{“page”:0,” year”:2023,” monthnum”:8,” day”:29,” name”:” why-multi-factor-indices-in-south-africa”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

Why Multi-Factor Indices in South Africa?

Burton Malkiel, author of the book A Random Stroll Down Wall Street, asserted, “The truths recommend that effective market timing is extremely challenging to accomplish.” 1

Multi-factor indices might be a method of guaranteeing you are “in the ideal location at the correct time,” getting involved throughout market cycles without jeopardizing timing or returns.

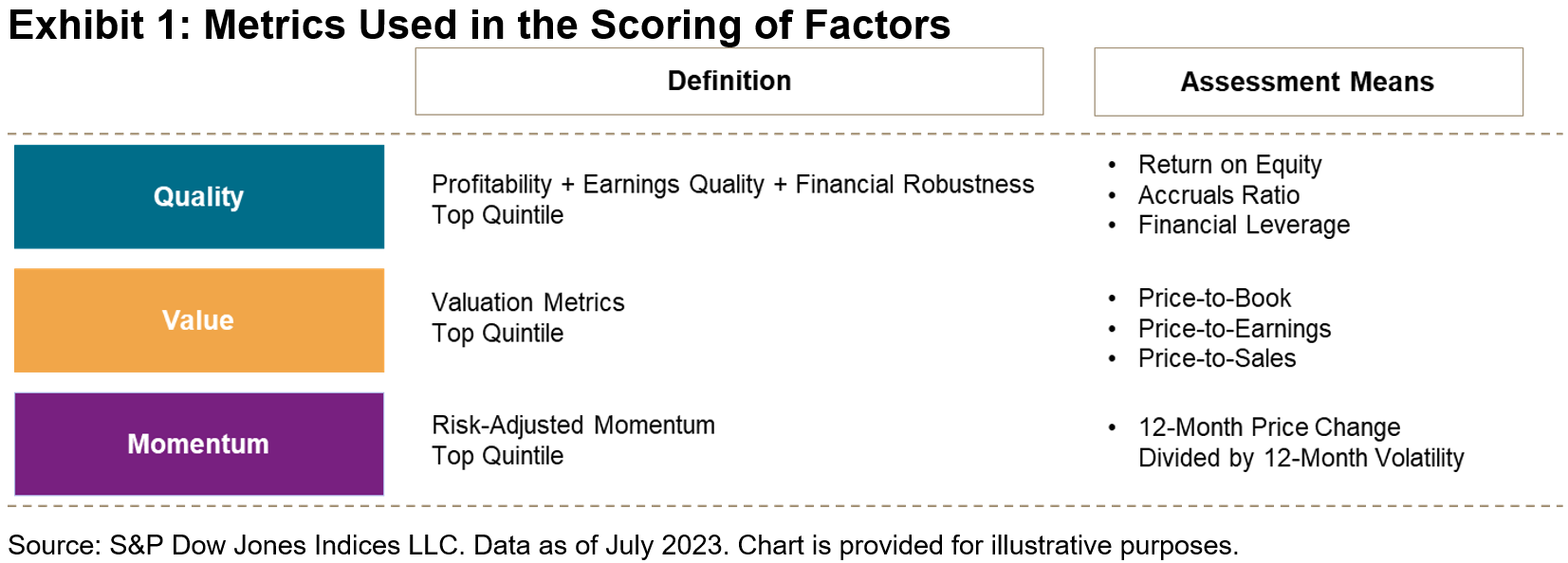

The S&P DJI Multi-Factor Indices are developed on a bottom-up method. This implies the aspect ratings are integrated to pick “all-rounders” that score extremely throughout numerous aspects. The S&P South Africa Composite Quality, Worth & & Momentum (QVM) Multi-factor Index uses the Quality, Worth and Momentum aspects. The illustration listed below programs the metrics utilized in the scoring for each private aspect.

To be qualified for addition in the S&P South Africa Composite QVM Multi-factor Index, the constituents should be members of the S&P South Africa Composite and pass a trading liquidity screen. Multi-factor ratings are computed for each business based upon the average for each aspect. The leading 40 constituents with the greatest aspect rating are consisted of in the index. All constituents are market capitalization times aspect rating weighted, to an optimum weight of 10%.

The method makes it possible for different advantages to be developed into the index. Stocks are chosen within the context of the overall combined portfolio and total direct exposures to the wanted aspects might be greater. In addition, back-tested outcomes reveal more powerful risk-adjusted returns than the index of indices method.

Multi-factor indices have actually traditionally tended to carry out more highly over the longer term on a risk-adjusted basis. This better dynamic is shown by returns being closer to the leading left in Exhibition 2. The S&P South Africa Composite QVM Multi-factor Index is nearer this point than other indices.

We reveal the S&P South Africa Composite QVM Multi-factor Index returns on an annual basis with the private aspect returns overlaid in Exhibition 3. The S&P South Africa Composite QVM Multi-factor Index line shows how the private aspect returns are interacting over different years to provide the risk-adjusted return.

The connections throughout excess returns in between aspects are low, which permits the possible take advantage of integrating private aspects within the S&P South Africa Composite QVM Multi-factor Index method.

Exhibition 5 reveals the risk-adjusted returns gradually for each of the aspects. The S&P South Africa QVM Multi-factor Index offers excellent returns over the long-lasting with lower tracking mistake versus the S&P South Africa Composite. It likewise gets involved well in increasing markets however prevents a few of the drawback in falling markets, showing the advantages of the multi-factor method.

The S&P South Africa Composite QVM Multi-factor Index offers an intriguing chance to think about for multi-factor indexing in the South African market.

1 Malkiel, Burton. A Random Stroll Down Wall Street W. W. Norton & & Business, Inc. 1973.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Stabilizing Defense with Development: The S&P Quality Indices

So far this year, about two-thirds of the S&P 500 ®‘s rally has actually been driven by development stocks and the so-called “Splendid 7” tech stocks. While the quality aspect is typically deemed protective, it has actually equaled the marketplace while numerous other aspect methods have actually underperformed (see Exhibition 1). Part of the factor for this is the concentrate on business with strong principles, which has actually had the ability to record development names that are economically strong.

Method Introduction

High quality is frequently connected with a business’s strong success, high profits quality and robust monetary strength For this reason, the S&P Quality Indices make use of 3 popular metrics to record a business’s quality attributes (see exhibition 2): return-on-equity (ROE), balance sheet accruals ratio (BSA) and monetary utilize ratio (FLR).

The choice for the S&P Quality Indices represents the leading 20% of qualified stocks within their particular universe, ranked by their total quality ratings. Index constituents are weighted by the item of their market capitalization and quality ratings, based on restrictions. 1

Efficiency Contrast

Historically, the S&P Quality Indices outshined their matching standards in the brief and the long term with regard to overall return and risk-adjusted return ( see Exhibition 3). Year-to-date, the S&P MidCap 400 ® Quality Index and S&P SmallCap 600 ® Quality Index outshined their standards by 8.55% and 6.46%, respectively.

In addition, these indices have actually tended to show protective qualities, as evidenced by lower volatility, lower beta and smaller sized drawdowns.

YTD Quality Index Efficiency Attribution

So far in 2023, the monetary utilize ratio (FLR) part has considerably outshined the S&P 500 (see Exhibition 4), recommending that markets might have rewarded lower leveraged business on the back of high rates of interest.

High Advantage Involvement and Protective Attributes

The historic capture ratios in Exhibition 5 reveal that the S&P Quality Indices tend to take part one for one in up markets 2 while providing substantial outperformance throughout down markets. The protective nature of these indices makes good sense given that the quality aspect tends to track business with resilient service designs and sustainable competitive benefits.

For the S&P 500 Quality Index, these capture ratios might be partly described by the choice of mega-cap development stocks, which tend to have strong financials and underlying service principles. The current constituents consist of 5 (Apple, Microsoft, Nvidia, Alphabet and Meta) of the Splendid 7. Exhibition 6 reveals the leading 15 factors to the S&P 500 Quality Index’s efficiency YTD.

Element Direct Exposure

Exhibition 7 reveals the aspect direct exposure distinction in between quality indices and their standards in regards to Axioma Threat Design Element Z-scores. The S&P Quality Indices showed a strong quality tilt versus their particular standards. Particularly, the quality indices had greater direct exposure to success and lower direct exposure to utilize ratio aspects. In addition, the indices had comparable evaluation and development direct exposures to their standards.

Sector Structure

Exhibition 8 reveals the historical sector direct exposure distinction in between the quality indices and their standards. Historically, the quality indices were obese in Industrials and Innovation, while underweighting Interaction Providers, Energy, Financials, Property and Utilities.

1 For more details about the aspect meaning, aspect rating estimation and index style, please see the S&P Quality Indices Method

2 The marketplace is specified as the month-to-month efficiency of the underlying standards from Dec. 31, 1994, to July 31, 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

4 Ways to Compare Asian and U.S. Dividend Markets

Dividends are ending up being significantly essential as financiers come to grips with greater U.S. Treasury yields that do not seem decreasing anytime quickly. Nevertheless, not all dividend markets are produced equivalent. Below are 4 charts that compare dividend index efficiency in Asia to the U.S.

The S&P Pan Asia Dividend Aristocrats Index brings S&P Dow Jones Indices’ noteworthy “Dividend Aristocrats ® “index method to Asia. The index picks business in both emerging and industrialized Asian economies that have actually increased their dividends every year for a minimum of the previous 7 years. Please click here for the complete index method and here for more dividend-related research study from KraneShares.

1. Momentum

The S&P Pan Asia Dividend Aristocrats Index has actually outshined the S&P 500 ®(* )Dividend Aristocrats Index, which tracks dividend growers in the U.S., up until now this year, acquiring 8.09% versus 3.97% for its U.S. equivalent, since June 20, 2023. 2. Yield

S&P Pan Asia Dividend Aristocrats Index constituents likewise presently use a greater dividend yield, usually, than their U.S. equivalents.

3. Assessment

S&P Pan Asia Dividend Aristocrats Index constituents are presently trading at almost one half of the price-to-earnings numerous of their U.S. equivalents, usually.

4. Connection

S&P Pan Asia Dividend Aristocrats constituents have actually likewise shown fairly low connections to the broad U.S. equity market and the S&P 500 Dividend Aristocrats Index constituents, which might provide extra portfolio advantages over the long term.

Meanings:

S&P 500 Dividend Aristocrats Index:

The S&P 500 Dividend Aristocrats Index determines the efficiency of S&P 500 business that have actually increased their dividends every year for the last 25 successive years. The index deals with each constituent as an unique financial investment chance without regard to its size by similarly weighting each business. The index was released on Might 2, 2005. See complete method here S&P Pan Asia Dividend Aristocrats Index:

The S&P Pan Asia Dividend Aristocrats Index determines the efficiency of constituents within the S&P Pan Asia Broad Market Index (BMI) that have actually followed a policy of regularly increasing dividends every year for a minimum of 7 years. The index was released on April 14, 2009. S&P 500:

The S&P 500 is commonly considered as the very best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed properties making up roughly USD 3.4 trillion of this overall. The index consists of 500 leading business and covers roughly 80% of offered market capitalization. The index was released on March 4, 1957. S&P Pan Asia Broad Market Index (BMI):

The S&P Pan Asia BMI is a sub-index of the S&P Global BMI and an extensive criteria consisting of securities from established and emerging Asia. The index was released on Dec. 31, 1997. Dividend Yield:

The portion of a business’s share rate that stated business pays in dividends each year. Price-to-Earnings Ratio (P/E):

A step of whether a business is over or under-valued. P/E is computed as a business’s rate per share divided by its profits per share. Profits Per Share (EPS):

The overall earnings of a business divided by the variety of shares impressive. Connection:

Connection is a fact that determines the degree to which 2 securities relocation in relation to one another. Connections are revealed here as the connection coefficient, which is a worth that should fall in between -1 (inverted connection) to 1 (outright connection).

The S&P 500

®,&S&P 500 Dividend Aristocrats Index, S&P Pan Asia Dividend Aristocrats Index and S&P Pan Asia Broad Market Index are items of S&P Dow Jones Indices LLC or its affiliates (” SPDJI”). S&P ®, S&P 500 ®, Dividend Aristocrats (* )&® are hallmarks of S&P Global, Inc. or its affiliates (” S&P”); Dow Jones ®(* )is a signed up hallmark of Dow Jones Hallmark Holdings LLC (” Dow Jones”). Kraneshares ETFs based upon SPDJI’s indices are not sponsored, backed, offered or promoted by SPDJI, Dow Jones, S&P, their particular affiliates or licensors and none of such celebrations make any representation concerning the advisability of purchasing such item( s) nor do they have any liability for any mistakes, omissions or disruptions of the Indices. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Dividends and Alternative Premiums: A Double Earnings Story Classifications Technique

Tags

-

2023,

call choices, -

covered call,

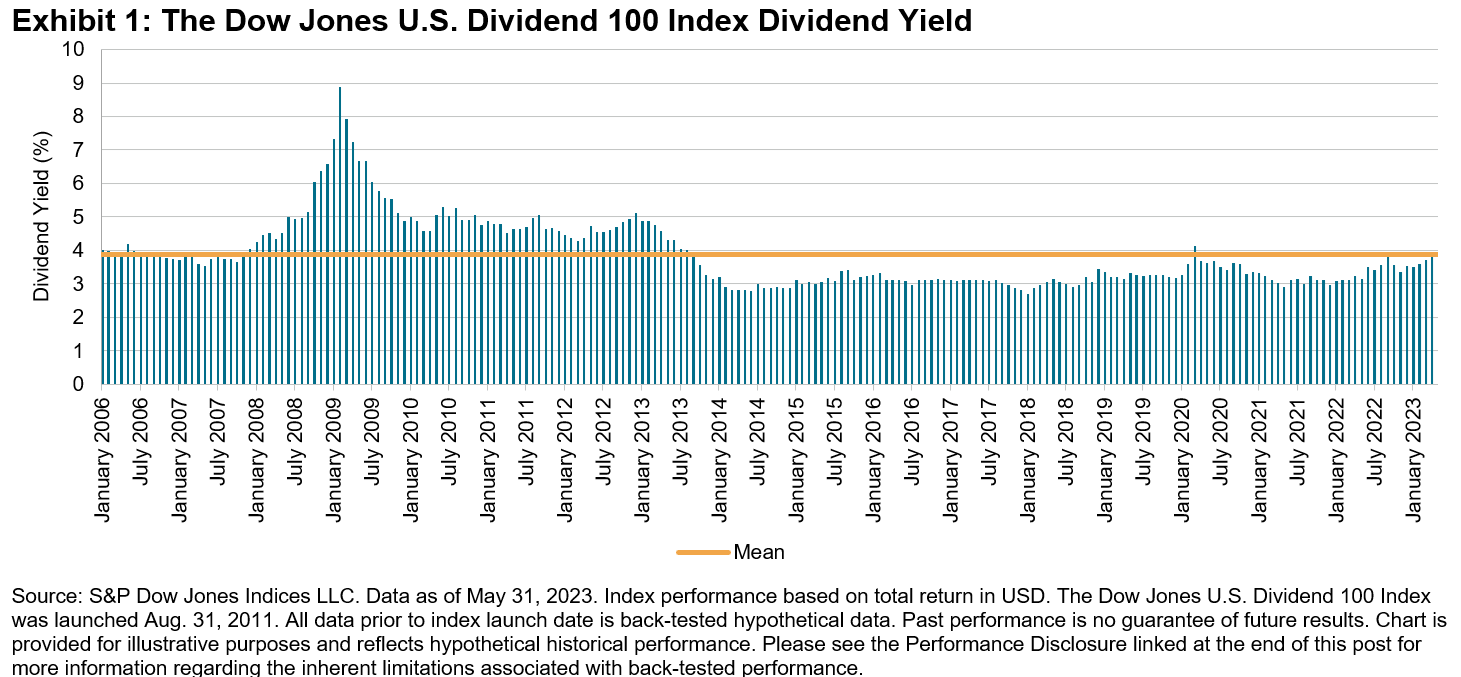

diversity, dividend protection ratio, dividend yield, dividends, Dow Jones U.S. Dividend 100 3% Premium Covered Call Index, Dow Jones U.S. Dividend 100 7% Premium Covered Call Index, Dow Jones U.S. Dividend 100 Index, institutional financier, multi-asset, S&P 500 Dividend Aristocrats, volatility Earnings generation might be looked for by a range of market individuals, consisting of those nearing retirement and those looking for a source of passive earnings. An income-focused method needs a various method to those concentrated on creating development. Conventional income sources consist of dividend-paying stocks and coupon-paying bonds. The financial landscape of the previous 18 months has actually been formed by consistent inflation, increasing rates of interest and basic market unpredictability, all of which have actually adversely impacted the efficiency of these standard methods. To assist diversify threat and include incremental earnings, market individuals may try to find non-traditional income sources generation such as a covered call method. The Dow Jones U.S. Dividend 100 3% Premium Covered Call Index

and the

Dow Jones U.S. Dividend 100 7% Premium Covered Call Index are developed to determine the efficiency of a long position in high-dividend-yielding stocks and a brief position in a basic S&P 500 ®(* )month-to-month call alternative. The underlying equity index utilized for the Dow Jones U.S. Dividend 100 Covered Call Indices is the Dow Jones U.S. Dividend 100 Index, which determines the efficiency of high-dividend-yielding U.S. stocks. Because 2006, the Dow Jones U.S. Dividend 100 Index has actually published a typical dividend yield of 3.88% (see Exhibition 1), conveniently surpassing the S&P 500 Dividend Aristocrats

® (2.58%) and the S&P 500 (1.95%). A covered call method includes offering a call alternative on a long equity position. If the property’s market value goes beyond the alternative’s strike, a logical alternative purchaser would work out the agreement and obligate the alternative author to offer the property or settle in money. The primary possible advantages of this method are the capital created from composing the calls– alternative premiums– and the restricted drawback defense that the premiums can offer. Likewise to dividends, the capital gotten from alternative premiums can alleviate the impacts of down markets. The primary disadvantage of a covered call is the restricted benefit capacity of the equity position. Covered call methods are especially appropriate throughout unpredictable market conditions. Alternative premiums tend to increase as volatility increases, using the capacity for higher earnings generation and included drawback defense. What makes the Dow Jones U.S. Dividend 100 3% Premium Covered Call Index and the

Dow Jones U.S. Dividend 100 7% Premium Covered Call Index

special is that they integrate a standard dividend-paying earnings method and a non-traditional covered call method. Both indices show the exact same dividend yield as the underlying Dow Jones U.S. Dividend 100 Index, which has actually balanced 3.88% given that 2006. In addition, each index targets a particular premium yield of 3% and 7%, respectively. Historically, these indices have actually changed their protection ratios and effectively attained their target yields (see Displays 3 and 4). The protection ratio is specified as the notional worth of the brief call position as a portion of the long equity notional quantity. For instance, a protection ratio of 100% implies that calls were composed versus the whole worth of the long equity position, while a protection ratio of 25% symbolizes that the worth of the calls represents one-fourth of the equity position. The vibrant nature of the protection ratio offers the index with some drawback defense (from the covered brief position) in addition to direct exposure to equity benefit (from the exposed long equity position). For market individuals looking for 2 income sources, including a covered call overlay might offer incremental earnings beyond what might be accessed from a simply dividend-paying equity index. The alternative for target yields of 3% or 7% offers the capability to select the perfect benefit capacity. The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Tags

2023, call choices, covered call,

Classifications

-

products,

product trading consultants, -

corn,

energy, energy shift, Nonrenewable Fuel Source, gasoil, gold, grains, heating oil, commercial metals, Petroleum, rare-earth elements, genuine properties, S&P GSCI, silver, wheat The S&P GSCI , the broad products criteria, began the 2nd half of the year in a blistering heat wave and increased 11% on the back of petroleum products, which all increased by more than 14% in July. The staying 4 sectors within the S&P GSCI likewise increased throughout the month, as worries of an economic crisis eased off with inflation falling and the Fed perhaps getting near ending their rate treking cycle. Strong inflows into product ETFs and the covering of brief positions throughout private products assisted to develop a possible bottom in a couple of crucial products futures markets. The energy sector totally reversed its underperformance from the very first half of the year, bringing all products into favorable area for 2023. OPEC+ production cuts and the lack of unfavorable financial information assisted to raise the fossil-fuel-based products in July. Need for petroleum has actually stayed strong throughout the energy shift, as the world continues to depend on old methods to sustain the economy, as can be seen by strong import need throughout countries, especially in Asia. The

S&P GSCI Gasoil and the S&P GSCI Heating Oil

were the standouts for the month, increasing 23.8% and 22.9%, respectively. The S&P GSCI Industrial Metals increased 6.5% with all 5 of the top-traded metals increasing in July. For the previous couple of months, Product Trading Advisors (CTAs) had big brief positions in the area, however brief covering in July resulted in a strong bounce off the lows for a number of crucial metals, which have actually published a few of the worst YTD efficiency rates in the products markets. Another source of favorable news originated from the rare-earth elements sector. The

signed up with the celebration by increasing 9.0% in July and moving into favorable area for the year. This normally takes place as silver tends to track gold relocations greater, however with a lag. The S&P GSCI Farming grew by a modest 3.0%, while the S&P GSCI Wheat

and the S&P GSCI Corn increased the most as issues over the most recent crop yields were popular. A current S&P International post highlighted the capacity for China to have actually reached peak food need China is the greatest customer of grains internationally, however the World Bank just recently anticipated that after years of strong development, their population will fall by 80 million individuals over the next 25 years. Could this result in less need, or will brand-new locations of need, such as in more eco-friendly biofuels, stimulate brand-new international usage to supplant the drop in the food requirements of China gradually? The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers Tags

2023, products, product trading consultants,