{“page”:0,” year”:2023,” monthnum”:8,” day”:2,” name”:” dividends-and-option-premiums-a-dual-income-story”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

Dividends and Choice Premiums: A Double Earnings Story

-

Classifications

Technique -

Tags

2023, call alternatives, covered call, diversity, dividend protection ratio, dividend yield, dividends, Dow Jones U.S. Dividend 100 3% Premium Covered Call Index, Dow Jones U.S. Dividend 100 7% Premium Covered Call Index, Dow Jones U.S. Dividend 100 Index, institutional financier, multi-asset, S&P 500 Dividend Aristocrats, volatility

Earnings generation might be looked for by a range of market individuals, consisting of those nearing retirement and those looking for a source of passive earnings. An income-focused method needs a various technique to those concentrated on creating development. Conventional income sources consist of dividend-paying stocks and coupon-paying bonds. The financial landscape of the previous 18 months has actually been formed by relentless inflation, increasing rates of interest and basic market unpredictability, all of which have actually adversely impacted the efficiency of these conventional techniques.

To assist diversify danger and include incremental earnings, market individuals may search for non-traditional income sources generation such as a covered call method. The Dow Jones U.S. Dividend 100 3% Premium Covered Call Index and the Dow Jones U.S. Dividend 100 7% Premium Covered Call Index are created to determine the efficiency of a long position in high-dividend-yielding stocks and a brief position in a basic S&P 500 ®(* )month-to-month call alternative. The underlying equity index utilized for the Dow Jones U.S. Dividend 100 Covered Call Indices is the

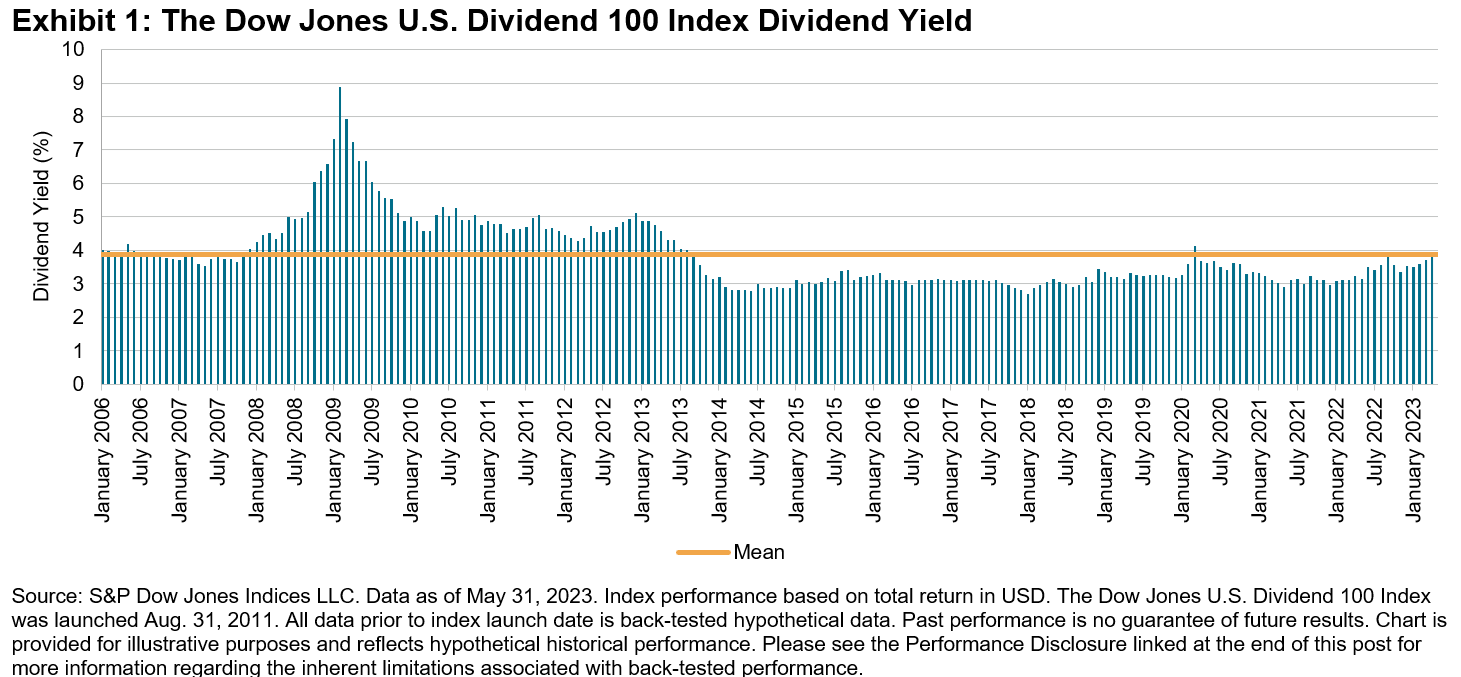

Dow Jones U.S. Dividend 100 Index, which determines the efficiency of high-dividend-yielding U.S. stocks. Considering that 2006, the Dow Jones U.S. Dividend 100 Index has actually published a typical dividend yield of 3.88% (see Display 1), conveniently surpassing the S&P 500 Dividend Aristocrats ® (2.58%) and the S&P 500 (1.95%). A covered call method includes offering a call alternative on a long equity position. If the property’s market value goes beyond the alternative’s strike, a logical alternative purchaser would work out the agreement and obligate the alternative author to offer the property or settle in money. The primary possible advantages of this method are the capital produced from composing the calls– alternative premiums– and the restricted drawback security that the premiums can offer. Likewise to dividends, the capital gotten from alternative premiums can alleviate the impacts of down markets. The primary disadvantage of a covered call is the restricted benefit capacity of the equity position. Covered call techniques are especially pertinent throughout unpredictable market conditions. Choice premiums tend to increase as volatility increases, using the capacity for higher earnings generation and included drawback security.

What makes the

Dow Jones U.S. Dividend 100 3% Premium Covered Call Index and the Dow Jones U.S. Dividend 100 7% Premium Covered Call Index distinct is that they integrate a conventional dividend-paying earnings method and a non-traditional covered call technique. Both indices show the exact same dividend yield as the underlying Dow Jones U.S. Dividend 100 Index, which has actually balanced 3.88% given that 2006. In addition, each index targets a particular premium yield of 3% and 7%, respectively. Historically, these indices have actually changed their protection ratios and effectively accomplished their target yields (see Exhibitions 3 and 4). The protection ratio is specified as the notional worth of the brief call position as a portion of the long equity notional quantity. For instance, a protection ratio of 100% indicates that calls were composed versus the whole worth of the long equity position, while a protection ratio of 25% represents that the worth of the calls represents one-fourth of the equity position. The vibrant nature of the protection ratio offers the index with some drawback security (from the covered brief position) in addition to direct exposure to equity benefit (from the exposed long equity position).

For market individuals looking for 2 income sources, including a covered call overlay might offer incremental earnings beyond what might be accessed from a simply dividend-paying equity index. The alternative for target yields of 3% or 7% offers the capability to pick the perfect benefit capacity.

The posts on this blog site are viewpoints, not recommendations. Please read our

Jim Wiederhold

S&P GSCI, the broad products criteria, began the 2nd half of the year in a blistering heat wave and increased 11% on the back of petroleum products, which all increased by more than 14% in July. The staying 4 sectors within the S&P GSCI likewise increased throughout the month, as worries of an economic crisis eased off with inflation falling and the Fed perhaps getting near to ending their rate treking cycle. Strong inflows into product ETFs and the covering of brief positions throughout specific products assisted to produce a prospective bottom in a couple of crucial products futures markets. The energy sector entirely reversed its underperformance from the very first half of the year, bringing all products into favorable area for 2023. OPEC+ production cuts and the lack of unfavorable financial information assisted to raise the fossil-fuel-based products in July. Need for petroleum has actually stayed strong throughout the energy shift, as the world continues to depend on old methods to sustain the economy, as can be seen by strong import need throughout countries, especially in Asia. The

S&P GSCI Gasoil and the S&P GSCI Heating Oil were the standouts for the month, increasing 23.8% and 22.9%, respectively. The

S&P GSCI Industrial Metals increased 6.5% with all 5 of the top-traded metals increasing in July. For the previous couple of months, Product Trading Advisors (CTAs) had big brief positions in the area, however brief covering in July resulted in a strong bounce off the lows for numerous crucial metals, which have actually published a few of the worst YTD efficiency rates in the products markets. Another source of favorable news originated from the rare-earth elements sector. The

S&P GSCI Gold was up 8.1% YTD, as market individuals placed for future U.S. dollar weak point with expectations for the Fed to end their rate treking cycle quickly. Reserve banks around the world have actually increased their gold reserves just recently at a speed not seen in years, which usually prefaces an increase in gold rates. The S&P GSCI Silver signed up with the celebration by increasing 9.0% in July and moving into favorable area for the year. This usually takes place as silver tends to track gold relocations greater, however with a lag. The

S&P GSCI Farming grew by a modest 3.0%, while the S&P GSCI Wheat and the S&P GSCI Corn increased the most as issues over the most recent crop yields were popular. A current S&P Worldwide post highlighted the capacity for China to have actually reached peak food need China is the greatest customer of grains internationally, however the World Bank just recently anticipated that after years of strong development, their population will fall by 80 million individuals over the next 25 years. Could this cause less need, or will brand-new locations of need, such as in more eco-friendly biofuels, stimulate brand-new worldwide usage to supplant the drop in the food requirements of China gradually? The posts on this blog site are viewpoints, not recommendations. Please read our

Craig Lazzara

twenty years of live history, the S&P 500 ®(* )Equal Weight Index has actually exceeded the S&P 500 by a considerable margin. In between Dec. 31, 1990, and June 30, 2023, Equal Weight’s substance yearly development rate was 11.82%, well ahead of the cap-weighted S&P 500 at 10.55%. This efficiency edge is a item of robust underlying attributes, most significantly a tilt towards smaller-capitalization stocks. Equal Weight’s historic returns have exceeded those of practically every active large-cap U.S. equity portfolio in our SPIVA ® database.(* )However the honest observer should acknowledge that Equal Weight’s efficiency benefit does not accumulate efficiently Display 1 plots the ratio of efficiency in between Equal Weight and the cap-weighted S&P 500. When the line in Display 1 is increasing, Equal Weight is surpassing; a falling line shows cap weight outperformance.

As the exhibition recommends, there can be extended periods of both under- and outperformance. For instance, Equal Weight lagged for more than 5 years in between August 1994 and February 2000, and after that started a six-year run of exceptional returns. We need not look up until now back in time to discover examples of market rotation in between Equal Weight and cap weight. In calendar 2022, Equal Weight exceeded the S&P 500 by 6.7%; in the very first 6 months of 2023, Equal Weight lagged by 9.9%. Display 2 reveals the distinction in between Equal Weight and cap weight over a routing six-month horizon. The typical distinction, determined over all six-month periods, was 0.59%. Display 2 makes it clear that when the series is well above that level, it tends to decrease; when well listed below that level, it tends to increase. Since June 30, 2023, the routing six-month distinction was -9.86%, which

ranks at the 2

nd

percentile of all observations If the historic circulation of returns is a reasonable representation of the future circulation, this indicates that the Equal Weight– cap weight spread is much more most likely to increase than to fall. Keep In Mind Stein’s Law: “If something can not go on permanently, it will stop.” However when? I would inform you if I understood, however thus numerous concerns in financial investment management, agnosticism is the most sensible action However, the information do inform us something essential about the

speed with which market patterns can reverse. The worst six-month period for the relative efficiency of Equal Weight ended with the innovation bubble in February 2000, as Equal Weight lagged the S&P 500 by 10.79%. The

finest six-month period for the relative efficiency of Equal Weight ended in February 2001, when Equal Weight exceeded by 20.04%. The space in between the worst and the very best readings in our 32-year history was just 12 months. A consultant who lowered his Equal Weight holdings in 2000 since of then-disappointing efficiency would most likely have actually discovered it much more frustrating to miss out on the subsequent turnaround. Effective property management often needs holding positions when one’s natural impulse is to offer

Perseverance is most needed when its possible advantage is fantastic. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Tags cap weight, Craig Lazzara,

S&P Dow Jones Indices

-

Tags

2023, tidy energy, -

ESG,

Inflation Decrease Act, renewable resource, S&P Global Clean Energy Index, S&P Global Clean Energy Select Index, sustainability, thematics, United States FA As we begin the 2nd half of 2023, we wished to evaluate a few of the crucial advancements from the very first half of the year in the tidy energy area and evaluate the outcomes of the S&P Global Clean Energy Index Series rebalance from April. Secret Advancement Federal Government Costs in Tidy Energy Area Continues in 2023

In Might 2023, 2 brand-new programs were revealed by the U.S. federal government to support tidy and inexpensive energy, as part of the Inflation Decrease Act. These 2 programs, with a combined quantity of nearly USD 11 billion in grants and loan chances, will bring tidy energy to rural energy and energy service providers.

1

Global Financial Investment in Clean Energy Keeps Increasing

Based Upon the International Energy Company’s most current World Energy Financial investment 2023 report, worldwide financial investment in tidy energy continues to increase and is forecasted to reach USD 1.7 trillion in 2023. The distinction in between the financial investment in tidy energy and nonrenewable fuel sources has actually continued to increase, implying we continue to see more capital purchased the tidy energy area than ever previously. 2

Renewable-Generated Electric Power Went Beyond Coal-Fired for Very First Time in the U.S.

Information for 2022 revealed by the U.S. Energy Info Administration reveals that eco-friendly sources, consisting of solar, wind, hydro, biomass and geothermal energy, produced 21% of the electrical power in the U.S., going beyond the 20% from coal for the very first time in history. The biggest source of U.S. electrical energy generation originates from gas which represents 39%. Amongst the renewables, wind and solar continue to be the 2 significant chauffeurs of development. 3

The G7 Settled On Joint Targets for the Growth of Renewable Resources for the Very First Time

The G7 (Canada, France, Germany, Italy, Japan, the U.K. and the U.S.) ministers fulfilled in Sapporo, Japan in April to talk about environment, energy and ecological concerns. At the conference, the G7 nations accepted jointly increase the overseas wind capability of 150GW and boost solar photovoltaics to more than 1TW by 2030. 4

April Rebalance

Introduced in 2007, the S&P Global Clean Energy Index

has actually been the criteria to determine tidy energy-related business’ efficiency over the previous 16 years. In April 2021, we likewise introduced the

S&P Global Clean Energy Select Index, which is created to determine the 30 biggest business in worldwide tidy energy services that are noted on industrialized market exchanges. Both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index went through a semi-annual rebalance on April 21, 2023. In the index method, we appoint business to 4 containers of direct exposure ratings from 0 to 1 with an increment of 0.25 to determine their pureness of direct exposure towards the tidy energy organization. Display 1 reveals the modification of direct exposure prior to and after the April rebalance. We can see that for the S&P Global Clean Energy Index post-rebalance, we have 3 more business with a direct exposure rating of 0.75 and one business with a direct exposure rating of 0.5 being contributed to the index. The weighted typical direct exposure rating of the index enhanced a little from 0.92 to 0.93. The S&P Global Clean Energy Select Index, on the other hand, picks 30 business with a direct exposure rating of 1 noted in the industrialized market exchanges. S&P Global Clean Energy Index Efficiency in H1 2023 After surpassing the

S&P Global BMI

in 2022, both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index underperformed throughout the very first half of 2023.

The S&P Global Clean Energy Select Index was down 2.74% and the S&P Global Clean Energy Index was down 7% in USD overall return terms. There was considerable dispersion seen amongst constituents; a few of the efficiency draggers consist of Sunpower (-45.65%), Enphase Energy (-36.79%) and Sunrun (-25.65%), while Cia Energetica (up 34.32%), Chubu Electric Power (up 31.31%) and Very First Solar (up 26.9%) contributed favorably to the efficiency. The energy shift is a long-lasting megatrend, and S&P Global Clean Energy Index series continues to assess the efficiency in the tidy energy area. 1

https://www.usda.gov/media/press-releases/2023/05/16/biden-harris-administration-makes-historic-11-billion-investment

2

https://www.iea.org/reports/world-energy-investment-2023/overview-and-key-findings 3

https://www.eia.gov/todayinenergy/detail.php?id=55960 4

https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/20/g7-hiroshima-leaders-communique/ The posts on this blog site are viewpoints, not recommendations. Please read our

Comparing Protective Consider the Current Market Environment On Sept. 17, 2020, S&P DJI’s Indexology blog site shared a post I composed entitled “ Comparing Protective Aspects Throughout the Last 3 Bear Markets

” This blog site is an extension of that research study, taking a look at the outcomes of the exact same elements throughout the 18-month duration around the 2022 market correction that led the S&P 500

® formally into bearishness area. As described in the September 2020 post, Low Volatility and Quality have actually been typically described as protective elements. One factor is they have actually traditionally displayed less volatility, as determined by basic variance, on a constant basis. Another factor is that over the long term, the optimum drawdown of each of these indices has actually not matched the degree of the optimum drawdown experienced by the S&P 500. A 3rd factor is that, usually, the S&P 500 Quality Index and the S&P 500 Low Volatility Index have actually exceeded the S&P 500 throughout the worst equity market programs. In the 2020 post, the bearish market of 2002, 2009 and 2020 were compared by taking a look at the efficiency of the S&P 500, S&P 500 Low Volatility Index and the S&P 500 Quality Index over an 18-month duration that consisted of comparable amount of time pre and post equity market low. Particularly, the 2002 analysis consisted of 88 days of healing after the low of 2002, the 2009 analysis consisted of 116 days of healing after the low of 2009, and the 2020 analysis consisted of 102 days of healing after the most current low. This upgrade analyzes an 18-month duration from June 30, 2021, to Dec. 31, 2022, consisting of 80 days of healing after the 2022 closing low of the S&P 500, signed up on October 12. As a refresher here are the 3 bearishness contrasts from the 2020 report.

The 3 durations analyzed above revealed the regularly lowered volatility related to the S&P 500 Quality Index and the S&P 500 Low Volatility Index compared to its criteria, the S&P 500, throughout those 3 bearish market. When it pertains to returns, the S&P 500 Low Volatility Index and the S&P 500 Quality Index both exceeded in 2002 and 2009. Nevertheless, in 2020, while the S&P 500 Quality Index exceeded the S&P 500 once again, the S&P 500 Low Volatility Index underperformed.

How did the S&P 500 Quality Index and the S&P 500 Low Volatility Index fare throughout the most current tough equity market environment?

Over the 18-month duration from June 30, 2021, to Dec. 31, 2022, the protective nature of the 2 indices held up fairly well vs. the S&P 500. Both produced exceptional relative returns over the measurement duration, however just the S&P 500 Low Volatility Index experienced lower volatility versus the S&P 500, while the S&P 500 Quality Index was normally in line with the S&P 500.

Whether we are still in the middle of an extended bearishness or in the early phases of a brand-new booming market is not part of the conversation of this analysis. Nevertheless, what is intriguing to keep in mind from this upgrade is that protective elements continue to reveal some relative strength throughout bad equity environments.

The info included herein has actually been offered by Andrew Neatt, Senior Citizen Portfolio Supervisor and Senior Citizen Financial Investment Consultant of TD Wealth Private Financial Investment Guidance is for info functions just. The info has actually been drawn from sources thought to be trusted.

Charts and charts are utilized for illustrative functions just and do not show future worths or future efficiency of any financial investment. The info does not offer monetary, legal, tax or financial investment recommendations. Specific financial investment, tax, or trading techniques ought to be assessed relative to each person’s goals and run the risk of tolerance.

Index returns are revealed for relative functions just. Indexes are unmanaged and their returns do not consist of any sales charges or costs as such expenses would reduce efficiency. It is not possible to invest straight in an index.

TD Wealth Private Financial Investment Guidance is a department of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers