Following the other day’s miserable Production study information (both in contraction – sub-50 – for numerous months), ‘soft landing’- hopers are counting on today’s Providers study information to conserve the story.

-

ISM Solutions (Final) dropped to 52.3 (listed below exp) in July (from 54.4 in June) – its least expensive given that Feb.

-

PMI Providers dropped to 52.7 (listed below exp) in July (from 53.9 in June)

These dissatisfactions are occurring as United States Macro information has actually been unexpected to the benefit …

Source: Bloomberg

Chris Williamson, Chief Company Economic Expert at S&P Global Market Intelligence, stated:

“ The service sector stays the primary engine of development in the United States economy, though there are indications of the motor spluttering in the middle of increasing headwinds.”

” Company activity increased in July at the slowest rate given that February, with the rate of growth moving even more from Might’s current peak in action to greatly lowered development of brand-new organization. Although costs from immigrants in the United States continues to grow highly as the post-pandemic travel rise reveals indications of continuing, need development subsided from domestic consumers, frequently connected to the increasing expense of living and greater rates of interest. “

” Showing issues that the upturn is failing, business have actually ended up being much less positive about the outlook and reined-in their hiring as an outcome.”

Inflationary pressures stayed traditionally raised in July, as provider in specific continued to sign up significant boosts in input expenses and output charges, frequently credited to walkings in incomes.

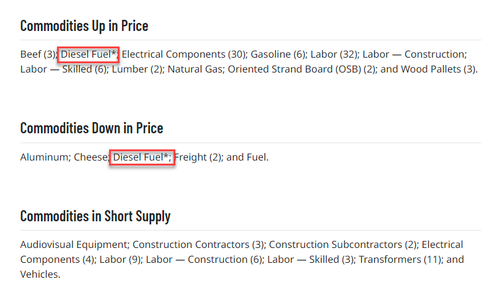

By the method, Diesel rates are both up … and down …

Providers Work slowed …

The S&P Global United States Composite PMI Output Index published 52.0 in July, below 53.2 in June, to signify just a modest upturn in personal sector organization activity.

” With the compromising service sector growth accompanied by a near-stalled production sector, the general message from the studies is that financial development compromised at the start of the 3rd quarter, cooling to an annualized rate of around 1.5%.

Williamson concluded even less optimistically that the study’s cost assesses, nevertheless, continue to signify a stubbornness of inflation around the 3% mark:

” An extra issue is that rates charged for services increased at a sped up rate in July, frequently connected to greater personnel expenses. Such a wage-led stickiness of inflation in the large service sector will naturally stress policymakers.“

So, simply put – STAGFLATION!

Packing …