Weekly highlights

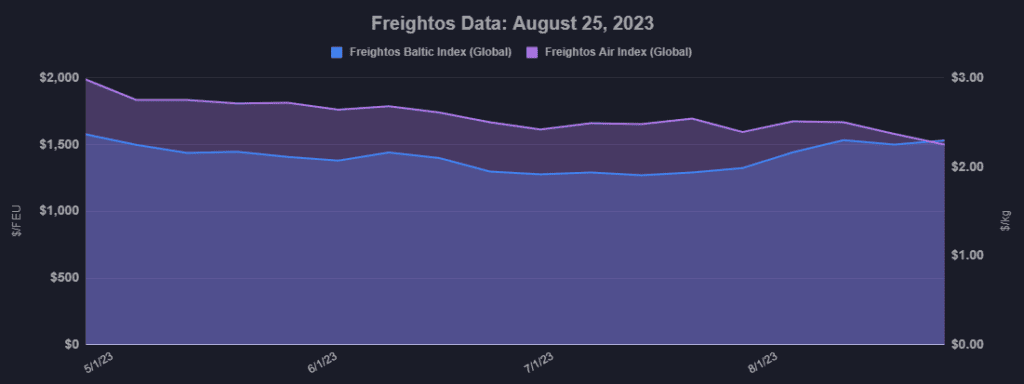

Ocean rates– Freightos Baltic Index:

- Asia-US West Coast rates (FBX01 Weekly) increased 5% to $ 2,029/ FEU

- Asia-US East Coast rates( FBX03 Weekly) climbed up 3% to $ 3,075/ FEU

- Asia-N. Europe rates( FBX11 Weekly) increased 2% to $ 1,747/ FEU

- Asia-Mediterranean rates( FBX13 Weekly) fell 1% to $ 2,313/ FEU

Air rates– Freightos Air index

- China– N. America weekly rates increased 6% to $ 4.02/ kg

- China– N. Europe weekly rates fell 3% to $ 2.91/ kg

- N. Europe– N. America weekly rates fell 4% to $ 1.67/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with instantaneous freight information reporting

Analysis

Though United States retail costs has actually held up even as inflation cools, sales throughout significant sellers have actually been unequal. While Amazon, Walmart and TJX reported strong Q2 numbers, others like Macy’s and Penis’s Sporting Item did not fare too and are seeing possible indications of a downturn in customer strength

And while a current analysis reveals United States retail stock levels are reducing, they stay raised, and, together with slowing sales, will likely press off a substantial restocking cycle and freight rebound till mid-2024. Taken together, these patterns support forecasts that import volumes most likely reached their peak for the year in August.

Transpacific ocean rates climbed up somewhat recently, with West Coast ranks up 5% to $2,029/ FEU, and East Coast rates up 3% to $3,075/ FEU, both above 2019 levels. And though the success of August General Rate Boosts were due not just to increased need however likewise rigorous capability management by providers, if need recedes as fleet sizes continue to grow we might be seeing peak rates for this year too, even as some providers have reveal transpacific GRIs for mid-September.

The Panama Canal Authority revealed that low-water constraints will likely remain in location for a minimum of 10 months, though there has not been any substantial effect on container shipping through the canal yet. With options and excess capability in the market, it is looking not likely that these constraints will trigger much interruption to container trade.

China– N. Europe overall H1 import volumes were down year on year, though need has actually enhanced because March, with June volumes 5% greater than in 2015 and 6% greater than in 2019. August GRIs pressed Asia– N. Europe area rates to about the $1,700/ FEU mark and above agreement levels through recently on this need enhancement and on capability decreases, though there is suspicion that providers will have the ability to sustain these rates.

Asia– Mediterranean need was durable through June, and August rates of $2,300/ FEU have actually had to do with 20% greater than in July, recommending volumes continue to enhance.

Freightos Air Index information reveal that China– N. America air freight rates increased for the 3rd successive week recently, and at $4.02/ kg are 15% greater than at the start of August, while China– N. Europe rates have actually fallen 7% to $2.91/ kg over the exact same duration.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.