, together with taking initiatives via discovery, finance, on time and on finances development, and manufacturing.

FORWARD-LOOKING STATEMENTS

This information free up incorporates “forward-looking statements” and “forward-looking data” (jointly “forward-looking statements”) inside the that means of acceptable Canadian and United States securities law. Those come with, with out limitation, statements with appreciate to: the timing and quantity of anticipated manufacturing from the Las Chispas Operation; the estimation of mine lifestyles, mining charges, Mineral Reserves and Mineral Assets, the metallurgical restoration charges, grade, manufacturing charge, the prices, and the money waft technology; and the strategic plans, timing and expectancies for the Corporate’s present and long run construction and exploration plans, together with however no longer restricted to the deliberate goal spaces and the possible to transform any portion of the Inferred Mineral Useful resource to economically viable Mineral Reserves. Such forward-looking statements or data are in line with plenty of assumptions, which might end up to be fallacious. Assumptions were made referring to, amongst different issues: provide and long run trade methods, endured business operations at Las Chispas, the surroundings by which the Corporate will function someday, together with the cost of gold and silver, estimates of capital and running prices, manufacturing estimates, estimates of Mineral Assets and Mineral Reserves and metallurgical recoveries and mining operational possibility; the reliability of Mineral Useful resource and Mineral Reserve Estimates, mining and construction prices, the prerequisites typically financial and monetary markets; availability of professional labour; timing and quantity of expenditures associated with exploration techniques; and results of law by means of governmental companies and adjustments in Mexican mining law. The true outcomes may vary materially from the ones expected in those forward-looking statements on account of possibility elements together with: the timing and content material of labor techniques; result of exploration actions; the translation of drilling outcomes and different geological knowledge; receipt, repairs and safety of allows and mineral assets titles; environmental and different regulatory dangers; undertaking value overruns or unanticipated prices and bills; fluctuations in gold and silver costs and basic marketplace and business prerequisites. Ahead-looking statements are in line with the expectancies and evaluations of the Corporate’s control at the date the statements are made. The assumptions used within the preparation of such statements, despite the fact that thought to be affordable on the time of preparation, might end up to be obscure and, as such, readers are cautioned to not position undue reliance on those forward-looking statements, which talk best as of the date the statements have been made. The Corporate undertakes no legal responsibility to replace or revise any forward-looking statements integrated on this information free up if those ideals, estimates and evaluations or different instances will have to alternate, except for as in a different way required by means of acceptable regulation.

CAUTIONARY NOTE TO US INVESTORS

This information free up contains Mineral Useful resource and Mineral Reserve classification phrases that agree to reporting requirements in Canada and the Mineral Useful resource and Mineral Reserve Estimates are made based on NI 43-101. NI 43-101 is a rule evolved by means of the Canadian Securities Directors that establishes requirements for all public disclosure an issuer makes of clinical and technical data regarding mineral initiatives. Those requirements vary from the necessities of america Securities and Change Fee (the “SEC”) acceptable to home United States reporting firms. Because of this, Mineral Useful resource and Mineral Reserve data integrated on this information free up is probably not related to an identical data that may usually be disclosed by means of United States home reporting firms matter to the reporting and disclosure necessities of the SEC. Accordingly, data regarding mineral deposits set forth herein is probably not related with data made public by means of firms that file based on US requirements.

NON-IFRS MEASURES

SilverCrest makes use of sure efficiency measures that don’t seem to be outlined below Global Monetary Reporting Requirements (“IFRS”) on this information free up. Non-IFRS measures should not have any standardized that means below IFRS and is probably not related to an identical measures offered by means of different issuers. The Corporate believes that, along with typical measures ready based on IFRS, control and likely traders use this knowledge to judge the Corporate’s efficiency and skill to generate money waft. Accordingly, it’s supposed to supply more information and will have to no longer be thought to be in isolation or as an alternative choice to measures of efficiency ready based on IFRS. For additional data on explanations and reconciliations of Non-IFRS measures for money prices, AISC and internet loose money waft, seek advice from the Non-IFRS Measures segment of the Corporate’s Control’s Dialogue & Research (“MD&A”) for the 3 months finishing March 31, 2023 , dated Would possibly 11, 2023 , starting on web page 14.

Money prices and money prices consistent with silver similar ounce payable

The Corporate makes use of money prices consistent with silver similar ounce payable to observe its running efficiency internally. Probably the most at once related measure ready based on IFRS is value of gross sales. The Corporate believes this Non-IFRS monetary measure supplies traders and analysts with helpful details about its underlying money prices of operations. Compared to Non-IFRS monetary measure disclosure within the Corporate’ MD&A, money value consistent with ounce on this information free up is in line with AgEq ounces payable, versus AgEq ounces bought.

AISC and AISC consistent with silver similar ounce payable

This Non-IFRS monetary measure targets to lend a hand readers in comparing the entire value of manufacturing silver from its operation. Probably the most at once related measure ready based on IFRS is value of gross sales. Compared to Non-IFRS monetary measure disclosure within the Corporate’ MD&A, AISC/ounces on this information free up is in line with AgEq ounces payable, versus AgEq ounces bought. As well as, for the aim of this information free up, AISC excludes however no longer restricted to company basic and administrative bills, exploration bills and share-based bills.

Internet loose money waft

Internet loose money waft isn’t supposed to be an alternative choice to the money waft data offered based on IFRS. The Corporate believes that this measure supplies treasured help to traders and analysts in comparing the Corporate’s skill to generate money waft after capital investments and construct the money assets of the Corporate. Probably the most at once related measure ready based on IFRS is internet money equipped by means of running actions much less internet money utilized in making an investment actions.

Treasury property

SilverCrest calculates treasury property as money and money equivalents plus bullion as reported within the consolidated statements of economic place. The Corporate believes that along with typical measures ready based on IFRS, treasury property comes in handy to judge the Corporate’s liquidity and capital assets.

N. Eric Fier , CPG, P.Eng

Leader Government Officer

SilverCrest Metals Inc.

![]() View unique content material to obtain multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-results-of-updated-independent-technical-report-301889737.html

View unique content material to obtain multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-results-of-updated-independent-technical-report-301889737.html

SOURCE SilverCrest Metals Inc.

![]() View unique content material to obtain multimedia: http://www.newswire.ca/en/releases/archive/July2023/31/c0251.html

View unique content material to obtain multimedia: http://www.newswire.ca/en/releases/archive/July2023/31/c0251.html