For months we have actually been cautioning that at a time when the United States economy is careening into a difficult landing economic downturn, the controlled, seasonally-adjusted, and politically goalseeked task openings information launched as part of the DOL’s JOLTS report is large rubbish (see “ United States Task Openings Far Lower Than Noted By Department Of Labor“; “ Manage The JOLTS Data With Care“, “ Simply Make it Up: Task Openings All Of A Sudden Skyrocket As Labor Department Now Thinking What The Number Is“). Today, the BLS lastly got the memo.

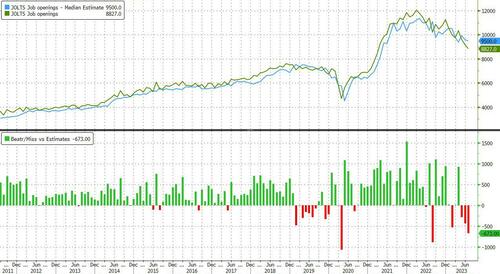

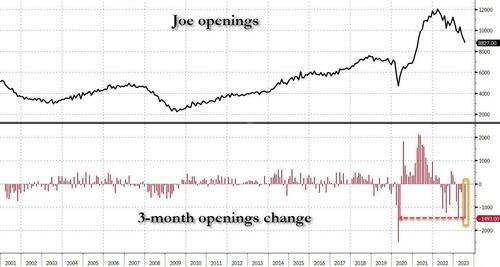

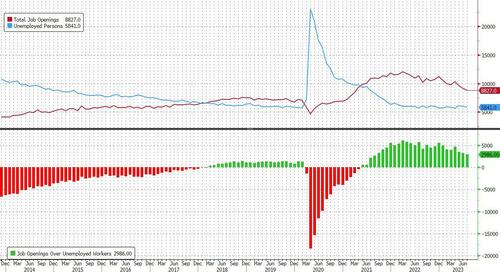

With agreement anticipating just a modest drop in the July task openings from 9.582 million to 9.5 million, what the BLS reported rather was a doozy: in July there were simply 8.827 million task openings, the very first sub-9 million print because March 2021 It was likewise the 3rd greatest miss on record!

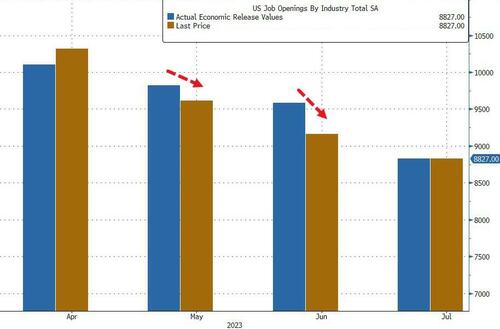

Worse, had the BLS not dramatically slashed the Might number from 9.582 MM to an absurd 9.165 MM, the drop would have been practically 800K task openings. And yes, today’s down modification …

… continues the current pattern of each and every single information point in the Biden administration being modified dramatically lower in subsequent month( s), in a collaborated propaganda effort to make the economy look more powerful, then silently modify it away when everybody forgets.

All the 2023 regular monthly tasks information was modified lower and now all the real estate information has actually likewise been modified … drumroll … lower pic.twitter.com/20Om6rHvFJ

— zerohedge (@zerohedge) August 23, 2023

Every regular monthly payrolls number in 2023 has actually been modified lower to control understanding and markets pic.twitter.com/T6qyXuqY7a

— zerohedge (@zerohedge) August 4, 2023

Industrial Production 1.0%, Exp. 0.3%, Last modified lower to -0.8%

Manufacturing production 0.5%, Exp. 0.0%, Last modified lower to -0.5%

Cap usage 79.3%, Exp. 79.1%, Last modified lower to 78.6%— zerohedge (@zerohedge) August 16, 2023

And while one month does not a pattern make, 3 months does, which is bad due to the fact that the 3-month drop in task openings was 1.5 million, the 2nd greatest on record exceeded just by the overall financial shutdown throughout the covid crash.

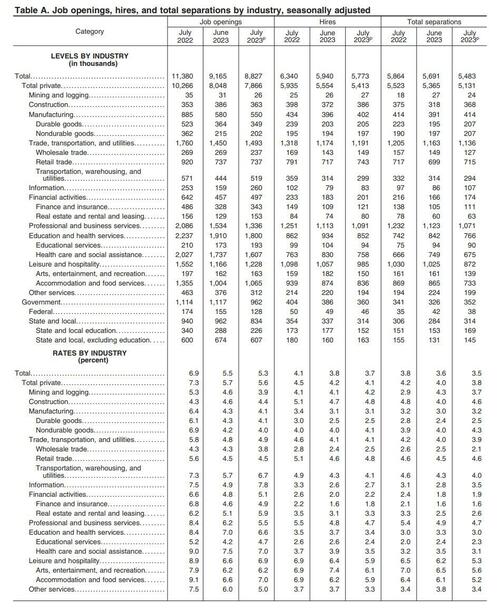

According to the BLS, the biggest reduction in task openings remained in expert and service services (-198,000); healthcare and social help (-130,000); state and city government, omitting education (-67,000); state and city government education (-62,000); and federal government (-27,000). By contrast, task openings increased in details (+101,000) and in transport, warehousing, and energies (+75,000)

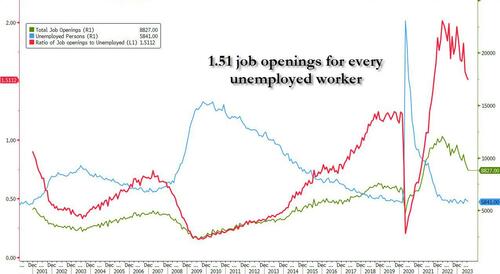

The plunge in the variety of task openings indicated that in July the variety of task openings was simply 2.986 million more than the variety of jobless employees, the most affordable because August 2021.

Stated otherwise, in July the variety of task openings to jobless dropped to simply 1.51, the most affordable level because Sept 2021.

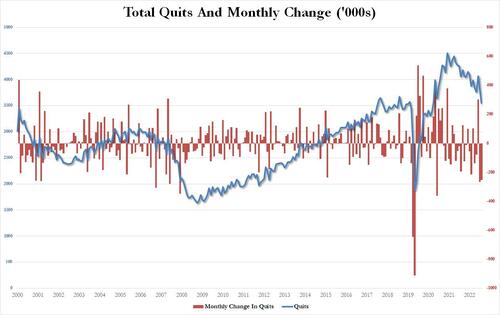

As the variety of task openings cratered to the most affordable in more than 2 years, the variety of individuals stopping their tasks – an indication typically carefully related to labor market strength as it reveals employees are positive they can discover a much better wage in other places – likewise plunged by 253K to simply 3.549 MM ( after toppling 265K in May), the most affordable because Feb 2021.

And simply in case some still think the “Bidenomics” strong tasks lie, the variety of hires likewise crashed in July, plunging by 167K to simply 5.773 million, the most affordable level because Jan 2021.

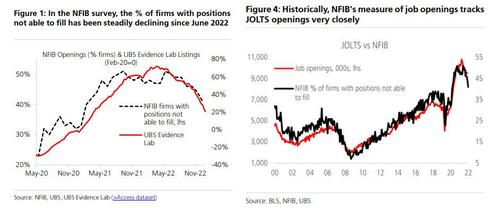

So what to make from this unsightly information which as not just UBS, however likewise the NFIB …

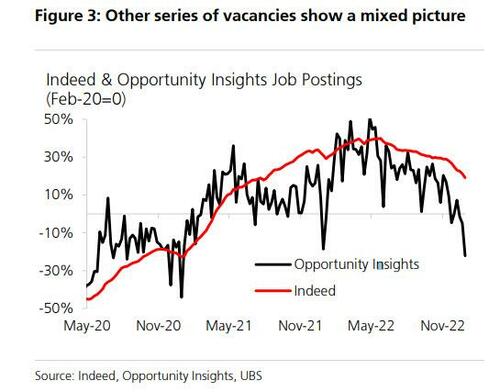

… Chance Insights …

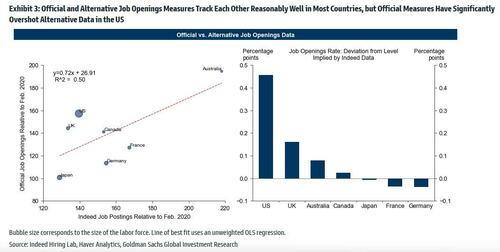

… and even Goldman …

… have been cautioning is long past due?

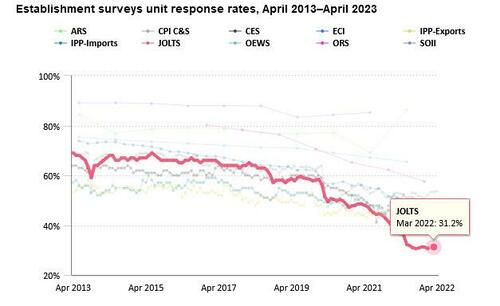

The response is basic: while the drop was significant, the genuine variety of task openings stays still far lower because half of it – or some 70% to be particular – is uncertainty. As the BLS itself confesses, while the action rate to the majority of its different labor (and other) studies has actually collapsed in the last few years, absolutely nothing is as bad as the JOLTS report where the real action rate has actually toppled to a record low 31%

Simply put, more than 2 thirds, or 70% of the last variety of task openings, is approximated!

And at a time when it is crucial for Biden to still preserve the impression that a minimum of the labor market stays strong when whatever else in Biden’s economy is crashing and burning, we’ll let readers choose if the admin’s Labor Department is plugging the price quote space with numbers that are more powerful or weaker.

When It Comes To the Fed, now that the labor market has actually formally broken – due to the fact that a sub 9mm print suggests that the rate walkings are truly taking their toll on the economy – not a surprise that chances of a Might rate trek toppled back listed below 50% after the substantial shocks miss out on …

… and not a surprise that stonks are rising: we are now formally back into “problem is excellent news” for the marketplace mode, because completion of Biden’s financial stimmy suggests that just the Fed is offered to start the economy when it formally moves into an economic downturn next.

Packing …