The last week of revenues season, generally booked for a variety of retail business, was likewise the one we got the loudest tip yet that the United States customer is undoubtedly beginning to strike their limitation, with seller after seller plunging by double digits on either weak revenues, bad assistance or some mix of both. Not remarkably, the Retail ETF got squashed in all 5 days today, dramatically underperforming the marketplace every day of the week.

And while some retail optimists have asked “did anything really alter?” the reality, as Goldman customer expert trader Scott Feiler keeps in mind, ” anytime the group underperforms 5 days in a row vs the marketplace and over 500 bps amount to on the week, it ‘d be a bit naïve to “state “absolutely nothing brand-new here.” To be sure, there have actually been some plainly unfavorable advancements – particularly when it pertains to the fast wear and tear in customer credit as highlighted in the miserable revenues from Macy’s and Nordstrom – that bear seeing particularly with trainee financial obligation payments set to resume in a coupe of months, this pattern will just become worse, while the steady phasing out of the trillion-dollar deficit moneyed “Bidenomics” stimmy

So what drove the considerable weak point in the group today?

1. July was the very best month of the quarter, however the focus has actually currently relied on August, when things turned much uglier. Beyond Foot Locker, almost every business spoke with a velocity in patterns in July. This was the very first noteworthy velocity in patterns for a complete month given that things saw their preliminary downturn in March. While some business early in the revenues season spoke with August being strong still (WMT, ROST, TJX), this was more consumables based or protective type business. As Feiler notes, while “August definitely does not look like it’s fallen off the cliff throughout the board, the view from today’s round of outcomes was it’s much choppier as an entire than July was. Nordstrom for instance spoke with a downturn at both of their banners in the month“

2. Diminish (i.e., theft) – Many business discussed this. Some were unanticipated (DKS), some were anticipated (ULTA) and some discussed it once again as a factor for margin weak point, after simply having actually done so last quarter (DLTR). What all business shared was all stocks traded down on this. The argument has actually made its method into just how much margin healing can be gotten out of this into 2024-2025, if at all( apparently ending up being more accepted that business will have 100 bps lower gross margins vs historic for the foreseeable future). The flipside is that merchants now have a scapegoat for ongoing margin disintegration ( and stock decrease): the Soros army of handpicked huge city DAs, who have actually mostly legalized retail theft.

3. Customer Credit– will this continue?: Macy’s discussed credit issues previously in the week by talking to greater than anticipated delinquencies in June and July. There was some apprehension initially from numerous if this was really breaking news or not: was ” this is simply a normalization to pre-covid levels” and “this is more of a low-income concern.” And while to the Goldman trader both rather sensible fair pieces of feedback, it felt noteworthy that Nordstrom ( greater earnings consumer) spoke later on in the week too to the pattern, keeping in mind that “ we have actually seen delinquencies increasing slowly and they are now above pre-pandemic levels, which might lead to greater credit losses in the 2nd half and into 2024.“

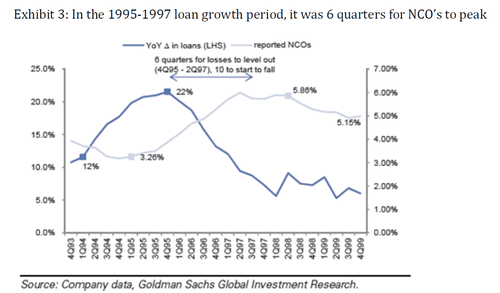

The next round of market master trust information begins September 12th. Information from the Goldman Financials group reveals it’s typically 6 quarters prior to net charge-offs peak, following peak loan development. Peak loan development happened this cycle at the end of Q1 23. See the 3 shows listed below on this from previous cycles that reveal this.

4. Positioning: One mitigating element behind the huge drops throughout the retail area is that according to the Goldman trading desk, a number of the names down the most today, while definitely not best, had reasoning for why they ought to have been down, and likewise had a placing vibrant to them too ( DLTR long vs DG short, DKS a top-line beat was anticipated, JWN was the chosen long this quarter in dept shop world, BURL was anticipated to have a much better print post TJX/ROST). Outcomes did dissatisfy, either sales, margins or the guides, however crowded – and incorrect – positioning likewise had a multiplier impact on the responses it appeared.

* * *

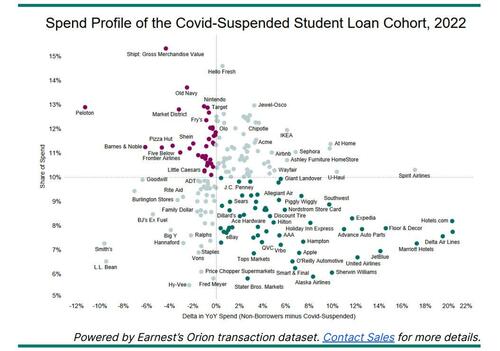

Lastly, those questioning where the next success will originate from, look no more than the trainee loan payers who suspended payments throughout Covid and who will need to resume those payments come October. According to Accomplice Analytics, that associate of buyers comprised more than 10% of costs at numerous nationwide brand names in 2022 (above the dotted line in the chart listed below). Their costs likewise exceeded non-borrowers at numerous brand names (left of the strong line n the chart listed below), recommending that their absence of payments might have buoyed their costs in the last few years (well, duh). That leaves lots of nationwide brand names that benefited meaningfully from the time out in trainee loans (mostly those in the upper-left quadrant listed below), that might be more exposed to that consumer base as payments resume.

Within Travel, Frontier Airlines was the most conscious the Covid-Suspended associate in 2022, with 11% share and 2 points of outspending from the associate. On the other hand, Alaska Airlines and United Airlines both had 7% share and 10 points of under-spending. Airbnb had a high 11% share from the associate however with 4 points of underspending.

Within the House sector, Peloton was most delicate, with 13% share and 11 points of outspending from the Covid-Suspended associate; Sherwin Williams had 6% share and 10 points of under-spending. IKEA, Ashley, HomeGoods, Wayfair, and Lowe’s all had 10%+ share from the associate however the associate likewise underspent Non-Borrowers by ~ 5 points.

The Majority Of Clothing and Department Stores had more than 10% share from the Covid-Suspended associate: Old Navy had the greatest share at 14%; Nordstrom Complete Cost had the most affordable share at 8%. Old Navy and Burlington each had 3 points of outspending from the associate, while a lot of others saw very little to underspending.

More in the complete reports ( here and here) readily available to professional subs.

Filling …