The United States Financial position is extremely bad and the United States is starting to appear like a 3rd world economy. And with Biden and Democrat AGs filing indictments versus Biden main Governmental oppoonent, that nation is Venezeula! Like escalating interest on the Federal financial obligation to spend for green energy hustlers and the Ukraine war.

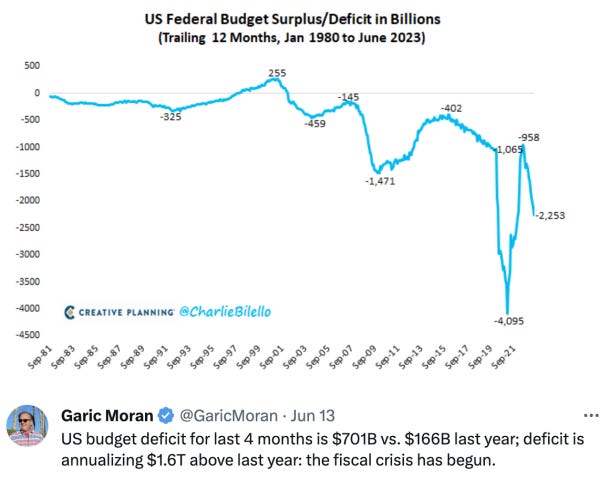

The United States Federal Deficit continues to grow as seen in the charts listed below. A $2.25 Trillion dollar run rate deficit is substantially even worse than the $1.3 Trillion that was tape-recorded in Financial 2022. This level of deficit is unmatched in an economy with low joblessness and in theory no economic crisis. Naturally, we ask simply how huge the deficit will be if we have either an economic downturn or a crisis? In the dotcom bust, the GFC and the COVID shock, the deficit broadened enormously.

Taking Garic’s mathematics one action even more, the United States sustained a deficit of $1.3 T in Financial 2022 (September). If the existing run rate is sustained that would indicate an annualized deficit of $2.9 Trillion.

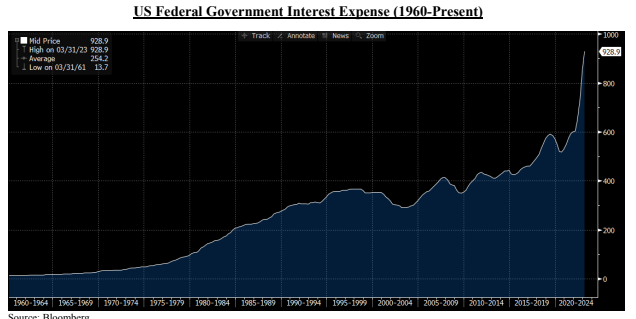

Obviously, one huge chauffeur of this deficit is the interest expense sustained by the Federal government itself. It is quickly approaching a $1 Trillion dollar run rate which indicates the Federal government is investing more in interest than on nationwide defense. As you can see in the schedule listed below, the Fed’s rate treking project has actually been extremely costly for the United States Federal government because a big part of the federal financial obligation remains in much shorter maturities which presently pay ~ 5.3% in interest. As just recently as September of 2021, a number of these exact same securities had much lower interest expense– as low as just 10-30 basis points.

Taking a look at the chart above, we question: exists anything about this that looks from another location sustainable? We are at that point in the motion picture where raising rates of interest to eliminate inflation in fact makes things (consisting of inflation) even worse. Worse due to the fact that deficits swell and will require to be generated income from.

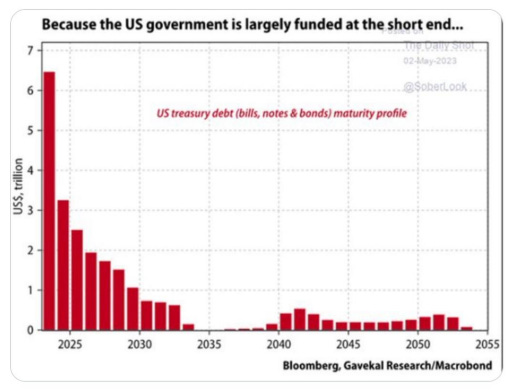

In addition, the concern is intense due to the fact that the United States Federal government utilizes the short-term bond market to Fund the majority of its financial obligation. As the chart listed below from Gavekal Research/Macrobond programs, the Federal government requires to roll over $6 Trillion of developing notes in 2023 and $3 Trillion of notes in 2024. This does not take into account any of the approximately $1.2 Trillion of bonds and notes that will be offered into the marketplace by the Fed if Quantitative Tightening up continues. Nor does it represent the ever increasing United States Federal Deficit which will quickly surpass $2.2 Trillion this year.

In other words, the United States Federal government has some severe financing obstacles especially when we think about that immigrants have actually been net sellers of our bonds because 2014.

IT’S THE FINANCIAL OBLIGATION, FOOLISH

On January 19, 2023 the United States Federal Federal government struck its financial obligation ceiling of $31.4 Trillion. Remarkable costs steps started which enabled the Federal government to keep operating. This lasted till June when Treasury Secretary Yellen notified Congress that a financial obligation default impended if the ceiling was not raised.

After the typical political posturing, Congress did 2 things: (i) they consented to position a 2 year cap on costs boosts for a little part of the budget plan that totaled up to just 7% of the overall budget plan. (like positioning a band help on an open injury); and (ii) they consented to suspend the financial obligation limitation and to not change it with another figure till January of 2025. We do not believe they have ever.

Put it in a different way, let’s call this “Federal government Gone Wild!”