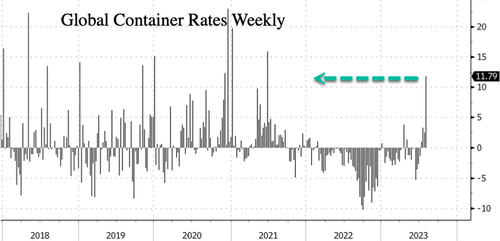

Area rates for shipping containers have actually been increasing for 4 weeks. The current information from the Drewry World Container Index composite programs the most substantial weekly gain in the index in more than 2 years. The 23-month depression in ocean-freight expenses seems ending.

The Drewry World Container Index leapt 11.79% to $1,761 for a 40-foot container, the biggest weekly gain considering that June 24, 2021– or the duration when delivering expenses worldwide were sky-high due to the fact that of snarled supply chains.

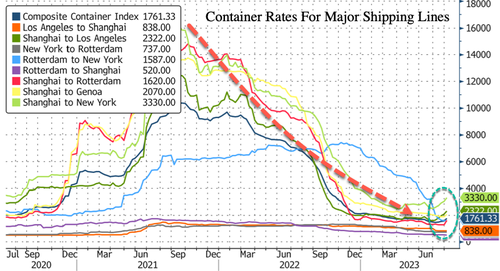

All significant shipping lines have actually experienced a multi-year decrease.

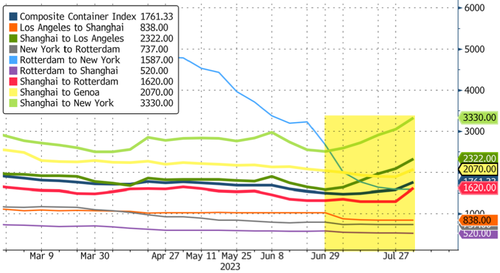

A few of the biggest gains in the last 4 weeks have actually been on the Shanghai to Los Angeles and Shanghai to New york city paths.

Senior editor Greg Miller of logistics company FreightWaves composed a note recently describing:

Area rates have actually been on the increase for 3 straight weeks, rebounding to levels last seen in early 2023 and late 2022, according to numerous index suppliers. U.S. import reservations stay above pre-COVID levels, and several experts are now highlighting favorable rate results from decreased vessel capability

While handling vessel capability seems working, French carrier CMA CGM SA cautioned East-West trade lanes are under more pressure and dropping faster than the North-South trade, which stays quite vibrant.”

In early Might, A.P. Moller-Maersk A/S, a bellwether for worldwide trade, anticipated weaker outcomes for the rest of 2023 after a downturn in the very first quarter. Maersk is slated to report on Friday.

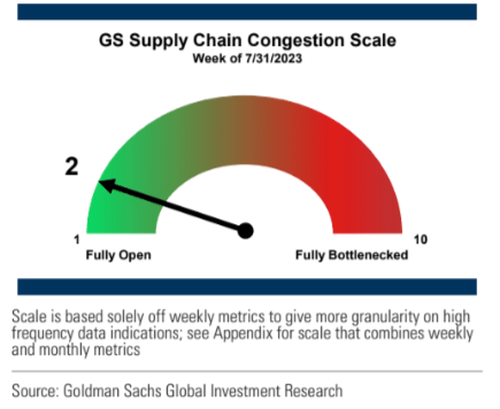

Goldman upgraded customers on its Supply Chain Blockage Scale signs up a “2,” which implies the weekly traffic jam metrics for worldwide supply chains appear to have actually stabilized after the snarls throughout Covid.

Financial experts and experts have actually been positive in current weeks that the Federal Reserve can craft a soft landing and prevent an economic downturn ( keep in mind, there’s stealth QE).

” Our company believe the Fed is on track for a soft landing … and the information today has actually been regularly great. It contributes to my conviction,” Jan Hatzius, primary financial expert at Goldman Sachs, just recently stated.

Worldwide’s second-largest economy, indications of slowing development and weak point in China continues Maybe the rise in container rates is basically a function of decreased capability rather of an increase in need.

By Zerohedge.com

.