2023.07.27

By now, we have actually most likely given up to the reality that food costs will continue to get more costly worldwide.

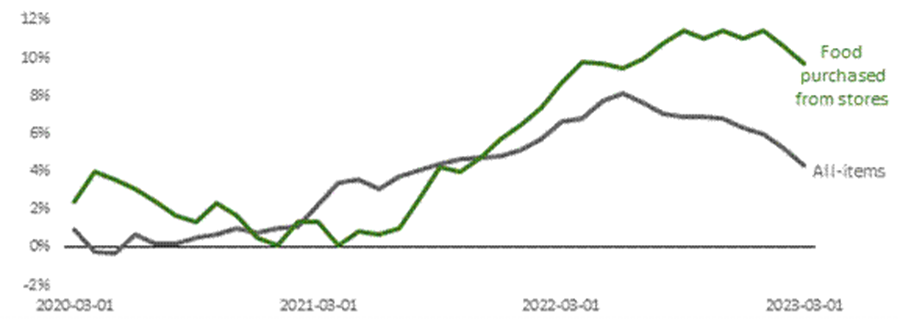

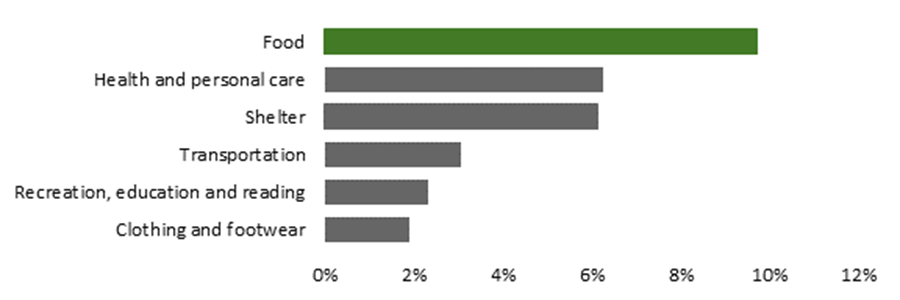

Here in Canada, the typical grocery costs simply continues increasing, and to some families, it’s now borderline unaffordable. For the month of June, Canada’s food inflation was tape-recorded at 9.1% year-over-year, acting on a 9% boost in Might.

Compare that to a general inflation rate of 2.8%, which has actually decreased over the previous year, the method food costs are trending appears to be a huge issue.

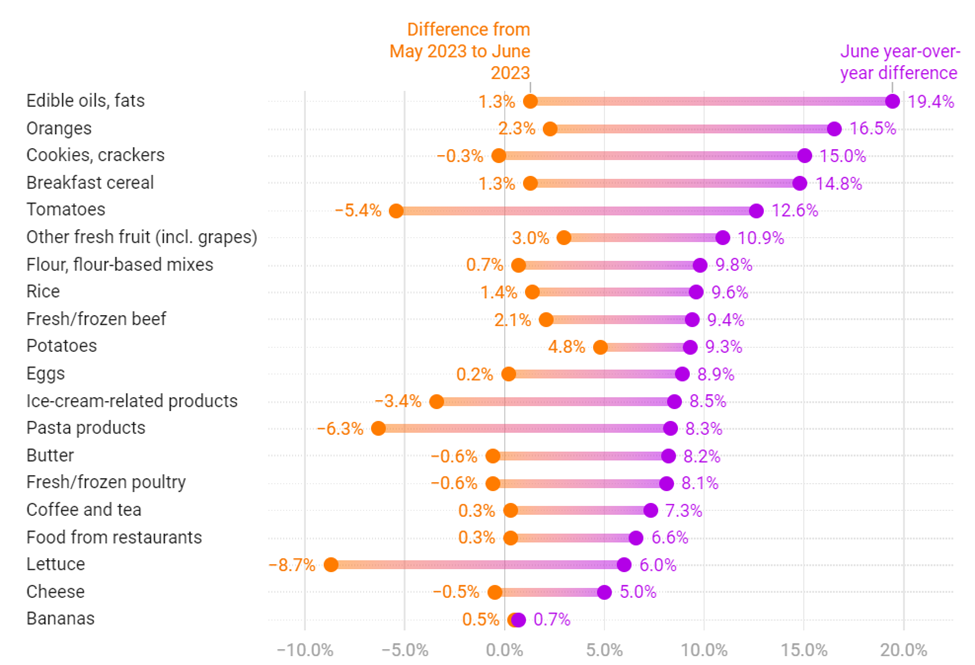

StatCan stated by means of CTV News last month that edible oils and fats, bakeshop items and cereal items are at the greatest year-over-year, with food from dining establishments likewise climbing up.

This seems a running style throughout the world’s significant economies. Really, Canada’s scenario might not be so bad when compared versus others. In the United States, for instance, regardless of inflation being up to its least expensive yearly rate in more than 2 years in June, food costs still increased 0.1% on the month.

” We really have the most affordable food inflation rate within the G7 after the United States, therefore I understand that a great deal of individuals are worried about food costs, however Canada really has actually done relatively well,” Sylvain Charlebois, director of the Agri-Food Analytics Laboratory at Dalhousie University, just recently informed CBC

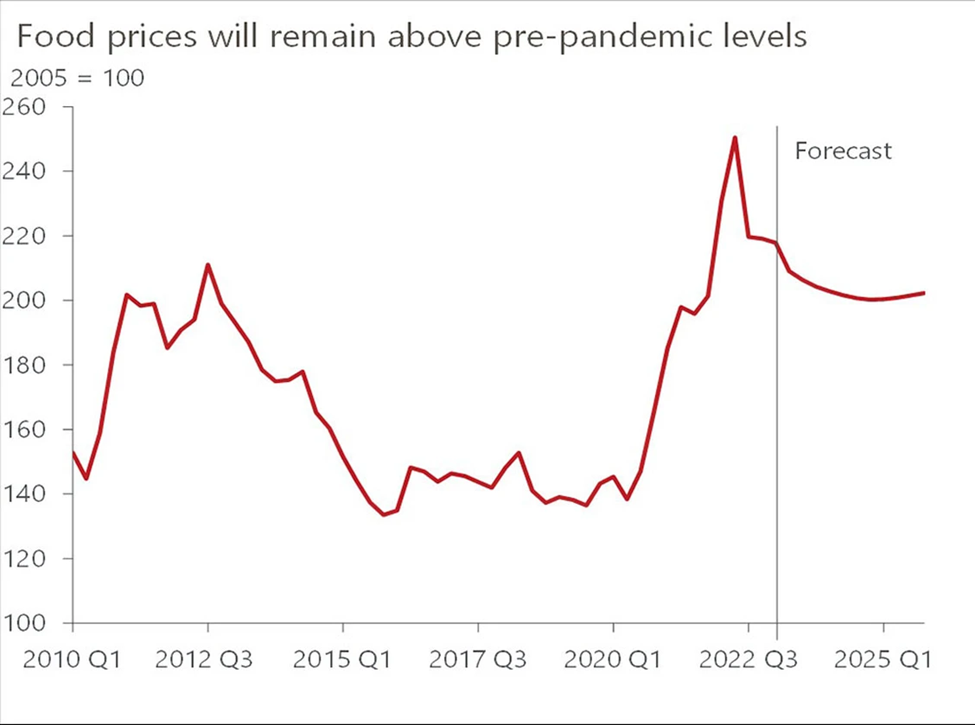

While lots of projection that food costs in Canada (and other locations) are anticipated to come down prior to completion of the year, they are still sitting well above the historic averages.

And when compared to 2021– when the international supply was struck by a mix of pandemic interruptions, unfavorable weather condition and labour scarcities– food inflation stays significantly greater. Considering that 2021, food costs in Canada have actually climbed up 18% and have actually remained stubbornly high, and they did not peak till this previous January.

Both RBC Economics and Oxford Economics, by means of the Financial Times, forecasted that while food inflation will continue to reduce this year, food costs will not go back to levels seen prior to the pandemic. Oxford sees international food costs staying 25% greater than throughout the pre-pandemic years

So moving on, we’re most likely to see traditionally high food costs as they will not ever revert back to what they were a number of years earlier.

This year’s Canada’s Food Rate Report is anticipating a 5% to 7% food cost boost in 2023, with the most significant boosts in veggies, dairy, and meat.

” We have not seen food costs increase this high in Canada for over 40 years and based upon our findings, the boosts we have actually forecasted are still rather high however not as high as the boosts for 2022,” stated Dr. Simon Somogyi, University of Guelph school lead.

” That might be cold convenience for Canadians, as food costs are currently high, however if inflation can boil down, it’s possible that we might see cost boosts for 2023 at or listed below 5%.”

The United States is dealing with a comparable fate, with all food costs anticipated to increase 6%, within a forecast period of 5% to 7.1%, according to the United States Department of Farming.

So why are food costs increasing regardless of steps required to fight inflation? There’s no single perpetrator. As RBC financial experts just recently put it– “almost whatever” you might think about.

Listed below, we note out a few of the most popular perpetrators behind our increasing grocery expenses:

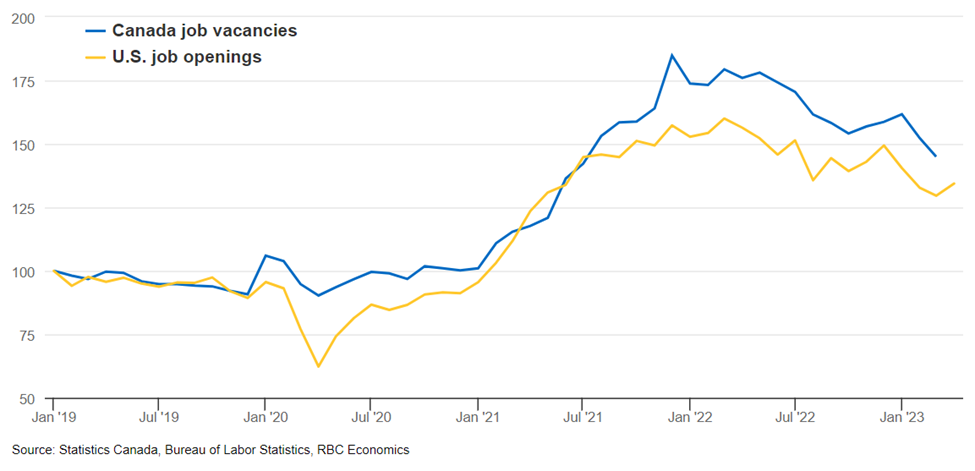

Low Joblessness

In late 2022, Bank of Canada guv Tiff Macklem stated that Canada’s low joblessness rate is not sustainable and is adding to decades-high inflation.

Financial theory recommends that when companies have a hard time to discover employees to stay up to date with need for products and services in the economy, they’ll be required to use greater salaries. In turn, employees will have more cash to invest, and therefore putting more pressure on costs.

” The tightness in the labour market is a sign of the basic imbalance in between need and supply that is sustaining inflation and harming all Canadians,” he stated throughout a speech in Downtown Toronto

The most recent study from StatCan reveals that the Canadian joblessness rate stays strongly below par from previous to the pandemic-induced crash. June 2023 saw just the 2nd month-to-month boost considering that August of 2022, at 5.4%. In spite of this small healing, the joblessness rate is still on a down pattern, distancing itself from the 2021 typical rate of 7.5%.

The greater joblessness can likewise be credited to migration, which lots of think is assisting to reduce the Canadian task market.

” The quickly growing labour force, which was likewise assisted along by an increase in involvement, will even more reduce a few of the labour scarcities reported by companies,” composed Desjardins economic expert Royce Mendes in a note.

” The supply of employees entering Canada has actually surpassed task development, which is why the joblessness rate has actually increased,” Pedro Antunes, primary economic expert at the Conference Board of Canada, informed CBC

The more informing figure is most likely the tasks openings, which far surpassed expectations with 60,000 tasks acquired in June. This indicates that Canadian food manufacturers are most likely dealing with a growing labour scarcity, and will be giving greater expenses to customers.

A report launched in April from RBC’s Environment Action Institute tasks that Canada’s farming sector is anticipated to be short some 24,000 basic farm, nursery and greenhouse employees over the next years.

The RBC report tasks that, in the short-term, Canada will require to draw in 30,000 long-term immigrants to develop their own farms or take control of current ones to preserve the farming sector’s output.

” This is putting the sector on the cusp of among the most transformative labour shifts in this nation’s history,” Mohamad Yaghi, RBC’s farming and environment policy lead, informed Global News

Taking that minute– or not– might have considerable effect on just how much Canadians invest in journeys to the supermarket, he included.

‘ Greedflation’ of Grocers?

Another description for getting bigger grocery expenses, as some Canadian customers are led to think, is that grocers have actually been utilizing inflation as a reason to trek costs and pad their own earnings margins– a practice they call “greedflation”.

” While the food and drink retail sector has actually been dealing with … expense pressures associated with provide chain problems and labour scarcities, they have likewise over the very same duration tape-recorded a boost in their earnings,” the Competitors Bureau composed in a report launched on June 13

This has actually led some to hypothesize regarding whether Canada’s 5 biggest sellers, who manage 80% of the grocery market, are taken part in ‘cost gouging’– which normally takes place following a need or supply shock, a prime example being the COVID pandemic.

In Between 2019 and 2022, the revenues of Canada’s 3 biggest grocers increased by $1.2 billion, representing a 50% boost over the four-year duration, the research study discovered.

” The reality that Canada’s biggest grocers have actually normally had the ability to increase these margins– nevertheless decently– is an indication that there is space for more competitors in Canada’s grocery market,” the report recommended.

Market watchers consisting of Charlebois weren’t at all surprised by the findings. The most important part of the research study, he stated by means of the Financial Post, is that it acknowledges that all levels of federal government require to be associated with enhancing the competitive landscape of the Canadian grocery sector.

Nevertheless, the “greedflation” claims were unmasked by reputable sources, consisting of 2 different research studies by Stats Canada and the Bank of Canada. In StatCan’s report, it associated food cost inflation to its numerous international causes, without any recommendation Canada’s grocers were benefiting from the scenario.

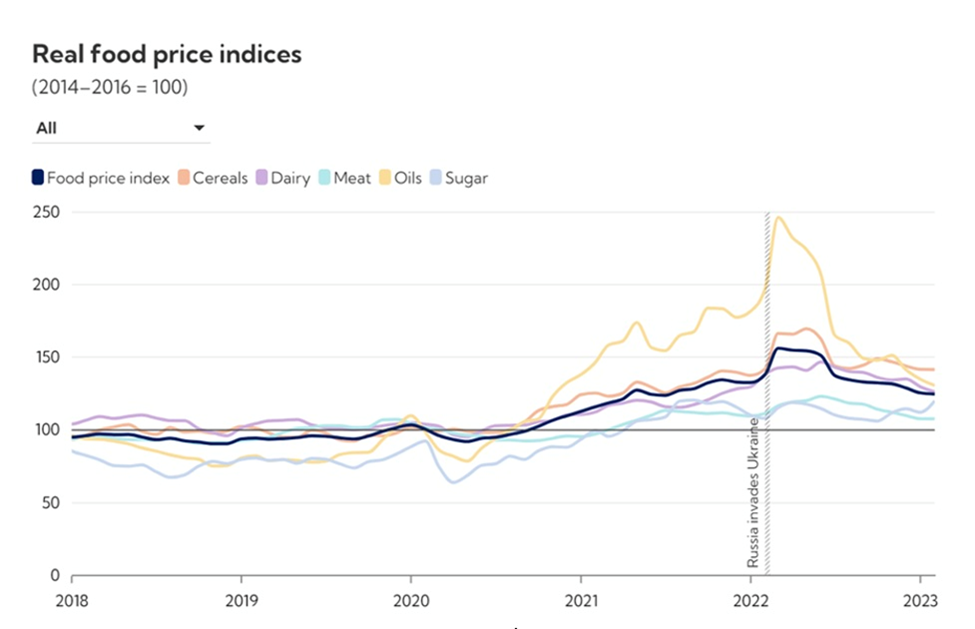

Russia-Ukraine Dispute

On a worldwide scale, Russia’s intrusion of Ukraine may be the single most significant driver resulting in the high food costs we’re seeing today.

Lots of establishing and emerging market nations count on food imported from Ukraine and Russia– called ‘the breadbasket of Europe’ due to the area’s abundance of grains like wheat, barley, corn and soybeans. For wheat, Russia and Ukraine are the biggest and seventh biggest exporters respectively.

It’s for that reason simple to see why food costs might increase as quickly as the war broke out.

Within about a week of Russia crossing into eastern Ukraine in the dawn of February 24, 2022, costs for grains like soybeans and some veggie oils surged about 50% to 60%, Joseph Glauber, a senior research study fellow at the International Food Policy Research Study Institute (IFPRI), informed ABC News

The Food Rate Index, which is utilized to determine the month-to-month modification in global costs of a basket of food products launched by the United Country’s Food and Farming Company, revealed a spike in March 2022, however then hung back down to pre-war levels numerous months later on.

Nevertheless, IFPRI’s Glauber alerted that “We remain in a stage of the marketplace where, a minimum of for the time being, it’s prematurely to state that we run out the woods.”

The war includes complex measurements on energy and fertilizer costs, products that Russia is a big exporter of, which likewise indirectly afflicted food costs, Glauber included.

With the war revealing no indications of stopping, who understands the length of time the inflationary pressures on our food supply might drag out. Making matters worse, while food costs went back to pre-invasion levels for much of the previous year, those levels are still a record high compared to the last years.

The international food supply remains in a “tight market” in the coming year, particularly as the war continues, Glauber forecasted. Plantings in Ukraine are down 35% to 40%, suggesting that a person of the significant exporters on the planet is going to produce far less once again this year, he stated.

In a different interview with NPR, Glauber kept in mind that about 25 to 35% of Ukraine’s historic wheat production remained in locations now inhabited by Russia, and over the in 2015, wheat production has actually been off by about 35%.

And with Russia taking out of the Black Sea grain offer, an arrangement that had actually looked for to avoid a worldwide food crisis by enabling Ukraine to continue to export, things are looking alarming.

” Then we’re right back to a point where extremely little of that grain that remains in Ukraine would really make it to the remainder of the world,” Glauber stated.

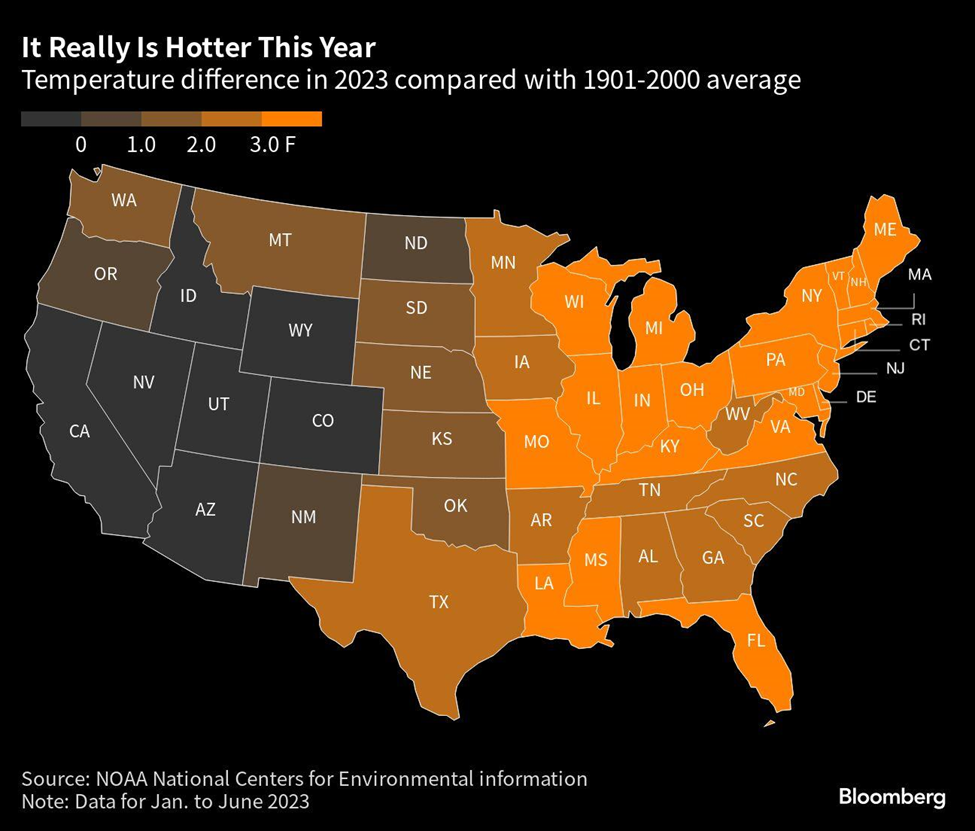

Environment Modification

Looking past the local trade interruptions, the effect of environment modification on food supply and costs over a longer horizon likewise can not be downplayed. Worldwide warming is affecting weather condition patterns, triggering heat waves, heavy rains, and dry spells, making it challenging to grow crops in lots of parts of the world every year.

According to the World Bank, about 80% of the international population most at danger from crop failures and appetite from environment modification remain in Sub-Saharan Africa, South Asia, and Southeast Asia, where farming households are disproportionately bad and susceptible. A serious dry spell triggered by an El Nino weather condition pattern or environment modification can press millions more individuals into hardship.

The company likewise stated increasing food product costs in 2021 were a significant consider pressing roughly 30 million extra individuals in low-income nations towards food insecurity.

Around harvest in 2015, the Wall Street Journal reported that staple crops like corn, rice and Mexican chilies, all of which are susceptible to heat and an absence of water, were seeing yields a portion of typical levels.

Waterways that normally feed farming systems were parched, consisting of Italy’s River Po, which represents approximately 40% of the nation’s farming production; and China’s Yangtze River, a vital life source for crops. France in 2022 experienced the most serious dry spell ever tape-recorded and China had the driest summertime in 6 years.

Gustavo Naumann from the International Center on Environmental Keeping track of explained the affiliation in between regional market conditions and internationally, especially for crops grown in so-called breadbaskets like South America, main United States, Ukraine, India and China. When a dry spell strikes several of these locations, there is less supply of staple crops in the international market, which presses costs up.

Researchers, states the WSJ, projection there will be an uptick in the frequency and seriousness of dry spells, as temperature levels continue to increase which indicates economies are going to need to brace themselves as dry spells can threaten international food security.

Up until now in 2023, those forecasts appear to be “ideal on the cash.”

Take what’s taking place in Kansas as a precursor. The state generally produces even more wheat than any other state, however Kansas wheat farmers will apparently gain their tiniest harvest in more than 60 years, the outcome of a two-year dry spell that has actually withered the crop. This is concurrent with what is the worst growing condition in the United States in more than 3 years.

Things are so bad, flour mills will likely need to purchase wheat grown in eastern Europe.

While rains levels have actually enhanced after hot and dry conditions previously this year, the weather condition is anticipated to turn once again throughout the Midwest into early August, simply as corn and soybean crops go through crucial advancement phases, according to Arlan Suderman, primary products economic expert at brokerage StoneX.

The Department of Farming projections that durum wheat output will fall 16% this year, with other spring ranges down 1%.

Transportation problems are additional intensifying food security issues. Water levels on the Mississippi and Ohio rivers are succumbing to a 2nd straight year, raising the possibility of shipping issues on essential freight paths.

” I would be shocked if international food costs do not begin increasing once again after over a year of reducing,” Caitlin Welsh, a food specialist at the Center for Strategic and International Researches in Washington, informed Bloomberg “We’re experiencing numerous hazards to farming markets.”

Severe heat is likewise swallowing up big swaths of other continents.

Today, it’s so hot in southern Europe that cows are producing less milk and tomatoes are being destroyed. Grain harvests will be much smaller sized too after dealing with dry spell.

Dry spells have actually suggested that grains production in Italy, Spain and Portugal will be as much as 60% lower than in 2015, adding to perhaps the EU’s worst grain harvest in 15 years, according to farm lobby Copa and Cogeca.

While the complete degree of the damage will depend upon the length of time the undesirable conditions continue, there are currently clear indications of damage in vegetables and fruit in southern Europe, which provides much of the continent.

In Sicily, some tomatoes have ominous-looking black rings, the outcome of a so-called bloom end rot, when severe weather condition renders plants calcium-deficient.

The temperature levels have actually accelerated ripening or triggered heat burns on whatever from grapes to melons, apricots and aubergines. Bee activity and pollination is impacted and wheat production is down, according to farmers group Coldiretti.

” This is not simply a routine hot summertime,” stated Lorenzo Bazzana, an agronomist at Coldiretti. “They state plants ought to adjust to the environment modifications, however we are discussing cultures that progressed gradually over countless years, they can not adapt to an environment that keeps altering so rapidly therefore drastically.”

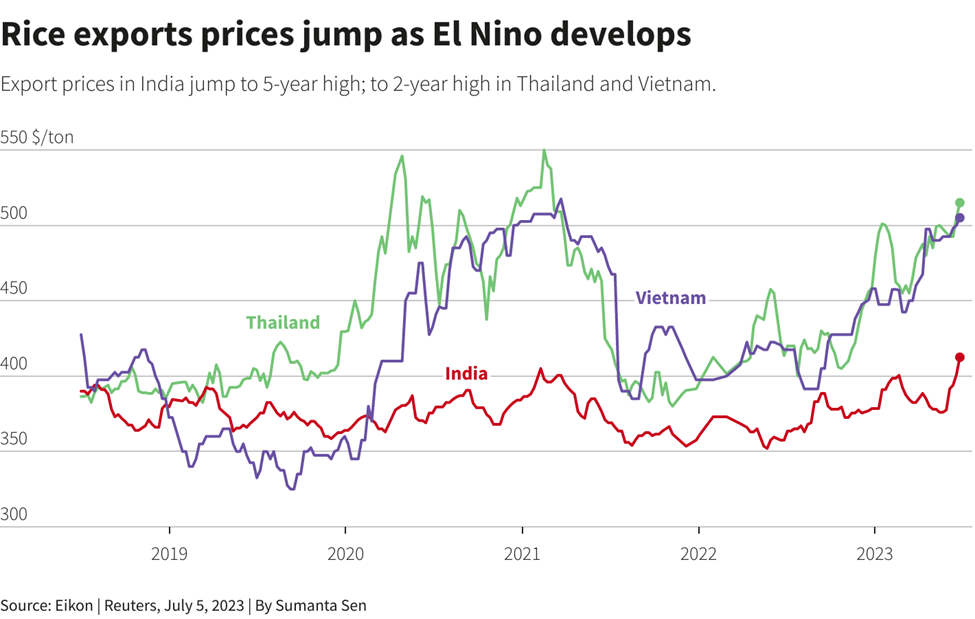

In Asia, the yields from China’s rice fields are at danger, as heats will likely require the early ripening of the crop. Rates for rice in Asia just recently reached a two-year high as importers developed stocks.

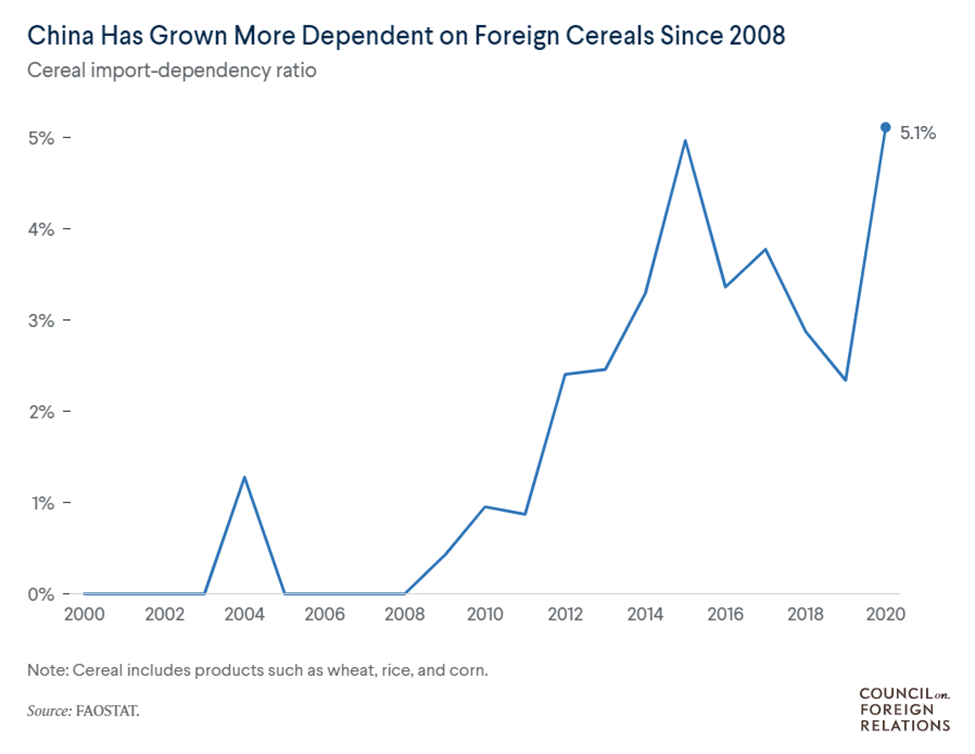

China Becoming Web Importer

If the weather-related occasions are not bothersome enough, Asian economies stockpiling food materials will undoubtedly make things even worse.

China, probably the world’s most significant customer, has actually currently been increasing its dependence on food imports over the previous 20 years, triggering worries of interruptions and imbalances to the international supply.

With less than 10% of the world’s arable land, China produces one-fourth of the world’s grain and feeds one-fifth of the world’s population, according to the Food and Farming Company.

Information from the nation’s National Bureau of Stats revealed that in 2022, its grain output reached a record high of 686.53 million lots regardless of postponed plantings, severe weather condition and COVID-19 interruptions.

China presently ranks very first internationally in producing cereals (such as corn, wheat, and rice), fruit, veggies, meat, poultry, eggs, and fishery items.

Yet, the country has actually been a net importer of farming items considering that 2004. Today, it imports more of these items, consisting of soybeans, corn, wheat, rice, and dairy items, than any other nation, the bureau’s data reveal.

In Between 2000 and 2020, the nation’s food self-sufficiency ratio reduced from 93.6% to 65.8%, suggesting it has actually moved far from domestic production over that duration. Altering diet plan patterns have actually likewise increased China’s imports of edible oils, sugar, meat and processed foods. In 2021, its edible oil import-dependency ratio reached almost 70%, which is nearly as high as its petroleum import reliance.

According to the Council on Foreign Relations, an American think tank, a main element has actually been Chinese individuals’s significantly advanced dietary needs, driven by a growing city-dwelling middle class pursuing more secure, more varied and higher-quality food. Issues about food security in specific have actually increased need for imports.

Chinese leaders likewise think about food security an essential part of nationwide security, with laws needing the state to take extensive steps to guarantee food security, security and quality, the CFR explained.

As such, it’s not tough to link the dots that all the food “hoarding” might involve China’s technique of leveraging versus the significant food exporters like the United States. However this would indirectly trigger food costs to rise, just like China’s stockpiling of mineral resources.

That crisis isn’t almost having enough to consume. It has to do with having enough food produced locally to reduce dependence on anybody else, President Xi Jin Ping when informed a top-level Communist Celebration conference.

India’s Restriction on Rice Exports

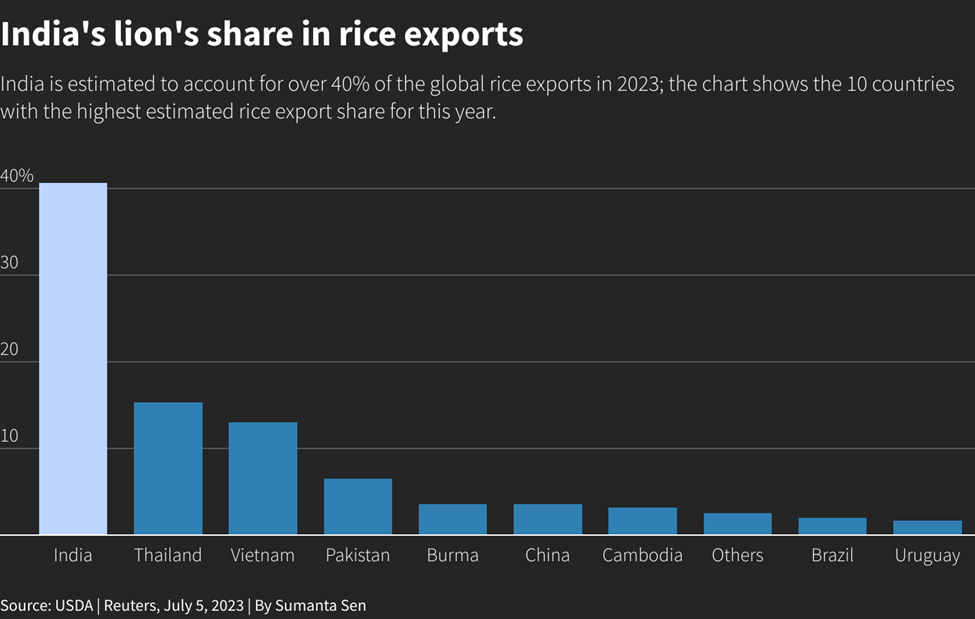

Another Asian powerhouse, India, just recently dropped a bombshell on the international markets by revealing that it would be stopping all exports of non-Basmati white rice– a staple food product for about half of the world’s population.

Such a relocation, according to a main federal government declaration, would assist guarantee “appropriate schedule” of non-basmati white rice in India, along with “ease the increase in costs in the domestic market.”

The South Asian country is the world’s leading rice exporter, representing more than 40% of the international rice trade, along with the second-largest manufacturer after China.

Rough rice futures increased 1% greater to stand at $15.8 per hundredweight following India’s statement. Lots of think that the raised costs might shoot even greater, intensifying the impacts from the nation’s previous restriction on deliveries of damaged rice.

” Worldwide rice [supplies] would significantly tighten up … considering that the nation is the world’s 2nd leading manufacturer of the food staple,” Eve Barre, ASEAN economic expert at trade credit insurance company Coface, informed CNBC

” In addition to a decrease in international rice supply, panic responses and speculation on international rice markets would worsen the boost in costs,” included Barre.

Prior to the statement, costs were currently hovering at years highs, in part due to tighter materials when the staple ended up being an appealing option as costs of other significant grains rose following Russia’s intrusion of Ukraine.

Likewise adding to the decade-high costs are the abovementioned weather condition effects. Almost 90% of the water-intensive crop is produced in Asia, where the El Nino weather condition pattern normally brings lower rains. Nevertheless, heavy rain in northern parts of India over the last couple of weeks has actually harmed freshly planted crops in the area.

DBS Bank approximates that rice inflation has actually currently sped up from approximately 6% year-on-year in 2015 to almost 12% in June 2023.

The export restriction might likewise worsen food insecurity for nations greatly reliant on rice, farming analytics firm Gro Intelligence forecasted in a report released prior to India’s statement.

” Leading locations for Indian rice consist of Bangladesh, China, Benin, and Nepal. Other African nations likewise import a big quantity of Indian rice,” Gro Intelligence’s experts composed.

According to India’s Ministry of Customer Affairs, non-basmati white rice presently makes up about 25% of the country’s rice exports. Cutting this supply off from the remainder of the world would just increase costs even more.

Richard (Rick) Mills

aheadoftheherd.com

Sign up for my complimentary newsletter

Legal Notification/ Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter called AOTH.

Please check out the whole Disclaimer thoroughly prior to you utilize this site or check out the newsletter. If you do not accept all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you really read this Disclaimer, you are considered to have actually accepted it.

Any AOTH/Richard Mills file is not, and ought to not be, interpreted as a deal to offer or the solicitation of a deal to acquire or subscribe for any financial investment.

AOTH/Richard Mills has actually based this file on info acquired from sources he thinks to be reputable, however which has actually not been separately confirmed.

AOTH/Richard Mills makes no warranty, representation or service warranty and accepts no obligation or liability regarding its precision or efficiency.

Expressions of viewpoint are those of AOTH/Richard Mills just and go through alter without notification.

AOTH/Richard Mills presumes no service warranty, liability or warranty for the present significance, accuracy or efficiency of any info offered within this Report and will not be held responsible for the repercussion of dependence upon any viewpoint or declaration included herein or any omission.

In Addition, AOTH/Richard Mills presumes no liability for any direct or indirect loss or damage for lost earnings, which you might sustain as an outcome of the usage and presence of the info offered within this AOTH/Richard Mills Report.

You concur that by checking out AOTH/Richard Mills short articles, you are acting at your OWN THREAT. In no occasion must AOTH/Richard Mills responsible for any direct or indirect trading losses triggered by any info included in AOTH/Richard Mills short articles. Details in AOTH/Richard Mills short articles is not a deal to offer or a solicitation of a deal to purchase any security. AOTH/Richard Mills is not recommending the negotiating of any monetary instruments.

Our publications are not a suggestion to purchase or offer a security– no info published on this website is to be thought about financial investment suggestions or a suggestion to do anything including financing or cash aside from performing your own due diligence and consulting with your individual signed up broker/financial consultant.

AOTH/Richard Mills advises that prior to purchasing any securities, you speak with an expert monetary coordinator or consultant, which you ought to perform a total and independent examination prior to purchasing any security after sensible factor to consider of all essential threats. Ahead of the Herd is not a signed up broker, dealership, expert, or consultant. We hold no financial investment licenses and might not offer, use to offer, or deal to purchase any security.