primeimages

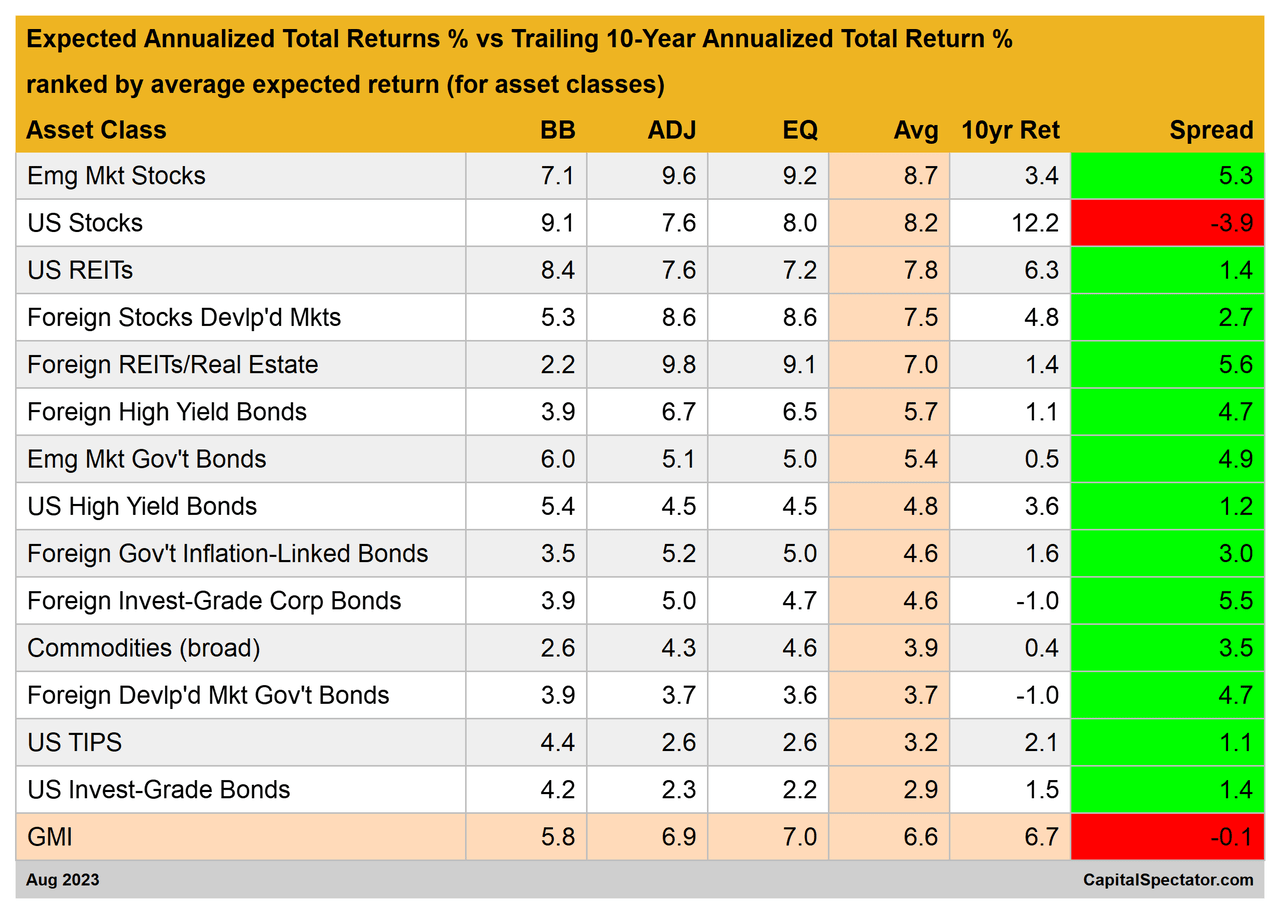

The anticipated return for the Global Market Index (GMI) ticked up in August from the previous month. Today’s modified long-run projection for this criteria– a market-value-weighted portfolio that holds all the significant property classes (other than money) by means of a set of ETF proxies– edged approximately an annualized 6.6% return, the greatest up until now in 2023.

Most of GMI’s parts continue to show projections (approaches specified listed below) above their present routing 10-year returns. The manipulated price quotes supply a basis for tilting allowances looking for producing favorable alpha (relative to GMI) for the long term in portfolio methods.

The United States stock exchange’s fairly soft ex ante efficiency outlook stays an outlier vs. its considerably greater routing 10-year efficiency.

American shares are forecasted to make a return that’s well listed below its recognized gain over the previous years, which suggests that it’s prompt to cut the allowance for United States stocks in portfolios– specifically in portfolios where United States equity weights are above tactical targets.

GMI represents a theoretical criteria of the ideal portfolio for the typical financier with an unlimited time horizon. On that basis, GMI works as a beginning point for research study on property allowance and portfolio style.

GMI’s history recommends that this passive criteria’s efficiency is competitive with most active asset-allocation methods, specifically after changing for danger, trading expenses and taxes.

It’s most likely that some, the majority of or potentially all of the projections above will be broad of the mark in some degree. GMI’s forecasts, nevertheless, are anticipated to be rather more trustworthy vs. the price quotes for its parts.

Forecasts for the particular markets (United States stocks, products, and so on) undergo higher volatility and tracking mistake compared to aggregating projections into the GMI quote, a procedure that might minimize a few of the mistakes through time.

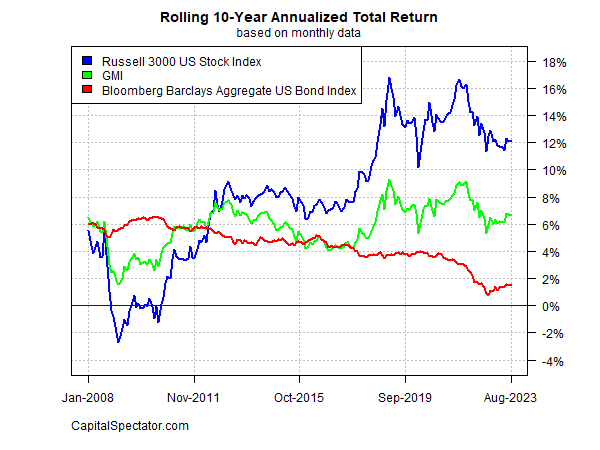

For context on how GMI’s recognized overall return has actually developed through time, think about the criteria’s performance history on a rolling 10-year annualized basis. The chart listed below compares GMI’s efficiency vs. the equivalent for United States stocks and United States bonds through last month.

GMI’s present 10-year return is 6.6%. That’s up from current levels over the previous year or two however well listed below the highs for the routing five-year window.

Here’s a short summary of how the projections are produced and meanings of the other metrics in the table above:

BB: The Foundation design utilizes historic returns as a proxy for approximating the future. The sample duration utilized starts in January 1998 (the earliest readily available date for all the property classes noted above).

The treatment is to determine the danger premium for each property class, calculate the annualized return and after that include an anticipated safe rate to create an overall return projection.

For the anticipated safe rate, we’re utilizing the current yield on the 10-year Treasury Inflation Protected Security (POINTERS). This yield is thought about a market quote of a safe, genuine (inflation-adjusted) return for a “safe” property– this “safe” rate is likewise utilized for all the designs laid out listed below.

Keep In Mind that the BB design utilized here is (loosely) based upon a method initially laid out by Ibbotson Associates (a department of Morningstar).

EQ: The Balance design reverse engineers anticipated return by method of danger. Instead of attempting to anticipate return straight, this design counts on the rather more trustworthy structure of utilizing danger metrics to approximate future efficiency. The procedure is fairly robust in the sense that forecasting danger is a little much easier than predicting return. The 3 inputs:

* A price quote of the general portfolio’s anticipated market value of danger, specified as the Sharpe ratio, which is the ratio of danger premia to volatility (basic variance). Keep in mind: the “portfolio” here and throughout is specified as GMI

* The anticipated volatility (basic variance) of each property (GMI’s market parts)

* The anticipated connection for each property relative to the portfolio (GMI)

This design for approximating stability returns was at first laid out in a 1974 paper by Teacher Costs Sharpe. For a summary, see Gary Brinson’s description in Chapter 3 of The Portable MBA in Financial Investment.

I likewise evaluate the design in my book Dynamic Property Allowance Keep in mind that this method at first approximates a danger premium and after that includes an anticipated safe rate to reach overall return projections. The anticipated safe rate is laid out in BB above.

ADJ: This method corresponds the Balance design (EQ) laid out above with one exception: the projections are changed based upon short-term momentum and longer-term mean reversion elements.

Momentum is specified as the present cost relative to the routing 12-month moving average. The mean reversion aspect is approximated as the present cost relative to the routing 60-month (5-year) moving average.

The stability projections are changed based upon present rates relative to the 12-month and 60-month moving averages. If present rates are above (listed below) the moving averages, the unadjusted danger premia price quotes are reduced (increased).

The formula for change is just taking the inverse of the average of the present cost to the 2 moving averages. For instance: if a possession class’s present cost is 10% above its 12-month moving typical and 20% over its 60-month moving average, the unadjusted projection is minimized by 15% (the average of 10% and 20%).

The reasoning here is that when rates are fairly high vs. current history, the stability projections are minimized. On the other side, when rates are fairly low vs. current history, the stability projections are increased.

Avg: This column is an easy average of the 3 projections for each row (property class)

10yr Ret: For viewpoint on real returns, this column reveals the routing 10-year annualized overall return for the property classes through the present target month.

Spread: Average-model projection less routing 10-year return.

Editor’s Note: The summary bullets for this short article were selected by Looking for Alpha editors.