A high and rising nationwide financial obligation presents a series of threats and dangers, consisting of slower earnings and wage development. A brand-new report from the Congressional Budget Plan Workplace (CBO) approximates the result of the financial outlook on Gross National Item (GNP) per capita — a step of typical earnings. CBO discovers:

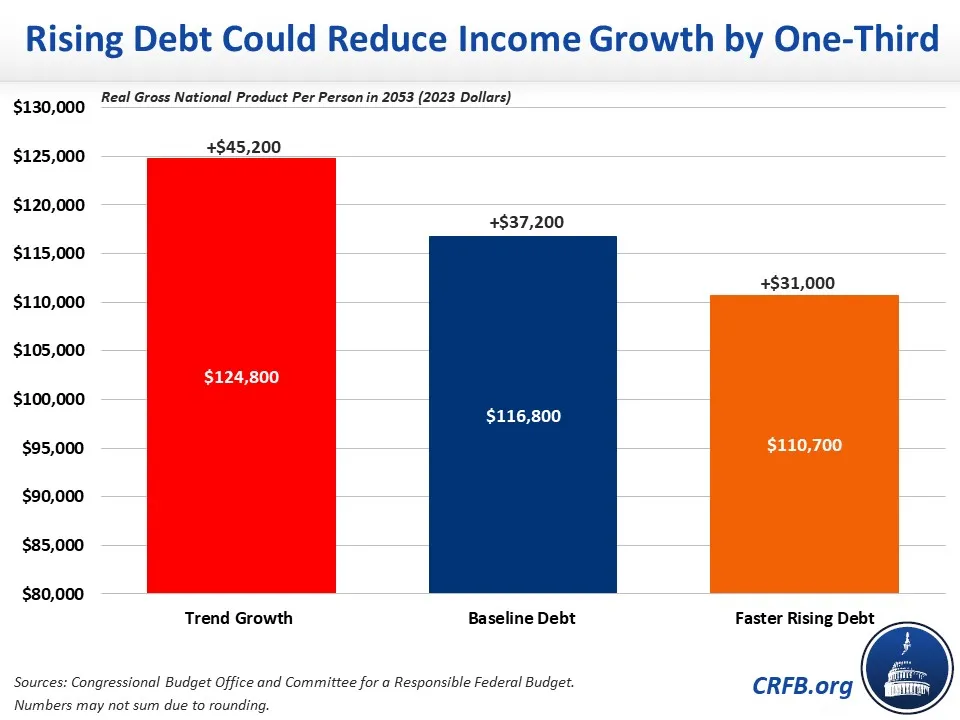

- Prior to accounting for increasing financial obligation, yearly earnings is forecasted to grow by $45,200 per individual over the next 3 years.

- Increasing financial obligation under present law would decrease earnings development by one-sixth, or by $8,000 per individual in 2053.

- With extra loaning for tax cuts and costs walkings, financial obligation would decrease earnings development by one-third, or by $14,100.

Greater financial obligation lowers future earnings by intensifying a phenomenon called “crowd out,” where the accessibility of financial obligation and modifications in rate of interest lead financiers to commit an increasing share of cost savings towards Treasury securities at the cost of more efficient financial investments. In truth, CBO’s basic design presumes that every brand-new dollar of federal government loaning lowers personal financial investment by 33 cents.

Federal financial obligation held by the public is presently 98 percent of Gdp (GDP)– about two times the historical average over the previous 50 years– and is forecasted to increase to 181 percent of GDP by the end of (FY) 2053 under CBO’s standard. Presuming more boosts in financial obligation do not crowd-out financial investment at all, CBO approximates typical earnings in 2023 inflation-adjusted dollars would increase by $45,200 over thirty years, from $79,600 in 2023 to $124,800 in 2053.

Increasing financial obligation would considerably slow that earnings development. After integrating the results of crowd out, CBO jobs typical earnings would just grow by $37,200, to $116,800 in 2053. To put it simply, increasing financial obligation would decrease earnings development by 18 percent and decrease overall earnings by over 6 percent in 2053.

Additional boosts in financial obligation would slow earnings development much more. If, for instance, earnings and discretionary costs were held continuous at their 30-year historic averages, we approximate CBO would forecast typical earnings would grow just by $31,000, to $110,700 in 2053. To put it simply, much faster increasing financial obligation would decrease earnings development by 31 percent and decrease overall earnings by 11 percent in 2053. This is in spite of the helpful results of lower tax rates and bigger public financial investments on earnings.

If policymakers slow the development of the financial obligation, the results on earnings will be more soft. For instance, in CBO’s ‘payable advantages circumstance,’ where Social Security costs is restricted to devoted earnings upon trust fund insolvency and financial obligation just grows to 132 percent of GDP, earnings per individual would increase by $42,400, to $122,000 in 2053. In this circumstance, earnings development would be 6 percent lower than without any financial obligation development, and overall earnings would be 2 percent smaller sized.

On the other hand, the real results of financial obligation on earnings might be even bigger than CBO price quotes. For instance, if crowd out is two times as strong as in its design, CBO jobs typical earnings under present law would just grow to $95,700 through 2047 and would start to diminish afterwards. Through 2053, we approximate financial obligation would slow earnings development by 69 percent under that circumstance and decrease typical earnings by 25 percent in 2053.

Policymakers who wish to guarantee strong earnings gains and strong financial development must work to put financial obligation on a down trajectory rather of permitting it to continue increasing unsustainably. Doing so would not just prevent the threats of high financial obligation levels however likewise enhance Americans’ standard of life.