Automobile insurance coverage premiums are increasing mostly due to increasing automobile parts expenses and severe weather condition, according to virtual insurance coverage representative platform Insurify’s Q3 2023 Mid-Year Vehicle Insurance Coverage Trends Report.

In the very first 6 months of this year, automobile insurance coverage premiums increased 17%, based upon Insurify’s evaluation of its database of 90 million automobile insurance coverage quotes.

The figure is substantial due to the fact that it’s more than double the 7% boost business experts had actually anticipated for the year. In addition, it’s anticipated that rates will increase another 4 percent by the end of 2023.

Of issue, the variety of motorists buying complete protection policies has actually decreased by more than half this year.

According to Allie Feakins, SVP of Insurance coverage, boosts of 12 to 15% in automobile insurance coverage rates are anticipated.

” Automobile repair work and upkeep expenses have actually exceeded inflation and reveal no indications of slowing, leading insurance providers to increase automobile insurance coverage rates to stay up to date with the expense of greater claim payments,” Feakins stated.

Automobile insurance coverage premiums are increasing one of the most in New Mexico, Nevada, New Jersey, Michigan and Indiana.

According to the digital insurance coverage platform company, those states saw boosts of more than 33% in the previous year.

Some insurance providers made an application for several rate boosts in 2022, according to state insurance coverage department regulators.

Some aspects that affect automobile insurance coverage rates consist of area, weather condition, population density and criminal offense rates.

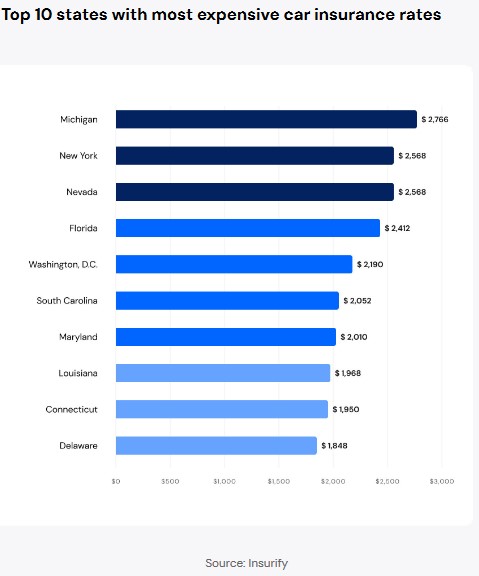

The leading 5 states with the most costly automobile insurance coverage premiums consist of Michigan, New york city, Nevada, Florida and Washington D.C.

” Serious environment disasters and an inflation-related rise in repair work and replacement expenses resulted in record-breaking losses in 2022,” the report kept in mind.

One aspect increasing automobile insurance coverage premiums is the customer rate index for car repair and maintenance has actually revealed double-digit boosts starting in September 2022.

Another aspect is severe weather condition with disasters increasing the frequency of automobile losses.

” The frequency and seriousness of natural catastrophes have actually resulted in some geographical locations experiencing various kinds of weather condition occasions from what they have actually seen prior to,” stated Betsy Stella, VP of Provider Management and Operations. “More cars are being captured and ruined in fires and floods, and ice is staying longer, increasing the probability of crashes.”

The increasing expense of automobile insurance coverage will lead customers to contrast buy the very best rates and protection.

As insurance providers seek to include their threat, high threat motorists and those in specific states with regular disaster losses where automobile insurance providers are leaving, will discover their alternatives restricted.

Subjects

Patterns

Vehicle

Rates Patterns

Intrigued in Vehicle?

Get automated informs for this subject.