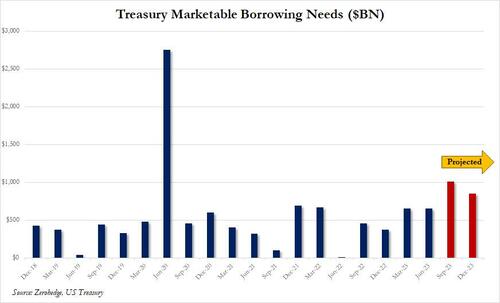

We offered a broad view sneak peek of the financial obligation flood (and financial crisis) that is concerning the United States this previous Monday when, taking a look at the current Treasury financial obligation price quotes, we revealed that the United States anticipated a near-record $1 trillion in financial obligation sales in the present quarter ( up from $$ 733BN anticipated formerly) and $852 billion in Oct-Dec quarter, numbers so staggering they are generally related to recessions …

… however in this case a rise in financial obligation issuance suggested to sustain the impression of the deficit-busting Bidenomics, which has actually handled to keep the United States economy from imploding just thanks to enormous brand-new financial obligation and budget deficit, or what BofA’s Michael Hartnett called ” The Period Of Financial Excess”, something which Fitch lastly understood last on Tuesday when it ended up being just the 2nd score firm in history to downgrade the United States AAA score.

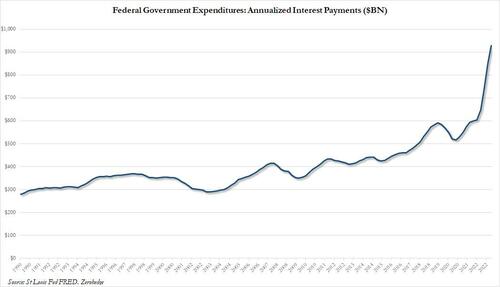

And while the endgame here is the very first $1+ trillion in United States interest payments which we anticipate will strike within the next 2 quarters …

… today we got a more granular sneak peek of how we arrive, when the Treasury released its quarter reimbursing declaration, in which the United States enhanced the size of its quarterly sale of longer-term financial obligation for the very first time in over 2Â 1/2 years, screening purchasers’ cravings in the middle of a boost in federal government loaning requires so disconcerting it assisted stimulate Fitch Scores to cut the United States sovereign score from AAA (and evaluating by the rise in yields today, the hunger might be doing not have).

The Treasury stated it will offer $103 billion of longer-term securities at its so-called quarterly refunding auctions next week, which cover 3-, 10- and 30-year Treasuries, and will reimburse roughly $84 billion of developing Treasury notes and bonds, raising about $19 billion in brand-new money. That’s a huge dive from a $96 billion in gross issuance last quarter, and bigger than many dealerships had actually anticipated.

Particularly, for next week’s refunding auctions, they break down as follows:

- $ 42 billion of 3-year notes on Aug. 8, up from $40 billion at the May refunding and at the last auction in July

- $ 38 billion of 10-year notes on Aug. 9, compared to $35 billion last quarter

- $ 23 billion of 30-year bonds on Aug. 10, versus $21 billion in May

Issuance prepares for ideas, were held stable other than for the 5-year maturity, where October’s new-issue auction will increase by $1 billion. Floating-rate note auction sizes were increased by $2 billion.

The table listed below presents, in billions of dollars, the real auction sizes for the May to July 2023 quarter and the expected auction sizes for the August to October 2023 quarter:

” Over the next 3 months, Treasury prepares for incrementally increasing auction sizes throughout benchmark tenors” the TSY stated in a declaration, including that it “strategies to increase auctions sizes by somewhat bigger quantities in specific tenors in order to preserve the structural balance of supply and need throughout tenors. Treasury will examine whether comparable relative modifications are proper when figuring out auction size modifications in future quarters.”

Treasury strategies to increase the auction sizes of the 2- and 5-year by $3 billion monthly, the 3-year by $2 billion monthly, and the 7-year by $1 billion monthly. As an outcome, the auction sizes of the 2-, 3-, 5-, and 7-year will increase by $9 billion, $6 billion, $9 billion, and $3 billion, respectively, by the end of October 2023.

Treasury strategies to increase both the brand-new concern and the resuming auction size of the 10-year note by $3 billion, the 30-year bond by $2 billion, and the $20-year bond by $1 billion.

Treasury strategies to increase the August and September resuming auction size of the 2-year FRN by $2 billion and the October brand-new concern auction size by $2 billion.

The larger than anticipated dive in issuance showcases the increasing loaning requires that added to Tuesday’s choice by Fitch Scores to reduce the sovereign United States credit score by one level, to AA+. Fitch stated it anticipates United States financial resources to weaken over the next 3 years, which’s utilizing old and out-of-date presumptions: the present truth is much even worse.

Ahead of the statement, dealerships had actually set out expectations for stepped-up issuance of other securities, and for the increases in sales to extend into 2024, which the Treasury validated on Wednesday.

” While these modifications will make significant development towards lining up auction sizes with intermediate- to long-lasting loaning requirements, even more steady boosts will likely be needed in future quarters” the department stated in a declaration.

Because the suspension of the financial obligation limitation in early June, Treasury has actually increased expense issuance to continue to fund the federal government and to slowly restore the money balance in time to a level more constant with its money balance policy. As formerly kept in mind, Treasury prepares for that the money balance will approach levels constant with its policy by the end of September. Appropriately, Treasury prepares for even more moderate boosts in Treasury expense auction sizes in the coming days. Treasury likewise plans to continue releasing the routine weekly 6-week CMB, a minimum of through completion of this fiscal year.

* * *

Independently, the Treasury stated on Monday it is likewise targeting a boost in its money balance to $750 billion at year-end, which according to Barclays strategist Joseph Abate, would press T-bills to go beyond the 20% ceiling of general financial obligation recommended by the Treasury Loaning Advisory Committee (or TBAC, the committee that silently runs the world’s most significant bond market).

Certainly, in the reimbursing declaration, the Treasury stated that it prepares for “additional moderate boosts in Treasury expense auction sizes in the coming days. Treasury likewise plans to continue releasing the routine weekly 6-week CMB, a minimum of through completion of this fiscal year.” In a different declaration launched Wednesday, the TBAC showed that going beyond the advised share of expenses for a time would not position an issue.

” The committee revealed convenience with the possibility that the Treasury expense share as portion of overall valuable financial obligation exceptional may momentarily increase above their advised variety, provided robust need for expenses,” the panel stated.

United States financial obligation supervisors likewise detailed strategies over coming months to raise sales of small Treasuries of all other maturities, in varying quantities depending upon the security.

Independently, the TBAC likewise provided on crucial factors to consider for Treasury when figuring out which voucher sectors and tenors to increase.

The providing member went over a range of factors to consider based upon the committee’s Optimum Treasury Financial obligation Structure Design, financier need, and market performance and liquidity. The providing member likewise highlighted that current expense issuance has actually been soaked up well and recommended that cash market fund need would supply considerable capability for extra expense issuance.

Laid out were a number of prospective issuance situations and concluded that Treasury needs to increase issuance throughout the curve, provided strong need throughout all tenors, with partially smaller sized boosts for the 7- and 20-year tenors. The TBAC likewise believed the marketplace might soak up modest boosts in ideas auction sizes, which would be valuable for preserving the ideas share as a portion of overall valuable financial obligation exceptional

In Addition, there was a “ robust conversation” on the various presumptions utilized in the design, especially with regard to term premia, and how those presumptions might affect the Design’s conclusions. It was kept in mind that the design is among numerous beneficial inputs that Treasury ought to think about when figuring out issuance size modifications

Likewise, the TBAC expected that increases in voucher issuance would likely take place over a number of quarters, however this would depend upon how the loaning outlook progresses. It advised that boosts take place throughout tenors, however with smaller sized boosts in the 7- and 20-year tenors. Likewise advised boosts to FRN and TIPS auction sizes, and the committee revealed convenience with the possibility that the Treasury expense share as portion of overall valuable financial obligation exceptional may momentarily increase above their advised variety, provided robust need for expenses

Independently, financial obligation supervisor Kyle Lee provided Treasury’s present views on the functional style specifications of the routine buyback program. Treasury strategies to carry out liquidity assistance and money management buybacks in 9 pails based upon maturity sectors throughout the curve for small voucher securities and ideas.

- For liquidity assistance, Treasury prepares for operating in each pail around one to 2 times per quarter, while money management buybacks would take place in the front-end with operations most likely taking place around significant tax payment dates

- Lee kept in mind that Treasury strategies to reveal an optimum quantity it wants to redeem per quarter in each maturity pail for liquidity assistance and money management, and highlighted that Treasury does not prepare to develop a repaired minimum total up to redeem in any provided operation which it is possible that Treasury might not purchase back any securities throughout an operation

- He likewise discussed what securities would normally be omitted from operations and how purchase limitations per CUSIP would be approached

- Lee examined how Treasury strategies to interact around buyback operations with regard to statements and outcomes, and he highlighted exceptional concerns that Treasury is still thinking about

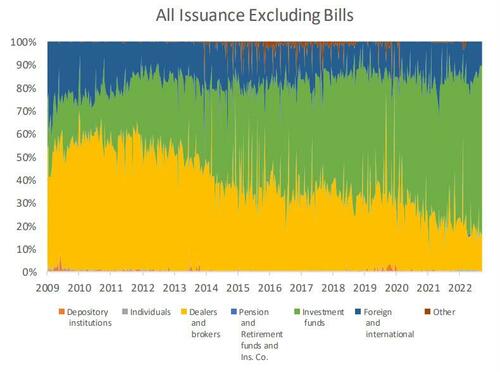

The TBAC likewise took a look at the Auction allocation in time: it discovered that the dealership involvement in issuance has actually progressively decreased over the previous years (thanks to QE), which increased portion of supply is being soaked up by mutual fund, while foreign involvement has actually stayed variety bound.

This Increased dependence on mutual fund suggests:

- Larger tails when those funds are less passionate to supply liquidity

- Stops method through the pre-auction levels when those funds are inspired to purchase

Translation: while mutual fund have actually been demolishing paper – mainly to money basis trades – the minute the basis trade blows up once again, as it carried out in Sept 2019 and March 2020, the Fed will come running in to backstop whatever.

The complete need to check out TBAC discussion on the coming debt-issuance deluge is here.

* * *

Putting everything together, and looking ahead, the message is easy: as Joseph Wang put it, “Expense issuance is heavy next couple of months, so Treasury will quickly be at their 20% advised level. Then trillions in discount coupons each year permanently.”

Here’s most current Treasury supply approximates from public and economic sector experts. Expense issuance is heavy next couple of months, so Treasury will quickly be at their 20% advised level. Then trillions in discount coupons each year permanently

IMO I can’t see anything however structurally greater yields. pic.twitter.com/PzKbwWyHeO

— Joseph Wang (@FedGuy12) August 2, 2023

He concluded that he “can’t see anything however structurally greater yields.” He is right, naturally, and it is just a matter of time prior to the purchaser of last option, the Fed, will be required to action in with another round of QE. So watch on the next manufactured crisis that will allow the Fed to do simply that.

* * *

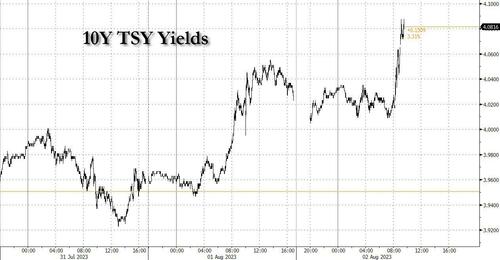

Following news of the “bigger than anticipated” reimbursing quantities, Treasuries dropped with benchmark 10-year yields surging to as high as about 4.08%, a gain of around 5 basis points relative to Tuesday’s close.

Packing …