MarkPiovesan/iStock through Getty Images

National Fuel Gas Business ( NYSE: NFG) is a $4.8 billion market-cap hybrid of upstream, midstream, and downstream (energy). The stock rate is down given that my last analysis eighteen months back, when I moved from a buy to a hold suggestion. I am reversing that suggestion with an expectation of greater costs for previously constrained Marcellus gas as the Mountain Valley Pipeline comes online, forecasted to be at the end of 2023.

Financiers need to however know regional, state, and federal guidelines and propositions to restrict or minimize using gas.

Because NFG is a gas operation, its incomes show weather condition seasonality, with more incomes in the October-March amount of time. Comparable business typically see an October-February stock rate peak, so possible financiers need to know this.

NFG has actually adjusted to this seasonality with a non-traditional monetary reporting schedule, albeit one that makes good sense for the gas rates cycle that peaks in the winter season: the business’s financial 4th quarter ends September 30. The most current outcomes, for April-June 2023, are hence its 3rd quarter of 2023 results.

The business’s 4 reporting sectors cover upstream, midstream, and downstream:

* expedition and production (Seneca Resources);

* pipeline and storage (National Fuel Gas Supply and Empire Pipeline);

* event (National Fuel Gas Midstream);

* energy (National Fuel Gas Circulation).

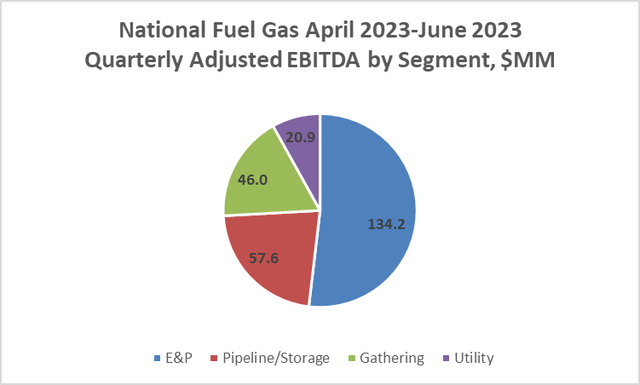

In the most current quarter, over half of the business’s changed EBITDA originated from its Seneca Resources expedition and production department.

Present dividend yield is 3.8%.

At a lower stock rate in its cycle and with greater gas costs ahead, I am updating my ranking on National Fuel Gas stock to purchase.

3rd Quarter 2023 (Quarter Ending June 30, 2023) Outcomes and Assistance

In NFG’s 3rd financial quarter of 2023 (April 2023-June 2023), GAAP earnings was $ 92.6 million, or $1.00/ share, compared to GAAP earnings of $108.2 million or $1.17/ share in the previous year.

For the very first 9 months of the (October 2022-June 2023), GAAP earnings was $403 million or $4.37/ share compared to $408 million or $4.69/ share for the exact same duration a year previously.

Changed operating outcomes, a non-GAAP procedure, for the April-June 2023 quarter were $1.01/ share, compared to $1.54/ share in the previous year.

The chart listed below programs the relative size of adjusted EBITDA by section for the April 2023- June 2023 quarter (3Q23).

Starks Energy Economics, LLC & & National Fuel Gas

The business’s full-year (October 2022-September 2023) incomes assistance is $5.15-$ 5.25/ share. Its financial 2024 incomes assistance is $5.50-$ 6.00/ share, an 11% boost.

Gas production for the is anticipated be 370-380 BCFe, or 1.01-1.04 BCFe/day. Per the business, this shows over 5 BCFe of price-related curtailments and volumes shut-in due to low in-basin rates and third-party pipeline system restrictions. Seneca has firm sales agreements in location for the rest of its financial 2023 gas production (July-September 2023).

For financial 2024, the business presumes typical NYMEX costs of $3.25/ MMBTU. Seneca has firm sales agreements for 88% of its anticipated 2024 production. Two-thirds of production is hedged economically or covered by repaired rate agreements.

Capital investment for the Pipeline, Storage, and Energy sectors are anticipated to be in between $250 million and $290 million in financial 2024. The costs is concentrated on facilities security, dependability, and resiliency, along with lowering emissions.

Capital costs for expedition and production (Seneca) is anticipated to be down somewhat at $525 million to $575 million in financial 2024. The business is leaning into expedition in Tioga and Lycoming counties, in Pennsylvania.

United States Gas Production and Rates

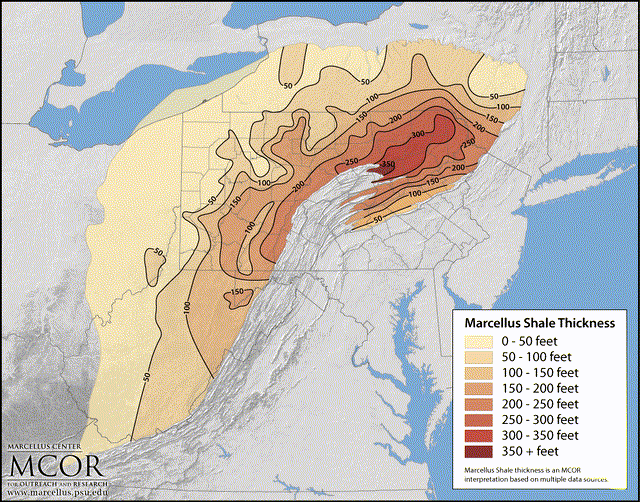

The map above programs the areal and depth degree of the Marcellus development.

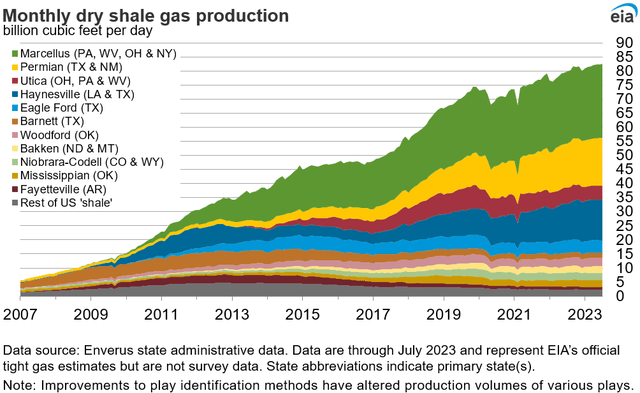

The Energy Details Administration (EIA) tasks Appalachian volumes to be 35.7 BCF/day in September 2023, out of about 103 BCF/D overall United States gas production. The Appalachian location is the mix of the green-colored Marcellus and the brown-colored Utica in the chart listed below.

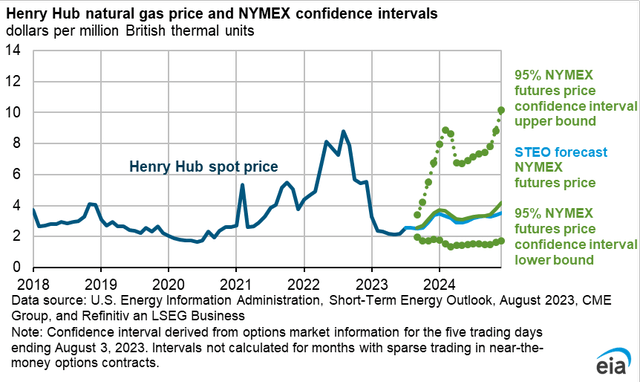

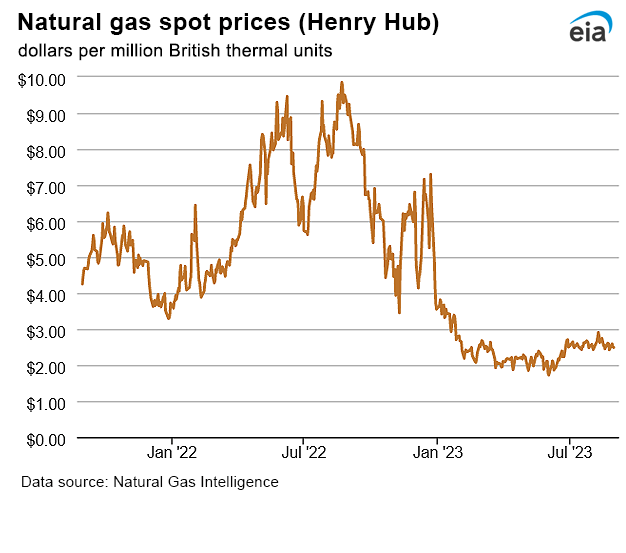

The September 5, 2023, NYMEX gas closing rate for shipment in October 2023 was $2.59/ MMBTU at Henry Center, Louisiana. The rate for Marcellus gas (Tennessee Zone 4 and Eastern Gas South centers) is normally lower. Gas costs have actually fallen drastically (albeit back to regular) given that the start of 2023.

EIA

The EIA’s 5-95 self-confidence period for gas costs through completion of 2024 is revealed listed below.

Reserves and Operations

At September 30, 2022, National Fuel Gas’ Seneca Resources Business had overall proven reserves of 4.2 trillion cubic feet (TCF) of Appalachian gas and a little 250,000 barrels of oil (1.5 BCFe).

The PV-10 of future net incomes of the business’s proven industrialized and undeveloped reserves at September 30, 2022, was $ 7.2 billion. Nevertheless, financiers need to understand this utilized a typical Henry Center rate (suitable at the time however high now) to worth gas of $6.13/ MMBTU. After changed for quality, transport costs, and market differentials, the gas rate utilized for Seneca’s reserve estimation was $4.60/ MCF.

Provided the sharp drop in gas costs revealed above, Seneca’s reserve worth computed on September 30, 2023, is most likely to be lower than the 2022 overall.

The map listed below typically reveals NFG’s operations in NW Pennsylvania and western New york city: light blue is energy service location, dark blue is Seneca Resources expedition and production, yellow is pipelines and storage. (For extra clearness, see page 3 of the pdf variation here.)

National Fuel GAS

Rivals

NFG is headquartered in Williamsville, New York City.

Rivals throughout the business’s numerous running sectors consist of Coterra ( CTRA), National Grid ( NGG), and EQT ( EQT).

Technically, United States gas in any area east of the Rockies takes on gas in all other east-of-Rockies areas. However in the (large) Appalachian Marcellus particularly, gas-producing rivals in addition to CTRA and EQT consist of Antero Resources ( AR), Chesapeake ( CHK), CNX Resources ( CNX), Northern Oil and Gas ( NOG), Ovintiv ( OVV), Variety Resources ( RRC), and Southwestern Energy ( SWN).

NFG is likewise active in the Utica: extra rivals there consist of EOG ( EOG), Gulfport Energy ( GPOR) and some personal business.

Comparable to the initial Cabot section of Coterra, with experience and ownership of facilities (event, pipelines, and storage) and its own gas energy, National Fuel Gas can more quickly transportation and offer its gas than other manufacturers. When Mountain Valley Pipeline opens, that might be less of a separating aspect than it has actually been.

In June 2022 the business’s Seneca Resources department offered its California oil possessions to Guard Peak Resources California for in between $280 million and $310 million: $280 million at closing and yearly payments in 2023-2025 of approximately $30 million, depending upon oil costs.

Governance

At September 1, 2023, Institutional Investor Providers ranked NFG’s total governance as an outstanding 1, with sub-scores of audit (1 ), board (6 ), investor rights (2 ), and settlement (1 ). In this ranking a 1 suggests lower governance threat and a 10 suggests greater governance threat.

At August 15, 2023, shorts were 3.0% of the stock float. Experts owned 1.2%.

The business’s newest beta is 0.69 suggesting that the stock rate relocations directionally with the total market however less dramatically.

Due to the fact that the business’s gas operations are mostly in New york city and Pennsylvania, it undergoes New york city’s stringent hydrocarbon regulative constraints created to prevent intake, consisting of a restriction on drilling (Impacts Seneca Resources).

Furthermore, New york city has actually passed a law prohibiting using gas in property structures beginning in 2026, and bigger structures in 2029. (Impacts other NFG sectors running in New york city).

Financiers need to likewise know the Biden administration’s suggested guideline to basically criminal present gas-powered generators. This might threaten those who depend on gas generators for backup throughout power interruptions, winter season and summertime.

At June 29, 2023, the leading 3 institutional holders were Lead (14.0%), BlackRock (9.3%), and State Street (8.7%). Some institutional fund holdings represent index fund financial investments that match the total market. BlackRock and State Street signatories to the Net No Possession Managers effort, a group that, since June 30, 2023, handles $59 trillion in possessions worldwide. NZAM restricts hydrocarbon financial investment through its dedication to attain net no positioning by 2050 or quicker.

Although BlackRock hasn’t left the group as Lead did numerous months ago BlackRock just recently made a point of stating it had turned down 93% of this year’s environment and social investor propositions.

Financial and Stock Emphasizes

National Fuel Gas’s September 5, 2023, closing stock rate of $51.99/ share provides a market capitalization of $4.77 billion.

With a 52-week rate variety of $48.89-$ 72.24/ share, the closing rate is 72% of the 52-week high. The business’s 1 year target rate is $62.25/ share, putting its present rate at 84% of that level. Put another method, upside to the 1 year target rate is 20%.

Tracking twelve-month incomes per share (EPS) was $6.09 for a tracking price/earnings ratio of 8.5. The midpoint of the company-projected financial 2024 EPS is $5.75 for a forward price-earnings ratio of 9.0.

At June 30, 2023, the business had $5.17 billion in liabilities, financial obligation, and postponed credits and $8.11 billion in possessions offering NFG a liability-to-asset ratio o f 64%. The long-lasting financial obligation web of the present part is $2.38 billion.

A dividend of $1.98/ share yields 3.8%. NFG’s tracking twelve-month return on possessions is 6.3% and return on equity is 22.7%.

The business’s mean expert ranking in September 2023 from 7 experts is 2.7, closer to “hold” than “purchase.”

One expert thinks about the stock to be substantially underestimated.

Notes on Evaluation

The business’s book worth per share of $31.98, about 60% of present market value, recommends favorable financier belief.

With a business worth (EV) of $7.04 billion, NFG’s EV/EBITDA ratio is 5.8, well listed below the favored ratio of 10 or less therefore in deal area.

Favorable and Unfavorable Dangers

Like other business that run in regulatorily-hostile locations, NFG is exposed to many restrictions from the state of New york city. While its New York-based event, storage, and pipelines can’t be physically moved, the business is currently making much of its earnings from non-New York expedition and production.

The business has actually resolved its rate level of sensitivity dangers with fixed-price agreements and, when required, curtailments. It however is exposed to gas costs in a basic method as agreements roll over.

Nevertheless, a favorable threat is the rate benefit for gas from LNG and electrical energy need. Another favorable threat is the possible benefit as transport out of the area ends up being more readily available.

The rate for this year’s (September 30, 2023) reserve worth is currently baked in. Financiers need to anticipate a lower reserve assessment.

Inflation increases costs-especially funding expenses– a specific issue for a business with a 64% ratio of liabilities to possessions and $2.4 billion of long-lasting financial obligation.

The limiting regulative environments for drilling, transport, and need (e.g. all 3 sectors) in which National Fuel Gas runs, specifically New york city is another double-edged sword. Policy might restrict development and upside capacity of NFG’s operation, however it likewise acts a barrier to entry to extra rivals.

Suggestions for National Fuel Gas

Although NFG is headquartered and has a sector of its operations in gas-unfriendly New york city, much of its operations, consisting of all of its drilling, remain in less-restrictive Pennsylvania. Furthermore, by nature of the thick, tradition pipeline system in Pennsylvania, gas produced there can go to other markets far beyond New york city.

The business’s stock rate has 20% benefit to its 1 year target, excellent governance ratings, and has actually done an outstanding task of incorporating Appalachian gas throughout upstream, midstream, and energy sectors.

The business provides a 3.8% dividend and approximated 2024 EPS of $5.50-$ 6.00/ share for a forward price/earnings ratio of 9.0.

As kept in mind, I am updating National Fuel Gas to a buy.

National Fuel Gas