After reaching 2 year highs in July, The Conference Board customer self-confidence study was anticipated to reveal a really modest decrease in August. Rather it plunged from the very best in 2 years to the weakest because Might (July was modified below 117 to 114 and after that August printed 106.1, considerably listed below the 116.0 exp).

Today Circumstance plunged to its least expensive because Dec 2022 and expectations toppled …

Source: Bloomberg

” Customer self-confidence fell in August 2023, eliminating back-to-back boosts in June and July,” stated Dana Peterson, Chief Economic Expert at The Conference Board.

” August’s frustrating heading number showed dips in both the existing conditions and expectations indexes.

Write-in reactions revealed that customers were when again preoccupied with increasing costs in basic, and for groceries and fuel in specific.

The pullback in customer self-confidence appeared throughout any age groups– and most significant amongst customers with home earnings of $100,000 or more, in addition to those making less than $50,000. Self-confidence held fairly stable for customers with earnings in between $50,000 and $99,999.”

” Expectations for the next 6 months toppled back near the economic crisis limit of 80, showing less self-confidence about future service conditions, task accessibility, and earnings.

“ Customers might be hearing more problem about business revenues, while task openings are narrowing, and rates of interest continue to increase— making big-ticket products more costly.

Significantly, expectations for rates of interest leapt in August after falling 2 months back. Likewise, the outlook for stock costs fell and typical 12-month inflation expectations ticked up.

The step of anticipated household monetary scenario, 6 months thus (not consisted of in the Expectations Index) softened even more.”

On the other hand, inflation expectations ticked up from Oct 2020 lows …

Source: Bloomberg

The Conference Board’s step of labor market tightness aggravated somewhat last month (less tasks abundant vs hard-to-get) …

Source: Bloomberg

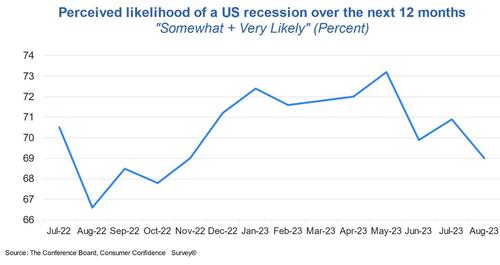

The percentage of customers stating economic crisis is ‘rather’ or ‘likely’ ticked down once again in August however stay raised at 69.0%.

So a weaker stock exchange and stickier costs lastly broke the optimism cycle? Or is this reflective of Americans striking the credit wall together?

Packing …