Panama Canal limitations are currently requiring ships to take multi-week detours by means of the Suez Canal and Cape of Great Hope. One shipping section is more exposed to these reroutings than any other: specialized tankers that bring melted petroleum gas (LPG) from the U.S. to Asia.

America is the world’s biggest exporter of LPG, i.e., gas and butane. Considering that the Neopanamax locks opened in 2016, the huge bulk of U.S. LPG exports to Asia have actually been filled on large gas providers (VLGCs) and sent out through the Panama Canal. (VLGCs were too big to suit the older Panamax locks.)

Canal blockage has actually developed occasionally for many years, however today’s scenario– including a severe dry spell– is various and might trigger a long lasting shift in VLGC streams far from Panama, according to Oystein Kalleklev, CEO of Avance Gas (Oslo: AGAS).

” We generally see blockage basically every year in the 4th quarter. Now we’re currently seeing it in August,” stated Kalleklev throughout a teleconference on Wednesday.

” Naturally, the rains will return, however with the blockage, [VLGC] traffic will increase in Q4, so we do not see any enhancement near-term. I believe we’ll see a clogged up canal for the rest of Q3 and into Q4 and it will most likely reduce at some point next year.”

Blockage at canal to continue

” There is likewise the conversation about environment modification and whether the canal is more susceptible in the future. A great deal of individuals are making that argument,” he stated.

On the other hand, the volume of LPG carried from the U.S. to Asia is anticipated to continue increasing in line with increased U.S. production, producing a lot more need for canal transit slots. U.S. LPG exports in January-August increased 10% year on year.

” This trade is broadening,” stated Kalleklev, who kept in mind that “America is likewise broadening a lot on the LNG side.” Melted gas providers take on LPG providers for Neopanamax transit slots.

” It’s not truly any surprise that the canal has actually been blocking basically every Q4 for the last number of years, due to the fact that when they initially broadened the canal, it was done to help with larger container ships and all the trade from China to America. No one was believing at that time that America would end up being the most significant LNG and LPG exporter on the planet. The canal was never ever scaled to this sort of trade– and on top of that, we now have this huge dry spell.”

If the Neopanamax locks can not deal with all the container ships, LNG ships, guest ships and LPG ships that wish to transit, it’s the LPG ships that get stuck at the back of the line, stated Kallaklev.

” There is precedence provided to travel ships, container ships and LNG ships that have better freight than LPG ships. So, you will most likely see less VLGCs transiting through Panama moving forward than in the past.”

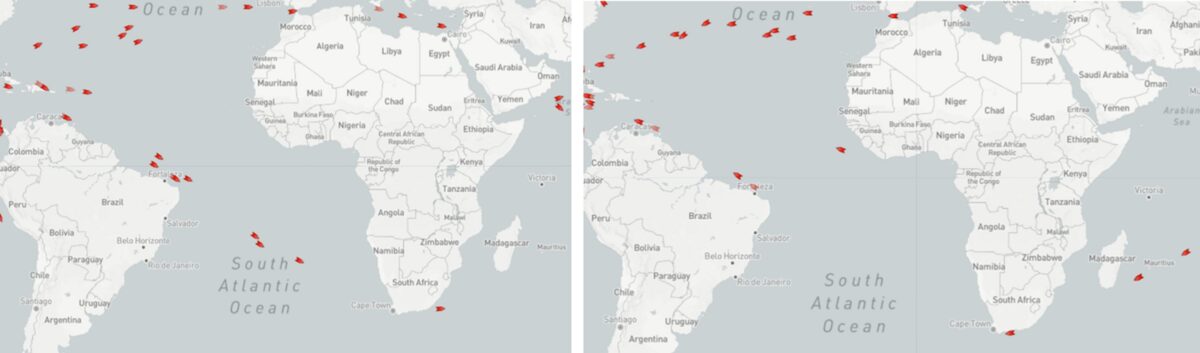

How canal unpredictability impacts LPG ship routing

A U.S.-China VLGC trip takes 58 days big salami by means of the Panama Canal, 81 days by means of the Suez Canal and 88 days around the Cape of Great Hope, according to Avance.

The trade is greatly concentrated on area offers. After a VLGC discharges in Asia, the shipowner looks for to secure the next offer as the vessel returns empty, i.e., “in ballast.” If a work contract (a “component”) is reached, it will consist of a “laycan”– an amount of time when the ship should be readily available to get the freight.

The issue for VLGCs heading back to the U.S. is that Panama Canal waiting time is now incredibly unpredictable, making laycans harder to strike, and area rates are extremely high, including seriousness to keeping schedules.

” The Panama Canal is a little a bingo. Often you can go directly through, other times you need to wait on a week or more,” stated Niels Rigault, executive vice president at BW LPG (Oslo: BWLPG), throughout a teleconference Tuesday.

” We likewise see that when the Panama Canal opens for [transit slot] auctions, the cost some VLGC owners want to pay simply to go through the Panama Canal for one leg depends on $2 million,” included Rigault.

According to Kalleklev, “Waiting time is extremely erratic. If you release a freight and repair a ship for the U.S., you do not understand if the waiting time will be 2 days, 5 days, 10 days or 20 days.

” If it unexpectedly increases, which occurs rather a lot, and you have actually repaired your freight with a two-day laycan and you do not make it, you will be dropped, and after that you’ll be ballasting by yourself account and will need to repair the ship once again.

” A great deal of individuals would rather simply go through the Suez, or if fuel rates are low, they may walk around the Cape of Great Wish to prevent the Suez Canal cost.

” You can likewise avoid the line by winning an auction, however it is profoundly expensive. Individuals are paying leading dollar. We have actually seen the numbers go to $1 million, then $1.5 million, then recently we saw somebody pay $2.4 million for an auction cost.” (All of the current quotes topping $1 million have actually been for Pacific-to-Atlantic transits on ballast legs.)

” When you include that to the routine cost of near to $400,000, the expense of getting your ship through the canal is close to $3 million. You would have conserved a great deal of cash simply going through the Suez or around the Cape of Great Hope rather.”

Area rates, stock rates increasing

The more VLGCs that detour around the Panama Canal, the greater the need for VLGCs determined in ton-miles (volume increased by range). Greater ton-mile need is a favorable for area rates.

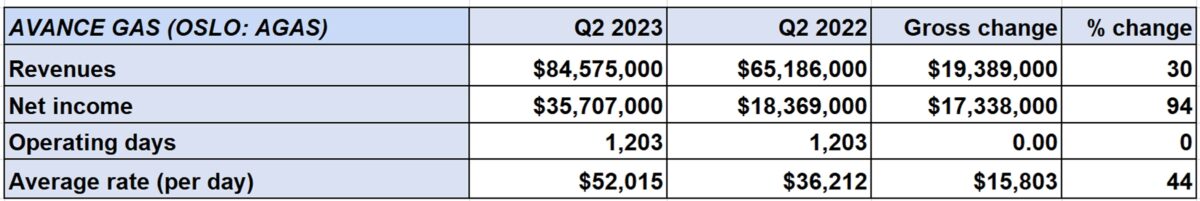

The Panama Canal impact is supporting rates on top of currently strong transportation need VLGC area rates are presently more than double typical levels for this time of year.

Stocks of VLGC owners have actually been star entertainers over the previous year Amongst the 3 noted VLGC owners, shares of Avance have actually doubled year on year. Shares of BW LPG– which revealed Tuesday that it will acquire a U.S. listing to match its Oslo listing– are up 83%. Shares of Connecticut-based Dorian LPG (NYSE: LPG) are up 63%.

VLGC area rates are presently $78,400 daily on a round-trip basis from the Middle East to Asia. Rates are $93,500 daily from the U.S. to Asia “however that’s just the case if you have an ideal trip that goes directly through the canal, which for the a lot of part is not the case today,” stated Kalleklev.

The longer range of the Suez path considerably increases fuel expenses, which reduces the net U.S.-Asia rate by means of the Suez path to around $80,000 daily, in line with the Middle East-Asia path, he kept in mind.

Area rates are greatly driven by arbitrage: the distinction in between the cost of LPG where it’s produced, in the U.S., and where it’s offered, in Asia. “Since today, LPG is super-cheap in the U.S., driven by extremely high stock levels … while need is strong in Asia,” stated Kalleklev.

The cost of LPG is presently $275 per lot cheaper in Asia than in the U.S. The transportation expense is $175 per lot. That leaves $100 per lot. The typical VLGC holds 45,000 heaps, relating to an earnings of $4.5 million on a single trip.

” It’s profoundly successful to move our freight from the U.S. to Asia– which implies you can likewise pay greater freight,” stated Kalleklev.

Click for more short articles by Greg Miller

Associated short articles:

- Delivering ‘traffic congestion’ at Panama Canal: Why it’s not a crisis (yet)

- As gas exports exceed, LPG shipping stock strikes brand-new high

- Huge tankers loaded with American gas are making waves

- Energy shipping boom: Gas tankers breach $100,000 a day

- How war, shipping boom, China lockdowns effect Panama Canal

- How the Panama Canal traffic congestion is impacting ocean shipping

- How Panama Canal browsed COVID, dry spell and trade war

- The Panama Connection: By truck and rail, not canal

The post Panama Canal limitations are rerouting LPG shipping streams appeared initially on FreightWaves