primeimages

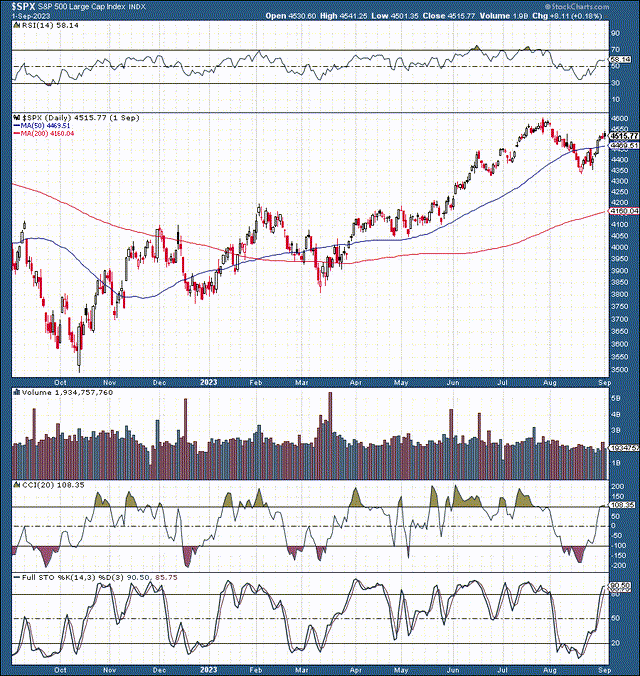

The “Market” S&P 500/SPX ( SP500) deals with another tough, temporal obstacle. Current financial information has actually been blended, and rate of interest stay high. There are concerns about the Fed’s course and inflation, and there is lots of unpredictability relating to the general health of the U.S. economy and its course forward. On the other hand, stocks have actually had a mind-blowing rebound, with some bellwether business rising into overbought and miscalculated area. For that reason, we’re faced with a bothersome near-term technical image and needs to stay mindful in the short-term.

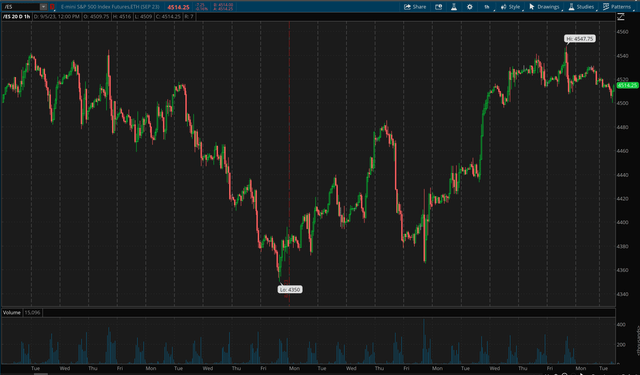

SPX 1-Hour Chart

The SPX is establishing a head and shoulders pattern, indicating the marketplace might continue losing momentum in the near term. 4,500 is the preliminary vital assistance level, with the 4,450 – 4,350 zone representing important short-term assistance. If SPX breaks listed below its current low of 4,350, it needs to move down to the 4,300-4,200 (8-10%) correction zone next.

Longer-Term – Not Out of The Woods Yet

We saw an impressive rally of around 30% from the bearish market lows attained last October. Nevertheless, lots of stocks and the marketplace in basic ended up being extremely overbought. While we got the severely required pullback, the correction has actually just had to do with 6% in the SPX and roughly 9% in the Nasdaq.

For that reason, a rational concern appears – Is the correction over, or will the marketplace choose another dip? There are numerous possible circumstances as we move on. The very first and most possible is that we will continue seeing rotation, debt consolidation, and some more volatility in the near term.

The variety for the debt consolidation procedure stays in the 4,500-4,350 zone. Nevertheless, the marketplace can likewise evaluate a little lower around the 4,300-4,200 assistance point, near the 200-day MA. Moving lower into this variety would lead to a correction of about 8-10% in the SPX. If the pullback continues, it needs to produce various engaging long-lasting purchasing chances, setting the marketplace up for a considerable rally into year-end (4,800-5,000 target variety).

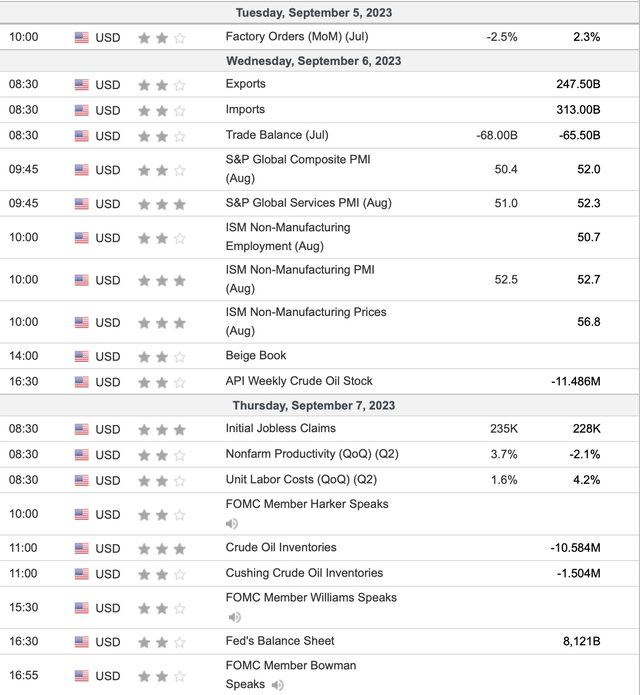

Crucial Information – Today

Financial information (Investing.com)

Today is light data-wise – We have manufacturing/non-manufacturing ISM figures, work stats, petroleum readings, Fed speak, and the beige book. Nevertheless, we do not have substantial market-moving occasions worrying financial information. Nevertheless, we might see amazing advancements from the beige book. For that reason, I am anticipating Wednesday for that.

Recently – GDP was available in listed below quotes ( 2.1% vs. 2.4%). As anticipated, PCE inflation was available in at 3.3% (4.2% core). Nonfarm payrolls were a little much better than prepared for (187K vs. 170K). Yet, the joblessness rate ticked approximately 3.8%. ISM production readings was available in much better than anticipated.

The Incomes Front

Recently – We experienced favorable incomes statements from numerous substantial business, consisting of PDD ( PDD), Salesforce ( CRM), Broadcom ( AVGO), and others. PDD’s report was extremely robust, as the business knocked earnings and EPS out of the park, squashing sales quotes by a shocking 20% The stock has actually risen by about 30% considering that the exceptional incomes statement.

Today – I do not see any substantial incomes statements today. For that reason, having a light data/earnings week, we might rely more on the technicals to drive cost action in the near term.

Monitoring in on the FOMC

The FOMC conference remains in 2 weeks – There is a frustrating possibility (93%) that the benchmark rate will stay at its existing 5.25-5.5% variety. Additionally, if we take a look at the rate possibilities for early next year, we see more than a 70% possibility that the funds rate will be at its existing rate or lower in early 2024. This vibrant indicates that the Fed might be nearing a pivot, and we might see the FOMC start reducing rate of interest early next year.

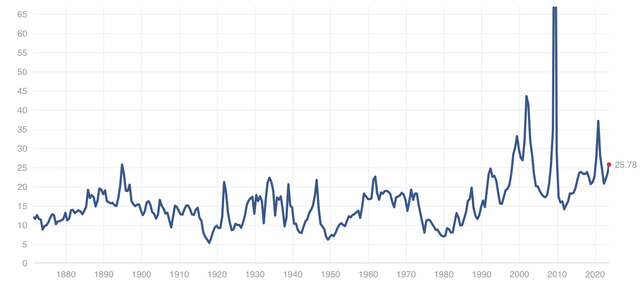

Some Bellwethers – Evaluations Look Pricey Now

- Microsoft ( MSFT) – 10 times sales, 30 times EPS quotes

- Apple ( AAPL) – 8 times sales, 31 times EPS quotes

- NVIDIA ( NVDA) – 22 times sales, 45 times EPS quotes

- Tesla ( TSLA) – 8 times sales, 71 times EPS quotes

- Netflix ( NFLX) – 6 times sales, 37 times EPS quotes

These are simply numerous examples, however the stock universe has plenty of stocks that might be momentarily overbought and miscalculated here. Additionally, the overvaluation problem is prevalent and might end up being more substantial if greater rates continue longer than prepared for.

The S&P 500 – Not That Inexpensive Anymore

While the SPX dipped to about 20 P/E, it’s recovered to around 25 now, showing that the basic market is not that low-cost any longer. It might be thought about fairly costly in a fairly high-interest rate environment. Expect we see another duration of several contractions. Because case, the SPX’s P/E might contract to about the 22-20 zone once again, indicating a drawback of around 10-20% is still possible for the S&P 500 and other significant averages.

The Bottom Line

While I stay bullish in the intermediate and long term, the marketplace might still grind through this debt consolidation and pullback stage in the coming weeks. Additionally, we might retest the previous low of about 4,350 SPX and move lower into the 4,300-4,200 (8-10%) correction variety in a worse-case situation. The essential aspects surrounding the marketplace appear strong, however we’re seeing more indicators of a considerable downturn underneath the surface area as we advance.

The Fed needs to support markets and might transfer to a much easier financial position as we move into the brand-new year. Nonetheless, the financial image might require to aggravate prior to the Fed reveals more evident indications that the pivot is near. Supplied these drivers and other establishing components, increased care is called for as we go into the Fall months. My correction bottom is the 4,150-4,350 level, and my year-end target variety stays at the 4,800-5,000 point in the SPX.