Is ‘Complete Protection’ Insurance Coverage Enough in Tennessee?

With the Garza Law practice, customers check out the ins and out of their insurance protection to make sure the result is whatever they anticipate and more.

When customers associated with vehicle wrecks think about whether they require legal help, we initially look into the crash information prior to talking about insurance coverage matters. If our customer is not at fault, we focus on their injuries and car damage, detailing our function in protecting payment for their losses, generally including financial payment.

However where does this payment stem? Who covers the injury expenses? Usually, the funds are supplied by an insurer, which may come from either the at-fault celebration or our customers themselves. It’s unusual for the accountable person to cover injury and damage expenditures personally. The crash report frequently suggests if the accountable celebration had insurance coverage, yet mistakes can take place. This is why we resolve your insurance coverage throughout our customer relationship.

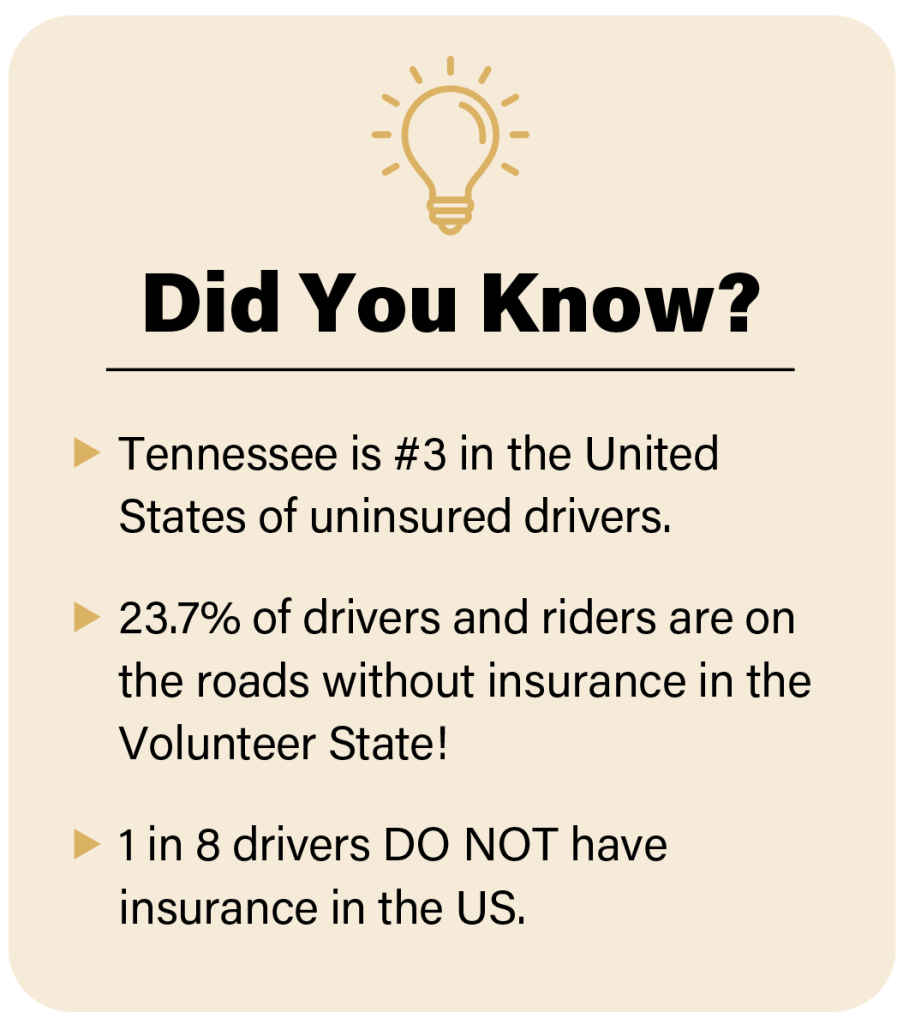

The majority of conversations start with, “Yes, I had complete protection.” While that’s excellent to hear, it does not constantly inform us whatever we require to understand. Just what does “complete protection” consist of? Does it cover things like mishaps with chauffeurs who do not have insurance coverage? Does it aid with medical costs? Just how much cash can it offer? The customer, regardless of having “complete protection,” frequently does not understand the responses to these crucial concerns and frequently does not have one or numerous of these protections.

Checking Out the ins and outs of vehicle insurance coverage exposes that there might be spaces that leave chauffeurs handling unforeseen monetary issues. That’s where 2 crucial kinds of protection can be found in: uninsured vehicle drivers (UM) protection and medical payments (MedPay) protection. UM protection resembles a guard that secures you if you remain in a mishap with somebody who does not have insurance coverage or if they flee. It ensures you’re not stuck spending for their errors. MedPay protection resembles a safeguard for medical expenditures. Even if you have complete protection for your vehicle, it may not suffice to cover all the medical expenses. MedPay actions in to aid with medical costs for you and your guests, no matter who triggered the mishap.

Think of “complete protection” like this: Picture you wish to safeguard your parked vehicle from hail damage. To “completely” safeguard it, you can utilize various kinds of covers. You choose to utilize a thin bed sheet with holes in it– you might state your vehicle is “completely covered,” however it’s not well safeguarded. Or you may utilize 2 new flannel sheets– that’s likewise “complete protection.” And if you utilize a heavy, thick winter season blanket, your vehicle is likewise “completely covered.” The distinction is clear in these examples. The heavy winter season blanket does the very best task, providing the most security.

So, which circumstance explains your vehicle insurance coverage?

To make sure total protection, we motivate you to ask for a copy of your statement page, which details the information of your policy. Consulting with your insurance coverage representative can assist address any concerns you might have. Here at Garza Law Office, our group of lawyers is completely trained in the insurance coverage requires of Tennessee chauffeurs. As a totally free service, we will happily evaluate your policy to verify that you and your household are properly covered. Do not let understanding if you have “complete protection” be by mishap.

550 W. Main Street # 340, Knoxville, TN 37902| (865) 540-8300