Early-stage start-ups are dealing with a financing predicament that has actually heightened considering that the marketplace for raising equity capital substantially tightened up in 2022. To attract possible financiers, especially recession-conscious ones, creators require to show engaging proof of a great benefit. One method to do that is through quantitative forecasting— however with little to no monetary history, the metrics offered to underpin such a projection are little.

Fortunately is that there are strategies to conquer this obstacle and develop an engaging case. If carried out properly, these actions can not just provide convincing, data-supported monetary forecasts, however likewise lay the structure for an information technique to assist creators scale operations.

Because moving into speaking with from monetary services in 2018, I have actually encouraged lots of start-ups on organization advancement and fundraising efforts. While investor enjoy huge, strong organization concepts and have actually just recently stressed metrics like money burn rates and courses to success, strong yearly earnings projections stay vital.

Begin With a Data Method

Even at a start-up’s earliest phases, financiers draw the line from topline earnings projections to the possible worth of the business. For your business to be worth $1 billion, you should have the ability to reveal you can create about $100 million each year within the next 5 to 7 years. There are various methods to attain this, however in basic, the greater the earnings development rate, the higher the possible evaluation and the more interest there is most likely to be from financiers.

Companies require to be nimble to grow rapidly and attain the yearly repeating earnings they require. To do this, they should be information literate, implying they need to make functional information available and simple to analyze. You must utilize metrics to develop criteria to assist your operations and after that consist of these metrics in your organization strategies, monetary designs, and pitch decks as you move through the numerous phases of fundraising

Still, I recognize that no business has limitless resources to research study and produce these data, so every start-up requires to prepare for a structured information collection and analysis function fixated the metrics it requires most. This is why I encourage customers to begin with 3 essential foundation:

- Marketing research

- Prices

- The sales pipeline

Focusing your effort on these 3 pillars will assist you establish the quantitative metrics you require to encourage financiers to bite, along with develop the required structure you’ll need to scale.

Marketing Research: Research Study Your Consumers and Market

The very first pillar you’ll require to establish to make the most of earnings and lay the structure for a flexible information technique is marketing research Acquiring a deep understanding of target audience assists creators develop a fact-based structure for predicting sales and success through important contrast information. The intelligence you gather will assist specify the broadest market to target, along with aid you establish the foundation for prices and other essential monetary signs.

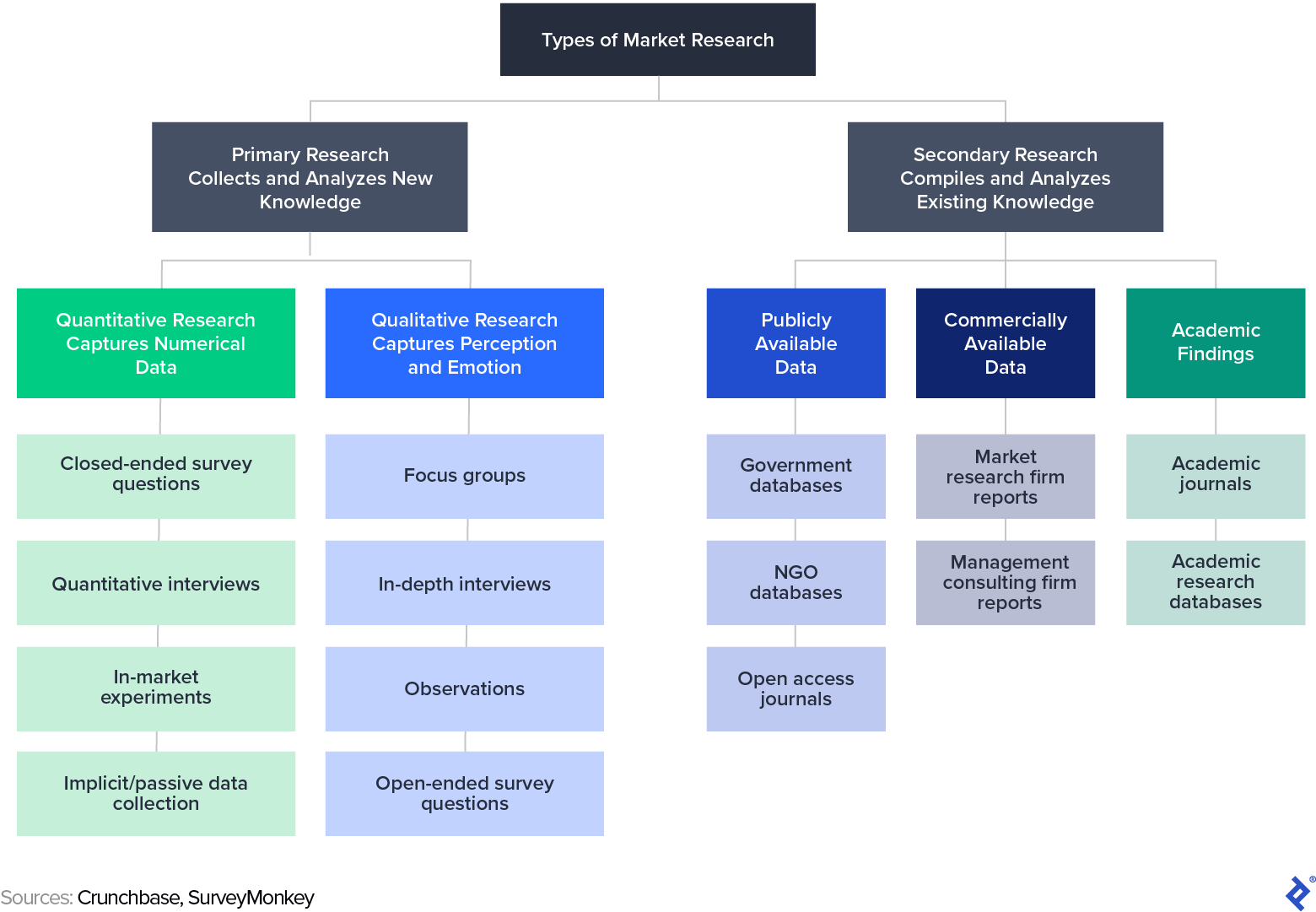

Even one of the most fundamental marketing research can produce effective outcomes for a business attempting to specify its consumer base. Studies of potential consumers are terrific sources of both qualitative and quantitative information, and I utilize them thoroughly, in the type of electronic surveys and remote interviews. Thorough interviews with existing business workers, suppliers, and consumers can supply qualitative insights that you can utilize to form business technique to make the most of business’s worth. I generally prevent focus groups, considering that I discover them hard to administer impartially.

I have likewise utilized marketing research to assist business produce quantitative data that are typically consisted of in pitch decks and can assist enhance elements of operations, such as the expense of getting consumers. For example, I when assisted an early-stage automatic production business style and perform a study of its possible consumers, which were recognized companies because market. The study collected a broad series of quantitative information, such as head count and earnings, along with qualitative actions identifying market challenges the business were dealing with.

We incentivized study participants by providing anonymized copies of actions, to assist them comprehend how they compared to other business in their market. With the information we gathered, we had the ability to assist our customer plainly specify the following essential variables in its organization:

Utilizing forecasts based upon this information assisted the business raise $25 million from a big endeavor fund, which financial investment has actually settled for all celebrations: The business has actually considering that fulfilled or surpassed expectations by establishing Fortune 500 customers while browsing a course to ending up being a market leader in its market.

Prices: Produce Worth for Your Consumers, Then Capture Your Fair Share

The 2nd pillar in a start-up’s metrics technique is to embrace the most financially rewarding and sustainable prices system in order to make the most of sales earnings. Nevertheless, I have actually observed that couple of business owners completely check out the range of prices methods offered to them.

Prices can appear like a dark art. Charge excessive, and you lose consumers. Charge insufficient, and you leave cash on the table and weaken your fundraising objectives. The balance is fragile however you can attain it.

Initially, you require to comprehend prices principles:

- Cost-plus prices: Determining the expense of your product and services and after that including a sensible margin

- Competitive prices: Identifying your rate based upon what rivals or possible rivals are charging

- Penetration prices: At first damaging your competitors by pricing lower than dominating market rates to develop a client base

- Value-based prices: Utilizing marketing research to approximate the worth your possible consumers put on your product and services

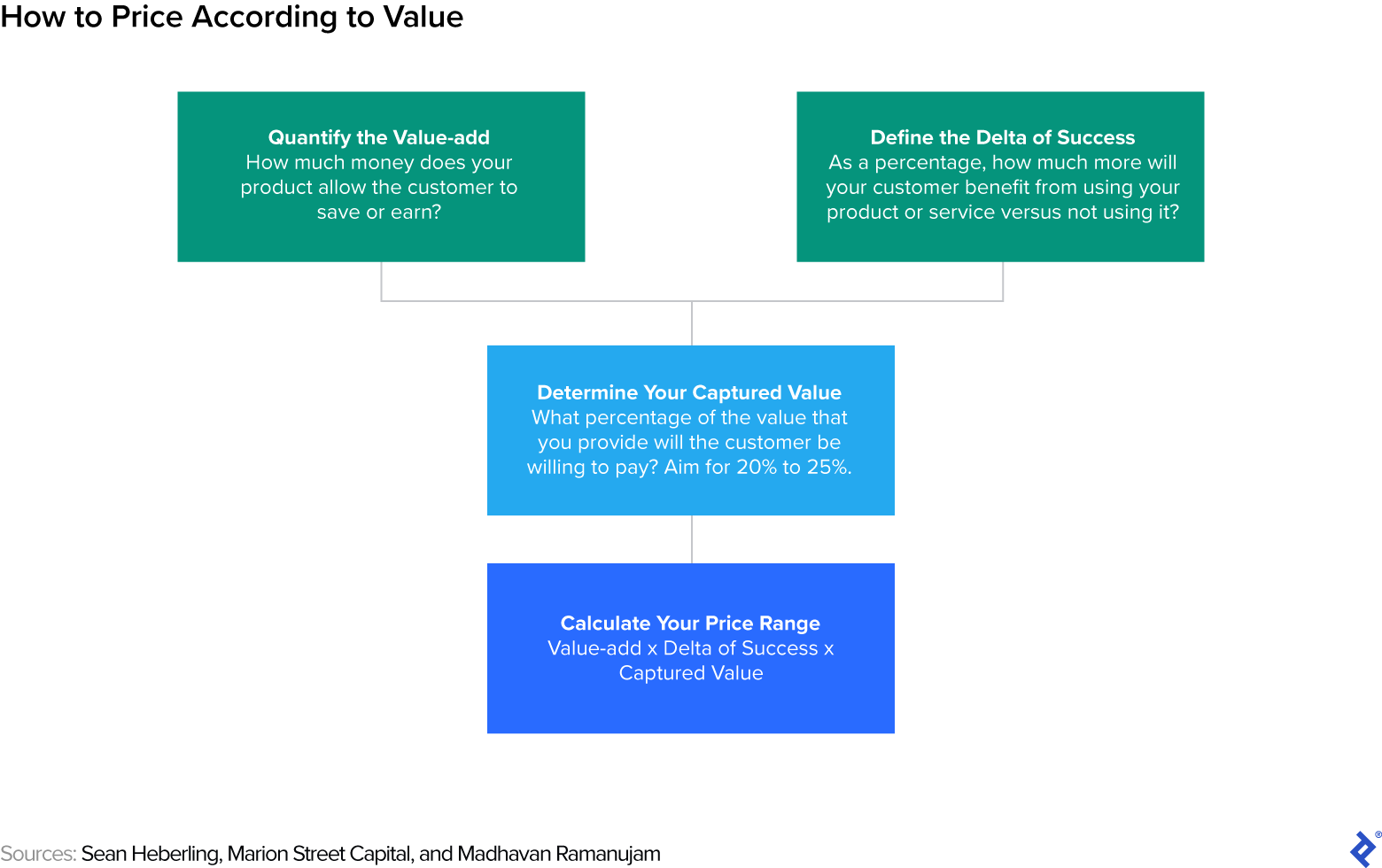

While each method has its advantages, I think that 90% of start-ups will fare finest utilizing value-based prices. I concur with prices specialist Madhavan Ramanujam’s evaluation that business must anticipate to recover about 20% to 25% of the overall worth they produce for consumers. This develops a sustainable balance in between your bottom line and the consumer’s advantage.

Usage this structure to identify your product and services’s perfect rate. (An example follows each action to show how the procedure works.)

-

Measure the dollar worth your product and services attends to consumers. Just how much cash does it conserve them in time, effort, or both? Or just how much more cash can they make utilizing it?

- Example: Utilizing Sample Corp.’s widgets, Purchasers Unlimited is X% most likely to attain sales worth $A.

-

Determine by portion just how much more effective your customer is utilizing your item than not utilizing it.

- Example: Without Sample Corp.’s widgets, Purchasers Unlimited is Y% most likely to attain sales worth $A. Therefore, Sample Corp.’s widgets deserve $B = $A x (X% – Y%) to Purchasers Endless.

-

Multiply the item of those 2 figures by 20% to come to your most affordable rate or 25% to come to your greatest rate.

- Example: Sample Corp. must make in between $B x 20% and $B x 25% for offering widgets to Purchasers Endless.

To reveal the formula in action, let’s state that acquiring Sample Corp.’s widgets suggests Purchaser’s Unlimited is 15 portion points most likely to make $100,000 in extra sales annually. That suggests the widgets deserve 15% x $100,000, or $15,000 to Purchasers Endless. Then 25% of $15,000 provides you a high rate of $3,750 and 20% provides you a low rate of $3,000.

As the mathematics shows, the greater the ROI your product and services provides, the greater the rate you can set.

Simply as essential as charging the best rate is charging the consumer the proper way.

For lots of start-ups, specifically those in the tech sector, there will currently be some type of recognized standard for your organization design If your business looks for to take on social networking companies or online search engine, the design is to provide the service to customers totally free and generate income from marketing. If you’re establishing a streaming service, you would generally do the same with other streaming services and embrace the freemium design, providing a stripped-down variation totally free and wishing to upsell consumers on a premium membership. The very same holds true for business-to-business designs, specifically software application as a service, the prices design of which is generally developed around membership services with tiers based upon the general variety of users.

While it’s possible to embrace a various method from your rivals, the truth is that the more competitive a market, the harder it is to leave from its standard. That stated, a disruptive prices method can be a crucial differentiator in a congested field, so do not discount it completely.

If you choose to line up with market standards, you will still have chances to increase earnings within those standards by utilizing need prices, prices tiers, and unique charges where proper. For example, I dealt with a customer that developed a service around handling health care centers. We established a rates schedule that consisted of not simply the management cost for supervising operations, however likewise seeking advice from charges for encouraging on the opening of brand-new centers, profit-sharing for offering funding, and charges for other particular services at the centers.

The Sales Pipeline: Track Conversions and Sales

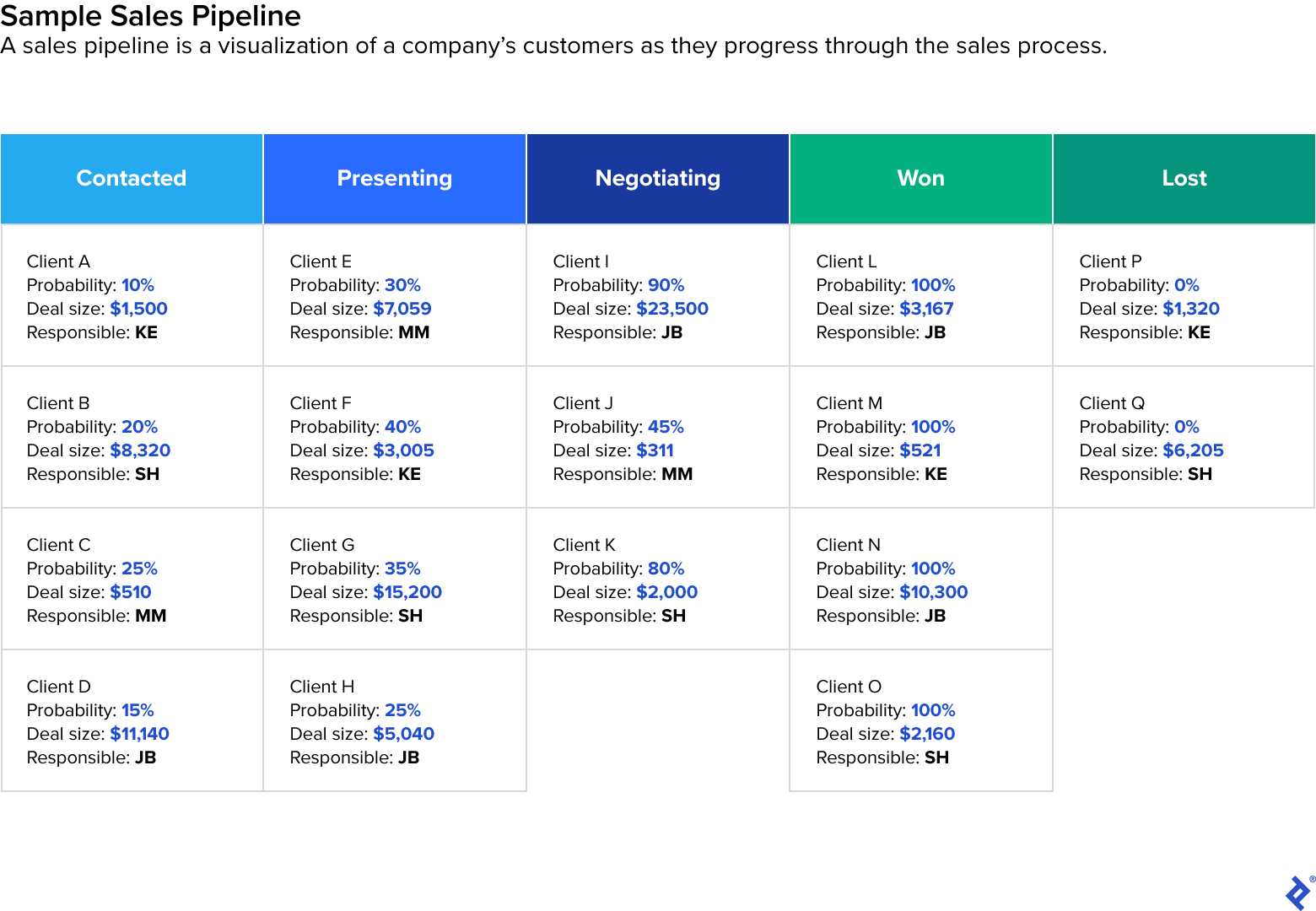

For the 3rd and last pillar, I encourage start-ups to make the most of earnings projections by establishing and fine-tuning metrics around consumer acquisition and sales This suggests producing the most effective sales pipeline possible. A sales pipeline permits creators, executives, sales workers, and financiers to picture the motion of consumers through the various phases in a business’s sales cycle. By approximating the likelihood of conversion of possible consumers to real consumers based upon their phases, you can create earnings projections.

Conversion information is especially effective from an operations and strategies viewpoint. With this information, you can forecast the number of brand-new leads you require to create over a particular amount of time to reach the yearly earnings projections

You can utilize a spreadsheet to produce a sales pipeline, however I advise purchasing a consumer relationship management system, or CRM. At its easiest, a CRM is an application with a variety of tools to collaborate a business’s consumer relationships and track interactions such as calls, discussions, and other engagements. The CRM works as a single source of fact about your consumers, a one-stop look for handling sales and possibility details. It’s important due to the fact that it allows your business to keep details about its relationships and to arrange that information internally as it grows. Those abilities can supply you with a more feature-rich pipeline than a spreadsheet can– I like to state a CRM provides you a 3D view while a spreadsheet can just deal with 2D.

There are various service providers, with alternatives like Salesforce on one end of the rate spectrum serving big business customers. On the other end, there are more budget-conscious platforms like HubSpot, with entry-level prices that makes it especially popular with development business

Once the CRM remains in location, you can then equate details about potential consumers into your sales pipeline. While the bigger objective is to produce topline metrics like pipeline worth and a earnings projection for financiers, the application is likewise helpful for offering insights into operations, such as sales pipeline speed and conversion rate per phase.

This information can likewise be utilized to approximate consumer acquisition expense and consumer life time worth, which can notify a wider discussion with your marketing group about sourcing leads and customizing a client acquisition technique.

A current experience I had dealing with an early-stage marketing start-up is useful here. Although the creator is a superior sales representative, the business’s CRM was basic, with a sales go to one fundamental application and contact details on another. My initial step was to publish all this details onto one platform through HubSpot. Then we had the ability to personalize it according to the creator’s sales cycle and to establish a sales pipeline that offered her a clear view of her consumer relationship funnel. This enabled her to determine earnings projections more effectively and precisely.

To personalize your pipeline, bear in mind that each phase ought to show a plainly specified sales procedure, from preliminary contacts and recommendations to diligence, pitches, propositions, settlements, and results. You can then appoint various likelihoods of conversion for each phase or for each offer. Typically, the CRM can do that immediately, however I generally change that quote utilizing historic information. I likewise attempt to err on the side of the most conservative quote. As you move through the sales phases, the chances of conversion must constantly increase.

The adoption of a flexible CRM and development of a pipeline are 2 important actions for producing a yearly earnings projection that will impress financiers. There are 2 factors for putting in the time and effort to establish defensible sales metrics: The very first is the information technique it will develop and the 2nd is the fundraising benefit. I inform my early-stage start-up customers that they must anticipate to invest around 200 hours into this procedure, the very first 100 working to optimize their earnings projection and produce other essential efficiency signs and the 2nd 100 hours networking and pitching to financiers. It’s a considerable financial investment of time and resources, however in my experience, it increases the chances of getting moneyed approximately fourfold while increasing the quantity of financing gotten by as much as 5 times.

Quantitative forecasting without a strong monetary history is hard however attainable. Most importantly, if you put in the effort on the front end, you will not just enhance your fundraising potential customers, however likewise place your organization for tactical development in the years to come.

Advanced Financial Modeling Finest Practices: Hacks for Intelligent, Error-free Modeling