The outlook for finishing metal zinc is bearish on boost in smelter supply, weak need, and Chinese curbs on steel production, experts have actually stated.

Zinc, utilized generally as finishing to safeguard steel and iron, has actually dropped to near two-year low and is presently trading at $2,328 a tonne on the London Metal Exchange (LME) for three-month agreements. Area zinc is estimating at $2,331.50.

Zinc rates have actually dropped over 20 percent in 2023 with LME-registered stocks almost doubling to a 12-month high.

The decrease in zinc rates has actually led to research study and score firms such as BMI, a system of Fitch Solutions, and Goldman Sachs to reduce their rates outlook for the metal.

H2 cost forecast.

” We have actually modified down our typical zinc cost projection for 2023 from $3,000/ tonne to $2,550. This indicates a typical cost of around $2,275 over June-December 2023,” BMI stated in its outlook.

Goldman Sachs has actually moved its outlook to a bearish one, forecasting an oversupply this year. The Workplace of Chief Economic Expert, Australia, had previously this year projection LME zinc area cost to typical around $3,100 a tonne in 2023. Nevertheless, it sees rates falling slowly to $2,600 by 2028.

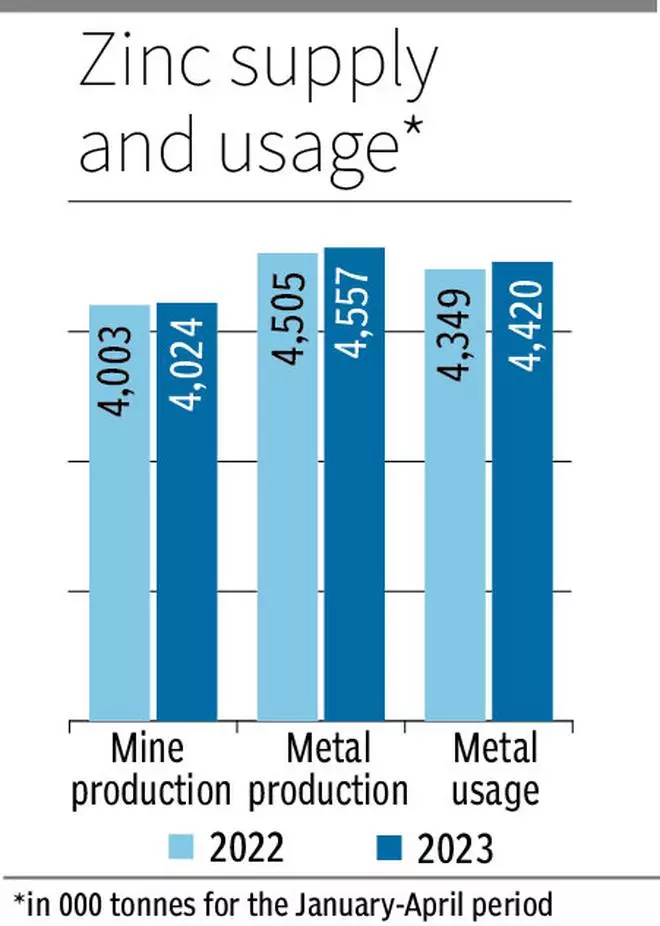

According to information from the International Lead and Zinc Study Hall (ILZSG), the worldwide market for refined zinc metal remained in surplus by 138,000 tonnes in the very first 4 months of 2023 with overall reported stocks increasing by 58,000 tonnes.

World zinc mine production increased by a minimal 0.5 percent and fine-tuned metal production was up 1.2 percent with China being the primary motorist of the increase.

Sluggish Chinese healing.

ING Believe, a monetary and financial analysis system of Dutch monetary services firm ING, stated on-warrant stocks increased previously this month by 13,775 tonnes (the most significant day-to-day addition given that December 2021) to 81,825 tonnes (the greatest given that 1 April 2022).

Net inflows in Might amounted to 34,950 tonnes compared to the inflows of 4,175 tonnes in April, it stated.

Experts stated the Chinese need is recuperating at a slower speed than at first prepared for. Nevertheless, Chinese manufacturers are increasing their production after soaking up surplus focuses.

BMI stated zinc need in Mainland China will likely slow over June-December 2023 due to curbs on steel production. “Steel production in the nation will require to agreement year-on-year over June-December 2023 in order to satisfy the federal government’s target for the year as an entire,” it stated.

Improved metal use.

The Australian Workplace of the Chief Economic expert stated zinc need was anticipated to rebound as China’s economy was anticipated to get speed and energy rates may reduce.

ILZSG stated boosts in the use of refined zinc metal in China, India, and the United States were partly balanced out by decreases in Europe, Brazil, the Republic of Korea, Taiwan (China), Thailand, and Turkey. This led to a general worldwide increase of 1.6 percent.

BMI stated there are tentative indications that European smelters might start increasing production once again in 2023. “In February 2023, Nyrstar rebooted production at the company’s Auby plant in France, having actually formerly been put on care and upkeep in 2022 due to high power expenses,” it stated.

Zinc mine production will continue to broaden slowly over the coming years in spite of decreasing rates over the duration. Australia, India and the United States will be accountable for the majority of this output development, the research study company stated.

Unfavorable moving forward.

The Workplace of Chief Economic expert stated Australia’s zinc production is anticipated to increase by 2.5 percent each year to around 1.5 mt by 2027– 28. High rates have actually motivated strong expedition expense, which will support long term production development, it stated.

BMI painted an unfavorable photo for zinc beyond 2023 also. “… our long-lasting view on zinc rates stays unfavorable, and we have actually modified down our typical cost projections. We now anticipate a steeper drop in zinc rates to typical $2,150/ tonne over 2024-2027, compared to our previous projection of $2,500,” it stated.

.